Abstract

This study proposes a harmonic average of support and confidence method (HSC), which is a new way to select important rules from the many rules in the decision tree and thereby build a core rule-based decision tree (CorDT) that more easily explains the insolvency factors related to small and medium-sized enterprises (SMEs) using the HSC. To this end, an insolvency prediction model for SMEs was developed using a decision tree algorithm and technological feasibility assessment data as non-financial datasets. We divided these datasets into three types, a general type, a technology development type and a toll processing type applying characteristics of SMEs. We also applied a cost-sensitive approach and several data balancing techniques to construct the same proportion of healthy and insolvent company samples in the datasets. As a result, the insolvency prediction model applied using the synthetic minority over-sampling technique (SMOTE), an over-sampling technique, showed the highest performance with an average hit ratio of 77.6%. Next, we selected important rules by applying HSC to the decision trees with the highest performance and built CorDTs for three types of SMEs using the selected rules. Finally, using the developed CorDTs, we explained the causes of insolvency by type of SME and presented insolvency prevention strategies customized to the three types of SMEs.

Similar content being viewed by others

Introduction

Bankruptcy caused by corporate insolvency is an important event that causes economic losses to different stakeholders, such as shareholders, investors, and creditors. Although corporate insolvency occurs, regardless of the size of the company, small and medium-sized enterprises (SMEs) are exposed to relatively greater threats since they lack the ability to raise funds from banks and have difficulty in finding and receiving additional policy finances or resources (Ropega, 2011). Sometimes, corporate insolvency not only occurs due to a corporation’s own problems, but may also occur as a chain effect due to the insolvency of consumers or suppliers. Therefore, it is very important to predict initial signs of corporate insolvency before it is too late to resolve these issues and a major crisis.

Financial information provides useful information for predicting corporate insolvency, so it has been used as the basic data for analyzing corporate credit risk in the early research (Beaver, 1966; Altman, 1968). However, with SMEs, accounting or management skills are often insufficient because they have difficulty in hiring accountants or professional managers (Mitchell and Reid, 2000). In addition, SMEs often do not have sophisticated financial decision-making systems and also do not always use them compared to large companies (Quinn, 2011). The financial information on SMEs is often unreliable due to the lack of internal controls. In addition, financial information and other financial ratio indicators only reflect the performance of the previous year, and they do not express the current operational status of the company (Balcaen and Ooghe, 2006).

Therefore, the insolvency prediction of SMEs based on their key financial information has the following limitations. First, it is difficult to collect that financial information compared to listed companies, and it is difficult to recognize the information that indicates the latest status of a SME company because their financial statements are prepared only once a year. Second, corporate activities of SMEs are simple in kind, so financial analysis and trend analysis based on their financial information is very difficult. Third, since companies in the early stages of start-ups do not have financial statements or even simple ones, the accuracy of financial evaluation based on their available financial statements is inevitably low. Fourth, since factors affecting insolvency may differ, depending on the type of company, any analysis should be conducted by also considering the characteristics of each type of company.

To solve this problem, this study aims to establish an insolvency prediction model for SMEs using technological feasibility assessment data, which is non-financial data offered by the Korea SMEs and Startups Agency (hereinafter referred to as KOSME). KOSME is a quasi-governmental organization that conducts corporate evaluation and loan policy funds to SMEs in Korea, and operates using about 5.4 trillion won (USD 4.6 Billion) in 2021. In the review and evaluation stage of a company, KOSME uses technological feasibility assessment data that consists of technology, business feasibility, and managerial evaluation, which will differ according to the industry, its business history, and use of funds. Previous studies have shown that technological feasibility assessment data can be used to predict the insolvency of classified SMEs based on their business history (Lee et al. 2020).

This study conducted an experiment to build an insolvency prediction model for SMEs’ using a decision tree algorithm that shows good performance and explanatory power for machine learning. Since the SMEs are classified into general types, technology development types, and toll processing types for the technological feasibility assessment, this study also classified the datasets of SMEs into general types, technology development types, and toll processing types. In the preprocessing stage, several data balancing techniques were applied to construct the same proportion of health and insolvent company samples for each analysis dataset. In addition, the feature selection technique was used to build an accurate prediction model for each type of SME and its important features.

This study analyzes the causes of insolvency by type of SME using a decision tree algorithm. When the decision tree is composed of many rules, difficulties in explanation can arise since there are many rules to explain. To solve this problem, we proposed a harmonic average of support and confidence (HSC), which is a new way to select the important rules among the many rules that are derived by the decision tree. Next, we conducted experiments to compare HSC to previously developed important rule selection methods to verify the performance of HSC. We also described the Core Rule-based Decision Tree (CorDT) per type of SME which consists of the important rules selected based on the HSC. Using these rules, we can explain the causes of insolvency by type of SMEs more easily and present an insolvency prevention strategy that is precisely tailored to each type.

The rest of this paper is organized as follows. Section “Literature review” reviews previous studies on insolvency prediction of SMEs and the previous rule selection methods used from decision trees. Section “Research methodology” describes the research framework proposed for this study and main research methods. Section “A proposed rule selection method” explains the HSC method that is proposed in this study and the experimental results, including a performance evaluation. In Section “Explaining the insolvency rues based on the three CorDT models”, the rules of CorDT and the uses of CorDT by type are explained. Section “Conclusion” summarizes the results of this study and notes the limitations of the research and suggestions for future studies.

Literature review

SMEs insolvency predictions

Since corporate insolvency affects multiple stakeholders in supply chains, it is very important to predict the insolvency of a company in advance. Thus, many studies have been conducted in the accounting and finance areas of these companies.

Most of these studies have used financial information to predict the insolvency of the company. Altman’s z-score model predicted corporate insolvency using five ratios for listed companies, namely, operating capital/total assets, retained earnings/total assets, pre-interest tax revenue/total assets, total stock market price/total liabilities, and sales/total assets (Altman, 1968). Ohlson used nine financial ratios (Ohlson, 1980). Altman and Sabato (2007) then made default predictions using additional cash/total assets, short-term borrowings, liquidity long-term liabilities/equity capital, EBITDA/total assets, and EBITDA/interest expenses in the existing z-score model.

In terms of financial information, since disclosed information is utilized, it has the advantage of accessing the most standardized form of data. However, it is only written on a semi-annual or annual basis and thus has a limitation in that it takes a certain amount of time to be disclosed after completing certain procedures, such as settlement and any external audit. In addition, financial statements have limitations in their functions, such as failing to express precise advantages and disadvantages in the development process of a company, company managerial ability, and technology development performance. In particular, the financial information of large companies and listed companies is easier to access because these are open data. However, non-financial information other than financial information should be used when predicting the insolvency of SMEs since SME financial information is limited in its acquisition and the financial statements of early start-ups are very simple (Shim, 2007; Hue et al. 2012; Kim, 2018; Choi et al. 2019; Veganzones et al. 2023).

Among the studies that predict the insolvency of a company with non-financial information, Lugovskaya (2010) used the age and the size of the company. Said et al. (2003) stated that customer satisfaction, employee satisfaction, quality, market share, productivity, and innovation are factors that affect performance. Altman et al. (2015) indicated that the ability to pay, turnover, industrial risk, and Board member characteristics are important non-financial predictors. Blanco-Oliver et al. (2015) obtained a higher prediction accuracy of insolvency than when using only financial information by using the age of the company, creditor legal action, and company governance structure. Kim et al. (2016) made a prediction using data derived from economic trends and financial ratios per economic cycle phase. As such, these studies on non-financial information affecting insolvency were thus conducted.

