Abstract

During the crucial stage of the energy transition for combating extreme climate changes, it has been frequently discussed: Whether clean and fossil energies are substitutes or complements? To answer this question, we first analyze the correlations of some main clean and fossil energy markets in 2015–2022. After identifying and measuring the volatility spillovers in these energy markets, the original sequence is decomposed into three subsequences in each time-frequency to accurately capture the temporal relations in the short or long term. Furthermore, we select three periods when global climate change issues occurred frequently for the event analysis, then explore the linkages between the energy markets when experiencing climate uncertainties from different time dimensions. We find that the close interactions between clean energy markets are mainly presented in the long term. Meanwhile, even though the spillover effects between the oil market and others are not obvious in the original sequence, significant spillovers could be observed in the selected periods. Therefore, we can infer that the frequently-occurred climate change issues could be one of the reasons that trigger the volatility spillovers between the oil and other energy markets. As climate uncertainties increase, different reactions between the energy markets can be seen in the short term, while a synchronized trend is also easily observed in the long term. Hence, we conclude that these energies could be substitutes in the short term, while complements in the long run. The above analytic results could be helpful for policymakers and investors to cope with the market fluctuations that are brought by climate issues.

Similar content being viewed by others

Introduction

Extreme climate change has posed severe threats to various fields of the world, leaving substantial uncertainty in the energy supply and the related financial area. Consider the year 2022, from the heat waves in Europe to the hurricanes in the United States and Cuba, as well as the floods in Pakistan and South Africa, and the severe droughts in Chile, these disasters caused massive human and economic losses. They also affected the extraction, processing and transmission of fuels and minerals, which directly or indirectly challenges the efficiency of power generation and the stability of power supply networks. Even though it is difficult to alleviate the negative impact brought by abnormal climate issues in a short time, many countries and regions have taken measures and put much effort into energy conservation and emission reduction. As a result, energy markets could be affected by extreme climate change, which in turn, provides the path to deal with climatic issues. Energy transition could be an effective way to decrease carbon emissions by transferring partial usage from fossil energy to clean energy. Since many countries are stepping into a crucial stage of energy transition, it is important to cope with the potential risks that might impact energy markets. As abovementioned, the climate can be one of the impact factors of the energy market in terms of energy supply and energy transmission, which further leads to price volatility and even causes systemic risks if effective risk management and strategies could be launched in time. The status quo also motivates us to investigate the correlations among different energy markets and identify the volatility spillover effects when impacted by climate change in different time dimensions.

The close correlations among different energy markets could be found and proved in many existing investigations. External and internal uncertainties could accelerate the volatility spillover effects between energy markets, which even spread to various industries and trigger financial crises. In comparison with renewable, traditional energy is more susceptible to external shock. Considering the significant impact and the complex interactions, many papers have been conducted to analyze the volatility spillovers that exist in energy markets from different perspectives. Among them, traditional energy markets have been given much attention. Du et al. (2011) explored the linkage between the oil and agricultural commodity markets and the factors that could impact the volatility. Furthermore, other markets are also taken into account, such as precious metal (Ji and Fan 2012; Sadorsky 2014; Kang et al. 2017), equity markets (Lin et al. 2014; Khalfaoui et al. 2015), cryptocurrencies (Ji et al. 2019; Katsiampa et al. 2019; Okorie 2021; Huynh et al. 2022; Yuan et al. 2022) and other traditional energy markets (Kang et al. 2017). The above research presented different and complicated connectiveness between traditional energy markets and other important industries or sectors, verifying the volatility spillovers could impact economic stability, and even lead to systemic risks to the whole system.

With the growing concern about climate change and environmental issues, many countries and regions have emphasized the crucial position of renewable and clean energies, which could be the substitutes for traditional energies and even effectively release the environmental burden. Nowadays, the system of energy consumption in China is characterized by declining traditional energy. Meanwhile, clean energy is supposed to have huge consumption potential (Wei et al. 2020). Therefore, many researchers turned to analyzing the linkages between clean energy markets and other ones. Indeed, there are also various new breakthroughs have been explored. It has been frequently discussed about the close correlations between clean energy and traditional energy markets (Sadorsky 2012; Ahmad 2017; Dutta 2017; Ferrer et al. 2018;) since they can be alternatives to fossil fuels. Song et al. (2019) investigated the dynamic relations among fossil energy, investor sentiment and renewable stock markets, suggesting a strong risk transmission phenomenon among the three markets. Besides, some empirical studies focus on the volatilities within renewable markets. For instance, Zhou et al. (2021) investigated the volatility spillover effects in some important renewable markets from two to multiple dimensions. Specifically, the connections between wind and solar energy markets have been frequently discussed (Abban andHasan 2021; Song et al. 2022; Zhang et al. 2022). Other markets and sectors are involved as well, including food markets (An et al. 2021), metals markets (Chen et al. 2022) and crypto markets (Yadav et al. 2023). The abovementioned studies present the fact that we are stepping into a significant stage of energy transmission. With clean energy markets tend to closely connect to other aspects of our economy and technology, the necessity to deeply analyze the volatility spillovers in clean energy markets is obvious. Also, the corresponding risk management could be effective in dealing with systemic risks in time.

Extreme external impacts and crushes are also the main reasons to exacerbate the volatility spillovers in energy markets. Antonakakis (2012) analyzed the interactions between major exchange rates before and after the introduction of the euro. Du and He (2015) focused on the extreme risk spillovers during and after the financial crisis and pointed out that the extreme volatility of one market in the past or at present may significantly predict the extreme co-movement of the other. This is also an important reason for us to explore the extreme co-movement between different markets as it could be a crucial predictive power for us to effectively manage risk spread in advance. Similarly, Wang et al. (2017) constructed extreme risk spillover networks based on diverse financial institutions to provide more deep insights in terms of interconnection across financial agencies during the financial crisis. Further, You et al. (2017) evaluated the influence of crude oil shocks and China’s economic policy uncertainty on shock returns. In addition to these economic and policy-related uncertainties, public health events are the main issues that we have to cope with recently. Many empirical investigations present the drastic changes in energy markets during the COVID-19. Regarding the negative WTI price event, Corbet et al. (2020) tested the co-movements of oil, coal and clean energy markets. At the same time, extreme volatility spillovers between traditional and clean energy markets have been analyzed from different perspectives (Karim et al. 2022; Zhou et al. 2022). Obviously, the pandemic has dramatically impacted the world’s stock markets (Zhang et al. 2021), agricultural markets (Bareille and Chakir 2023) and precious metals (Farid et al., 2021). Moreover, extreme reactions of energy stock markets in other emergencies were also compared and discussed (Chang et al. 2020). As a result, unexpected emergencies could severely crush the world’s economy, energy markets are considered to be a crucial component. Based on the existing studies, clean energy markets have been gradually occupying vital positions in sustainable development.

The stabilization and development of the clean energy market contribute to energy transition and further enable us to cope with climate change issues. In turn, the world’s economy could be easily impacted by climate change from different perspectives. Global warming has prevented the economy from developing. Low-carbon development is the first need that each country should meet (Cao et al. 2023; Xu 2023). As pointed out by Ding et al. (2022), this impact is reflected by investors’ concerns. The researchers analyzed the dynamic time-frequency spillovers existing in carbon, fossil energy and clean energy markets and found that investors’ attention would accelerate the volatility when considering climate change. Besides, the uncertainty brought by climate change policy is another important research direction. Hoque et al. (2023) explored the co-relations of US climate uncertainty and energy stock market, alternative energy stocks and carbon futures, then found that US climate policy uncertainty is related to the world energy stocks and carbon emissions. From the aspect of different countries and regions, climate policy uncertainty is also analyzed by Kalkuhl et al. (2020) and Ren et al. (2023). Energy and financial markets are verified to connect with climate policy uncertainty. Many efforts have to be made to deal with this problem even though we are still pursuing effective methods. The impact of extreme spillover networks connecting fossil fuel, renewables and carbon markets was more obvious (Su et al. 2023). Climate change can also lead to systemic risk in the banking system (Wu et al. 2023). Although many investigations are conducted to analyze the extreme volatility spillovers under the influence of climate change, few attempts could be found to reveal the linkage of clean energy markets. Considering the important contributions that renewable energies have made in terms of energy transition and sustainable development, this paper also focuses on the connectedness of clean energy markets, especially wind and solar energy when reacting to extreme weather conditions.

