Abstract

This study endeavors to investigate the influence of environmentally conscious financial inclinations on the sustainable investment practices of 137 Chinese companies operating within the exhibition industry from 2015 to 2021. Employing the CS-ARDL (cross-sectionally augmented autoregressive distributed lag) method, the findings indicate that a 1% upswing in the green financing preference index leads to short-term and long-term increases of 0.55% and 0.63%, respectively, in the green investments of Chinese exhibition industry companies. The workforce size has a positive impact on green investments, while a 1% increase in profitability correlates with enhanced green investments among Chinese companies. Furthermore, total income emerges as a factor that encourages green investments within China’s exhibition industry. Notably, the preference for financing through green bonds exerts a more substantial influence on green investments than other preferences of exhibition industry companies. The paper also proposes crucial practical policies, including the adoption of modern digital technologies like big data, the creation of green job opportunities, and the promotion of green initiatives among small and medium-sized enterprises in the exhibition industry through the implementation of environmentally efficient fiscal policies.

Similar content being viewed by others

Introduction

Given the critical and pressing concerns presented by climate change and global warming, a keen focus on sustainability becomes imperative. Human activities, notably the combustion of fossil fuels and deforestation for the dual purposes of industrialization and urbanization, have made substantial contributions to the escalation of greenhouse gas emissions, resulting in a swift and alarming surge in global temperatures. The Intergovernmental Panel on Climate Change (IPCC) has reported a temperature increase of approximately 1.0 °C above pre-industrial (1880–1900) levels (Wang et al., 2023). This uptick in temperatures is linked to the occurrence of extreme weather phenomena like heatwaves, droughts, and severe storms, all of which pose substantial threats to ecosystems, agriculture, and human well-being (Hughes, 2000). Furthermore, the melting of ice caps and glaciers is driving sea-level rise, jeopardizing coastal communities and intensifying the risk of flooding. The World Health Organization (2021) projects that climate change could be responsible for more than 250,000 fatalities between 2030–2050 and the economic toll of climate-related disasters is anticipated to reach $54 trillion by 2040. These alarming statistics underscore the immediate need for the adoption of sustainable practices and the transition to low-carbon economies to mitigate the repercussions of climate change and ensure a sustainable future for future generations. Mostaghimi and Rasoulinezhad (2022) have pointed out that environmental sustainability encompasses a multitude of tools and policies that can aid nations in addressing the depletion of natural resources and the exploration of climate change.

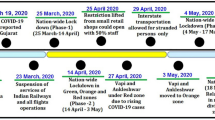

The significance of promoting sustainability and nurturing green prosperity has taken on greater importance in the era of the Coronavirus. The period following the COVID-19 outbreak offers a distinct chance to give precedence to sustainability and embark on an environmentally friendly economic revival. Government-imposed pandemic restrictions temporarily curbed carbon dioxide emissions, resulting in an enhancement of environmental quality and the proliferation of green initiatives (Guo et al., 2023; Liang et al., 2023). The pandemic has laid bare the vulnerabilities in our existing systems and underscored the necessity for resilient and sustainable solutions. By integrating sustainable principles into recovery initiatives, we can not only reconstruct our economies but also confront urgent environmental issues. A green economic recovery involves investments in renewable energy, clean technologies, and sustainable infrastructure, the creation of green jobs, and the promotion of circular economy practices (Li et al., 2023). This approach can stimulate economic growth while simultaneously reducing greenhouse gas emissions, safeguarding biodiversity, and elevating societal well-being. Furthermore, a recent study by the International Renewable Energy Agency (IRENA) suggests that an annual investment of $1 trillion in renewable energy and energy efficiency could generate up to 42 million jobs worldwide over the next decade (IRENA, 2021). By harnessing the momentum of the post-pandemic recovery, we have the opportunity to transition towards a more sustainable and resilient future where economic prosperity and environmental stewardship are mutually reinforcing. However, it’s essential to note that attaining green development and sustainability poses a formidable challenge for enterprises, particularly for small and medium-sized businesses with limited financial resources to undertake green projects.