In terms of technology, many studies have been conducted. Starting with the univariate analysis of Beaver (1966), many insolvency prediction models were developed using statistical techniques, such as Multi Discriminant Analysis (MDA) (Altman, 1968) and the logit model (Ohlson, 1980). Recently, studies on the development of corporate insolvency prediction models used various machine learning techniques, such as deep learning, artificial neural network, decision tree, support vector machine, ensemble, and hybrid techniques to overcome the limitations of the traditional statistical techniques. Table 1 summarizes the studies on the prediction of corporate insolvency reviewed so far.

Traditionally, research on corporate insolvency has primarily relied on financial information. However, in recent times, there has been a notable increase in studies that combine both financial and non-financial information. McCann and McIndoe-Calder (2015) studied the factors that can predict corporate failure. They found that the size of the company and the accuracy of its credit score are two important factors. Their study further found that the predictive accuracy was 80.65% in the financial sector, but only 64.8% in the manufacturing sector. Grunert et al. (2005) and Kohv and Lukason (2021) have argued that when financial and non-financial factors are used together, it is possible to predict future debt default events more accurately than when each factor is used individually. Höglund (2017) stated that when using a genetic algorithm for variable selection on non-financial variables, that analysis revealed that variables measuring solvency, liquidity, and payment period of trade payables are significant in predicting tax defaults.

Bhimani et al. (2013) demonstrated that the incorporation of non-financial information and macroeconomic indicators along with financial data can substantially enhance the predictive accuracy of default models. Ciampi (2018) conducted a study to improve corporate insolvency prediction using non-financial data, specifically corporate social responsibility (CSR). All these findings emphasize that integrating CSR orientation significantly enhances default prediction models for SMEs. Additionally, the ongoing research indicates that smaller firms experience greater prediction accuracy enhancement by utilizing CSR characteristics as default indicators.

For mid-sized and larger corporations, it is relatively simple to acquire financial and non-financial data, such as CSR text. There is also a lot of non-financial information available for these companies. However, obtaining accurate financial data for small businesses and startups is challenging because these companies are often not required to disclose their financial information to the public. Additionally, the financial information that is available may be outdated or inaccurate. As a result, using financial data for insolvency prediction for small businesses and startups can be unreliable. Moreover, the non-financial data for these companies are even scarcer and harder to obtain because non-financial information is often not collected or tracked by small businesses and startups.

This current study used the technological feasibility assessment of companies used for credit loans or guarantees to SMEs, and also reviewed other studies based on the non-financial information of technological feasibility assessments that were similar.

Nam (2008) employed PCA (principal component analysis) on technological assessment to model data that consisted of factors, such as technological soundness, business viability, and market feasibility, to construct a bankruptcy prediction model. These findings indicated that economic environmental variables significantly contribute to bankruptcy prediction accuracy. Upon scrutinizing individual variables, factors like technical expertize, managerial proficiency, operational competence, and profit outlook were assigned higher weights in that analysis.

Park and Lim (2015) proposed a two-step approach for operating technological assessment-based guarantees. The first step is to evaluate a company’s technological competence, excluding financial statement data. Companies that receive higher ratings in that first step then undergo a second evaluation step that combines financial information and other factors, to determine guarantee approval and terms. That analysis revealed that technological assessment data can enhance bankruptcy prediction capability, especially when integrated into the soundness management of lending institutions.

Lim (2016) conducted an analysis of bankruptcy prediction using technological assessment data. Within this context, he emphasized that managerial attributes and business viability variables within gathered technological assessment data make the most significant contribution to bankruptcy prediction. He also found that the predictive power of a model increased when a financial variable, such as liquidity or stability, was added to the technological assessment data.

Lee and Kim (2017) attempted to integrate technological competence evaluation models with credit assessment models by verifying the relationship between technological competence assessments and corporate insolvency. They demonstrated that managerial competencies, technological development capabilities, and product commercialization competencies closely correlate with corporate insolvency, thereby substantiating these variables’ relevance. Further, they proposed that the potential of enhancing insolvency discrimination through such non-financial indicators.

Lee et al. (2020) utilized technological feasibility assessment and the analysis of the corporate history by categorizing it into three-year segments. These findings highlighted that for companies that had been established for less than three years, variables such as financing ability, the CEO’s reliability, and future profitability emerged as significant. On the other hand, credit status, financing ability, and competitive strength were identified as important variables for companies already established for more than 3 years.

Therefore, these findings from the literature review of previous studies that utilized technological feasibility assessment as a non-financial indicator to predict a company’s growth, bankruptcy, and high-profit generation capabilities suggest that predictive research using non-financial information is indeed viable technique. Particularly, in cases where financial information is unreliable, such as with startups that lack accumulated financial data and small businesses with weak financial credibility, non-financial information can be effectively employed for predictive analysis.

As demonstrated above, there are studies that indicate the significance of using non-financial information, specifically technological feasibility assessments, to predict both corporate insolvency and growth potential. In light of this evidence, the present study undertakes an investigation into corporate insolvency prediction by utilizing non-financial technological feasibility assessment data.

Based on the trends in the aforementioned research, we developed a corporate insolvency prediction model using only non-financial information. In more detail, technological feasibility assessment information consisting of management ability, business feasibility, and technical ability, and data reflecting the actual status of SMEs’ general health was used in this study.

The research on rule selection

Decision tree, one of the most widely used algorithms in machine learning, is an explainable and white box algorithm that shows classification results using an if-then rule format. The decision tree provides a logical intervention of the rules (Witten and Frank, 2002; Adadi and Berrada, 2018). However, when the decision tree consists of many rules, users may have difficulty in selecting the most important rules that can help them make decisions from the many rules. The number of rules in the decision tree can also be controlled by limiting the number of leaf nodes (Olson et al. 2012). Reducing the number of generated rules simplifies the interpretation of the results and eliminates the characteristics of the data, so a technique to measure the importance of all the generated rules after proper pruning is thus required.

In the past, classification accuracy was used as a criterion for evaluating the importance of a rule (Safavian and Landgrebe, 1991). However, it has since been noted that the total number of observations is more important than the classification accuracy ratio that distributes the total observations to accurately classified observations in the criteria for determining important rules. To solve these problems, the Laplace method considered not only that the ratio was classified correctly, but also the number of observations when selecting important rules. This method was proposed by Clark and Boswell (1991) to complement the problem of having an entropy algorithm when generating decision trees (Gamberger et al. 2000; Provost and Domingos, 2003; Tanha et al. 2017; Nandhini et al. 2022).

In Eq. (1), k is the number of classes in the domain, Ncorr is the number of examples in the predicted class corr covered by the rule, and Ntot is the total number of examples covered by the rule.

In Laplace, even if the classification accuracy is high, a low value is calculated whenever the number of observations in the rule is small. In addition, there is no difference herein from the existing classification accuracy for rules with a certain level of observation. To compensate for the problem of calculating classification accuracy only within one rule, weighted relative accuracy (WRA) has emerged (Lavrač et al. 1999, 2004; Kaytoue et al. 2017; Hammal et al. 2019; Liu et al. 2020), as it can evaluate the generality and specificity of the rule at the same time as follows:

In Eq. (2), p(Cond) represents the generality of the rule and is the ratio of examples that the conditional covers for all examples, regardless of the target class of the rule r, which is called coverage. The p(Class) is the ratio of positive examples corresponding to the target class for all examples, and represents the general trend of the target class in the data. The P(Class|Cond) is the proportion of positive examples in the examples covered by the rule.

The value obtained by subtracting the P(Class) from p(Class|Cond) indicates how different the learned subgroup is from the general trend. It is thus called Relative Accuracy because it shows the specificity of the rule in relative terms. A measure for evaluating rules by applying a weight representing generality for these rule specificities is called Weighted Relative Accuracy.

