Abstract

The purpose of this study is to determine if financial inclusion in low-, lower-middle-, and upper-middle-income nations promotes human development. Our aim was accomplished by employing an empirical technique of using the System Generalized Method of Moments (SGMM) and dynamic threshold panel (DTP) data on a sample of 79 nations between 2000 and 2017. Three sub-samples representing low-, lower-, and upper-middle-income nations were created from the entire sample. In general, lower- and upper-middle-income nations’ human development is positively impacted by financial inclusion, according to SGMM empirical studies. Furthermore, the DTP method’s results show that there is a threshold impact for both human development and financial inclusion. The degree of human development in upper-middle-income and lower-middle-income countries is greatly raised by financial inclusion, whether the threshold is met or beyond.

Similar content being viewed by others

Introduction

The central question in the inclusion-development literature in recent times is whether financial inclusion (FI) can enhance human development (HD)—a topic that has gained significant attention (Kamalu and Wan Ibrahim 2021; Ofosu-Mensah Ababio et al. 2021; Matekenya et al. 2021; Duvendack and Mader 2019; Nanda and Kaur 2016). Rather than only increasing economic wealth, HD seeks to increase the richness of human existence, according to the United Nations (2022). To further enhance people’s lives and promote sustainable development, the World Bank (2022a, 2022b) views HD as the cornerstone of its strategy. Special attention has been given to HD as it is founded on three primary dimensions: standard of life, healthcare, and education. Enhancing HD is seen by governments and policymakers as a top priority.

Numerous disparities in the HDI score have been reported globally. The HDI score of 0.8 or more was observed in the majority of industrialized nations, for instance. Strong economy, stable governments, broad access to healthcare and education, and long life expectancies are all reflected in this high HD. Conversely, the least developed nations (LDCs) typically have HDI values that are lower than 0.55. Unstable governance, pervasive poverty, inadequate education, limited access to healthcare, and inadequate education are the causes of this low HD.

In recent years, there has been an extensive debate on the definition and measurement of FI. Nevertheless, the definition of the World Bank (2022a, 2022b) is the most used in recent empirical studies. Financial inclusion (FI) refers to the availability of practical and reasonably priced financial goods and services that satisfy customers’ demands in terms of payments, transactions, savings, credit, and insurance, all of which are provided in an ethical and sustainable manner. However, per the United Nations, FI is not just the access and the use of financial services but also focuses on their qualities. Focusing on quality means that financial services are timely and accountable, responsive to clients’ needs and capabilities, and safe and user-friendly. Rangarajan (2008) defines FI as a “process of ensuring access to timely, proportionate and affordable financial services by weaker sections and low-income groups.”

According to Demirguc-Kunt et al. (2018), the 2017 Global Findex survey states that 69% of individuals worldwide have an account. Multiple gaps are filled by this global rate. For example, 94% of individuals in high-income nations have a bank account, but just 63% in underdeveloped countries do. Also, according to the 2017 Global Findex study, just 12% of individuals in Sub-Saharan Africa have a mobile money account in 2014. A growing body of research has been focused on whether FI can enhance HD. Significant literature supports FI’s positive effect on HD (Kamalu and Wan Ibrahim 2021; Emara and El-Said 2021; Matekenya et al. 2021; Van et al. 2021). The lives of isolated impoverished families are improved, and their economic activity is stimulated. FI enables individuals to save money and spend more on needs by providing digital services (Morgan and Long 2020). FI also reduces payment costs and helps in risk management for individuals. Increased education and skill are favorably correlated with FI (World Bank 2016). Many kids don’t attend school because they can’t afford the costs of their education, including fees and other expenses. Expanding low-income families’ access to school financing and removing obstacles to education can be accomplished by promoting FI through the use of financial services. Since education enhances knowledge and abilities, it can promote learning. Even though education is acquired through professors or instructors while knowledge is acquired through self-motivation or self-advancement, the two ideas are deeply entwined. Education and knowledge increase capability and proficiency because it is understood that capability is a confluence of technical and non-technical skills, knowledge, procedures, tools, and behaviors. By competence and knowledge, it also results in a rise in work and a decrease in poverty. According to Chakrabarty and Mukherjee (2022) FI facilitates improvements in well-being. HD will therefore speed up.