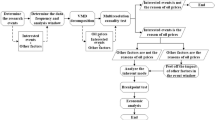

There are various methods to identify and measure volatility spillovers. Among them, the GARCH model has been frequently utilized. Using the GARCH model, Arouri et al. (2011) analyzed the volatility spillover between oil and stock markets. Sadorsky (2012) revealed the correlations and spillover effect in oil prices, clean energy and technology markets. Furthermore, more markets and sectors were considered, such as energy, food and gold markets (Mensi et al.,2013), international stock index futures markets (Yarovaya et al. 2017) and spatial linkage cross G20 stock markets (Zhang et al. 2020). Besides, this model is also introduced to explore extreme volatility spillovers during the COVID-19 pandemic (Karim et al. 2022; Arfaoui et al. 2023; Chancharat and Sinlapates, 2023). The BEKK-GARCH model is also an effective method to depict the interactions in multiple financial time series (Wang et al. 2018; Sarwar et al. 2020). However, even though many studies have found the interactions in energy markets under general and extreme conditions, the impact of climate change on clean energy markets in different time frequencies is worthy being further investigation. As a result, this paper integrates the Empirical Mode Decomposition (EMD) method (Huang, 1998) and constructs a new method, namely the temporal volatility spillover decomposition model (TVSD) model, to accurately capture the characteristics of volatility spillovers between the main traditional and clean energy markets at different time frequencies. The EMD method is introduced in a part of our methodology to decompose the time series of each energy market. It was once proposed to analyze the observation data of the ocean, atmosphere and earthquakes and further applied in wide areas. For instance, it is utilized to make predictions of carbon prices (Zhu et al. 2017), PM2.5 concentration changes (Huang et al. 2021), and wind speed (Jaseena and Kovoor 2021; Suo et al. 2023). Almost all of the recent studies realized the effective and innovative integration between the EMD and machine learning approaches. Being inspired by these methodologies, we attempt to introduce the EMD to analyze the interactions between different energy markets in the short and long term, which we believe could be an empirical innovation. Due to its advantage of processing nonlinear and non-stationary signals, the EMD method has been widely introduced in numerous crucial studies (Zheng et al. 2021).

In summary, the existing related studies mainly investigated the general linkages of energy markets instead of further exploring their relations in accurate time frequencies. Since climate changes could greatly impact energy markets, and we are now taking action to meet energy transition goals, it is vital to analyze how energy markets react to the frequently-occurred climate change uncertainties. In this study, a new method is proposed to learn the volatility spillovers in different time frequencies, which is also introduced in an event analysis to investigate the temporal relation between clean and fossil energy markets when climate change issues frequently occur. Based on the analytic results given by the empirical research, we are further motivated to help policymakers formulate long-term and short-term strategies that realize market stability when experiencing extreme uncertainties. The findings can also assist policymakers and even investors with the construction of effective energy portfolios and reasonable investment decisions, respectively. To achieve the above goals, we first introduce the construction process of the TVSD model and explain how it identifies, measures and decomposes the energy markets’ volatility spillover in different time frequencies in Section “Methodology”. The empirical investigation, the event analysis and corresponding result details are shown in Sections “Empirical study” and “Temporal relations between energy markets under climate change”. Finally, further discussion is presented in Section “Discussion about the roles of substitute and complement”. Finally, the conclusion of this study can be found in Section “Conclusion”.

Methodology

To accurately capture the characteristics of volatility spillovers between the energy markets in different time frequencies thereby providing policymakers and investors with more accurate and reliable references in terms of energy portfolios and investment decisions, we first introduce the empirical mode decomposition (EMD) method that extracts local characteristics of the original time sequence. Further, the volatility spillover effects are identified and measured based on the extracted time sequence using the BEKK-GARCH model. The details about methods are illustrated in the following content. We first clarify how the original time sequence is decomposed by the EMD method, then the model principle and specific analytic scenario of volatility spillover investigation are presented as well. The wind and solar energy markets are taken as examples, which show the process of conducting the sample entropy to reconstruct IMF components and illustrate the volatility spillover identification, respectively.

Correlation analysis between energy markets

In this paper, we analyze the correlations between energy markets by identifying volatility spillover effects, which are mainly measured based on conditional covariance matrices. Therefore, a simple methodological specification for the conditional mean equation is introduced, excluding possible exogenous that may affect the volatility of the energy markets’ price returns, which is shown as follows:

Specifically, take the wind and solar energy markets as an example in Eq. (1), \({F}_{t}\) is the vector of the wind energy market return, \({\upsilon }\) is the vector of estimated parameters for the mean of the solar energy market yield, and \({{\varepsilon }}_{{t}}\) denotes the vector of residuals with a conditional covariance matrix \({{H}}_{{t}}\) provided by the available information set \({{I}}_{{t}{-}{1}}\). Furthermore, this article introduces the BEKK-GARCH model as the conditional variance-covariance equation. The yield of two energy markets will be decomposed into signals in different scale wavelet transforms, and the volatility spillover effects at different trade circuits will be depicted based on signals from two dimensions: time and frequency, and the residuals of the mean equation conforms to the multivariate normal distribution, which can be seen in Eq. (2):

Where \({{H}}_{{t}}\) is a covariance matrix representing the daily return of the two markets at time \({t}\), \({W}\) is the constant coefficient matrix, \({A}\) is the conditional residual coefficient matrix and \({B}\) is the conditional covariance coefficient matrix, \({{\varepsilon }}_{{t}}\) represents the market shocks among the two financial markets at time \({t}\). The specific conditional expression is as follows:

When performing the indicated matrix multiplications, Eq. (2) can be presented as:

The equation-by-equation model in the matrix form of the BEKK-GARCH (1,1) is expanded into the form of a system of equations as follows:

Where \({{h}}_{{11}{,}{t}}\) denotes the conditional variance of the rate of return in the wind energy market while \({{h}}_{{22}{,}{t}}\) represents the conditional variance of the rate of return in the solar energy market, as well as \({{h}}_{{12}{,}{t}}\) signifies the conditional variance of the rate of return in both wind and solar energy markets. Based on the above equations, it appears that an energy market’s volatility tends to source from its past shocks and residuals. When the fluctuation of a market cannot be transmitted to another, the fluctuation of the latter could come from its past volatility. Thus, the elements \({{\alpha }}_{{ii}}\) and \({{\beta }}_{{ii}}\) in matrices A and B denote the wind energy market’s past ARCH and GARCH shocks and volatility respectively of the wind energy market itself. Simultaneously, \({{\alpha }}_{{22}}\) and \({{\beta }}_{{22}}\) describes the ARCH and GARCH volatility effects of the solar energy market itself. Furthermore, \({{\alpha }}_{{12}}\) and \({{\beta }}_{{12}}\) denote the cross-market ARCH effects and the cross-market GARCH effects of the wind on solar energy markets, as well as the conditional volatility of the solar energy market caused by past abnormal impacts of the wind energy market. Besides, \({{\alpha }}_{{21}}\) and \({{\beta }}_{{21}}\) depict the cross-market ARCH effects and the cross-market GARCH effects of the solar energy market on wind energy markets, as well as the conditional volatility of the wind energy market caused by past abnormal impacts of the solar energy market. Therefore, correlations between energy markets could be identified by testing whether the significance coefficients are equal to zero.

