Abstract

Investors and financial regulators are increasingly aware of climate-change risks. So far, most of the attention has fallen on whether controls on carbon emissions will strand the assets of fossil-fuel companies1,2. However, it is no less important to ask, what might be the impact of climate change itself on asset values? Here we show how a leading integrated assessment model can be used to estimate the impact of twenty-first-century climate change on the present market value of global financial assets. We find that the expected ‘climate value at risk’ (climate VaR) of global financial assets today is 1.8% along a business-as-usual emissions path. Taking a representative estimate of global financial assets, this amounts to US$2.5 trillion. However, much of the risk is in the tail. For example, the 99th percentile climate VaR is 16.9%, or US$24.2 trillion. These estimates would constitute a substantial write-down in the fundamental value of financial assets. Cutting emissions to limit warming to no more than 2 °C reduces the climate VaR by an expected 0.6 percentage points, and the 99th percentile reduction is 7.7 percentage points. Including mitigation costs, the present value of global financial assets is an expected 0.2% higher when warming is limited to no more than 2 °C, compared with business as usual. The 99th percentile is 9.1% higher. Limiting warming to no more than 2 °C makes financial sense to risk-neutral investors—and even more so to the risk averse.

Similar content being viewed by others

Main

The impact of climate change on the financial sector has been little researched so far, with the exception of some kinds of insurance3. Yet, if the economic impacts of climate change are as large as some studies have suggested4,5,6, then, because financial assets are ultimately backed by economic activities, it follows that the impact of climate change on financial assets could also be significant.

The value of a financial asset derives from its owner’s contractual claim on income such as a bond or share/stock. It is created by an economic agent raising a liability that will ultimately be paid off from a flow of output of goods and services. For example, a firm pays its shareholders’ dividends out of its production earnings, and a household usually pays its mortgage from its wages. Output is the result of a production process, which combines knowledge, labour, intermediate inputs and non-financial or capital assets. Therefore, there are two principal ways in which climate change can affect the value of financial assets. First, it can directly destroy or accelerate the depreciation of capital assets, for example through its connection with extreme weather events7. Second, it can change (usually reduce) the outputs achievable with given inputs, which amounts to a change in the return on capital assets, in the productivity of knowledge8, and/or in labour productivity and hence wages9.

Why is it important to know the impact of climate change on asset values? Institutional investors, notably pension funds, have been in the vanguard of work in this area10: for them, the possibility that climate change will reduce the long-term returns on investments makes it a matter of fiduciary duty towards fund beneficiaries, which is why it is not unusual to see pension funds advocating significant emissions reductions11. Despite this, levels of awareness about climate change remain low in the financial sector as a whole3, so one purpose of this exercise is to raise them. For their part, financial regulators need to ensure that financial institutions such as banks are resilient to shocks, hence their growing interest in the possibility of a climate-generated shock12,13. Value at risk (VaR) quantifies the size of loss on a portfolio of assets over a given time horizon, at given probability. Thus, our estimates of VaR from climate change can be seen as a measure of the potential for asset-price corrections due to climate change.

The difficult question in practice is how to construct a global estimate of the impact of climate change on financial assets, given the paucity of existing research. How can we get a handle on the magnitude of the effect? Typical approaches in the finance industry involve directly estimating the returns to different asset classes in different regions, as well as the co-variances between them14. In principle, these could be modelled as being dependent on climate change, yet at present there is a lack of knowledge of the economic/financial impacts of climate change at this granularity.

In contrast, it is possible to show how existing, aggregated integrated assessment models (IAMs) can be used to obtain a first estimate of the climate VaR, that is, the probability distribution of the present market value (PV) of losses on global financial assets due to climate change15. The argument is in three stages.

First, in the benchmark valuation model of corporate finance, an asset is valued at its discounted cash flow. For a stock, this is the PV of future dividends. Of course, many stocks do not pay dividends (so-called ‘growth stocks’), and their value in the short run lies in expected increases in the stock price. However, in the long run a dividend must be paid, else the stock is worthless. For a bond, the discounted cash flow is the PV of future interest payments.