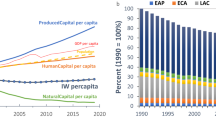

While some studies suggest a positive impact of FI on HD (Abdelghaffar et al. 2023; Djekonbe et al. 2022; Ofosu-Mensah Ababio et al. 2021; Kamalu and Wan Ibrahim 2021; Emara and El-Said 2021; Matekenya et al. 2021; Van et al. 2021), others suggest a negative correlation. Given the inconsistent findings, the goal of this study is to see if increased FI in low- and middle-income countries improves HD. We employed the SGMM as an empirical method and a sample of 79 nations from 2000 to 2017 to achieve this (Fig. 1).

Low and middle-income countries are considered an appropriate case study to assess the link between FI and HD. These countries recorded weak levels of HD and FI. There is a strong need to improve and see how these indicators coexist. According to the statistics of the World Bank, the average number of ATMs per 100,000 adults is 39 for upper-middle-income (UMI) countries, 12 for lower-middle-income (LMI) countries, and only 3 for low-income (LI) countries. In addition, the average value of the Bank branches per 100,000 adults in these countries also remains very weak. It represents 17 for UMI countries, 20 for LMI countries, and only 2 for LI countries. In the same vein of the idea, and according to the UNDP’s HD reports, the HDI’s average value does not exceed 0.6, and some countries registered fragile levels. For example, the lowest level is 0.2 for UMI and LI countries and 0.3 for LMI. So, we think investigating the linkage between FI and HD and how they develop and coexist over time could be an interesting topic for these countries.

This study makes many contributions to the body of current literature. First, to our knowledge, few studies explored the link between FI and HD in low and middle-income countries. This study presents an insight into how FI affects HD in low and middle-income countries and how this effect differs across the groups of countries. Second, previous studies on this subject have only tested the effect of FI on HD using an index of FI. The authors of these studies have not checked the effect of the two dimensions of FI: access and usage. In the current study, we used three primary measurements: the access dimension, and the usage dimension and we built a synthetic index of FI. Using these dimensions, we can detect which dimension contributes more to HD in low and middle-income countries. Third, to learn more about the connectedness between FI and HD, the whole sample was divided into three sub-samples: low-, lower-middle, and UMI countries. Based on the empirical findings, we can address some specific recommendations for each group of countries.

Only for LMI and UMI nations do empirical evidence generally suggest the positive effect of FI on HD. For LI nations, however, no discernible impact was discovered. Furthermore, DTP technique results show that there is a threshold impact in both FI and HD. Below or above the defined threshold, FI significantly increases the level of HD. The result of this paper could be beneficial for policymakers of these countries. First, there is a strong need to improve the level of FI to enhance the level of HD. Second, a certain income level should be achieved to benefit from FI. The level of income mediates the inclusion-HD relationship.

The remaining sections of this work are as follows. Section 2 contains the review of the literature. The sample and the empirical technique are presented in Section 3. Section 4 discusses the findings. The results of the robustness assessment are shown in Section 5. Section 6 wraps up and covers some policy recommendations.

Literature review

Policymakers and scholars have increasingly focused their attention on two of the most important issues: low levels of HD and higher degrees of financial exclusion. Encouraging FI and advancing HD are among the shared goals of nations, international organizations, and governments.

There is currently much disagreement around the meaning and metrics of FI, with no widely agreed upon definition in place (Pesque-Cela et al. 2021:318). The early criteria were based on how various people were able to use formal financial services (Carbó et al. 2005). Demirgüç-Kunt et al. 2017 present progressively more contemporary definitions that emphasize that FI should not be confined to only providing access to financial services, but rather emphasise their quality, prices, and utilization.