Small and medium-sized enterprises (SMEs) encounter a range of difficulties when it comes to incorporating environmentally sustainable practices. These challenges primarily stem from limited access to green financing, a low level of investment in green initiatives, and a lack of expertize in sustainability (Mirza et al., 2023). SMEs often struggle to secure affordable and suitable financing for their sustainable endeavors. Financial institutions frequently exhibit reluctance in offering loans or investments for green projects, citing concerns about risk and the absence of collateral. This restricted access to green finance, as highlighted by Haiyang and Xiaohui (2022), obstructs SMEs from obtaining the essential funds required for investments in environmentally friendly technologies, energy-efficient equipment, or sustainable supply chains. Furthermore, the meager levels of green investment within SMEs can be attributed to factors such as limited awareness of the potential benefits of sustainability, perceived high initial costs, and a short-term focus on immediate financial returns. Moreover, many SMEs lack the necessary knowledge and expertize in green practices and technologies, making it challenging for them to navigate the intricacies of adopting and implementing sustainable measures (Yoshino et al., 2023). Effectively addressing these challenges demands coordinated efforts from financial institutions, governments, and business support organizations. Such efforts should focus on providing accessible green financing options, raising awareness about the advantages of sustainable practices, and offering training and educational programs to enhance the green knowledge and capabilities of SMEs.

The role of financing preferences and practices is crucial in developing sustainability across various sectors. By aligning financial decisions with sustainability goals, businesses can drive positive environmental and social change. Financing preferences play a key role in determining the types of investments made and the allocation of financial resources toward sustainable initiatives (Akyuz et al., 2006). By favoring funding sources that support environmentally friendly projects, such as green bonds or impact investing, businesses can contribute to sustainable development and address pressing global challenges. Additionally, financing practices that prioritize transparency, accountability, and responsible financial management are essential for ensuring that sustainability efforts are effectively implemented. This includes robust financial planning, risk management, and reporting mechanisms to track and measure the impact of sustainability initiatives. Furthermore, integrating sustainability considerations into lending and investment practices helps incentivize and reward businesses that adopt sustainable practices, driving a positive shift in the overall market towards greener and more socially responsible activities. Overall, financing preferences and practices play a necessary and transformative role in advancing sustainability, facilitating the transition to a more inclusive, resilient, and environmentally conscious economy.

The purpose of my research is to investigate and understand the financing preferences and practices of Chinese SMEs operating in the exhibitions industry with a focus on promoting sustainability. Exhibitions play a significant role in various sectors, serving as platforms for knowledge exchange, business networking, and showcasing products and services. However, the environmental and social impacts associated with exhibitions can be substantial. Therefore, it is crucial to examine how SMEs in China’s exhibitions industry approach financing decisions to foster sustainability. The research aims to explore the types of funding sources and instruments preferred by these SMEs, such as equity financing, debt financing, grants, or alternative financing options. Additionally, it will examine the financing practices employed by SMEs to manage their financial resources effectively while integrating sustainable principles. By studying the financing preferences and practices of Chinese SMEs in the exhibitions industry, this research seeks to identify opportunities, challenges, and potential strategies for promoting sustainable development in this sector. The findings will contribute to enhancing the understanding of sustainable financing in exhibitions and provide valuable insights for SMEs, industry stakeholders, and policymakers to make informed decisions and advance sustainable practices in the exhibitions industry in China.