Second, corporate earnings account for a roughly constant share of GDP (gross domestic product) in the long run16, so those earnings should grow at roughly the same rate as the economy. This is related to Kaldor’s famous ‘stylized fact’ that the shares of national income received by labour and capital are roughly constant over long periods of time17,18. As corporate earnings ultimately accrue to the owners of the financial liabilities of the corporate sector in one form or another, the (undiscounted) cash flow from a globally diversified portfolio of stocks should also grow at roughly the same rate as the economy16.

Third, assuming debt and equity are perfect substitutes as stores of value, which is consistent with the neoclassical model of economic growth underpinning those aggregated IAMs that represent it explicitly, the same relationship will govern the cash flow from bonds, the other principal type of financial asset. According to the Modigliani–Miller theorem of corporate finance, under certain assumptions, any future changes in capital structure will not change the expected value of today’s aggregate portfolio19,20. Therefore, we can use forecasts of global GDP growth with and without climate change to make a first approximation of the climate VaR of financial assets.

In particular, the ingredients for the calculation are IAM-based estimates of the rate of GDP growth along various scenarios (the basic climate VaR is a comparison, for given emissions, of GDP growth after climate change with counterfactual GDP growth without climate change), a schedule of discount rates, and an estimate of today’s stock of global financial assets (see Methods). It is important to note that the discount rate applied in valuing a portfolio of privately held financial assets is that of a private investor, and is given by the opportunity cost of capital appropriate for the riskiness of the portfolio. Thus, the extensive literature on social discount rates for appraisal of climate-change policies21 is not relevant. We also highlight that the climate VaR, by definition, includes only the effect on asset values of climate impacts (that is, adaptation costs and residual damages). It does not include mitigation costs, which for a low-emissions path could be considerable. However, at the end of this paper we do tackle the wider issue of the PV of assets when mitigation costs are also included.

We use an extended version of Nordhaus’s DICE model22 to estimate the impact of climate change on GDP growth. Our version allows for a portion of the damages from climate change to fall directly on the capital stock23,24, rather than simply reducing the output that can be obtained from given capital and labour inputs (see Methods). Thus, it is capable of representing the two broad ways in which climate change affects financial asset values that we identified above, and it has been argued more generally that such a representation of climate impacts is important in understanding the full potential for climate change to compromise growth in the long run8.

We conduct a Monte Carlo simulation of DICE to estimate the VaR at different probabilities. We focus on four key uncertainties in the model, identified by previous studies (see Methods)22,25,26. The first is the rate of productivity growth, which in the neoclassical model is the sole determinant of long-run growth of GDP per capita, absent climate damages. Productivity growth influences the stock of assets in the future, but, because unmitigated industrial carbon dioxide emissions are proportional to GDP, it also influences warming and the magnitude of climate damages. The second is the climate sensitivity parameter, that is, the increase in the equilibrium global mean temperature in response to a doubling of atmospheric carbon. The third is an element of the damage function linking warming with losses in GDP. In particular, we parameterize uncertainty about a higher-order term in the damage function5. The uncertainty is best regarded as capturing the range of subjective views about the potential for catastrophic climate impacts in the region of at least 4 °C warming. The fourth controls the costs of emissions abatement.

Table 1 provides estimates of the impact of climate change over the course of this century on the PV of global financial assets. Along the DICE baseline or business-as-usual (BAU) emissions scenario, in which the expected increase in the global mean temperature in 2100, relative to pre-industrial, is about 2.5 °C (see Supplementary Information), the expected climate VaR of global financial assets today is 1.8%. As Table 1 indicates, there is particularly significant tail risk attending to the climate VaR. The 95th percentile is 4.8% and the 99th percentile is 16.9%. This is important, because distribution percentage points deep in the tail have particular relevance in some financial risk management regimes, such as insurance (for example, the EU Solvency II Directive).