Extraction of different timescales

It can be known that the time sequence of different energy markets presents complicated and stochastic features. Directly identifying the spillover effect between each two energy markets without stationary processing the time sequence may lead to inaccurate results. To accurately measure the spillovers and analyze the temporal relations between the energy markets, we introduce the EMD model to capture the partial characteristics of the energy markets. It is mainly utilized to decompose the original complex task into several simple sub-tasks, helping us to find more useful information hidden in the series. Based on this method, the original time series could be decomposed into high- and low-frequency terms, representing the short- and long-term volatilities of the sequence. By decomposing the original sequence into Intrinsic Mode Functions (IMFs) characterized by different frequencies, high-order IMFs represent components with high volatility as well as low-order corresponding to components with low volatility, specifically (Zhang et al. 2010). Thus, these signals help us to analyze the original sequence in the domains of time and frequency (Huang et al. 2019), then learn the market changes in the long and short terms in this study.

Where \({r}{(}{t}{)}\) represents trend item, \({{c}}_{{i}}{(}{t}{)}\) represents IMF of each layer. When the number of maximum values of \({X}{(}{t}{)}\) is 2 or more than the number of upper (or lower) cross zeros, or the average of the upper and lower envelope are not zero everywhere, the time sequence is required to be carried out smoothly under the EMD method. Firstly, the maximum and minimum points of the original data sequence are interpolated by the spline function to obtain the upper and lower envelope lines, and further take the average of the upper and lower envelope lines to get the average envelope line \({{m}}_{{1}}{(}{t}{)}\). Then subtract the average envelope \({{m}}_{{1}}{(}{t}{)}\) from the original data sequence \({X}{(}{t}{)}\) to obtain a new data sequence \({{h}}_{{1}}{(}{t}{)}\):

Generally, \({{h}}_{{1}}{(}{t}{)}\) is not supposed to be a smooth sequence, so the process above is supposed to repeat several times, and the process is stopped when the average envelope line reaches zero. So we get the first component \({{C}}_{{1}}{(}{t}{)}\):

The first IMF is the most frequent component \({{C}}_{{1}}{(}{t}{)}\). Subtracting the component from the original data sequence \({X}{(}{t}{)}\) yields \({{r}}_{1}{(}{t}{)}\) free of the high-frequency portion. After the above processing, the second IMF component \({{C}}_{2}{(}{t}{)}\) can be obtained, and the process is repeated until the sequence of difference can no longer be decomposed. The final difference sequence is the residual component:

The original time series of the energy market \({X}{(}{t}{)}\) can be reconstructed as the sum of IMFs and residual components:

\({{C}}_{{j}}\) represents the IMF component of different layers. \({{r}}_{{n}}\) is a long-period smooth curve and represents the macro-overall trend of the signal.

IMF includes local changes in the sequence from high to low frequency. Furthermore, to reorganize the IMFs obtained from the decomposition above, we introduce the sample entropy to measure the complexity of the time series by measuring the probability of generating a new pattern in the signal. The greater the probability of generating a new pattern, the greater the complexity of the sequence. In a series of IMFs, those sample entropy higher than that of the original series are classified as the high-frequency term, representing the impacts on the energy market of the market sentiment in the short run. Meanwhile, those sample entropy lower than that of the original series are classified as the high-frequency term, representing the impacts of the external emergency on the energy market in the long term.

The advantages of sample entropy are as follows: (1) the calculation does not depend on data length; (2) Sample entropy has a better consistency. The lower the sample entropy, the higher the self-similarity of the sequence. A larger sample entropy’s value indicates higher sequence complexity. Furthermore, the X is composed of a group of vector sequences with dimensions formed by serial number:

These vectors represent consecutive values of \({x}\) at point \({i}\). Define the distance between vectors \({{X}}_{{m}}{(}{i}{)}\) and \({{X}}_{{m}}{(}{j}{)}\) as \({d}{[}{{X}}_{{m}}{(}{i}{)}{,}{{X}}_{{m}}{(}{j}{)}{]}\), the absolute value of the maximum difference in corresponding elements:

For a given \({{X}}_{{m}}{(}{i}{)}\), count the number \({j}\) \({(}{1}\le {j}\le {N}{-}{m}{,}{j}\ne {i}{)}\) whose distance between \({{X}}_{{m}}{(}{i}{)}\) and \({{X}}_{{m}}{(}{j}{)}\) is less than or equal to \({r}\), and denote it as \({{B}}_{{i}}\). For \({1}\le {i}\le {N}{-}{m}\):

Increase the dimension to \(m+1\) and count the number of distances between \({{X}}_{{m}{+}{1}}{(}{i}{)}\) and \({{X}}_{{M}{+}{1}}{(}{j}{)}\)\({(}{1}\le {j}\le {N}{-}{m}{,}\,{j}\,\ne\, {i}{)}\) that is less than or equal to \(r\), denoted as:

\({B}^{m}(r)\) is the probability that \(r\) sequences match three points under a similar tolerance of \(m\), while \({A}^{m}(r)\) is the probability that two sequences match \(m+1\) points. Sample entropy is defined as follows:

Through the process above, we complete the construction of the temporal volatility spillover decomposition (TVSD) model and obtain the sample entropy of all IMFs in energy markets. We will further study the volatility spillovers in different time frequencies based among the international energy markets on the high-frequency, the low-frequency and the trend terms decomposed by the original series respectively. In the following part, we will take the wind energy market as an example to introduce the application of the TVSD model in this paper.

Temporal relation analysis based on the TVSD model

Based on the EMD method, the original sequence of each energy market stock index is decomposed into multiple IMFs. This article conducts sample entropy to reconstruct the IMF component. Take the wind energy market as an example, the IMFs of EMD decomposition of the index during the sample period is shown in Fig. 1. The signal is the original sequence, the frequency of \(IM{F}_{1}\sim IM{F}_{8}\) decreases successively, and rest is the residual component. The sample entropy of the original sequence \(IM{F}_{1}\sim IM{F}_{8}\) and the residual component is calculated as 0.0924, 1.1208, 0.6464, 0.4947, 0.306, 0.2335, 0.0176, 0.0222, 0.0183, 0.0013. Among them, the sample entropy of \(IM{F}_{1}\sim IM{F}_{5}\) is greater than the original sequence, and the sample entropy of \(IM{F}_{6}\) and \(IM{F}_{7}\) is greater than the original sample entropy. Therefore, \(IM{F}_{1}\sim IM{F}_{5}\) is combined as a high-frequency sequence, \(IM{F}_{6}\) and \(IM{F}_{7}\) are combined as a low-frequency sequence, and the residual component is the trend item. According to Zhang et al. (2008), the residue describes the long-term trend of the original signal. Simultaneously, the low-frequency component represents the effects of significant events, and the high-frequency component denotes the shocks from markets’ short-term fluctuations. The composite diagram of the exponential EMD decomposition is shown in Fig. 2. The trend item reflects the overall trend of the return of the wind energy market, the low-frequency term reflects the effect of various events on the market, and the high-frequency term shows the speculative fluctuations in the market.