The selection of China’s SMEs as the focus of this research is motivated by several compelling reasons. Firstly, China is the world’s largest emitter of carbon dioxide (CO2), making it a crucial player in global efforts to address climate change. The country’s commitment to sustainability and the reduction of greenhouse gas emissions is of paramount importance in achieving global climate goals. Furthermore, China has recognized the significance of sustainability and green growth as key drivers for long-term economic and social development. As China continues to embrace sustainable practices, it is essential to study the financing preferences and practices of SMEs within the country, as they play a pivotal role in driving economic growth, innovation, and employment. SMEs in China have a unique potential to promote sustainability and green growth through their agility, flexibility, and capacity for adopting and implementing sustainable practices. By understanding their financing preferences and practices, we can identify opportunities to support and enhance their contributions to China’s sustainability goals. This research aims to shed light on the role of SMEs in promoting sustainability and green growth in China and provide valuable insights for policymakers, industry stakeholders, and SMEs themselves to accelerate the transition towards a more sustainable future for the country and the global community.

This research follows a structured framework to investigate the financing preferences and practices of Chinese SMEs to promote sustainable exhibitions under study. Section “Literature review” conducts a comprehensive literature review, synthesizing existing scholarly works and identifying gaps in the current knowledge. Section “Theoretical mainstreams” establishes the theoretical background. In the section “Methodology of research”, the data and methodology employed in this study are described, including data sources, collection methods, and analytical techniques utilized. Section “Empirical outputs” focuses on the empirical outputs, presenting and analyzing the findings in relation to the research objectives. Finally, the section “Conclusions and policy recommendations” concludes the paper by summarizing the key findings and discussing their practical implications, providing valuable insights for policymakers and suggesting potential policies for implementation.

Literature review

The financing preferences and practices of SMEs play a pivotal role in driving sustainable development. Previous research has recognized the significance of this issue, with numerous studies shedding light on the challenges faced by SMEs in accessing appropriate financing options and the potential benefits of sustainable financing practices. SMEs, being the backbone of many economies, contribute to job creation, innovation, and economic growth. However, limited financial resources often hinder their potential for sustainable development. Understanding and addressing the financing needs and preferences of SMEs are crucial for promoting their growth, resilience, and long-term viability. By adopting sustainable financing practices, such as accessing green financing options or integrating environmental, social, and governance (ESG) considerations into their financial decisions, SMEs can mitigate environmental risks, improve social outcomes, and enhance their overall sustainability performance. Additionally, aligning financing preferences with sustainable development goals can enable SMEs to foster innovation, adopt cleaner technologies, and develop more sustainable business models. Hence, a deep understanding of financing preferences and effective practices tailored to the unique characteristics of SMEs is essential for promoting their sustainable development and contributing to a more resilient and inclusive economy. Rahaman (2011) discussed that access to financing tools is a challenging issue for firms. The investment preferences are a way to find out the behavior and intention of firms to use financing tools and strategies of firms to access to wider and cheaper funds. Baker et al. (2020) expressed that financing preferences across SMEs exist and the difference depends on the managerial perception of investment and financial plans. By the way, most of SMEs are keen to use external equity and trade credit. Yang et al. (2021) and Razen et al. (2021) highlighted the role of financial literacy on the shape of investment in the preferences and practices of SMEs. They expressed that preferences in enterprises are complex and depend on various factors. However, the financial literacy of enterprises can be an influential factor in financial risk management and optimization of financing practices. Kling et al. (2022) explored the investment preferences and its association with risk perception. They concluded that the perception of owners/managers is so important for the construction of the investment portfolio of an enterprise. In other paper, Peng and Xiong (2022) argued that green transition needs finance and investment that are various and complex to select. The preferences and perceptions of owners of enterprises should be in line with sustainability to manage green financing costs and promote optimized access to green finance. Khan et al. (2022) and Sharma et al. (2022) discussed that green finance is not only a market development issue, but it needs to be analyzed from the view of firms. The preferences to use financing tools shape intention quality and the green investment flows. Benkhodja et al. (2023) and He and Liu (2023) declared that improving green financing perceptions of firms can be obtained by the green corporate governance concept that increases the capacity of firms to use green credit and loans and to make investment in greening activities and procedures. Gao and Liu (2023) expressed that corporate ESG (environmental, social, and governance) investing is a crucial factor for SMEs to find the best ways to access green credit, and also to revise their emission accounting and financial reporting.