Analysis with Spearman’s rank correlation coefficients (a linear regression model is a poor overall fit of the data) indicates that the most important of the three uncertain parameters in determining the expected climate VaR on BAU is the climate sensitivity, followed by the initial rate of productivity growth, with the curvature of the damage function least important (see Supplementary Information). Recall that abatement costs do not affect the climate VaR by definition. Nonetheless, whereas there is an evidential basis on which to calibrate uncertainty about productivity growth and climate sensitivity, the same cannot be said of the curvature of the damage function (see Methods), so in the Supplementary Information we carry out sensitivity analysis on an alternative calibration that concentrates probability mass in the middle of the range of estimates in the literature, rather than spreading it uniformly. We find that the expected climate VaR is a little lower (at 1.5%), but that the tail risk is considerably lower (at for example, 9.6% at the 99th percentile).

Table 1 also shows the equivalent climate VaR under a representative path of emissions reductions to limit the increase in the global mean temperature to no more than 2 °C, with a probability of 2/3 (see Methods). In this scenario the expected climate VaR is 1.2%, the 95th percentile is 2.9% and the 99th percentile is 9.2%. The expected reduction in the climate VaR due to mitigation is 0.6 percentage points, the 95th percentile reduction is 1.8 percentage points and the 99th percentile is 7.7 percentage points. Mitigation is hence particularly effective in reducing the tail risk.

How large is the climate VaR in absolute terms? Answering this question requires an appropriate estimate of the current stock of global financial assets. There is more uncertainty about this than one might perhaps imagine. The Financial Stability Board nonetheless puts the value of global non-bank financial assets at US$143.3 trillion in 201327. This implies that the expected climate VaR under BAU is US$2.5 trillion, rising to US$24.2 trillion at the 99th percentile. Under the 2 °C mitigation scenario it is US$1.7 trillion, rising to US$13.2 trillion at the 99th percentile.

These estimates are not inconsiderable, particularly in the tail. To put them into perspective, the total stock market capitalization today of fossil-fuel companies has been estimated at US$5 trillion28. And whereas intra-day stock market movements are frequently considerably higher than our mean estimates, it can be argued that stock markets suffer from excess volatility, so increases in climate risk could trigger larger stock price movements than our estimates would suggest29. The risk is likely to be difficult to hedge fully, given the global incidence of climate impacts and the potentially long holding periods that would be required30. The nature of climate risk is such that, if it crystallizes, there would be no subsequent reversion to the previous trend growth path. Also, our approach assumes that debt will be affected as well as equities, and it smoothes the full effect of extreme weather on short-run volatility in economic performance.

Figure 1 analyses the contribution to the climate VaR of global financial assets today from impacts at different stages of the century. It makes clear that most of the climate VaR arises in the second half of the century. This suggests that the climate VaR ought to depend sensitively on the discount rate chosen. In the Supplementary Information, we apply an alternative, high discount rate of 7% initially (compared with 4.07%; see Methods) and find that the expected climate VaR along BAU is 1%, the 95th percentile is 2.4% and the 99th percentile is 7.7%. However, such a high discount rate is difficult to justify in relation to historical equity and bond returns at the global scale31.

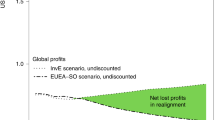

Table 2 and Fig. 2 compare the PV of global financial assets along the 2 °C mitigation scenario with its counterpart along BAU, when mitigation costs are included. The expected value of global financial assets is 0.2% higher along the mitigation scenario, although, as Fig. 2 shows, in fact roughly 65% of the distribution lies below zero, meaning that the PV of global financial assets is larger under BAU. This reflects the reduction in asset values brought about by paying abatement costs in the economy—including, for instance, the stranded assets of fossil-fuel companies—especially in the coming decades. It is consistent with cost–benefit analyses of climate change that show a horizon stretching beyond the end of this century may be necessary for emissions reductions to increase social welfare, as measured by net present value4. Similarly, if the non-market impacts of climate change (for example, on human health and ecosystems) would be greater than the damages represented in our version of the DICE model, then this would mean that the overall net present economic value of emissions reductions is greater than their net present financial value. Even so, because the PV of global financial assets is higher in expectations along the 2 °C path, mitigation is still preferred from the narrower perspective of financial assets, and more so the higher is risk aversion.