This study proposes an HSC method as a new way of selecting important rules from decision trees. To prove the usefulness of this proposed method, we conducted a performance comparison experiment between the HSC and existing methods (Clark and Boswell, 1991; Lavrač et al. 1999, 2004; Kaytoue et al. 2017; Hammal et al. 2019; Liu et al. 2020).

Research methodology

Methodological process

Figure 1 shows our research framework. First, we collected datasets on the technological feasibility assessment used in the actual lending progress to SMEs. In the preprocessing step, we extracted technological feasibility assessment information of the manufacturing industry. We divided the datasets into three types, a general type, a technology development type, and a toll processing type, according to the kind of technology of the company. To solve the imbalance problem between insolvency and healthy companies in the dataset, we sought an appropriate sampling method by applying a data balancing method, such as under-sampling techniques and over-sampling techniques. We also used the feature selection method to select variables that play an essential role in predicting the target variable among the independent variable candidates. Next, we developed three insolvency prediction models for each technology type of SME using a decision tree algorithm. We built three CorDT from these three insolvency prediction models after selecting important rules using the HSC method. Based on the CorDTs, we explained the causes of insolvency by type of SME more easily and presented insolvency prevention strategies for three technology types of SMEs.

The datasets

A company assessment comprehensively analyzes non-financial factors that are affecting a company’s competitiveness, business feasibility, and management capabilities and the financial factors that affecting its credit risk. That assessment then evaluates the company’s technological competitiveness and business insolvency to have a company evaluation grade. Company evaluation examines each of the financial items and technological feasibility items by conducting a fact-finding survey on the evaluated company. It then calculates a financial grade and a technological feasibility grade, and combines them to calculate a company evaluation grade. Herein, the financial items are an evaluation model that uses the company’s financial indicators. The technological feasibility assessment is an evaluation model that is rated by the evaluator based on non-financial factors, such as the company’s management ability, business feasibility, and technical ability.

These financial performance indicators, however, only show past management performance and do not explain the process, cause, and future expectations of that company’s management performance. Since the 1980s, many studies have indicated the need for non-financial performance indicators as performance indicators of companies to overcome the limitations of financial evaluation. For example, the predictive power of the bankruptcy prediction model can be improved by 25% when non-financial factors and macroeconomic data are evaluated, together with the financial factors (Bhimani et al. 2013). A study that analyzed corporate credit information for large German banks found that using financial and non-financial factors together can accurately predict corporate bankruptcy better than using only financial or non-financial factors (Grunert et al. 2005).

In particular, in the case of SMEs, the accuracy of the bankruptcy prediction model increased by 13% when non-financial and financial factors together were used as predictors of corporate bankruptcy. Therefore, the value of non-financial factors becomes more important when predicting the insolvency of SMEs that lack adequate financial factors (Altman et al. 2010).

In this paper, we use the technological feasibility assessment data of KOSME as non-financial data. The technological feasibility assessment consists of three evaluation categories: Management availability, business feasibility, and technical availability. The technological feasibility assessment items and points for each category are applied differently. SMEs belonging to the manufacturing industry are divided into a general type, a technology development type, and a toll processing type according to technology type. A general type of manufacturing company is one that has all its own technology, a technology development base, and a production base. A technology development type manufacturing company is a company that has its own technology and technology development base, but does not have its own production base or it is weak. A toll processing type manufacturing companies are defined as specific services for customers’ products. It is a company that possesses special processing equipment and specializes in processing raw materials or semi-finished products, and charges fees (more commonly referred to as a toll) for this service. They have extensive material processing experience and parts manufacturing experience in various industries, but they do not have the ability to develop complete products and technologies.

The target variable and the independent variables

In this study, a company with more than three months of delinquency after lending from the KOSME was defined as an insolvent company. After that, the company insolvency or healthy value was used as the target variable.

The technological feasibility assessment is designed to evaluate indicators of management ability, business feasibility, and technical ability, depending on company age, the industry to which the company belongs, and the type of technology characteristics. In this study, a total of 32 assessment indicators of manufacturing companies that were evaluated for policy funds in 2014 were used as the independent variables. The summary of these assessment indicators is shown in Table 2.

Cost-sensitive approach

To train a high-performance classification model, a large-scale dataset of high quality is essential. However, most naturally occurring datasets are imbalanced, which means that the number of examples in each category are not equal. When training models with such imbalanced datasets are used, the biases inherent in that data can transfer to the trained model and can lead to a decrease in overall model performance.

Two options are commonly employed to address such imbalanced datasets. The first is re-sampling, which seeks to equalize class distribution by either under-sampling the majority class or over-sampling the minority class. Mienye and Sun (2021) indicated that misclassifying a positive instance bears a greater cost than misclassifying a negative sample. In this context, resampling techniques have been utilized to rectify class imbalances in datasets. However, such techniques may inadvertently exclude valuable data while also increasing computational overhead with redundant instances. In essence, both under-sampling and over-sampling methods alter the distribution of the distinct classes. Therefore, a potential definitely exists for the use of resampling to act as a bias during the model learning process.

The second option is cost-sensitive learning, wherein higher misclassification costs are attributed to the minority class when compared to the majority. By assigning elevated weights to the minority class, this technique alleviates the bias that was previously skewed towards the majority class in the model.

The cost-sensitive learning approach, which comes under the category of data sampling, is thus implemented. It uses a cost matrix. Each instance is given a misclassification cost and for each incorrect classification, that instance is penalized ‘n’ times the misclassification cost. A cost sensitive SVM using a cost matrix that penalizes twice for a misclassification is thus proposed (Mathew, 2023).

However, for cost-sensitive methods, costs set based on the occurrence ratios of each class may not be ideal due to a lack of consideration for the specific modeling problem, the dataset distribution, and the characteristics of each class. Consequently, this particular drawback produces the possibility of introducing another form of bias to the model.

A universally accepted theory for how to determine class weights does not yet exist. However, a common practice is to use methods that balance the classes by inversely reflecting the class proportions. One common heuristic for assigning class weights is to use the inverse of the class distribution in the dataset. This process can be accomplished by assigning sample weights or re-sampling the data inversely proportionally to the class frequency.

In this current study, we assigned cost-sensitive values of 3.25, 2.52, and 2.38 to three technology types, respectively. This simple heuristic has also been widely adopted (Huang et al. 2016; Wang et al. 2017; Cui et al. 2019; Brownlee, 2020; Mienye and Sun, 2021; Johnson and Khoshgoftaar, 2022).

Data balancing

When developing the prediction model from the training data, we need to identify the class distribution of the target variable. Learning is generally focused on over-represented (majority) class when the value that belongs to a specific class is more than under-represented (minority) class within the target variable. Thus, a biased prediction model that predicts only a specific class may well be constructed. Therefore, it is necessary to match the ratio of the classes that exist in the target variable through using data balancing techniques before constructing any prediction model.

In general, company insolvency is rare compared to healthy companies, so data imbalance occurs by collecting data on company bankruptcy. When developing an insolvency prediction model using the imbalanced datasets, the prediction model can predict healthy companies well, but cannot predict insolvent companies well. To overcome this problem, data balancing techniques, such as under-sampling and over-sampling, are used. Under-sampling is a method of reducing the majority class samples according to the number of samples from the minority class. This sampling method has the advantage of shortening learning time. Still, classification accuracy can be undermined when the extracted sample does not represent the characteristics of the population, and the number of samples from minority classes is very small. Over-sampling is a method of increasing the sample of a minority class according to the number of majority class samples (Mathew et al. 2018). There is no loss of information, and it has the advantage of showing high classification accuracy compared to under-sampling. Still, it has the disadvantage of needed increased computation time due to data increase and overfitting of problems.