Furthermore, it has been verified by many prior studies that return on financial assets often follows the leptokurtic characteristic. To analyze the volatility spillover effects between multiple energy markets and clarify the spillover directions, we introduce the BEKK-GARCH model to study the volatility spillover effects between different energy markets on the original sequence. Secondly, the original sequence was processed through the EMD method. The decomposed IMFs highlighted the local characteristics of the data. The synthesized high-frequency term, low-frequency term and trend term are supposed to capture the long-term trend characteristics of the stock index, the impact of mid-term emergencies in markets and the characteristics of short-term speculative behavior in markets. Then the spillovers between the energy markets in the three terms could be observed based on the TVSD model and the Wald test. The characteristics of the original sequence can be grasped from different frequency domains more accurately and effectively, and information on volatility spillover between energy markets in different periods can be presented.

Empirical study

Data selection

This paper aims to explore the impact of climate change on the energy markets. Global warming results in extreme climate events, further leading to catastrophic weather phenomena in the world (Guzovic et al. 2022). According to the report of IEA, growing climate change is putting global energy security at risk. Energy supplies will be affected by risks from tropical cyclones, wildfires, heavy rainfall and flooding to reach the goal of limiting global warming to 2 degrees. Besides, the associated risk of tropical cyclones can hit oil, gas and wind power plants, and smoke particles from wildfires can make solar power less efficient. Indeed, it is difficult to assert that climate change is the cause of spillovers and risk spread in energy markets since the results could be generated by numerous events. The fact is climate change issues and energy market linkages could be directly or indirectly interacted (Lorente et al. 2023; Liang et al. 2022; Lorente et al. 2023; Ren et al. 2023;). Therefore, we are motivated to analyze the interactions between energy markets when experiencing frequently-occurred climate change issues. Similarly, there are also many studies that select specific time-periods to analyze the impact of the COVID-19 pandemic on oil prices (Hung 2021) and clean energy markets (Zhang et al. 2023), the interactions between stock and energy markets during the breakout of 2008 global financial crisis (Jebabli et al. 2022) and the spillovers between international oil and commodity futures markets under the research background of Russia-Ukraine conflict (Cui and Maghyereh 2023).

The data sources selected in our empirical investigation are representative of analyzing changes in clean and fossil energy markets. As the largest exchange company in the world, the NASDAQ OMX Group Inc. provides a family of indices to comprehensively track the green economy. Therefore, comprising 350 securities from 13 leading sectors which cover 460 companies in the world, the comprehensive records including a price return (Nasdaq: GREEN), a total return (Nasdaq: QGREENX), a capped price return (Nasdaq: QGREENCP4) and a capped price return (Nasdaq: QGREENCP4X) are calculated by the NASDAQ OMX Green Economy Index since September of 2010. Due to the comprehensive index data it provides, we select the return prices of GRNSOLAR and GRNWIND indices to analyze the solar and wind market spillovers (Giannarakis et al. 2014; Pham 2019; Hammoudeh et al. 2021; Zhou et al. 2022). Meanwhile, the prices of WTI crude oil futures and Bloomberg Natural Gas are the data sources to investigate the oil and gas market dynamics (Salisu et al. 2022; Chen et al. 2023). As a result, the research findings could be helpful for policymakers and investors in the world to cope with potential risks in energy market fluctuations that are brought by climate issues. Even though some climate issues may not impact certain energy markets due to their fixed geographical locations, investors’ and policymakers’ financial decisions may change over time, leading to interactive price volatilities across different energy markets and geographical locations especially in extreme contexts.

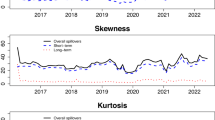

The report issued by WMO (World Meteorological Organization) pointed out that 2015 and 2019 were the hottest five years on record, exacerbated by rising sea levels, disappearing sea ice and more extreme climate. Concentrations of greenhouse gases in the atmosphere have also risen to record levels. Therefore, the daily log returns of wind, solar, gas and oil energy markets from 2015 to 2022 are selected as the data source. We first analyze and test the volatility spillovers of the four energy markets from 2015 to 2022. Furthermore, the EMD method is combined to explore more local information in the original time sequence, the spillover effect between energy markets is investigated from the different characteristics of the time sequence, and time intervals with high volatility are selected for further analysis. The descriptive statistics of the selected data is shown in Table 1. It shows the summary statistics of the full sample size. The mean values for wind, solar, gas and oil are 0.0005, 0.0008, −0.0026 and 0.0008, respectively. Only the mean value of gas is negative. Regarding standard deviation, gas represents the highest volatility with a standard deviation value of 0.095 among the energy markets. According to the skewness results, we can conclude that wind and solar energy are negatively skewed while gas and oil are right-skewed. The results of Kurtosis show that all variables conform to high kurtosis. The Jarque-Bera test shows that all variables violate the normal distribution. Besides, concerning testing the stationary conditions of variables, we use the ADF unit root test to find that the wind, solar energy, gas and oil remain stationary at a 1% level of significance.

Spillover identification based on the original sequence

We build a BEKK-GARCH model for the original sequence of four energy markets during 2015–2022 and make a preliminary analysis of the spillovers of the original sequence. The results are presented in Table 2. The volatility spillover of the time sequence can be judged from the coefficients of matrices A and B. Specifically, A(1,1), A(2,2), A(3,3) and A(4,4) correspond to \({{\alpha }}_{{ii}}\) in Eqs. (5)–(7). They measure the ARCH effects of four energy markets. They are all significant at 1%, indicating that these markets are exposed to their past fluctuations, which are characterized by agglomerate. Simultaneously, B(1,1), B(2,2), B(3,3) and B(4,4) correspond to \({{\beta }}_{{ii}}\). They estimate the GARCH effects of these markets. They are all significant at 1%, indicating that these markets are exposed to their past shocks, which are characterized by persistence. A(i,j) and B(i,j) correspond to \({{\alpha }}_{{ij}}\) and \({{\beta }}_{{ij}}\) respectively, measure ARCH and GARCH effects of market i on market j. Taking wind energy and oil as examples, the coefficient of A(1,2) is significantly different from 0, while B(1,2) is not significant, indicating that the ARCH-effect of spillovers from the wind energy market to the solar energy market is significant, and the GARCH-effect is not significant.

The general volatility spillovers based on the original sequence are shown in the second column of Table 2. The connections between wind and other energy markets are obvious. Regarding spillover directions, the wind energy market could be interpreted as a volatility receiver that easily be impacted by the uncertainties spread from the solar and gas energy markets. The solar energy market can be seen as a volatility receiver of the gas market and a transmitter of the wind energy market. While the gas market is more likely to transfer the volatility to the formers, as well as the oil market. However, the oil market occupies a relatively independent position as a significant volatility spillover effect could hardly observed between the oil market and others. The above analysis demonstrates the general volatility spillover effects between the clean and fossil energy markets. Based on the original sequence, we further construct three subsequences in different time frequencies to investigate the market responses in the short and long terms.

Temporal relations between the energy markets

Back to the above findings, we merge the yields of the four markets from 2015 to 2022 into the trend, low-frequency and high-frequency terms, respectively through the EMD method. EMD is capable of processing nonlinear and nonstationary signals, providing further information on time sequence (Jaber et al. 2014). In terms of financial research, the high-, medium-, and low-frequency components represent the short-, medium-, and long-term volatilities of the index sequences respectively (Xu et al. 2016). The trend sequence reflects the long-term trend characteristics of the energy market, the low-frequency sequence reflects the characteristics of being affected by emergencies in the medium and long term, and the high-frequency sequence reflects the characteristics of short-term speculation behavior.