Another group of scholars has focused on the aspects of the sustainable exhibition industry as an eco-friendly industry that has not brought any adverse environmental consequences or at least has a more negligible adverse impact than the traditional exhibition industry. Li et al. (2021) expressed that eco-friendly exhibitions represent a more sustainable service in relation to the exhibition industry that is in line with the goals of sustainable development. In other studies, Cai et al., (2023) addressed the sustainable exhibition as an efficient tool in the post-COVID-19 era that can improve the aspect of the green tourism industry. Shang et al., (2023) studied the relationship between the e-exhibition industry on green recovery and confirmed that e-exhibition can enhance green culture through changing visitor’s perception of sustainability.

Theoretical mainstreams

Financing preferences and practices can have significant impacts on sustainability. In this section of the paper, the transmission channels are discussed to clarify the association between financing preferences and green development. First, financing preferences that prioritize sustainable projects can drive investments toward initiatives that have positive environmental, social, and economic impacts (Delis et al., 2023). This can include investments in renewable energy, clean technologies, sustainable agriculture, waste management, and conservation efforts. By allocating funds to such projects, financing institutions can contribute to sustainable development by supporting initiatives that promote resource efficiency, reduce emissions, and protect ecosystems. Second, financing practices that incorporate environmental and social risk assessments can encourage businesses and projects to adopt sustainable practices. By evaluating the potential environmental and social impacts of investments, financial institutions can make informed decisions and promote responsible lending (Chen et al., 2023). Additionally, transparent disclosure of these assessments can create awareness among investors and stakeholders, enabling them to make more sustainable choices (Zhang, 2022). Third, Financing preferences can also influence sustainable development by providing incentives for sustainable practices. For example, financial institutions may offer preferential loan terms, lower interest rates, or other benefits to businesses that meet certain sustainability criteria or certifications. These incentives encourage companies to adopt environmentally friendly practices, reduce their carbon footprint, and promote social responsibility. Next, financing institutions can have a significant impact by divesting from industries or activities that are harmful to the environment or contribute to social inequality. By withdrawing financial support from sectors such as fossil fuels, deforestation, or industries with poor labor practices, financial institutions can signal the importance of sustainability and encourage a shift towards more sustainable alternatives. Fifth, Financing preferences and practices can also facilitate collaboration and knowledge sharing among various stakeholders. Financial institutions can support sustainable development by fostering partnerships, facilitating access to capital for smaller enterprises or projects, and sharing best practices. By creating networks and platforms for collaboration, they can promote innovation and the adoption of sustainability.

Overall, the financing preferences and practices of institutions have the potential to shape sustainable development by directing capital towards sustainable projects, influencing business practices, and creating incentives for responsible and environmentally friendly initiatives. By considering the environmental, social, and economic impacts of investments, financial institutions can contribute to a more sustainable and inclusive future.

Methodology of research

The central concentration of this paper is to analyze the financing preferences and practices for developing sustainable exhibitions. To this end, the information about the Chinese SMEs in exhibitions services is gathered from The Enterprise Survey for Innovation and Entrepreneurship in China (ESIEC), A survey of Chinese SMEs on plans, experiences, and perceptions of global e-business, and Information Disclosure and Corporate Governance in China (CPAS). The 137 numbers from 468 identified companies working in the exhibition industry are accepted to interview and give us the financial statements and reporting. The financing green preferences index is constructed based on green loans, green credit, green bonds, and internal equity green financing. The components of the index are determined based on Baker et al. (2020) and the green financing tools in China. The sustainable investment of the selected SMEs is collected from the Refinitiv database. As the firms are active in the exhibition industry, their green investment can be considered as a proxy for sustainable exhibition. In addition, a number of employees, profit, total revenues, and ICT development are selected as the control variables. Table 1 reports the information on the selected variables:

It is expected that the financing index of green preferences will be the driving factor for sustainable investment of companies active in the exhibition industry. The number of company employees can have a favorable or unfavorable effect. According to Malthus’s theory, the increase in population (employees) will weaken the power of the government (enterprise) due to the creation of costs, while according to Baserup’s theory, the increase in population (employees) will improve collective identity, wisdom and create organizational innovation. The profit of the company is expected to have a favorable effect on sustainable investment. The higher the profit of a company, the more it will be possible to promote organizational investment in the field of sustainable development. Total income can have a positive or negative effect. If the increase in income is accompanied by cost stability, the company’s profitability will increase, and as a result, the company’s sustainable investment will increase. On the other hand, the increase in income can only be a tool to cover the increase in costs, which itself weakens the company’s financial strength to advance its development goals. The development of information and communication technology can be a stimulus for increasing sustainable investment from two aspects. First, the development of information and communication technology improves the company’s access to green finance and attracts investors from abroad; Second, the application of platforms based on information and communication technology has reduced the company’s operational costs, which will result in profitability and increase in sustainable investment. Table 2 argues the expected impacts of the independent variables:

The data of the variables in the form of logarithms are collected from 2015 to 2021, hence the observations of our panel data are [7*137 = 959].

To find the impacts of the chosen independent variables, the cross-sectional dependency at the variable level is tested by Pesaran (2004). The cross-sectional dependency is an important issue in the panel data pattern as the cross-section units may have a correlation that has significant impacts on the suitability of the traditional preliminary tests and estimation techniques. Next, the CADF (cross-sectionally ADF) is used to explore the level of stationary of all series. The method was represented by Pesaran (2007) and has the advantage of considering cross-sectional dependency compared to the traditional panel unit root tests. The Westerlund (2007) technique is considered to determine the long-run association of variables. The technique is the advanced version of the panel co-integration process that considers cross-sectional dependency. The estimation part is conducted by the CS-ARDL (the cross-sectionally augmented autoregressive distributed lag) approach. The advantages of the CS-ARDL approach have been declared by some earlier studies like Ahmed (2020) and Salinas et al. (2023). Next, the robustness test is implemented to confirm that the findings are adequate to interpret and analyze. For this purpose, the CUP-FM (the continuously updated fully modified), proposed by Bai and Kao (2006), is conducted to evaluate the empirical model again.

Empirical outputs

The econometric evaluation process begins with checking the presence of the cross-sectional dependency (CSD). Table 3 reports the CSD test, and expresses that we should consider our panel of Chinese SMEs with correlation between the cross-section units.

Table 4 discusses the CADF method to evaluate the level of stationary of variables. The outputs of the test assert that all the series have the stationary level of one which means that the nature of stationarity of the variables is I (1).

According to the CSD and panel unit root tests’ outputs, it is vital to identify the co-integration association between the variables. Table 5 represents the findings of the method proposed by Westerlund (2007):

According to the results, reported in Table 5, we can conclude that the co-integration association is present among the series of our empirical model.

Table 6 demonstrates the estimation outputs by the CS-ARDL:

Based on the obtained results, it can be stated that the index of green financing preferences is a special stimulus for sustainable investment in companies active in the exhibition industry. Econometrically speaking, a 1% increase in the index of green financing preferences will lead to an increase in green investment by Chinese companies in the exhibition industry by 0.55% and 0.63%, respectively, in the short and long-term. The number of personnel has a favorable effect on the green investment of selected enterprises in China’s exhibition industry. In such a way that with a 1% increase in the number of employees of the studied companies, their green investment will improve by 0.03% and 0.19% in the short and long-term, respectively. Profitability is a factor that can become an enabler of green investment by enterprises in China’s exhibition industry. According to the results, a 1% increase in profitability will lead to an improvement in the green investment of Chinese companies studied by 0.07% and 0.09% in the short and long-term, respectively. The total income should be considered as a factor encouraging the green investment of enterprises in China’s exhibition industry. Although the magnitude of the total income effect is less than the magnitude of the profitability effect on green investment. Therefore, it can be concluded that the profitability of China’s exhibition industry companies is a more special driving factor for the green investment of this company compared to the effect of increasing their income on the volume of environmentally friendly investment. As predicted, information and communication technology has a favorable effect on the green investment of active Chinese enterprises in the exhibition industry, both in the short-term and in the long-term. A 1% improvement in the level of development of information and communication technology will increase the amount of green investment of the studied companies by 0.43% and 0.50%.