This study collected 4356 datasets (no sampling datasets) to develop the prediction models for three types of SMEs. Then we applied a data balancing technique to these collected datasets to create 2334 under-sampling datasets and 6378 over-sampling datasets, as shown in Table 3.

Feature selection

The process of selecting only those variables that play an essential role in predicting a target variable from the independent variables is called feature selection. Among the independent variables chosen after preprocessing, we removed those independent variables that were not helpful to the prediction model as they might negatively affect the accuracy of the entire prediction (Dash and Liu, 1997). To select influential variables for the prediction model, we used the gain ratio as a criterion to evaluate the importance of the independent variables (Choi et al. 2013). We found the ideal combination of variables and built the prediction models using the combination.

Experimental results

In this study, we developed the prediction models for the insolvency of SMEs using data mining techniques. To develop these models, we used the data mining open software, Weka 3.8.3 and Python 3.8.5. We also used a decision tree algorithm that showed the highest hit ratio among several machine learning algorithms for technological feasibility assessment data (Lee et al. 2020). We conducted several experiments by dividing the dataset into training and test data at a ratio of 7:3. We also applied cost-sensitive approach and three under-sampling techniques random under-sampling (RUS), SpreadSubsample, and ClusterCentroids, as well as three over-sampling techniques random over-sampling (ROS), SMOTE (Chawla et al. 2002; Cheng et al. 2019), and Adaptive Synthetic Sampling (ADASYN) (He et al. 2008), to mitigate the data imbalance problem that is more biased toward healthy companies than toward insolvent companies. Thus, we were able to generate a total of 21 datasets by applying each of the three technology types to a single no sampling dataset, three under-sampled datasets, and three over-sampled datasets.

Table 4 shows the experimental results for each prediction model where, the over-sampling method showed a better hit ratio than the under-sampling method. The application of the cost-sensitive approach did not result in notable improvements in hit ratio and AUC within our dataset. In any case of under-sampling, the hit ratio was lower than using no sampling, and the over-sampling method that amplifies data was more effective than the under-sampling that artificially removes data. In the general type, ADASYN datasets had the highest hit ratio of 80.5%, followed by SMOTE datasets in the technology development type with 77.7% and toll processing type with 75.1%. This result compares well to similar conditions in prior studies, such as Höglund (2017) with a predictive accuracy of 73.8%, and Alzayed et al. (2023) with a predictive accuracy of around 75%. Given these positive results, it becomes challenging to view lower predictive accuracies as a detriment, and so we consider the approach as a suitable research methodology for corporates with limited usability of financial data. Through using these experiments, we determined that the SMOTE dataset showed the highest average hit ratio for the three types of SMEs.

In this study, we analyzed three insolvency prediction models that were developed from the three datasets that applied the SMOTE technique. Table 5 shows the important variables with the highest performance in the prediction model, using a decision tree algorithm for three manufacturing types of SMEs.

For a general type manufacturing company, the eight influential variables’ affecting SME insolvency were management stability, financing ability, credit status, business propulsion, CEO’s professionalism, transaction stability, production efficiency, and quality & process improvement. The seven essential variables for a technology development type of company were internal control, financing ability, transaction stability, sales management, competitive strength, market growth, and technical application capacity. For a toll processing type, we found eight important variables, including management stability, business propulsion, CEO’s reliability, sales management, future profitability, market position, competitive strength, and market environment.

Since the general type had a technology, technology development base, and production base, it was evaluated using all evaluation categories, including management ability, business feasibility, and technical ability. Among these, the management ability category included five evaluation indicators, so it was more important than the other categories.

We expected that several evaluation indicators would be found in the technical ability category because the technology development type has its own technology, but no production base. However, we found out only one indicator of technical application capacity. Instead, four business feasibility indicators were found to use to evaluate corporate management, and competitive strength and sales management were then derived as the most critical indicators. Competitive strength is an index that assesses the level of competition, barriers to entry, and the possibility of the emergence of substitutes. It was found to be an important indicator, although the score was not large. The sales management indicator evaluates the average recovery management of accounts receivables and the level of the marketing operation. Therefore, technology development type companies should prioritize their competitive strength and the sales management capabilities of their products.

The toll processing type has only a production base without any self-development technology. In this type of company, business feasibility indicators were derived as important, unlike the other two types where management ability was important. These results reflect the characteristics of the toll processing type, and they require placing greater emphasis on management ability and business feasibility indicators than on technology.

In general, when making insolvency predictions using the financial information of SMEs, problems such as the inaccuracy of financial statements, a lack of reflection on the current situation, and a lack of financial items for early start-ups make it difficult to predict the insolvency of SMEs. However, the results of the experiment also showed that technological feasibility assessment is a valuable dataset that can predict insolvency in SMEs. Therefore, CEOs in the manufacturing sector should first recognize that the factors affecting insolvency are different, depending on the type of technology used by the SMEs. In addition, the CEO will be able to effectively prevent insolvency by identifying technology types, finding appropriate insolvency factors, and improving them both intensively and preemptively.

A proposed rule selection method

Harmonic average of support and confidence (HSC)

Among machine learning algorithms, artificial neural networks and support vector machines are classified as black box algorithms. On the other hand, the decision tree is classified as a white algorithm enabling logical interpretation of classification (Adadi and Berrada, 2018). However, despite that advantage, it is difficult to determine the importance of multiple rules generated by the decision tree, which makes it difficult to derive strategies from the rules. To lessen this problem from occurring when deriving strategies from rules, this study proposes an HSC methodology that is based on the concept that is used in the association rule mining algorithm.

When the association rule is expressed as ‘Rule: X→Y’, X is referred to as conditional and Y is referred to as the outcome. Rule interpretation says that ‘observations satisfying the X condition are classified into Y groups’, and the support and the confidence measures are commonly used in order to evaluate the importance of the rule (Agrawal et al. 1993).

Support refers to the ratio of the number of transactions supporting the association rule to the total number of transactions in the database, as shown in Eq. (3). That is, this support relates the usefulness of the rule as follows:

Confidence refers to the ratio where a transaction satisfying the conditional part satisfies the conclusion part, as shown in Eq. (4). That is, confidence refers to the accuracy of the rules as follows:

This study proposed and applied an HSC which selects the important rules from the rules generated in the decision tree. First, the support is calculated as shown in Eq. (5), thereby reflecting the number of instances in a leaf node and the entire instances as well as follows:

Second, the confidence is calculated as shown in Eq. (6), reflecting the number of instances in a leaf node and the number of instances with a target value that same as what the leaf node represents as follows:

Third, the normalization of support and confidence is obtained by dividing each maximum value, respectively, as shown in Eq. (7) and Eq. (8). Since the value of the support is relatively small compared to level of the confidence, normalization must be performed to consider the two measures equally as follows:

Fourth, to comprehensively consider both normalized measures, the HSC is calculated, as shown in Eq. (9). Then a leaf node (pattern) with the top n HSC values is selected.

where I denotes the set of leaf nodes, N denotes the total number of instances, Nit denotes the number of instances that belong to the class represented by the leaf node i among all instances, ni denotes the number of instances belonging to the leaf node i, and nit denotes the number of instances belonging to the class represented by the leaf node for the instances in the leaf node i.