Methods

The present value of global financial assets and value at risk.

The PV of global financial assets is the discounted cash flow arising from holding these assets. For a globally diversified portfolio of stocks that is assumed to grow at the same rate as the economy,

where D is the initial aggregate dividend payment, and gt and rt are the GDP growth rate and the discount rate at time t respectively. The climate VaR, in absolute terms, is the difference in PV with and without climate change, which reduces to

where  is the counterfactual growth rate in the absence of climate damages and gc is the growth rate net of climate damages. Computed in this way, we assume that future climate damages are not already priced into D, which is consistent with low levels of overall awareness of climate risks in financial markets3.

is the counterfactual growth rate in the absence of climate damages and gc is the growth rate net of climate damages. Computed in this way, we assume that future climate damages are not already priced into D, which is consistent with low levels of overall awareness of climate risks in financial markets3.

Relative to the PV of assets without climate change, the climate VaR is

which is independent of the initial stock of assets. Therefore, equation (1) may also apply to the stock of bonds, assuming debt and equity are perfect substitutes as stores of value. As bonds typically pay fixed income, bond issuers are assumed to factor in the growth effect of climate change through the interest promised when entering into an agreement with the bondholder.

The discount rate rt for a globally diversified portfolio of assets is calculated by making an initial estimate r0 from economic/market data, and subsequently pegging {rt}t=1T to the GDP growth rate estimated by DICE. The initial estimate r0 is 4.07% (in real terms). This is based on the long-term historical relationships between returns to world equities and bonds31, and global GDP growth32, weighted by an estimate of their current share in global financial assets33. According to this approach, a representative investor today holds bonds and equities in proportion circa 1.3:1, and if the relationship that held between world bonds and world GDP on average in the twentieth century, and world equities and world GDP in the same period, holds today and in the future, then the discount rate is 0.36 percentage points above the GDP growth rate, which DICE puts initially at 3.71%. For sensitivity analysis (see Supplementary Information), we set r0 = 7%.

We peg {rt}t=1T to  , which again implies that investors do not incorporate climate-change forecasts in their asset valuations at present, nonetheless leading to a conservative estimate of the climate VaR as

, which again implies that investors do not incorporate climate-change forecasts in their asset valuations at present, nonetheless leading to a conservative estimate of the climate VaR as  , for all t. In this sense, the assumption is behavioural rather than being based on rational expectations. Note that the initial year in the version of DICE that we use is 2005 (see below); we however treat 2015 as year 0 for the purposes of estimating PV and VaR.

, for all t. In this sense, the assumption is behavioural rather than being based on rational expectations. Note that the initial year in the version of DICE that we use is 2005 (see below); we however treat 2015 as year 0 for the purposes of estimating PV and VaR.

Exceptionally, the analysis behind Fig. 1 requires an assumption about the initial cash flow D. We assume that the initial dividend yield is 2.76%, based on data on long-term mean dividend yields and bond interest payments for a world index comprising 19 countries31, weighted like rt in accordance with the proportion of stocks and bonds in global financial assets33.

DICE model structure.

We use an extended version of DICE2010 (ref. 34). Here we confine ourselves to reporting changes to the basic model, which is comprehensively described elsewhere22.

We extend the model to partition climate damages between direct damages to the capital stock and damages to output, for given capital and labour inputs23,24:

where fK is the share of damages Dt falling on capital, estimated at 0.3 (ref. 35).