Accurately like the definition issue, recent empirical research have approached the task of assessing FI differently. While there is broad consensus about the application of FI as a multifaceted term, there is less consensus regarding the selection of its primary aspects (Pesque-Cela et al. 2021:318). Furthermore, utilizing composite indices to measure FI has been deemed advantageous in a number of ways; yet, opinions differ about the most effective way to create these indexes.

When it comes to utilizing indices of banking service usage and accessibility across 99 nations to gauge how inclusive financial systems, Beck et al. (2007) are regarded as industry pioneers. However, their measurements are based on aggregate indicators which are considered as the common limitation. Hence, using these indicators, the measure of FI suffers from various measurement problems. Initially, there’s a chance that certain overall metrics exaggerate the availability and utilization of financial services. Second, using these aggregate indicators, the exclusion of non-residents is not possible. Third, some indicators such as deposits and loans (in % GDP) measure better financial development rather than FI. To overcome these problems using aggregate indicators, Allen et al. (2016) have used micro-level survey data collected by the World Bank.

Much work has gone into developing these indexes since there are several benefits to utilizing them as a gauge of FI. The creation of an index of FI was originally done by Sarma (2008) and Sarma and Pais (2011). These authors’ suggested indexes combine data on financial service availability, accessibility, and usage into a single value. This number falls between 0 and 1. total financial exclusion is represented by a number of 0, and total inclusion is represented by a number of 1. Regarding their methodological methods, a number of scholars have put out novel indices that diverge from Sarma’s (2008) index. A new measure of FI that is distinct from Sarma’s (2008) was recently suggested by Mialou et al. (2017). The difference is with the normalization, weighting, and aggregation techniques.

There are numerous theoretical vantage points to view the connection between HD and FI. These vantage points emphasize the diverse ways in which FI advances the general welfare and growth of people as well as communities. The following important theories aid in the explanation of this relationship:

FI is viewed through the lens of Sen’s (1993) Capabilities Approach as a way to empower people by giving them access to the financial resources they need for economic engagement, healthcare, education, and other facets of life. In the same vein, the human capital theory of Schultz (1961a, 1961b) contends that an individual’s total productivity and well-being are enhanced by investments in their education, health, and skill sets. By supplying resources for healthcare and education, FI fosters the development of human capital and raises each person’s potential for productivity.

In addition, the empowerment theory supposes that FI is often associated with empowerment. Therefore, access to financial services empowers individuals by giving them control over their financial resources, fostering economic independence, and enabling them to make meaningful choices in their lives. Furthermore, the empowerment theory postulates that FI and empowerment are frequently linked. As a result, having access to financial services empowers people by allowing them to take charge of their finances, promote economic independence, and make important life decisions.

According to the inclusive growth theory, FI is a major factor in inclusive growth because it makes sure that more people can engage in the economy and have access to financial resources. The networks, connections, and social trust that exist within a community are referred to as social capital (social capital theory), and FI can help these things grow. Financial services accessibility promotes economic exchanges, teamwork, and cooperation, enhancing the social fabric of communities and advancing their general development.

These theoretical stances offer a framework for comprehending the complex interplay between HD and FI. They emphasize how crucial it is to make sure financial services are not only available but also improve people’s capacities, opportunities, and general well-being.

Several empirical studies have been conducted on whether FI can improve HD. Although a major portion of the inclusion-HD literature supports the favorable effect (Kamalu and Wan Ibrahim 2021; Matekenya et al. 2021; Van et al. 2021).

In Bangladesh, India, and Pakistan, Chowdhury and Chowdhury (2023) conducted a more contemporary study on the contribution of FI to HD. Findings from the generalized method of moments (GMM) verify that FI has a positive impact on HD. The researchers discovered that life expectancy, educational achievement, and income level are all positively impacted by FI. Barik et al. (2022) looked at the relationship between HD and FI from 1993 to 2015 in the Indian setting. According to the empirical findings, FI greatly advances human growth.

Investigating the relationship between human growth and FI, Sarma and Pais (2011) used a sample of 49 countries. The results of the study indicate a tight relationship between HD and FI. The first indicator’s level closely follows the second indicator in each nation. Infrastructure, economic factors, wealth, inequality, urbanization, and literacy were deemed to be considered as significant factors. FI, however, is unaffected by the health of the banking industry.