Results of the important rule selection experiment

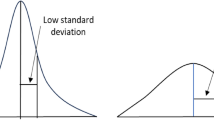

We conducted the following experiments to prove the performance of our proposed methodology. Figure 2 shows the experimental results, and it can be seen there whether the importance ranking of the rules that was determined using each evaluation method (Laplace, WRA, and HSC) actually reflected the classification accuracy, the number of observations included, and the validity of the rules. It should also be considered that there is a big difference in interpretation of these results even if the ranking of rules with high importance is only one grade different.

The experiment results for a Laplace, b WRA, and c HSC (proposed). The x-axis indicates the sorting of rules selected using each evaluation method based on their importance ranking. The y-axis represents the classification accuracy (CA) of data for each rule and the cumulative ratio of correctly classified observations (CRCC).

In Fig. 2, the x-axis indicates that the rules selected using each evaluation method are sorted according to importance ranking. The y-axis is the classification accuracy (CA) of data for each rule and the cumulative ratio of correctly classified observations (CRCC). Here, CA is a percentage value obtained by dividing the sum of nit (i.e., the number of instances belonging to the class represented) by the leaf node for the instances in the leaf node i) by the sum of ni (i.e., the number of instances belonging to the leaf node i) when all rules are sorted according to the order of large HSC values as follows:

where k is the number of rules.

CRCC is the sum of nit (i.e., the number of instances belonging to the class represented by the leaf node) divided by the sum of Nit (i.e., the number of instances that belong to the class represented by the leaf node i for all instances) when all rules are sorted in the order of the large HSC values.

In this experiment, we used several distance functions to evaluate the performance of the evaluation method. The distance metrics were used to determine the closeness of each data point to the cluster centroids. The Euclidean distance (ED) between one vector \({{{\mathrm{X}}}} = \left( {{{{\mathrm{x}}}}_1,\,{{{\mathrm{x}}}}_2, \ldots ,{{{\mathrm{x}}}}_{{{\mathrm{n}}}}} \right)\) and another vector \({{{\mathrm{Y}}}} = \left( {y_1,\,y_2, \ldots ,y_n} \right)\) was obtained as follows:

In the case of the same vector X and Y, the Manhattan distance (MD) and Canberra distance (CD) were obtained as follows:

Table 6 shows the results of calculating the sum of the three different distances between the two points of CA and CRCC for each type of SMEs in Fig. 2. The Euclidean distance was calculated as 208.2 for Laplace, 106.6 for WRA, and 104.6 for HSC. The Manhattan distance was calculated as 671 for Laplace, 328 for WRA, and 319 for HSC. The Canberra distance was calculated as 5.3 for Laplace, 2.6 for WRA, and 2.4 for HSC. The results showed that the newly proposed HSC method had the smallest total distance of the evaluation methods among the three rule selection methods. In the case of the Laplace, important rules have high classification accuracy, but the ratio of observations when correctly classified was very low. In the case of the WRA, this method selected the important rules by reflecting classification accuracy and the ratio of observations in a relatively balanced manner. However, the WRA may include the number of incorrectly classified observations whenever calculating weights. Therefore, the WRA can select rules with many observations as important rules. However, compared with the two methods mentioned above, HSC showed that when the average of Euclidean distance, Manhattan distance and Canberra distance were calculated the smallest, considering the CA and CRCC ratios, was more balanced. Therefore, the results of this experiment demonstrated that the HSC is a helpful method for decision-makers to use to recognize and select the most important rules from the original decision tree model as shown in Table 6.

Table 7 shows the normalized support value, the normalized confidence value, and the HSC value for the top five important rules for each SME type shown in (c) of Fig. 2.

Explaining the insolvency rules based on the three CorDT models

Insolvency rules for the general type of SMEs

In this study, we selected five important rules for the insolvency of SMEs for each technology type by applying HSC to the original decision tree models with the best hit ratio. Then, we built three CorDT models using the selected five critical rules for each SME type. Based on these developed CorDT models, we made it easier to explain the main causes of insolvency by type of SMEs and suggested insolvency prevention strategies as customized for the three types of SMEs.

Figure 3 shows the CorDT model for insolvency of general type manufacturing companies consisting of five important rules selected via HSC (see Table 7). Only the five rules presented in Fig. 3 can explain 666 cases of insolvency or about 63.8% of the total 1044 cases of insolvency of general type manufacturing companies.

G10 explains the causes of the most insolvent SMEs in general type manufacturing companies and occurs when the credit status (M7) is 3 points or less, which is lower than the average of 3.29 points, and management stability (M2) is greater than 2.4 or less than 3.1 points. Through this process, we see that credit status (M7) and management stability (M2) indicators are the most critical indicators for predicting insolvency in general type manufacturing companies. The credit status (M7) indicator is an index that evaluates the average procurement rate of existing loans, the performance of transactions in second-tier financial companies, and the existence of bank delinquency and thus is the most intuitive indicator of a company’s credit rating. A high procurement rate is attributable to a fall in credit ratings, and it can be judged as delinquency occurring due to the occurrence of transactions in second-tier financial companies or a credit crunch due to loan limits in the banking sector. Therefore, credit rating is the most important indicator for predicting the insolvency of general type manufacturing companies. In Rule G10 of Fig. 3, Y(234,0) indicates that 234 instances have been classified as Y, and among them, there are no misclassified data.

G6 shows that credit status (M7), management stability (M2), transaction stability (B1), and financing ability (M6) are lower than the average of each indicator. In the case of low evaluation in the management capability category and business feasibility category, insolvency prediction is high. When the credit status (M7) exceeds 3.9 points, then the probability of insolvency is significantly lower, indicating that credit status (M7) management is a way to prevent the insolvency of general type manufacturing companies.

G11 explains that if the credit status (M7) obtains an evaluation score of 3–3.9 points, insolvency occurs even if the credit status is above the average value. For credit status (M7), the probability of insolvency is lowered only when a high evaluation rating of 4 points or more is obtained. Therefore, it can be seen as an indicator of the highest insolvency determination for general type manufacturing companies.

G2 consists of all the evaluation indicators derived from the original decision trees of general type manufacturing companies. The difference from rule G6 indicates that even if the financing ability (M6) is greater than 2.3 points, insolvency is observed if the business propulsion (M8), financing ability (M6), and CEO’s professionalism (M10) are evaluated as low. Financing ability (M6) is an evaluation indicator with an average of 2.76 points out of 6 points, and it evaluates the level of borrowing and the liquidity of assets held. When the financing ability (M6) score is greater than 2.9 points, we found that the hit ratio for insolvency was low.

G7 indicates that credit status (M7) and management stability (M2) are lower than average values, and transaction stability (B1) is 3.6–4.7 points. The transaction stability (B1) indicator evaluates the diversification of customers, the level of long-term fixed vendors, and the stability of raw material procurement, with an average of 4.06 points out of 6 points. For this indicator, the hit ratio for insolvency was low when it was 4.7 points or higher.

Since general type companies have functions that are necessary for manufacturing, such as their technology, technology development capabilities, and production base, several indicators in three categories evenly appeared as important variables. Of these, five indicators of the management capability category are included, so they should be treated as being more significant than other category items. Unlike other technology type manufacturers, general type companies appear like large companies in terms of sales, asset size, and capital. However, they have different risks, such as purchasing raw materials necessary for production and holding inventory for product sales. Therefore, these types of companies can receive better evaluation for stability, profitability, and growth in financial evaluation. In the analysis of technological feasibility assessment, the management ability category’s indicators, such as credit status (M7), management stability (M2), and financing ability (M6) are more important variables for predicting SME insolvency than the business feasibility and the technical ability categories.