As is well known, damages in DICE are a function of global mean temperature above the pre-industrial level T,

and our specification of g(Tt) is

where αi are coefficients used to calibrate the function on impacts studies and  is a random parameter (see below). We set α1 = 0 and α2 = 0.0028 as per the standard model. The element

is a random parameter (see below). We set α1 = 0 and α2 = 0.0028 as per the standard model. The element  roughly speaking introduces the possibility of catastrophic climate change5,26. It is worth noting that although the overall convexity of g(Tt) is widely assumed, some of the most recent evidence suggests it might be approximately linear, if not indeed slightly concave6.

roughly speaking introduces the possibility of catastrophic climate change5,26. It is worth noting that although the overall convexity of g(Tt) is widely assumed, some of the most recent evidence suggests it might be approximately linear, if not indeed slightly concave6.

Random parameters and Monte Carlo simulation.

We incorporate uncertainty about TFP growth by parameterizing a probability distribution over the initial growth rate of global TFP. Long-run data suggest that this uncertainty can be represented by a normal distribution with a mean of 0.84% per year and a standard deviation of 0.59% per year36.

We parameterize a probability distribution for the climate sensitivity S, which is a key parameter driving transient climate response in DICE, based on the consensus statements in the Intergovernmental Panel on Climate Change (IPCC) Fifth Assessment Report37. As IPCC AR5 gives ranges, here we report our specific assumptions: p(S < 1) = 0.025, p(S < 1.5) = 0.085, p(S < 4.5) = 0.915 and p(S < 6) = 0.95. Owing to the behaviour of DICE’s physical climate model, we must place the additional restriction that S ≥ 0.75. The best fit of these data is a Pearson type-V distribution with a shape parameter value of approximately 1.54 and a scale parameter value of approximately 0.9, giving  .

.

The random parameter on damages  is intended to span the spectrum of subjective beliefs of economists working on climate change about the level of aggregate damage at T ≥ 4°C (this spectrum is roughly Nordhaus–Weitzman–Stern). We follow the principle of insufficient reason in specifying a uniform distribution with a minimum of α3 = 0 (Nordhaus) and a maximum of α3 ≍ 0.248 (which replicates the ‘high’ scenario in Stern’s recent work23). However, alternative approaches to calibrating subjective uncertainty about this parameter are arguably no less valid, so in sensitivity analysis we investigate an alternative, normal distribution with a mean of 0.12 and a standard deviation of 0.04. This means that at −3σ the damage function reduces to Nordhaus’s standard version, whereas at +3σ it corresponds with Stern’s high scenario.

is intended to span the spectrum of subjective beliefs of economists working on climate change about the level of aggregate damage at T ≥ 4°C (this spectrum is roughly Nordhaus–Weitzman–Stern). We follow the principle of insufficient reason in specifying a uniform distribution with a minimum of α3 = 0 (Nordhaus) and a maximum of α3 ≍ 0.248 (which replicates the ‘high’ scenario in Stern’s recent work23). However, alternative approaches to calibrating subjective uncertainty about this parameter are arguably no less valid, so in sensitivity analysis we investigate an alternative, normal distribution with a mean of 0.12 and a standard deviation of 0.04. This means that at −3σ the damage function reduces to Nordhaus’s standard version, whereas at +3σ it corresponds with Stern’s high scenario.

We follow Nordhaus22 and others in using uncertainty about the backstop price of abatement in DICE to create uncertainty about marginal abatement costs. Updating Nordhaus22, we assume the initial cost of the backstop abatement technology (note: not the cheapest abatement technology) is normally distributed with a mean of approximately US$343 per tCO2 and a standard deviation of approximately US$137.

For the Monte Carlo simulation, we take a Latin hypercube sample of the probability space with 50,000 draws. Each input distribution is assumed independent.

2 °C mitigation scenario.