As the robustness test, the CUP-FM technique is employed to evaluate the long-run coefficients. Table 7 sheds light on the outputs of the robustness test as follows:

The appropriateness of the empirical findings is ascertained by the robustness test.

To make a further discussion, we decompose the financing green preferences index into green loans, green credit, green bonds, and internal equity green financing. Then added them to the empirical model and did the estimation through the CS-ARDL to determine the impacts of each green financing preference. Table 8 lists the coefficients of only the four financing preferences in the Chinese SMEs:

According to Table 8, it can be stated that the preference for financing green bonds has a greater effect on green investment than other preferences of exhibition industry companies. After green bonds, green financing is domestic equity, which has an effect of 0.20% in the short-term and 0.26% in the long-term on sustainable investment. The lowest estimated effect is the preference for green credit financing by exhibition industry firms. The reason why Chinese companies do not want green credit is the lack of a standard for preparing green financial reports, which makes it difficult for financial and banking institutions to determine credit.

Conclusions and policy recommendations

Sustainable development has become a controversial issue due to the increase in environmental pollution and resource degradation. The importance of dealing with sustainable development is considered not only as an environmental slogan but also as a global solution to create a better quality environment on the planet. This research has the main research question “Do green financing preferences have an effect on green investment?” and using panel data analysis for 137 Chinese companies active in the exhibition industry during the time period of 2015 to 2021, the research question was answered. According to the estimation results, it can be concluded that the coefficients of the independent variables in the long-term are more than the sum of the coefficients of these variables in the short-term. Therefore, any changes in independent variables will have more effects on the green investment of Chinese exhibition industry companies in the long-run. In addition, the index of green financing preferences on green investment of selected Chinese exhibition industry companies has a positive effect, and among the preferences, green bond financing has a greater effect on green investment. Also, among green financing preferences, green credit has the least effect on green investment. The important reason for that is the lack of financial reporting and accounting standards for companies in China, which is itself the cause of disruption in the evaluation of the creditworthiness of the company by the financial institution that provides green credit. Examining the coefficients of the control variables showed that information and communication technology, profitability, income generation, and the number of employees have a favorable effect on the green investment of Chinese exhibition industry enterprises.

Based on the summary of the research, suggestions can be made to improve the green investment of Chinese exhibition industry companies. Small and medium-sized enterprises in China’s exhibition industry can use new digital technologies such as big data to analyze the conditions of green financing markets in order to identify the best green financing tools. Planning to standardize financial reports is a suitable practical policy for small and medium enterprises in China’s exhibition industry to have more access to green credit. Digitization of the financial and economic activities of the exhibition industry companies can lead to the development of a sustainable exhibition in China, which will result in greater energy efficiency and a reduction in environmental pollution. According to the obtained results, the number of employees has a positive relationship with the green investment of Chinese exhibition industry enterprises, confirming the presence of Baserup’s theory. It is suggested that small and medium-sized enterprises in China’s exhibition industry go towards hiring green jobs so that the skills and needs of the company’s personnel are in line with sustainable development. Considering entering the post-corona period and returning the economic activities of companies to the pre-corona state, there is a possibility of sustainable development of the exhibition industry. Therefore, the central government of China should increase the scope of encouraging small and medium-sized enterprises active in the exhibition industry to go green by applying a green fiscal efficiency policy (green tax or green subsidy). The development of corporate green management is considered the main indicator of the strategy of small and medium-sized enterprises in directing financial and human capital towards sustainable development as one of the special applied policies. Under the development of sustainable corporate management, companies can use their available resources optimally and realize the goals of social-environmental responsibility.