Insolvency rules for the technology development type of SMEs

Figure 4 shows the CorDT model for the insolvency of technology development type manufacturing companies. It consists of five main rules selected using HSC (see Table 7). Only the five rules presented in Fig. 4 could explain 175 cases of insolvency or about 58.1% of the total of 301 cases of insolvency for the technology development type of manufacturing companies.

TD2 shows that if competitive strength (B8) and sales management (B2) are lower than the average values of each indicator, financing ability (M6) is lower than 2 points, and transaction stability (B1) is higher than 2.4 points, then the hit ratio for insolvency is the highest. It is also characteristic that there is no insolvency when competitive strength (B8) is 2.3 points or higher, higher than the average 1.79 points. The competitive strength (B8) indicator evaluates the level of competition, the barriers to entry, and the possibility of the emergence of substitutes. A total score of competitive strength (B8) is 3 points, and the standard deviation for this indicator is low at 0.3 points. Thus, is necessary to raise the score and adjust the scoring section of this indicator.

TD5 implies that if competitive strength (B8) is low, then the insolvency rate is high even if sales management (B2) is evaluated well. Given these rules, it can be seen that when the sales management (B2) is greater than 3.1 points, then the insolvency rate is significantly lowered. Therefore, it is necessary to increase barriers to entry of competing products and suppress the possibility of appearance of similar products as much as possible to prevent them from falling into insolvency.

TD14 shows cases where insolvency appears even though sales management (B2), financing ability (M6), and internal control (M3) have scored close to or exceeded the average value. Therefore, it is necessary to redesign the corresponding indicators to obtain significant results for the prediction of insolvent companies.

TD15 showed that even if the technical application capacity (T10) and financing ability (M6) for evaluating new product development speed and product design ability are excellent, companies with low internal control (M3) and market growth (B9) can suffer insolvency. The internal control (M3) indicator, which evaluates the level of management plan establishment and the appropriateness of the internal control system, has an evaluation indicator with an average of 2.47 points out of 4 points.

TD4 states that the hit ratio for insolvency is high when competitive strength (B8) and sales management (B2) are evaluated lower than average, respectively. In sales management (B2), it was the highest at 3.2 points out of 4 points, and insolvency was predicted in the remaining 1.6–3.1 points range. In particular, when the indicator scored 2.4 points, three insolvency rules (TD2, TD14, TD15) appeared. Therefore, since the indicator has low discrimination, it is necessary to redesign the score of the indicator or even review a plan to remove it from the business feasibility category.

In the case of technology development manufacturing companies, competitive strength (B8) and sales management (B2) indicators are essential variables that influence whether they will become insolvent. They should make efforts to prevent corporate insolvency through better management of the management ability category, even if they must make additional efforts to develop their technology and use outsourced production systems. Only the technical application capacity (T10) indicator was a significant variable when predicting insolvency in the technical ability category. This indicator is used to evaluate the possibility and the ripple effect of product development when using core technologies. It can be thus said to be the core competitiveness of technology development manufacturing companies.

Insolvency rules for the toll processing type of SMEs

Figure 5 shows that the CorDT model for insolvency of toll processing type manufacturing companies consists of five important rules selected using HSC (see Table 7). Only the five rules presented in Fig. 5 can explain 786 cases of insolvency or 79.4% of the total 990 cases of insolvency of toll processing type manufacturing companies.

TP5 indicates that the greatest insolvency is observed when the remaining indicators, such as management stability (M2), CEO’s reliability (M9), sales management (B2), competitive strength (B8), market position (B6), and market environment (B10) indicators are all low score, except when the business propulsion (M8) score is greater than 2.3. The business propulsion (M8) indicator evaluates the adequacy of business plans, leadership, crisis response capabilities. The probability of insolvency is significantly lower when this indicator is higher than the average value of 3.1 points. Still, the probability of insolvency is large when the indicator’s score is greater than 2.3 points, and the scores of other evaluation indicators are low.

TP11 shows that insolvency is predicted when business propulsion (M8) and management stability (M2) are lower than that for each average value. It also shows that only two indicators can produce a good prediction about company insolvency. In particular, the probability of insolvency is lower when the management stability (M2) that evaluates the company’s age, factory ownership, and governance structure has an above average value. This indicator demonstrates that there is more importance related to insolvency prediction.

TP6 used all evaluation indicators derived from the original decision tree for the toll processing type manufacturing companies. The difference from rule TP5 is that even if the market environment (B10) is more than 2.3 points, which is larger than the average score, future profitability (B4) is lower than 3.7 points, and business propulsion (M8) is lower than 4.3 points, that it is more likely that rule TP5 will lead to insolvency. The market environment (B10) indicator, which evaluates the possibility of change in government policies and regulations, must have an evaluation score above the average to reduce the probability of insolvency. Therefore, that company will need to gain better discernment by increasing the evaluation score of future profitability (B4) and business propulsion (M8). Future profitability (B4), which is an indicator of expected sales growth, needs to differentiate the score by adjusting the growth rate standard or objectifying the evaluator’s profit rate estimation process, so that strict evaluations can be made to prevent upward evaluation.

TP4 shows when insolvency has occurred by acquiring 2.3 points or less, far less than the average of 3.01 points, in the business propulsion (M8) indicator. This rule is a representative pone that shows that even using only one indicator can determine insolvency.

TP9 is an insolvent rule that occurs when management stability (M2) is lower than 2.4 points and CEO’s reliability (M9) is between 4.2 and 5.5 points. The CEO’s reliability (M9) indicator evaluates the CB (Credit Bureau) score of the representative, whether the rights of the owned real estate are violated, and the loans to related parties. Using this rule, the CEO’s reliability (M9) indicator scored higher than the average score of 3.4 points, but less than the highest score of 7. From the fact that this rule was selected as the top 5 more important insolvency rules, we can see that CEO’s reliability (M9) is an important indicator.

Unlike other technology types, toll processing type companies have skilled technical personnel and special equipment. They do not directly procure materials, so their financial status is relatively stable due to having no fluctuations in raw material prices and inventory risks. Therefore, if the score of the management stability (M2) indicator is raised, then the characteristics of toll processing type companies will be well reflected, the hit ratio for insolvency can be further increased. In addition, the importance of the market environment indicator for evaluating the ability to respond to changes in government policies such as strengthening industrial safety and prohibition of the use of hazardous substances has also increased, so the score of that indicator should be raised. Indeed, business propulsion (M8), which evaluates the adequacy of an organizational structure, the ability to utilize external resources, and cope with crisis, appears to be the most important variable and can be considered to be the key factor necessary to maintain the competitiveness of toll processing type companies.

Conclusion

This study developed a decision tree-based insolvency prediction model for SMEs using non-financial information, such as technological feasibility assessment information. In our experiments, we divided the datasets of SMEs into general, technology development, and toll processing. Since the original decision trees generally consisted of many rules, we proposed the HSC method as a new way to select important rules from decision trees. We then built a CorDT consisting of only the important rules using the HSC, more easily explained the key factors affecting the SMEs insolvency by technology type, and thereby suggested insolvency prevention strategies more efficiently.

Our experiments did not reflect environmental variables, such as economic or financial conditions, that occurred within the 5-year repayment period and also used only technological feasibility assessment information as non-financial information. Therefore, we plan to conduct a future study to improve prediction performance by reflecting such market environment variables and additional non-financial information in the insolvency prediction model for SMEs. Moreover, we are planning to proceed with research that encompasses the detection of any anomaly that can typically arise in imbalanced datasets. This focus includes the application of cluster-based, distance-based, and density-based methods to effectively manage such outliers.

Data availability

Data are available from the authors upon reasonable request. Supplementary material is available at https://dataverse.harvard.edu/api/access/datafile/7530349.