In this study, the original sequence is decomposed into three subsequences shown in Fig. 3. From sharp and frequent fluctuations in the high-frequency sequence, the closing price curves become steadier and flatter in the low-frequency and trend sequences. The descriptive statistics of the decomposed sequences are presented in Table 3. Based on the skewness statistics, the low-frequency terms of wind, solar energy and oil markets are significantly left-skewed. Simultaneously, it appears that all variables are significantly leptokurtic and non-normally distributed according to the kurtosis. Furthermore, all energy markets remain stationary at a 1% level of significance through a unit root test. As mentioned above, they are utilized to depict the volatility spillovers in the energy markets from the short term to the long term. In Table 4, the spillover effects among the four energy markets are significant in the trend sequence, which means there exist significant volatility spillovers between the 4 markets in the long run. The spillovers between wind and other energy markets are not significant in the high-frequency term. In contrast, the spillover effects presented in the low-frequency term are significant. For example, the linkage between the solar and wind energy markets is not significant in the high-frequency term, while it becomes obvious in the low-frequency term. There exist significant spillover effects between them after being affected by specific events.

Compared with the volatility spillover coefficients of the four energy markets in different time frequencies, it can be found that significant interactions between the energy markets could be detected in the low frequency and the trend term, implying that they can be impacted by the crushes of specific events. Meanwhile, this influence could be profound and last for a long time. For instance, in the original sequence, trend and low-frequency terms, wind energy is a receiver of spillovers from gas, whereas the high-frequency terms do not present significant spillover effects. This phenomenon exists in almost every energy market being analyzed, including the oil market, which once occupied a relatively independent position in the original sequence. The analytic results also motivate us to further explore the specific events that may impact the energy markets and lead to the interactions between each other.

Even though there could be multiple and complicated factors causing the market fluctuation, as aforementioned, climate change is possibly one of them. In Fig. 4, we point out extreme climate events on the low-frequency price curve. There is a time lag between the fluctuation of low-frequency terms and the occurrence of extreme climate events, suggesting that the fluctuation of low-frequency terms may occur behind the extreme climate events, giving rise to a lagging trend. Take the forest fires in the Amazon region in 2019 as an example, Forest fires are frequent and continue to burn in the Amazon region. The fire destroys the local ecological environment. A large amount of carbon dioxide and aerosols are released, which greatly impacts the global climate. The drastic fluctuations of the low-frequency terms of wind and solar energy occurred 3 or 4 months after the fire, indicating that there exists a time lag in the transmission of the risk caused by the Amazon forest fire to the price fluctuation of the energy market. Following our assumption, we conduct event analysis in Section “Temporal relations between energy markets under climate change” to explore the energy markets’ temporal relations during extreme climate change events.

Temporal relations between energy markets under climate change

Based on our earlier findings on the stage of 2015–2022, we further choose three intervals with marked fluctuation on the low-frequency terms: 2015.09–2016.09, 2019.01–2020.01 and 2021.04–2022.04. The event analysis is conducted to explore the impact of specific extreme climate events on the spillover effects of energy market risks.

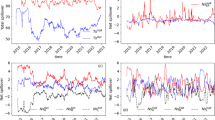

In Fig. 5, we visualized the empirical results of 2015–2022 and 3 intervals. The first column represents the results of the original time sequence, the second column represents the results of the high-frequency term, the third column represents the results of the low-frequency term, and the fourth column represents the results of the trend term. The spillover effects between energy markets become more significant in the selected time intervals. Besides, the significance of the trend term is the highest in each time interval, indicating that the impact of climate change on the spillover effects between energy markets is more significant in the long run.

Table 5 shows the volatility spillover effects in different time frequencies between the energy markets in 2015.09–2016.09. The spillover effects are more significant than that in the time interval of 2015–2022, indicating more close linkages between the energy markets. Directional volatility spillover effects are obvious between the wind and solar energy markets in the original sequence. Although the oil market still plays a relatively independent role compared with other ones, it could be impacted by the uncertainties spread from the outside. Besides, the interactions between each energy market in the high-frequency sequence are not as significant as those in the original sequence. However, an opposite situation can be observed in the trend term.

During the period being analyzed, global land and ocean surface temperatures have broken records for 14 consecutive months, driven by the super El Nino event in 2015–2016. At the same time, extreme heat events occurred in many countries and regions of the world. Combined with the results of the Wald-test after decomposition, the wind energy and oil markets are significant in the original sequence and trend terms, but insignificant in the low-frequency and high-frequency terms, indicating that the two markets do not have significant volatility spillover effects after being affected by the same extreme climate event, and it is not significant in the short term. The risk spillover effects between the energy markets are significant in the trend term, indicating that the impact of extreme weather such as the super El Nino event and extreme temperature events on the energy market could last for a long time.

Table 6 presents the volatility spillover effects in different time frequencies between the energy markets in 2019.01–2020.01. Compared with the empirical results in 2015–2022, the spillover effects between energy markets are much more significant. Unidirectional risk spillovers from the wind energy market to solar energy, and wind energy to gas become significant, which indicates that risk spillover from the wind energy market to other energy markets is significant.

Severe snowstorms occurred in many European countries from 2019.01–2019.06, resulting in serious obstruction of traffic. Forest fires broke out frequently and continued to burn in the Amazon region in 2019.08, releasing a large amount of carbon dioxide and aerosols, which had a great impact on the local and even the global climate. Compared with the spillovers of the original sequence and the subsequences, most of the results are consistent with each other, but there are still some differences.

In the original time sequence, there are significant spillovers between the markets of solar energy and oil, and the trend term and low-frequency term of the two also have significant volatility spillover effects, but the result of the high-frequency term is not significant. Meanwhile, the interaction between the wind and solar energy markets in the high-frequency term cannot be observed as well, whereas the linkage between the wind energy and oil market becomes closer. The high-frequency term reflects the impact of market speculation on the sequence in the short term, in this short-term fluctuation, less connection can be found between the clean energy markets.

Table 7 shows the volatility spillover effects in different time frequencies between the energy markets in 2021.04–2022.04. Compared with the empirical results in 2015–2022, the significance of spillovers in the four energy markets is quite different. The wind and gas markets have significant spillovers from 2015 to 2022, which tend to be indistinct from 2021.04 to 2022.04. The same phenomenon applies to solar energy and gas markets, and oil and gas markets, which indicates that the spillover effects between the gas market and other markets are not obvious during this period.

The Sixth Assessment Report of the United Nations Intergovernmental Panel on Climate Change (IPCC), Climate Change 2021: Natural Science Foundation pointed out that global warming is leading to the frequent and increasing intensity of extreme weather and climate events such as rainstorms, floods, droughts, typhoons, heat waves, cold waves and sandstorms in some regions, and human beings may increase the probability of compound extreme weather events. During the sample period, an extreme storm “bomb cyclone” occurred in the United States in 2021.12, causing widespread power outages and flight cancellations. Europe experienced a “historically warm winter” in 2022.01, with Lithuania, Latvia, the Czech Republic, the Netherlands, Poland, Denmark and Belarus recording their highest temperatures in January. At the same time, a volcano on the South Pacific island of Tonga erupted and triggered a tsunami, which is the world’s largest volcanic eruption in nearly 30 years.

In this period, fewer interactions could be found in the energy markets, especially for the gas market in the original sequence. Unlike the results in the prior two intervals, volatility spillovers are more significant in the high-frequency sequence and fewer connections are shown in the low-frequency sequence. The solar energy market is less likely to be affected, while the interactions between the wind energy markets and others could be found. These two markets are closely related in the original and high-frequency sequence, but unrelated in the low-frequency sequence. The climate change events that occurred between 2021.04 and 2022.04 might aggravate the spillover effects between the wind and the solar energy markets in the long term. However, the two markets have insignificant volatility spillover effects after being affected by the climate events.