Using a sample of 68 countries from 2004 to 2012, Nanda and Kaur (2016) investigated the relationship between FI and HD. Initial results show that over the research period, there was a rise in the degree of FI. On average, the FI index upgraded from 0.292 (low inclusion level) in 2004 to 0.332 (medium inclusion level) in 2012. Second, the empirical results show a strong and significant connectedness between the two indicators. The authors also found a movement between the index of FI, the HD index, and the income level. While some studies investigated the relationship between FI and HD, others investigated the causal relationship between these two indicators. For instance, Ofosu-Mensah Ababio et al. (2021) discovered that a lack of FI is a result of low HD. Furthermore, encouraging HD may be achieved via expanding the banking industry and enhancing FI.

By Matekenya et al. (2021), the African situation was investigated. The relationship between FI and HD was examined by the authors using a sample of Sub-Saharan African (SSA) nations. Their research, like that of most others, uses the access and usage component as a stand-in for FI. Empirical results from the Generalized Method of Moments (GMM) approach show a favorable and substantial association between FI and human growth in this region. Based on this positive association, the authors recommend that policymakers of these countries reduce the cost of access and usage of financial services for greater FI. For the same context, it was reported that greater FI through improving the access and usage dimensions positively affects HD in sub-Saharan Africa (Djekonbe et al. 2022).

To check whether FI affects HD in Iran, Kamalu and Wan Ibrahim (2021) have used a sample of Organization of Islamic Cooperation (OIC) member countries. Overall, findings revealed that FI promotes higher HD. The same result was found by Anurag et al. (2014). The authors used a sample of 28 states and six regions of India to explore the link between FI and HD. Empirical results show that FI and HD indexes are positively correlated. The authors state that greater FI should be considered a policy priority in India to achieve robust growth and enhance human and economic development(ED).

Although the majority of the studies mentioned above concentrate on the direct impact of FI on HD, some studies focus on the indirect impact of FI on growth, poverty, and disparity. In keeping with this idea, Ali et al. (2021) investigated whether FI boosts ED in member nations of the Islamic Development Bank (IsDB).

Using a range of econometric approaches, such as including the generalized method of moments (GMM), two-stage least squares (2SLS), panel vector autoregressive (VAR), and panel Granger causality tests, findings show a favorable correlation between FI and economic growth (EG). Furthermore, a bi-directional causal relationship between the two variables is revealed by the Granger causality study. More recently, Demir et al. (2022) looked into the relationship between wage disparity and FI. 140 nations from the Global Findex for the years 2011, 2014, and 2017 were used as a sample. The authors assume that FI caused by fintech impacts inequality both directly and indirectly. According to research results from the quantile regression, FI is a crucial pathway by which FinTech lowers income disparity.

Khan et al. (2021) examined whether FI can both guarantee financial security and decrease poverty and income disparity. They employed multiple regressions as an empirical approach and a sample of 54 African nations spanning the years 2001 to 2019 to accomplish this objective. According to the empirical findings, FI considerably lowers poverty and wage inequality and improves financial stability. Additionally, Dogan et al. (2022) looked at how FI affected three metrics of poverty in the Turkish context: the lower middle-income line, the lower middle-income poverty line, and the higher middle-income poverty line. The authors demonstrated that FI reduces poverty in Turkey using logistic regressions. Additionally, they demonstrate how spending on money and health is necessary for FI to significantly affect poverty.

FI’s impact on growth in developing nations was examined by Van et al. (2021). The outcome is consistent with a favorable correlation between ED and FI. More specifically, the authors disclose that this favorable association is more pronounced in nations with low levels of FI and income.

The relationship between FI and EG was examined by Emara and El Said (2021) utilizing data for 44 emerging markets (E.M.s) and the Middle East and North Africa (MENA) during the 1990–2018 period, in contrast to other research that concentrated on developing or low– and middle-income nations. The selected sample’s growth and FI are positively correlated, according to SGMM empirical findings. Outcomes also show that a company’s ability to obtain financing influences its growth rate favorably and significantly—but only when robust institutions are present.