References

Adadi A, Berrada M (2018) Peeking inside the black-box: a survey on explainable artificial intelligence (XAI). IEEE Access 6:52138–52160. https://doi.org/10.1109/ACCESS.2018.2870052

Agrawal R, Imieliński T, Swami A (1993) Mining association rules between sets of items in large databases. In: Proceedings of the 1993 ACM SIGMOD international conference on Management of data 207–216. https://doi.org/10.1145/170035.170072

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609. https://doi.org/10.2307/2978933

Altman EI, Iwanicz-Drozdowska M, Laitinen EK, Suvas A (2015) Financial and non-financial variables as long-horizon predictors of bankruptcy. Available at SSRN 2669668. https://doi.org/10.2139/ssrn.2669668

Altman EI, Sabato G (2007) Modelling credit risk for SMEs: evidence from the U.S. market. Abacus 43(3):332–357. https://doi.org/10.1111/j.1467-6281.2007.00234.x

Altman EI, Sabato G, Wilson N (2010) The value of non-financial information in SME risk management. J Credit Risk 6(2):95–127. https://doi.org/10.21314/JCR.2010.110

Alzayed N, Eskandari R, Yazdifar H (2023) Bank failure prediction: corporate governance and financial indicators. Rev Quant Financ Account 61:601–631. https://doi.org/10.1007/s11156-023-01158-z

Ansari A, Ahmad IS, Bakar AA, Yaakub MR (2020) A hybrid metaheuristic method in training artificial neural network for bankruptcy prediction. IEEE Access 8:176640–176650. https://doi.org/10.1109/ACCESS.2020.3026529

Balcaen S, Ooghe H (2006) 35 years of studies on business failure: an overview of the classic statistical methodologies and their related problems. Br Account Rev 38(1):63–93. https://doi.org/10.1016/j.bar.2005.09.001

Barboza F, Kimura H, Altman E (2017) Machine learning models and bankruptcy prediction. Expert Syst Appl 83:405–417. https://doi.org/10.1016/j.eswa.2017.04.006

Beaver WH (1966) Financial ratios as predictors of failure. J Account Res 4:71–111. https://doi.org/10.2307/2490171

Bhimani A, Gulamhussen MA, Lopes SDR (2013) The role of financial, macroeconomic, and non-financial information in bank loan default timing prediction. Eur Account Rev 22(4):739–763. https://doi.org/10.1080/09638180.2013.770967

Blanco-Oliver AJ, Irimia Diéguez AI, Oliver Alfonso MD, Wilson N (2015) Improving bankruptcy prediction in micro-entities by using nonlinear effects and non-financial variables. J Econ Financ 65(2):144–166. https://idus.us.es/handle/11441/80856

Brownlee J (2020) How to Develop a Cost-Sensitive Neural Network for Imbalanced Classification. August 21, 2020. https://machinelearningmastery.com/cost-sensitive-neural-network-for-imbalanced-classification/ (accessed August 18, 2023)

Chawla NV, Bowyer KW, Hall LO, Kegelmeyer WP (2002) SMOTE: synthetic minority over-sampling technique. J Artif Intell Res 16:321–357. https://doi.org/10.1613/jair.953

Chen TK, Liao HH, Chen GD, Kang WH, Lin YC (2023) Bankruptcy prediction using machine learning models with the text-based communicative value of annual reports. Expert Syst Appl 233:120714. https://doi.org/10.1016/j.eswa.2023.120714

Cheng K, Zhang C, Yu H, Yang X, Zou H, Gao S (2019) Grouped SMOTE with noise filtering mechanism for classifying imbalanced data. IEEE Access 7:170668–170681. https://doi.org/10.1109/ACCESS.2019.2955086

Choi K, Kim G, Suh Y (2013) Classification model for detecting and managing credit loan fraud based on individual-level utility concept. DATABASE for Adv Inf Syst 44(3):49–67. https://doi.org/10.1145/2516955.2516959

Choi J, Bae S, Lee D (2019) Proposal for transparency of accounting and credibility of accounting in the South Korea. J Account Financ 37(3):1–31

Chou CH, Hsieh SC, Qiu CJ (2017) Hybrid genetic algorithm and fuzzy clustering for bankruptcy prediction. Appl Soft Comput 56:298–316. https://doi.org/10.1016/j.asoc.2017.03.014

Ciampi F (2018) Using corporate social responsibility orientation characteristics for small enterprise default prediction. WSEAS Trans Bus Econ 15:113–127

Clark P, Boswell R (1991) Rule induction with CN2: Some recent improvements. In: Proceedings of the 5th European Working Session on Learning 482:151–163. https://doi.org/10.1007/BFb0017011

Cui Y, Jia M, Lin TY, Song Y, Belongie S (2019) Class-balanced loss based on effective number of samples. In: Proceedings of the IEEE/CVF conference on computer vision and pattern recognition 9268–9277

Dash M, Liu H (1997) Feature selection for classification. Intell Data Anal 1(1-4):131–156. https://doi.org/10.1016/S1088-467X(97)00008-5

Gamberger D, Lavrac N, Dzeroski S (2000) Noise detection and elimination in data preprocessing: experiments in medical domains. Appl Artif intell 14(2):205–223. https://doi.org/10.1080/088395100117124

Giannopoulos V, Aggelopoulos E (2019) Predicting SME loan delinquencies during recession using accounting data and SME characteristics: the case of Greece. Intell Syst Account Financ Manag 26(2):71–82. https://doi.org/10.1002/isaf.1456

Grunert J, Norden L, Weber M (2005) The role of non-financial factors in internal credit ratings. J Bank Financ 29(2):509–531. https://doi.org/10.1016/j.jbankfin.2004.05.017

Hammal MA, Mathian H, Merchez L, Plantevit M, Robardet C (2019) Rank correlated subgroup discovery. J Intell Inf Syst 53:305–328. https://doi.org/10.1007/s10844-019-00555-y

He H, Bai Y, Garcia EA, Li S (2008) ADASYN: Adaptive synthetic sampling approach for imbalanced learning. In: Proceeding of the 2008 IEEE international joint conference on neural networks (IEEE world congress on computational intelligence) 1322–1328. https://doi.org/10.1109/IJCNN.2008.4633969

Höglund H (2017) Tax payment default prediction using genetic algorithm-based variable selection. Expert Syst Appl 88:368–375. https://doi.org/10.1016/j.eswa.2017.07.027

Hue WB, Park HW, Yoo KW (2012) The suggestions for the improvement on accounting transparency of small and medium enterprises. Korea Bus Rev 16(1):35–50

Huang C, Li Y, Loy CC, Tang X (2016) Learning deep representation for imbalanced classification. In: Proceedings of the IEEE conference on computer vision and pattern recognition 5375–5384. https://doi.org/10.1109/CVPR.2016.580

Johnson JM, Khoshgoftaar TM (2022) Cost-Sensitive Ensemble Learning for Highly Imbalanced Classification. 2022 21st IEEE International Conference on Machine Learning and Applications (ICMLA) 1427–1434. https://doi.org/10.1109/ICMLA55696.2022.00225

Kanapickienė R, Kanapickas T, Nečiūnas A (2023) Bankruptcy prediction for micro and small enterprises using financial, non-financial, business sector and macroeconomic variables: the case of the Lithuanian construction sector. Risks 11(5):97. https://doi.org/10.3390/risks11050097

Kaytoue M, Plantevit M, Zimmermann A, Bendimerad A, Robardet C (2017) Exceptional contextual subgraph mining. Mach Learn 106:1171–1211. https://doi.org/10.1007/s10994-016-5598-0