The research we conducted had practical and useful results for policymakers and academics on sustainable development, green financing preferences, and enterprises active in the exhibition industry. However, in the future, the scope of this research can be expanded in different ways. For example, one way of research in the future is to study the effect of corona disease and geopolitical tensions in the region on the development of the sustainable exhibition industry in China. Another field of research includes the use of future research methods such as scenario building and content analysis methods to obtain qualitative findings on the development of the sustainable exhibition industry in China. Of course, not all facts exist in quantitative data, so extracting facts from qualitative data is of great importance in the future. Studying the development of the sustainable exhibition industry in different provinces of China and at the city level is also necessary to study. Because the provincial or urban findings are more detailed and will provide more practical help to the policymakers of the central and provincial governments of China.

Data availability

Our analysis of the included articles scoping is available in Supplementary File 1.

References

Ahmed W (2020) Stock market reactions to domestic sentiment: panel CS-ARDL evidence. Res Int Bus Financ 54:101240. https://doi.org/10.1016/j.ribaf.2020.101240

Akyuz K, Akyuz I, Serin H, Cindik H (2006) The financing preferences and capital structure of micro, small and medium sized firm owners in forest products industry in Turkey. For Policy Econ 8(3):301–311

Bai J, Kao C (2006) On the estimation and inference of a panel cointegration model with cross-sectional dependence. Contributions to economic. Analysis 274:3–30

Baker H, Kumar S, Rao P (2020) Financing preferences and practices of Indian SMEs. Glob Financ J 43:100388. https://doi.org/10.1016/j.gfj.2017.10.003

Benkhodja M, Ma X, Razafindrabe T (2023) Green monetary and fiscal policies: the role of consumer preferences. Resour Energy Econ 73:101370. https://doi.org/10.1016/j.reseneeco.2023.101370

Cai G, Xu B, Lu F, Lu Y (2023) The promotion strategies and dynamic evaluation model of exhibition-driven sustainable tourism based on previous/prospective tourist satisfaction after COVID-19. Eval Program Plan 101:102355. https://doi.org/10.1016/j.evalprogplan.2023.102355

Chen J, Liu X, Ou F, Lu M, Wang P (2023) Green lending and stock price crash risk: Evidence from the green credit reform in China. J Int Money Financ 130:102770. https://doi.org/10.1016/j.jimonfin.2022.102770

Delis M, Hasan I, Iosifidi M, Tsoumas C (2023) Economic preferences for risk-taking and financing costs. J Corp Financ 80:102423. https://doi.org/10.1016/j.jcorpfin.2023.102423

Gao W, Liu Z (2023) Green credit and corporate ESG performance: evidence from China. Financ Res Lett 55(Part B):103940. https://doi.org/10.1016/j.frl.2023.103940

Guo L, Bai L, Liu Y, Yang Y, Guo X (2023) Research on the impact of COVID-19 on the spatiotemporal distribution of carbon dioxide emissions in China. Heliyon 9(3):e13963. https://doi.org/10.1016/j.heliyon.2023.e13963

Haiyang W, Xiaohui Z (2022) Financing strategy of SMEs based on the shortage of environmental protection funds. Procedia Comput Sci 199:1521–1528

He Y, Liu R (2023) The impact of the level of green finance development on corporate debt financing capacity. Financ Res Lett 52:103552. https://doi.org/10.1016/j.frl.2022.103552

Hughes L (2000) Biological consequences of global warming: is the signal already apparent? Trends Ecol Evol 15(2):56–61

IRENA (2021) Renewable Energy and Jobs. URL: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Oct/IRENA_RE_Jobs_2021.pdf [accessed 04 Jun 2023]

Khan M, Riaz H, Ahmed M, Saeed A (2022) Does green finance really deliver what is expected? An empirical perspective. Borsa Istanb Rev 22(3):586–593

Kling L, Konig-Kersting C, Trautmann S (2022) Investment preferences and risk perception: financial agents versus clients. J Bank Financ (in press), https://doi.org/10.1016/j.jbankfin.2022.106489