Although most of the studies on the nexus between FI and HD have been focused on a linear approach, few studies discussed the potentially nonlinear relationship. For example, Kim and Lin (2011), explored the nonlinear relationship between income inequality and financial development. They performed the instrumental-variable threshold regressions approach. The authors found that there is a threshold effect in this relationship. Abdelaziz and Helmi (2019) studied the nonlinear relationship between financial development and HD in the MENA region. Empirical results of the panel smooth transition regression (PSTR) model indicate that there is a threshold effect in this relationship. This threshold differs across oil-exporting and oil-importing countries. In addition, the authors found that above these thresholds, financial development improves HD, however; below the defined thresholds, it acts negatively and significantly.

When reviewing the literature, we note that few empirical studies focused on low and middle-income countries. For example, Abdelghaffar et al. (2022) supported FI’s positive and significant effect on HD. However, they conclude that low- and LMI countries benefit form FI rather thanhigh-income and UMI countries. This study extends the existing literature on the FI-HD relationship. It compares the connectedness between FI and HD in UMI, LMI, and LI countries.

The relationship between FI and HD involves several mechanisms and channels through which increased access to financial services can positively impact various aspects of individuals’ lives. Below are some key mechanisms on how FI can affect the three components of HD.

Through microfinance initiatives, individuals can obtain credit. This enables them to start or grow businesses, invest in ventures that generate revenue, and improve their overall financial well-being. Having access to financial services like savings and insurance also helps people manage the risks inherent with unforeseen occurrences like crop failure, natural catastrophes, or medical issues.This can keep households from becoming impoverished as a result of unanticipated events. FI gives business owners the capital to launch or grow their enterprises. This promotes creativity, economic expansion, and the creation of jobs, which benefits the development of the individual, the firms as well as the community. Additionally, having access to official financial services helps families budget and save for future costs, such as schooling. Higher savings can result in higher school enrollment rates. Concerning healthcare, FI makes insurance and savings products more accessible, which helps people and families deal with unforeseen medical costs. People may have better health outcomes as a result of being able to afford medical care.

It’s crucial to note that the effects of FI on HD can differ based on regional circumstances, legal frameworks, and the particular layout of FI programs. A comprehensive strategy is frequently needed for effective implementation, one that tackles problems like consumer protection, financial literacy, and the availability of financial services in addition to access to them.

Empirical design

Data

We utilized a dataset related to 79 LMI countries from 2000–2017 to examine if FIhas an impact on HD. As per the World Bank classificationFootnote 1, economies classified as LI have a gross national income (GNI) per capita of $1045 or less, as determined by the World Bank Atlas method. LMI economies are those that have a GNI per capita ranging from $1046 to $4095, while UMI economies have a GNI per capita ranging from $4096 to $12,695.

The initial sample covers 94 countries; however, due to the unavailability and the discontinuity of some data, particularly FI information, 15 nations are removed. Thus, the final sample consists of 79 countries. This study is limited to only 2017 since data related to FI are available only up to this year. To learn more about the dynamic connection between FI and HD, the whole sample of 79 countries was divided into three sub-samples, 27 UMI countries, 26 LMI countries, and 26 LI countries. The World Development Indicators (WDI) databaseFootnote 2 is the primary source of data, while data for the HD index are gathered from the UNDP’s HD reports.

Human Development Index (HDI)

In this study, HD was quantified using the HD Index (HDI). UN-compiled data is used to create the HDI measure. It is employed to measure average performance in fundamental areas of HD. Three principal dimensions exist. Measured by life expectancy at birth, the first one is the health component. The mean years of education for people 25 years of age and older, as well as the anticipated years of education for children of school-age, are used to measure the second dimension, which is education. The third dimension pertains to the level of life, which is determined by the gross national income per capita.