Discussion about the roles of substitute and complement

Based on the climate change event analysis in different time frequencies, we find that there are significant spillovers between the solar energy and oil markets during the period from 2015.09 to 2016.09, and extreme climate events such as the super El Nino event and the extreme heat event occurring in this interval has a long-term impact on the four energy markets. The wind energy market has more significant one-way spillover effects on the other three markets in 2019.01–2020.01. Extreme climate events such as snowstorms and Amazon forest fires caused fluctuations in market sentiment during this period, which had different impacts on the solar energy and oil markets. Europe experienced a “historically warm winter” in the period of 2021.04–2022.04, and the spillover effects between gas and other energy markets were not obvious. According to the above results, the main findings of our study are summarized as follows:

-

According to the whole sequence in 2015–2022, clean energy markets present more obvious interactions than the oil market, especially in the long term.

-

Based on the event analysis, the frequently-occurred climate change issues could be one of the reasons that trigger the volatility spillovers between the oil and other energy markets.

-

As climate uncertainties increase, different reactions between the energy markets can be seen in the short term, while a synchronized trend is also easily observed in the long term.

As can be seen from Fig. 6, the spillover coefficients between each two energy markets are presented with the corresponding significances. The interactions between other energy markets are more obvious than those between the oil and other energy markets. Considering the existing studies that investigate energy markets’ volatility spillover effect under extreme conditions either caused by climate change or other external events, we could obtain deeper insights. First, there are many researchers pointed out that extreme market conditions could aggravate the correlations between clean energy markets (Zhou et al. 2022; Khalfaoui et al. 2022). Similarly, Wang et al. (2023) also found that extreme events could possibly strengthen the spillovers among climate policy uncertainty, energy prices, green bond and carbon markets. However, this linkage is relatively not significant in fossil fuel energy markets (Su et al. 2023; Dutta et al. 2023). The above analyses support our findings based on the whole sequence in 2015–2022. Besides, even though it has been verified by some existing studies that clean energy markets are more closely connected during extreme fluctuations, we found the connections are more likely to be reflected in the long term.

It has been frequently discussed whether clean and fossil energies are substitutes or complements. We try to answer the question based on the above findings and provide our following analysis, which is mainly from the perspective of temporal relations between energy markets when experiencing climate change uncertainties.

With an increasing number of studies focusing on climate change and the linkages between energy markets, many recent literatures explored the spillovers in multiple energy markets, which have been introduced in detail in the above content. Nevertheless, the linkages could be dynamic and also depend on specific extreme market and weather conditions. As suggested by Ren et al. (2023), significant dynamic correlations may exist in specific series, instead of the whole period, which verifies different interactions of the energy markets in each time-frequency. This also explains the reason that we conduct the decomposition to capture the volatility characteristics of the energy market changes in different time frequencies. Spillovers of the energy markets present different results in the short and long term. It verifies many related existing studies and could improve the robustness of the empirical investigation in this paper as well. As a result, we select three periods when extreme climate change issues occur. Then the market spillover effects are identified, measured and also discomposed which are shown in Fig. 7. The top half of the figure illustrates the high-frequency spillovers between the energy markets, while low-frequency spillovers are presented in the bottom half. Combined with the results shown in Tables 4–6, more significant spillover effects could be found compared with those in the whole sequence. Note that significant linkages between the oil and other energy markets can be observed, which could not be explored in the longer and the whole sequence. As a result, the frequently-occurred climate change issues could be one of the reasons that triggers the volatility spillovers between the oil and other energy markets. Furthermore, the energy markets present different reactions in the short term and a synchronized tend in the long term, especially in the latest two periods. The above phenomenon also explains different reactions of the energy markets when experiencing climate change uncertainties. In the short term, the market panic could be interpreted as one of the driving forces that aggravate the risk spillovers, which may lead to financial crises if the risks cannot be effectively managed. It can be observed that risks are less likely to spread between the solar and oil markets, and so are the solar and gas markets. The isolated status may indicate their substitute relations. However, we find a synchronized trend between the energy markets in the low frequency, indicating the close relations between each other. All of the energy markets are complementary in the long term.

Furthermore, we conduct a robustness analysis based on the BIC information criterion. Changes in lag order will affect the volatility spillovers among energy markets. Thus, we choose the optimal lag order 4 according to the BIC criterion to test the robustness of our findings. The results are shown in Table 8 and visualized in Fig. 8. The top half of the figure illustrates the high-frequency spillovers between the energy markets, while low-frequency spillovers are presented in the bottom half. Combined with the results shown in Fig. 7, the robustness test corresponds to the main results of our previous empirical research. Note that the overall significance of risk transmission among wind energy, solar energy, natural gas and oil markets does not change a lot, especially during the period of 2015.09–2016.09 and 2019.01–2020.02.

Furthermore, we have concluded that these energy markets are substitutes in the short run as well as they become complements in the relatively long term in the previous research. Results in Fig. 7 support the conclusion, especially in the latest two periods, which also accords to the analysis in Section “Discussion about the roles of substitute and complement”. In the high-frequency, the significance of volatility spillovers differs among energy markets. On the other hand, a synchronized trend could be found among these energy markets in the low-frequency.

In this paper, we attempt to make explanations regarding the temporal relations between the energy markets when dealing with climate change-related issues. In the relatively short term, these energy markets are more likely to be substituted as the spillovers in some energy markets are significant, while some are not. Nevertheless, the low-frequency synchronization in the energy system implies that these energy markets are more likely to be complemented in a relatively long term, as the spillovers are sometimes obvious in all the energy markets, whereas the interactions are not significant in the whole energy system. The above findings could be helpful for policy implementation to cope with market fluctuations, especially when experiencing extreme climate conditions. For instance, when climate change issues are impacting the energy markets, we should focus on the ones that are more vulnerable to crashes. Meanwhile, other energies could be the alternatives from supply, consumption or investment perspectives. However, the energy markets are interacted in the long run, suggesting synergistic efforts to cope with climate change issues or other extreme market challenges.

Conclusion

This paper analyzes the temporal relations between four energy markets, which could be classified as clean and fossil energy markets in 2015–2022 when climate change issues frequently occurred. Then finally discusses whether clean and fossil energies are substitutes or complements according to the given empirical results. As for the preliminary investigation, more connections could be found between clean energy markets, while the oil market occupies a relatively more independent position. Furthermore, we decompose the original sequence into three subsequences to explore the volatility spillovers in short-, medium- and long-terms, respectively, then find that the volatility spillovers are mainly in the low and trend frequencies. Using the TVSD model, we select three time periods when extreme climate change events frequently happened for the event analysis. Finally, more interesting results emerged, which are partially in accord with the findings presented in prior literature but different in specific time frequencies. For instance, more significant spillover effects could be observed after the decomposition. Different reactions between the energy markets can be seen in the short term, while a synchronized trend is also easily observed. This phenomenon motivates us to further discuss the relations between clean and fossil energy markets: whether they are substitutes or complements? The answer could be substitutes in the short term, while complements in the long run. Hence the above analytic results could be helpful for to cope with the market fluctuations that are brought by climate issues.

We make contributions in discussing the linkages between clean and fossil energy markets in different time frequencies and further analyze their temporal relations when experiencing extreme climate change issues. Therefore, how the energy markets connect in short and long terms could be accurately analyzed. Besides, we further utilize event analysis to investigate how the energy markets are correlated when experiencing extreme climate change events. Based on our research, we finally explain the roles of substitute or complement of the energy markets. More interesting findings could be found, which we believe would be of great help for energy market policy makers and investors in dealing with climate change uncertainties. Ultimately, whether the energy markets are substitutes or complements is explained by our empirical investigation. It could provide more deep insights or inspirations in terms of risk management in energy systems. Nevertheless, there are still some limitations in our study. The impact of extreme climate change events should be quantified more accurately and objectively. In future research, correlations between the energy markets can be investigated before identifying and measuring the specific climate issues’ impact. Besides, the impact mechanism should be also clarified. Therefore, we will introduce a more objective method to quantify the impact of climate change events and explain the impacting mechanism. Meanwhile, the dynamic correlations in different time frequencies can be considered as well. Therefore, we will introduce a more objective method to quantify the impact of climate change events and explain the impacting mechanism. Meanwhile, the dynamic correlations in different time frequencies can be considered as well.