Li X, Su X, Du Y (2021) The environmental sustainability of an exhibition in visitors’ eyes: Scale development and validation. J Hospit Tour Manag 46:172–182

Li Z, Wu Y, Rasoulinezhad E, Sheng Y (2023) Green economic recovery in central Asia by utilizing natural resources. Resour Policy 83:103621. https://doi.org/10.1016/j.resourpol.2023.103621

Liang M, Zhang Y, Ma Q, Yu D, Chen X, Cohen J (2023) Dramatic decline of observed atmospheric CO2 and CH4 during the COVID-19 lockdown over the Yangtze River Delta of China. J Environ Sci 124:712–722

Mirza N, Afzal A, Umar M, Skare M (2023) The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Econ Anal Policy 77:843–850

Mostaghimi N, Rasoulinezhad E (2022) Energy transition and environmental sustainability in Iran: pros and cons through SWOT analysis approach. J Environ Assess Policy Manag 24(04):2350002. https://doi.org/10.1142/S1464333223500023

Peng W, Xiong L (2022) Managing financing costs and fostering green transition: the role of green financial policy in China. Economic Anal Policy 76:820–836

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. IZA DP N. 1240, URL: https://docs.iza.org/dp1240.pdf [accessed 13 Apr 2023]

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Rahaman M (2011) Access to financing and firm growth. J Bank Financ 35(3):709–723

Razen M, Huber J, Hueber L, Kirchler M, Stefan M (2021) Financial literacy, economic preferences, and adolescents’ field behaviour. Financ Res Lett 40:101728. https://doi.org/10.1016/j.frl.2020.101728

Salinas A, Ortiz C, Changoluisa J, Muffatto M (2023) Testing three views about the determinants of informal economy: new evidence at global level and by country groups using the CS-ARDL approach. Econ Anal Policy 78:438–455

Shang Y, Pu Y, Yu Y, Gao N, Lu Y (2023) Role of the e-exhibition industry in the green growth of businesses and recovery. Econ Change Restruct 56:2003–2020

Sharma G, Verma M, Shahbaz M, Gupta M, Chopra R (2022) Transitioning green finance from theory to practice for renewable energy development. Renew Energy 195:554–565

Wang L, Wang L, Li Y, Wang J (2023) A century-long analysis of global warming and earth temperature using a random walk with drift approach. Decis Anal J 7:100237. https://doi.org/10.1016/j.dajour.2023.100237

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

World Health Organization (2021) Climate change and health. URL: https://www.who.int/news-room/fact-sheets/detail/climate-change-and-health [accessed 22 Jun 2023]

Yang Y, Su X, Yao S (2021) Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resour Policy 74:102445. https://doi.org/10.1016/j.resourpol.2021.102445

Yoshino N, Rasoulinezhad E, Phoumin H, Taghizadeh-Hesary F (2023) SMEs and carbon neutrality in ASEAN: the need to revisit sustainability policies. Econ Res-Ekonomska Istraživanja 36(2):2177180. https://doi.org/10.1080/1331677X.2023.2177180

Zhang D (2022) Does the green loan policy boost greener production? – Evidence from Chinese firms. Emerg Mark Rev 51(Part B):100882. https://doi.org/10.1016/j.ememar.2021.100882

Acknowledgements

This study was supported by the Zhejiang Philosophy Social Science Planning Project Achievements, Enabling Common Prosperity through the Integrated Development of Ecological Agriculture and Tourism: logic, mechanism, and optimization path (No. 24NDQN201YBM).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study’s conception and design. Material preparation, data collection, and analysis were performed by FQ and YP. The first draft of the manuscript was written by FQ, YP, and YS commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Qian, F., Pu, Y. & Shang, Y. Financing preferences and practices for developing sustainable exhibitions in Chinese companies. Humanit Soc Sci Commun 10, 938 (2023). https://doi.org/10.1057/s41599-023-02467-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02467-3