Kohv K, Lukason O (2021) What best predicts corporate bank loan defaults? An analysis of three different variable domains. Risks 9(2):29. https://doi.org/10.3390/risks9020029

Kim R, Yoo D, Kim G (2016) Development of prediction model of financial distress and improvement of prediction performance using data mining techniques. Inf Syst Rev 18(2):173–198. https://doi.org/10.14329/isr.2016.18.2.173

Kim S (2018) A study on the Improvement of accounting transparency for SMEs. J SME Financ 38(3):3–45. https://doi.org/10.33219/jsmef.2018.38.3.001

Lahmiri S, Bekiros S (2019) Can machine learning approaches predict corporate bankruptcy? Evidence from a qualitative experimental design. Quant Financ 19(9):1569–1577. https://doi.org/10.1080/14697688.2019.1588468

Lavrač N, Flach P, Zupan B (1999) Rule evaluation measures: a unifying view. In: Proceedings of the International Conference on Inductive Logic Programming 174-185. https://doi.org/10.1007/3-540-48751-4_17

Lavrač N, Kavšek B, Flach PA, Todorovski L (2004) Subgroup discovery with CN2-SD. J Mach Learn Res 5:153–188

Lee J, Kim J (2017) A study on the relationship between technology appraisal model and corporate insolvency. Innov Stud 12(2):117–137. https://doi.org/10.46251/INNOS.2017.05.12.2.117

Lee S, Choi K, Yoo D (2020) Predicting the insolvency of SMEs using technological feasibility assessment information and data mining techniques. Sustainability 12(23):9790. https://doi.org/10.3390/su12239790

Liang D, Lu CC, Tsai CF, Shih GA (2016) Financial ratios and corporate governance indicators in bankruptcy prediction: a comprehensive study. Eur J Ope Res 252(2):561–572. https://doi.org/10.1016/j.ejor.2016.01.012

Lim H (2016) Firm characteristics and default predictability: relationship-banking, age, and size. J Korean Econ Anal 22(1):81–142

Liu K, Xu S, Xu G, Zhang M, Sun D, Liu H (2020) A review of android malware detection approaches based on machine learning. IEEE Access 8:124579–124607. https://doi.org/10.1109/ACCESS.2020.3006143

Lugovskaya L (2010) Predicting default of Russian SMEs on the basis of financial and non-financial variables. J Financ Serv Mark 14:301–313. https://doi.org/10.1057/fsm.2009.28

McCann F, McIndoe-Calder T (2015) Firm size, credit scoring accuracy and banks’ production of soft information. Appl Econ 47(33):3594–3611. https://doi.org/10.1080/00036846.2015.1019034

Mathew J, Pang CK, Luo M, Leong WH (2018) Classification of imbalanced data by oversampling in kernel space of support vector machines. IEEE Trans Neural Netw Learn Syst 29(9):4065–4076. https://doi.org/10.1109/TNNLS.2017.2751612

Mathew TE (2023) A cost sensitive SVM and neural network ensemble model for breast cancer classification. Indones J Electr Eng Inform 11(2):366–374. https://doi.org/10.52549/ijeei.v11i2.3934

Mienye ID, Sun Y (2021) Performance analysis of cost-sensitive learning methods with application to imbalanced medical data. Inform Med Unlocked 25:100690. https://doi.org/10.1016/j.imu.2021.100690

Mitchell F, Reid GC (2000) Problems, challenges and opportunities: the small business as a setting for management accounting research. Manag Account Res 11(4):385–390. https://doi.org/10.1006/mare.2000.0152

Naidu GP, Govinda K (2018) Bankruptcy prediction using neural networks. In: Proceeding of the 2nd International Conference on Inventive Systems and Control (ICISC) 248–251. https://doi.org/10.1109/ICISC.2018.8399072

Nam J (2008) The bankruptcy prediction model of technology innovation small medium enterprises: principal component analysis approach. Korean Assoc Small Bus Stud 30(4):35–52

Nandhini M, Rajalakshmi M, Sivanandam SN (2022) Performance analysis of predictive association rule classifiers using healthcare datasets. IETE Tech Rev 39(1):143–156. https://doi.org/10.1080/02564602.2020.1827988

Ohlson JA (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Account Res 18(1):109–131. https://doi.org/10.2307/2490395

Olson DL, Delen D, Meng Y (2012) Comparative analysis of data mining methods for bankruptcy prediction. Decis Support Syst 52(2):464–473. https://doi.org/10.1016/j.dss.2011.10.007

Park C, Lim H (2015) Using technology evaluation information to predict the bankruptcy of technology SMEs and policy implications. KIF Rep 2015(2):1–185

Provost F, Domingos P (2003) Tree induction for probability-based ranking. Mach Learn 52:199–215. https://doi.org/10.1023/A:1024099825458

Quinn M (2011) Routines in management accounting research: further exploration. J Account Organ Change 7(4):337–357. https://doi.org/10.1108/18325911111182303

Ropega J (2011) The reasons and symptoms of failure in SME. Int Adv Econ Res 17(4):476–483. https://doi.org/10.1007/s11294-011-9316-1

Safavian SR, Landgrebe D (1991) A survey of decision tree classifier methodology. IEEE Trans Syst Man Cybern 21(3):660–674. https://doi.org/10.1109/21.97458

Said AA, HassabElnaby HR, Wier B (2003) An empirical investigation of the performance consequences of nonfinancial measures. J Manag Account Res 15(1):193–223. https://doi.org/10.2308/jmar.2003.15.1.193

Shim S (2007) On improvement on accounting transparency of unlisted small and medium business. Korean Small Bus Rev 29(4):215–236

Son H, Hyun C, Phan D, Hwang HJ (2019) Data analytic approach for bankruptcy prediction. Expert Syst Appl 138:112816. https://doi.org/10.1016/j.eswa.2019.07.033

Tanha J, Van Someren M, Afsarmanesh H (2017) Semi-supervised self-training for decision tree classifiers. Int J Mach Learn Cybern 8:355–370. https://doi.org/10.1007/s13042-015-0328-7

Veganzones D, Séverin E, Chlibi S (2023) Influence of earnings management on forecasting corporate failure. Int J Forec 39(1):123–143. https://doi.org/10.1016/j.ijforecast.2021.09.006

Wang YX, Ramanan D, Hebert M (2017) Learning to model the tail. In: Proceedings of the 31st International Conference on Neural Information Processing Systems 7032–7042. https://dl.acm.org/doi/10.5555/3295222.3295446

Witten IH, Frank E (2002) Data mining: practical machine learning tools and techniques with Java implementations. ACM Sigmod Rec 31(1):76–77. https://doi.org/10.1145/507338.507355

Zoričák M, Gnip P, Drotár P, Gazda V (2020) Bankruptcy prediction for small-and medium-sized companies using severely imbalanced datasets. Econ Model 84:165–176. https://doi.org/10.1016/j.econmod.2019.04.003

Acknowledgements

This work was supported by the National Research Foundation of Korea (NRF) grant funded by the Korea government (MSIT) (NRF-2021R1G1A1004513).

Author information

Authors and Affiliations

Contributions

SL contributed to data analysis, interpretation, paper writing and revision; KC contributed to algorithm design, paper editing and proofreading; and DY contributed to the overall conceptual design of the paper, data interpretation, paper writing, and revision. All authors approved the version to be published and agreed to take responsibility for all aspects of the work.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lee, S., Choi, K. & Yoo, D. Building a core rule-based decision tree to explain the causes of insolvency in small and medium-sized enterprises more easily. Humanit Soc Sci Commun 10, 933 (2023). https://doi.org/10.1057/s41599-023-02382-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02382-7