Data availability

The datasets generated during and/or analyzed during the current study are shared in supplementary information.

References

Abban AR, Hasan MZ (2021) Solar energy penetration and volatility transmission to electricity markets-An Australian perspective. Economic Anal Policy 69:434–449

Ahmad W (2017) On the dynamic dependence and investment performance of crude oil and clean energy stocks. Res Int Bus Financ 42:376–389

An HR, Qiu F, Rude J (2021) Volatility spillovers between food and fuel markets: Do administrative regulations affect the transmission? Economic Model 102:105552

Antonakakis N (2012) Exchange return co-movements and volatility spillovers before and after the introduction of euro. J Int Financial Mark Inst Money 22(5):1091–1109

Arfaoui N, Yousaf I, Jareno F (2023) Return and volatility connectedness between gold and energy markets: Evidence from the pre- and post-COVID vaccination phases. Economic Anal Policy 77:617–634

Arouri MEH, Jouini J, Nguyen DK (2011) Volatility spillovers between oil prices and stock sector returns: implications for portfolio management. Money Financ 30(7):1387–1405

Bareille F, Chakir R (2023) The impact of climate change on agriculture: A repeat-Ricardian analysis. J Environ Econ Manag 119:102822

Cao L, Han YM, Feng MF, Geng ZQ, Lu Y, Chen LC et al. (2023) Economy and carbon emissions optimization of different provinces or regions in China using an improved temporal attention mechanism based on gate recurrent unit. J Clean Prod 434:139827

Chancharat S, Sinlapates P (2023) Dependences and dynamic spillovers across the crude oil and stock markets throughout the COVID-19 pandemic and Russia-Ukraine conflict: Evidence from the ASEAN+6. Financ Res Lett 57:104249

Chang CL, McAleer M, Wang YA (2020) Herding behaviour in energy stock markets during the Global Financial Crisis, SARS, and ongoing COVID-19. Renew Sustain Energy Rev 134:110349

Chen JY, Liang ZP, Ding Q, Liu ZH (2022) Extreme spillovers among fossil energy, clean energy, and metals markets: Evidence from a quantile-based analysis. Energy Econ 107:105880

Chen J, Chen J, Chen Y, Gu QE, Zhou W (2023) Network evolution underneath the volatility spillover in traditional and clean energy markets. Appl Econ 55(58):6305–6921

Corbet S, Goodell JW, Guenay S (2020) Co-movements and spillovers of oil and renewable firms under extreme conditions: New evidence from negative WTI prices during COVID-19. Energy Econ 92:104978

Cui JX, Maghyereh A (2023) Higher-order moment risk connectedness and optimal investment strategies between international oil and commodity futures markets: Insights from the COVID-19 pandemic and Russia-Ukraine conflict. Int Rev Financial Anal 86:102520

Ding Q, Huang JB, Zhang HW (2022) Time-frequency spillovers among carbon, fossil energy and clean energy markets: The effects of attention to climate change. Int Rev Financial Anal 83:102222

Du LM, He YA (2015) Extreme risk spillovers between crude oil and stock markets. Energy Econ 51:455–465

Du XD, Yu CL, Hayes DJ (2011) Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Econ 33(3):497–503

Dutta A (2017) Oil price uncertainty and clean energy stock returns: New evidence from crude oil volatility index. J Clean Prod 164:1157–1166

Dutta A, Bouri E, Rothovius T, Uddin GS (2023) Climate risk and green investments: New evidence. Energy 265:126376

Farid S, Kayani GM, Naeem MA, Shahzad SJH (2021) Intraday volatility transmission among precious metals, energy and stocks during the COVID-19 pandemic. Res Policy 72:102101

Ferrer R, Hussain SJH, Lopez R, Jareno F (2018) Time and frequency dynamics of connectedness between clean energy stocks and crude oil prices. Energy Econ 76:1–20

Giannarakis G, Konteos G, Sariannidis N (2014) Financial, governance and environmental determinants of corporate social responsible disclosure. Manag Decis 52(10):1928–1951

Guzovic Z, Duic N, Piacentino A, Markovska N, Mathiesen BV, Lund H (2022) Recent advances in methods, policies and technologies at sustainable energy systems development. Energy 245:123276

Hammoudeh S, Mokni K, Ben-Salha O, Ajmi AN (2021) Distributional predictability between oil prices and renewable energy stocks: Is there a role for the COVID-19 pandemic? Energy Econ 103:105512

Hoque ME, Soo-Wah L, Bilgili F, Ali MH (2023) Connectedness and spillover effects of US climate policy uncertainty on energy stock, alternative energy stock, and carbon future. Environ Sci Pollut Res 30(7):18956–18972

Huang NE, Shen Z, Long SR, Wu MLC, Shih HH, Zheng QN, Yen NC, Tung CC, Liu HH (1998) The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proceedings of the Royal Society A-Mathematical Physical and Engineering Sciences. 454(1971):903–995

Huang GY, Li XY, Zhang B, Ren JD (2021) PM2.5 concentration forecasting at surface monitoring sites using GRU neural network based on empirical mode decomposition. Sci Total Environ 768:144516

Huang SX, Wang XP, Li CF, Kang C (2019) Data decomposition method combining permutation entropy and spectral substitution with ensemble empirical mode decomposition. Measurement 139:438–453

Hung NT (2021) Oil prices and agricultural commodity markets: Evidence from pre and during COVID-19 outbreak. Resour Policy 73:102236

Huynh TLD, Shahbaz M, Nasir MA, Ullah S (2022) Financial modelling, risk management of energy instruments and the role of cryptocurrencies. Ann Oper Res 313(1):47–75

Jaber AM, Ismail MT, Altaher AM (2014) Empirical Mode Decomposition Combined with Local Linear Quantile Regression for Automatic Boundary Correction. Abstr Appl Anal 287:731827

Jaseena KU, Kovoor BC (2021) Decomposition-based hybrid wind speed forecasting model using deep bidirectional LSTM networks. Energy Convers Manag 234:113944

Jebabli I, Kouaissah N, Arouri M (2022) Volatility Spillovers between Stock and Energy Markets during Crises: A Comparative Assessment between the 2008 Global Financial Crisis and the Covid-19 Pandemic Crisis. Financ Res Lett 46:102363

Ji Q, Fan Y (2012) How does oil price volatility affect non-energy commodity markets? Appl Energy 89(1):273–280

Ji Q, Bouri E, Roubaud D, Kristoufek L (2019) Information interdependence among energy, cryptocurrency and major commodity markets. Energy Econ 81:1042–1055

Kalkuhl M, Steckel JC, Edenhofer O (2020) All or nothing: Climate policy when assets can become stranded. J Environ Econ Manag 100:102214

Kang WS, de Gracia FP, Ratti RA (2017) Oil price shocks, policy uncertainty, and stock returns of oil and gas corporations. J Int Money Financ 70:344–359

Karim S, Khan S, Mirza N, Alawi SM, Taghizadeh-Hesary F (2022) Climate finance in the wake of covid-19: Connectedness of clean energy with conventional energy and regional stock markets. Clim Change Econ 13(3):2240008

Katsiampa P, Corbet S, Lucey B (2019) High frequency volatility co-movements in cryptocurrency markets. J Int Financial Mark Inst Money 62:35–52