These three indicators are then combined and normalized to get the index. First, a scale with a range of 0 to 1 is applied to all of the indications.This is accomplished by giving a score of 1 to countries that are at or above the maximum value and 0 to countries that are at or below the minimum value for each indicator. Each indication is assigned a minimum and maximum value. Afterwards, the indicatiors are combined. The geometric mean over the three dimensions is calculated by taking the arithmetic mean of the knowledge indicators.

This index score is a single number and ranges from 0 (lowest degree of HD) to 1 (highest level of HD). The first is ranked between [0.8 and 1] and indicates a very high HD. The second one indicates a high level of HD and it ranges between [0.7 and 0.79]. The third one refers to a medium HD when the score is between [0.55 and 0.70]. The fourth one is relative to low HD if the score is below 0.55.

Like all indexes, the HDI index presents some advantages and some limitations when gauging HD, the HDI index is the most often used metric globally. In contrast to the GDP, the HDI considers social indicators and an individual’s health in addition to economic progress as a means of HD. Since it considers living conditions and literacy levels in addition to ED, it is also regarded as more trustworthy. The accuracy of the HDI is increased by its three key components: income level, education, and health. Policymakers can readily modify and execute economic policies to raise the standard of HD based on the HDI ratings. Additionally, it enables the government to identify areas in need of quick attention and action.

One of the HDI index’s drawbacks is that it responds less to abrupt changes and instead concentrates on long-term developments in a nation, such as the life expectancy indicator. Furthermore, there is significant variation in the HDI index across nations, and the relationship between a nation’s wealth and welfare is not taken into account. When calculating economic welfare, certain important metrics—such as death rate, gender equality, wealth distribution, and poverty—were overlooked. It also leaves out several things, such as environmental degradation, which can have a big impact on people’s quality of life.

Financial inclusion measurements

According to the definition by the World Bank (2022a, 2022b), “FImeans that individuals and businesses have access to useful and affordable financial products and services that meet their needs–transactions, payments, savings, credit, and insurance–delivered in a responsible and sustainable way”. Another definition of FIis the process of making formal financial services conveniently accessible, available, and useable across all economic sectors (Sarma 2016).

Despite that, FI has been treated as one of the most important topics that have several effects on the micro-economic and macro-economic levels; its measurement lacks official consensus (Tram et al. 2021). Several empirical research heavily relied on the Global Findex database (for example, Hund et al. 2007; Danisman and Tarazi 2020). Additionally, this database remains one of the most valuable international databases on FI. In some other studies, various FI metrics have been employed individually to capture access to and use of financial services (for example, Allen et al. 2016; Demir et al. 2022). However, literature on FI has reported little consensus regarding three main measures: the access dimension (e.g., Hakimi et al. 2022; Rasheed et al. 2016; Adeola and Evans 2017), the usage dimension (e.g., Hakimi et al. 2022; Evans 2015; Adeola and Evans 2017; Sarma 2008; 2012) and the index of FI (Sarma 2008; Ahamed and Mallick 2019; Hakimi et al. 2022).

Since there is an agreement on the use of the access dimension, the usage dimension, and the index of FI(e.g., Hakimi et al. 2022; Rasheed et al. 2016; Adeola and Evans 2017; Evans 2015; Sarma 2008; 2012; Ahamed and Mallick 2019), this study adheres to this agreement and uses three measures. The first one is the access dimension which is an indicator of access to financial services. Two proxies are used for the access dimension.

We used ATM per 100,000 adults (ATM) bank branch per 100,000 adults. The second dimension is usage dimension, which relates to how people and organizations use financial services. We calculated the ratio of bank deposits to GDP (DEPO) and domestic credit to the private sector (DCPS). The third one is the FI index. We constructed a composite FI index (IFI) as a robustness assessment, following Hakimi et al. (2022), Sarma (2008), and Ahamed and Mallick (2019). This index is derived from the four indicators mentioned above: ATM, BRAN, DEPO, and DCPS. Using Principal Component Analysis (PCA), we created the FI (IFI) index. This technique reduces the dimensionality of data while not losing more information. In addition, the PCS removes correlated features and reduces overfitting.