This is derived from a cost-effective path to keep the ‘likely’ increase in the global mean temperature to not more than 2 °C at all times. Likely is defined as per IPCC as 2/3 probability. Cost-effectiveness implies choosing the vector of emissions control rates in DICE so as to minimize the discounted sum of abatement costs, using the DICE standard social discount rate. The resulting schedule of emissions control rates for the twenty-first century, starting in 2015 and proceeding in increments of ten years, is 14.25%, 20%, 25.75%, 35.25%, 43.75%, 53.5%, 66.75%, 75%, 74.5% and 74.5%.

To compare the PV of global financial assets along this scenario with that along BAU, we apply equation (1), but where, instead of comparing GDP growth with and without climate damages, both along BAU, we have growth inclusive of climate damages and abatement costs along the 2 °C mitigation scenario and BAU.

Change history

13 April 2016

In the version of this Letter originally published, a reference was mistakenly omitted. The new reference 15 — The Cost of Inaction: Recognising the Value at Risk from Climate Change (Economist Intelligence Unit, 2015) — is now cited in the sixth paragraph and subsequent references have been renumbered in all versions of the Letter.

References

McGlade, C. & Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517, 187–190 (2015).

Carbon Tracker & Grantham Research Institute on Climate Change and the Environment Unburnable Carbon 2013: Wasted Capital and Stranded Assets (Carbon Tracker, 2013).

Arent, D. J. et al. in Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects (eds Field, C. B. et al.) (Cambridge Univ. Press, 2014).

Stern, N. The Economics of Climate Change: The Stern Review (Cambridge Univ. Press, 2007).

Weitzman, M. L. GHG targets as insurance against catastrophic climate damages. J. Pub. Econ. Theory 14, 221–244 (2012).

Burke, M. B., Hsiang, S. M. & Miguel, E. Global non-linear effect of temperature on economic production. Nature 527, 235–239 (2015).

IPCC Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation. A Special Report of Working Groups I and II of the Intergovernmental Panel on Climate Change (Cambridge Univ. Press, 2012).

Stern, N. The structure of economic modeling of the potential impacts of climate change: grafting gross underestimation of risk onto already narrow science models. J. Econ. Lit. 51, 838–859 (2013).

Graff Zivin, J. & Neidell, M. Temperature and the allocation of time: implications for climate change. J. Labor Econ. 32, 1–26 (2014).

Climate Change Scenarios: Implications for Strategic Asset Allocation (Mercer, 2011).

Open letter to Finance Ministers in the Group of Seven (G-7) (Institutional Investors Group on Climate Change, 2015).

Carney, M. Breaking the Tragedy of the Horizon: Climate Change and Financial Stability (Bank of England, 2015).

Integrating Risks into the Financial System: The 1-in-100 Initiative Action Statement (United Nations, 2014).

Campbell, J. Y. & Viceira, L. M. Strategic Asset Allocation: Portfolio Choice for Long-Term Investors (Oxford Univ. Press, 2014).

The Cost of Inaction: Recognising the Value at Risk from Climate Change (Economist Intelligence Unit, 2015).

Covington, H. & Thamotheram, R. The Case for Forceful Stewardship Part 1: The Financial Risk from Global Warming (2015).

Kaldor, N. A model of economic growth. Econ. J. 67, 591–624 (1957).

Gollin, D. Getting Income Shares Right. J. Polit. Econ. 110, 458–474 (2002).

Modigliani, F. & Miller, M. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 48, 261–297 (1958).

Modigliani, F. & Miller, M. Corporate income taxes and the cost of capital: a correction. Am. Econ. Rev. 53, 433–443 (1963).

Arrow, K. J. et al. How should benefits and costs be discounted in an intergenerational context? Rev. Environ. Econ. Policy 8, 145–163 (2014).

Nordhaus, W. D. A Question of Balance: Weighing the Options on Global Warming Policies (Yale Univ. Press, 2008).