Khalfaoui R, Boutahar M, Boubaker H (2015) Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Econ 49:540–549

Khalfaoui R, Mefteh-Wali S, Viviani JL, Ben Jabeur S, Abedin MZ, Lucey B (2022) How do climate risk and clean energy spillovers, and uncertainty affect US stock markets? Technol Forecast Soc Change 185:122083

Liang C, Umar M, Ma F, Huynh TLD (2022) Climate policy uncertainty and world renewable energy index volatility forecasting. Technol Forecast Soc Change 182:121810

Lin BQ, Wesseh PK, Appiah MO (2014) Oil price fluctuation, volatility spillover and the Ghanaian equity market: Implication for portfolio management and hedging effectiveness. Energy Econ 42:172–182

Lorente DB, Mohammed KS, Cifuentes-Faura J, Cifuentes-Faura U (2023) Dynamic connectedness among climate change index, green financial assets and renewable energy markets: Novel evidence from sustainable development perspective. Renew Energy 204:94–105

Mensi W, Beljid M, Boubaker A, Managi S (2013) Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Model 32:15–22

Okorie DI (2021) A network analysis of electricity demand and the cryptocurrency markets. Int J Financ Econ 26(2):3093–3108

Pham L (2019) Do all clean energy stocks respond homogeneously to oil price? Energy Econ 81:355–379

Ren XH, Li JY, He F, Lucey B (2023) Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew Sustain Energy Rev 173:113058

Sadorsky P (2012) Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ 34(1):248–255

Sadorsky P (2014) Modeling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Econ 43:72–81

Salisu AA, Gupta R, Bouri E, Ji Q (2022) Mixed-frequency forecasting of crude oil volatility based on the information content of global economic conditions. J Forecast 41(1):134–157

Sarwar S, Tiwari AK, Cao TQ (2020) Analyzing volatility spillovers between oil market and Asian stock markets. Resour Policy 66:101608

Song F, Cui J, Yu YH (2022) Dynamic volatility spillover effects between wind and solar power generations: Implications for hedging strategies and a sustainable power sector. Econ Model 116:106036

Song YJ, Ji Q, Du YJ, Geng JB (2019) The dynamic dependence of fossil energy, investor sentiment and clean energy stock markets. Energy Econ 84:104564

Su CW, Pang LD, Qin M, Lobont OR, Umar M (2023) The spillover effects among fossil fuel, renewables and carbon markets: Evidence under the dual dilemma of climate change and energy crises. Energy 274:127304

Suo LM, Peng T, Song SH, Zhang C, Wang YH, Fu YY, Nazir MS (2023) Wind speed prediction by a swarm intelligence based deep learning model via signal decomposition and parameter optimization using improved chimp optimization algorithm. Energy 276:127526

Wang GJ, Xie C, He JK, Stanley HE (2017) Extreme risk spillover network: application to financial institutions. Quant Financ 17(9):1417–1433

Wang KH, Wang ZS, Yunis M, Kchouri B (2023) Spillovers and connectedness among climate policy uncertainty, energy, green bond and carbon markets: A global perspective. Energy Econ 128:107170

Wang YD, Pan ZY, Wu CF (2018) Volatility spillover from the US to international stock markets: A heterogeneous volatility spillover GARCH model. J Forecast 37(3):385–400

Wei YG, Wang ZC, Wang HW, Li Y (2020) Compositional data techniques for forecasting dynamic change in China’s energy consumption structure by 2020 and 2030. J Clean Prod 284:124702

Wu X, Bai X, Qi HY, Lu LX, Yang MY, Taghizadeh-Hesary F (2023) The impact of climate change on banking systemic risk. Econ Anal Policy 78:419–437

Xu MJ, Shang PJ, Lin AJ (2016) Cross-correlation analysis of stock markets using EMD and EEMD. Phys A Stat Mech Appl 442:82–90

Xu SQ (2023) China’s climate governance for carbon neutrality: regulatory gaps and the ways forward. Humanit Soc Sci Commun 10:No.853

Yadav MP, Pandey A, Taghizadeh-Hesary F, Arya V, Mishra N (2023) Volatility spillover of green bond with clean energy and crypto market. Clean Energy 212:928–939

Yarovaya L, Brzeszczynski J, Lau CKM (2017) Asymmetry in spillover effects: Evidence for international stock index futures markets. Int Rev Financial Anal 53:94–111

You WH, Guo YW, Zhu HM, Tang Y (2017) Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ 68:1–18

Yuan X, Su CW, Peculea AD (2022) Dynamic linkage of the bitcoin market and energy consumption:An analysis across time. Energy Strategy Rev 44:100976

Zhang HW, Zhang YB, Gao W, Li YL (2023) Extreme quantile spillovers and drivers among clean energy, electricity and energy metals markets. Int Rev Financial Anal 86:102474

Zhang H, Chen JY, Shao LG (2021) Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. Int Rev Financial Anal 77:101828

Zhang J, Yan RQ, Gao RX, Feng ZH (2010) Performance enhancement of ensemble empirical mode decomposition. Mech Syst Signal Process 24(7):2104–2123

Zhang WP, Zhuang XT, Lu Y, Wang J (2020) Spatial linkage of volatility spillovers and its explanation across G20 stock markets: A network framework. Int Rev Financial Anal 71:101454

Zhang WT, He X, Hamori S (2022) Volatility spillover and investment strategies among sustainability-related financial indexes: Evidence from the DCC-GARCH-based dynamic connectedness and DCC-GARCH t-copula approach. Int Rev Financial Anal 83:102223

Zhang X, Lai KK, Wang SY (2008) A new approach for crude oil price analysis based on Empirical Mode Decomposition. Energy Econ 30(3):905–918

Zheng JD, Su MX, Ying WM, Tong YJ, Pan ZW (2021) Improved uniform phase empirical mode decomposition and its application in machinery fault diagnosis. Measurement 179:109425

Zhou W, Chen Y, Chen J (2022) Risk spread in multiple energy markets: Extreme volatility spillover network analysis before and during the COVID-19 pandemic. Energy 256:124580

Zhou W, Gu QE, Chen J (2021) From volatility spillover to risk spread: An empirical study focuses on clean energy markets. Renew Energy 180:329–342

Zhu BZ, Han D, Wang P, Wu ZC, Zhang T, Wei YM (2017) Forecasting carbon price using empirical mode decomposition and evolutionary least squares support vector regression. Appl Energy 191:521–530

Acknowledgements

This work was supported by the Natural Science Foundation of China (No. 72071176), the Philosophy and Social Science Innovation Team Project of Yunnan Province (No. 2022CX01), Yunnan Applied Basic Research Fund for Distinguished Young Scholars (No. 202301AV070010), Yunnan Province of Philosophy and Social Science Program (No. QN202211), the Basic Research Foundation of Yunnan Province (No. 202301AU070093), Philosophy and Social Research Innovation Team of Kunming University of Science and Technology (No. CXTD2023004), Major Cultivation Program of Humanities and Social Sciences Research of Kunming University of Science and Technology (No. PYZDA202201).

Author information

Authors and Affiliations

Contributions

Jin Chen- Conceptualization, Methodology, Visualization. Yue Chen- Writing - Original Draft, Software, Data Curation. Wei Zhou- Supervision, Funding Acquisition, Writing - Review & Editing. All the authors discussed the results, commented on the whole study, and approved the final revisions.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Informed consent is not applicable. The study used secondary data. The authors did not directly engage any participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chen, J., Chen, Y. & Zhou, W. Relation exploration between clean and fossil energy markets when experiencing climate change uncertainties: substitutes or complements?. Humanit Soc Sci Commun 11, 691 (2024). https://doi.org/10.1057/s41599-024-03208-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03208-w