Hence, the present study examines the relationship between FI and HD, using two measures of FI, which capture ‘access’ to and ‘use’ of financial services, as well as a FIindex, which includes both dimensions of financial inclusionFootnote 3.

The World Bank’s definition of FIincludes quantitative and qualitative dimensions. However, this study focuses only on the “quantitative dimension” of FI (i.e., access and use) and does not take account into its “qualitative” dimension (i.e., whether financial services, such as credit, are delivered responsibly and sustainably).

Empirical approach

Following Ofosu-Mensah Ababio et al. (2021), As an empirical method, we used the SGMM method to investigate the link between FI and HD. These authors claim that when the individual dimension (N) of the data is greater than the temporal dimension (T) of the data, the SGMM is the best approach to use. The SGMM offers reliable findings and effective parameter estimates in contrast to the ordinary least squares (OLS), fixed, and random effect models, which struggle with bias from missing variables and measurement error (Teixeira and Queirós 2016). In addition, this method deals with one of the most severe econometric problems: the endogeneity problem (Danisman and Tarazi 2020 and Hakimi et al. 2022).

In addition, the use of dynamic panel data requires approval of the homogeneity test. This is why, in the first step, we apply the slope homogeneity test of Pesaran and Yamagata (2008). However, several authors who have studied the relationship between FI and HD assert that the relationship is nonlinear. To this end, in the second step, we apply the Wald and Fisher linearity tests against the dynamic panel threshold model proposed by Kremer et al. (2013). The model, based on threshold regression takes the following form:

where i = 1,...,N represents the number of countries in the panel and T = 1,..., T is the time. The country-specific fixed effect is \({\mu }_{{it}}\), while the error term is \({\varepsilon }_{{it}}\). I(.)stands for the indicator function of the regime set by the threshold variable \({q}_{{it}}\) and the threshold level γ. \({z}_{{it}}\) is a vector of m-dimensional explanatory regressors which may include lags in the dependant variable (y) and other endogenous variables. The explanatory variables vector is divided into a subset \({z}_{1{it}}\), of exogenous variables uncorrelated with \({\varepsilon }_{{it}}\), a subset of endogenous variables \({z}_{2{it}}\),correlated with \({\varepsilon }_{{it}}\). Additionally, this model also requires an adequate set of k ≥ m instrumental variables \({X}_{{it}}\) including \({z}_{1{it}}\).

The individual effects (μ_it) need to be removed using a fixed-effects transformation in the first stage of model estimation in Eq. (1). We therefore use the orthogonal forward deviation approach of Arellano and Bover (1995), which is given by the following formula:

This technique has the advantage of avoiding serial correlation of the modified error terms. This feature enables the estimating process developed for a cross-sectional model to be applied to dynamic panel data models.

Estimation involves identifying and selecting the threshold value γ with the smallest sum of squared residuals Having determined δ ̂, the slope coefficients can be estimated by the generalized method of moments (GMM) for instruments previously used and the thresholdδ ̂ previously estimated.

We specify the following threshold model using the dynamic panel threshold model to analyze the effect of FI on HD in Lo, Low-middle and Up-middle Income countries:

\({{IFI}}_{{it}}\) being both the threshold variable and the regime-dependent regressors in our application. \({z}_{{it}}\) gives the partially endogenous vector of control variables, in which the slope coefficients are assumed to be regime-independent. In line with Kremer, Bick, and Nautz (2013), we allow differences in the regime intercept \({\delta }_{1}\). Initial HD is regarded as an endogenous variable, \({z}_{2{it}}\) = Initial = \({{HDI}}_{{it}}\) while \({z}_{1{it}}\) contains the remaining control variable which for our application include the \({{\boldsymbol{ATM}}}_{{\boldsymbol{i}}{\boldsymbol{,}}{\boldsymbol{t}}}\), \({{\boldsymbol{BRAN}}}_{{\boldsymbol{i}}{\boldsymbol{,}}{\boldsymbol{t}}}\), \({{INVES}}_{i,{t}}\), \({{FDI}}_{i,{t}}\), \({{TRADE}}_{i,{t}}\), \({{INFRA}}_{i,{t}}\), \({{GSAV}}_{{t}}\), \({{GNE}}_{i,{t}}\), \({{LOANS}}_{i,{t}}\), \({{\boldsymbol{DEPO}}}_{{\boldsymbol{i}}{\boldsymbol{,}}{\boldsymbol{t}}}\) and \({{\boldsymbol{DCPS}}}_{{\boldsymbol{i}}{\boldsymbol{,}}{\boldsymbol{t}}}\).