Dietz, S. & Stern, N. Endogenous growth, convexity of damages and climate risk: how Nordhaus’ framework supports deep cuts in carbon emissions. Econ. J. 125, 574–602 (2015).

Moyer, E., Woolley, M., Glotter, M. & Weisbach, D. A. Climate impacts on economic growth as drivers of uncertainty in the social cost of carbon. J. Legal Stud. 43, 401–425 (2014).

Anderson, B., Borgonovo, E., Galeotti, M. & Roson, R. Uncertainty in climate change modeling: can global sensitivity analysis be of help? Risk Anal. 34, 271–293 (2014).

Dietz, S. & Asheim, G. B. Climate policy under sustainable discounted utilitarianism. J. Environ. Econ. Manage. 63, 321–335 (2012).

Global Shadow Banking Monitoring Report 2014 (Financial Stability Board, 2014).

Fossil Fuel Divestment: A US$5 trillion Challenge (Bloomberg New Energy Finance, 2014); http://about.bnef.com/content/uploads/sites/4/2014/08/BNEF

Shiller, R. J. Do stock prices move too much to be justified by subsequent changes in dividends? Am. Econ. Rev. 71, 421–436 (1981).

CISL Unhedgeable Risk: How Climate Change Sentiment Impacts Investment (Cambridge Institute for Sustainability Leadership, 2015).

Dimson, E., Marsh, P. & Staunton, M. Equity Premiums Around the World (CFA Institute, 2011).

Maddison, A. The World Economy: A Millennial Perspective (Development Centre of the OECD, 2006).

Global Financial Stability Report 2011 (IMF, 2011).

Nordhaus, W. D. RICE-2010 and DICE-2010 Models (2012); http://www.econ.yale.edu/∼nordhaus/homepage/RICEmodels.htm

Nordhaus, W. D. & Boyer, J. Warming the World: Economic Models of Global Warming (MIT, 2000).

Dietz, S., Gollier, C. & Kessler, L. The Climate Beta (Centre for Climate Change Economics and Policy Working Paper 215 and Grantham Research Institute on Climate Change and the Environment, 2015).

IPCC Climate Change 2013: The Physical Science Basis (IPCC, 2013).

Acknowledgements

S.D. and A.B. would like to acknowledge the support of the UK’s Economic and Social Research Council (ESRC), and the Grantham Foundation for the Protection of the Environment. We are grateful for the invaluable advice of H. Covington and S. Waygood.

Author information

Authors and Affiliations

Contributions

S.D. led the project, from research design through modelling to writing the manuscript. A.B. helped design the research and draft the manuscript. P.G. helped design the research and run the model. C.D. also helped run the model.

Corresponding author

Ethics declarations

Competing interests

No competing financial interests have affected the conduct or results of this research. However, for the sake of transparency, the authors would like to make clear that they were employed by Vivid Economics Ltd during the production of this research. Vivid Economics Ltd is a London-based economics consultancy. Neither the authors nor the company stands to profit directly from this research.

Supplementary information

Supplementary Information

Supplementary Information (PDF 519 kb)

Rights and permissions

About this article

Cite this article

Dietz, S., Bowen, A., Dixon, C. et al. ‘Climate value at risk’ of global financial assets. Nature Clim Change 6, 676–679 (2016). https://doi.org/10.1038/nclimate2972

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/nclimate2972

This article is cited by

-

Navigating sustainable horizons: exploring the dynamics of financial stability, green growth, renewable energy, technological innovation, financial inclusion, and soft infrastructure in shaping sustainable development

Environmental Science and Pollution Research (2024)

-

A machine learning approach to rapidly project climate responses under a multitude of net-zero emission pathways

Communications Earth & Environment (2023)

-

Green preferences

Environment, Development and Sustainability (2023)

-

Near-term transition and longer-term physical climate risks of greenhouse gas emissions pathways

Nature Climate Change (2022)