Similar to Arellano and Bover (1995) and Kremer, Bick, and Nautz (2013), we use lags of the dependent variable (\({{HDI}}_{{it}-1}\),.…\(\,{{HDI}}_{{it}-p}\)) as instruments. A bias/efficiency trade-off exists in finite samples when selecting the number (p) of instruments. The use of all available lags of the instrumental variable (p = t) may improve efficiency, while decreasing the number of instruments to 1 (p = 1) may prevent over-adjustment of the instrumented variables, which could lead to biased coefficient estimates.

Besides, we follow an empirical strategy based on three steps. Since FI is measured through access and usage, we investigate the effect of the access dimension on HD in the first step. The econometric model is given in Eq. (1).

The second step consists of testing the effect of the usage dimension on the level of HD, and the model to be tested is as follows:

Following Hakimi et al. (2022), in the third step, as a robustness check, we built an index of FI (IFI) using the four proxies of FI. The index of FI (IFI) is built using the Principal Component Analysis (PCA).

Besides FI, we used several control variables to explain changes in HD. We include domestic or foreign investments as a control variable in the econometric model. FDI facilitates technological transfer that enhances skills and narrows the gap between education and employability. Additionally, local investment creates more job opportunities that improve living conditions (Hakimi and Hamdi 2016; Abdelaziz and Hamdi 2019). Trade openness is considered a driver for EG and HD. Trade openness affects HD through EG, environmental quality, and health conditions (Abdelaziz and Hamdi 2019). Prior studies have recognized the importance of infrastructure in improving HD. These research have concluded that infrastructure services inhibit inclusive development. Gross saving and gross national expenditure. These two indicators inform about the level of income and the level of expenditure. They also indirectly inform about HD in each country. HD is supported by credits from the International Bank for Reconstruction and Development (IBRD) or the International Development Association (IDA).These credits finance projects aiming to improve infrastructure, education, healthcare, food, and potable water access.

All variables’ definitions are given in Table 1.

As described in the data sub-section, the sample of 79 countries was divided into three sub-samples, 27 UMI countries, 26 LMI countries, and 26 LI countries.

Empirical findings

Our initial presentation of summary statistics for the three sub-samples is made in this section. The multicollinearity issue is checked for in the second step. We conclude by discussing the empirical results.

Summary statistics and correlation

Statistics that are descriptive are included in Table 2. Statistics for the three sub-samples—UMI, LMI, and LI—are provided for comparative analysis.

According to Table 2, the average HDI score for UMI nations is 0.72, but it is around 0.61 and 0.46 for LI countries, respectively. As expected, the highest level of HDI is registered by UMI countries with a score of 0.82. LI countries recorded the lowest HDI score with only 0.33.

Argentina had the greatest level of HDI for UMI nations (0.82), Georgia had the lowest-income countries (0.75), and Togo had the lowest-income countries (0.71). However, the lowest score of HDI in the UMI countries was registered by Angola with a score of 0.49, by the Congo Republic for LI countries with a score of 0.42 and by Niger for the lower-income countries with a score of 0.33.

For the scores for each of the HDI dimensions, Supplementary Appendix 2 shows that the mean value of the per capita GDP is 6195$ for UMI countries, 3202$ for LI countries, and 1120$ for lower-income countries. The second component of the HDI score is life expectancy at birth. This dimension records an average of 71 years for the UMI countries, 65 years for the LI countries, and 57 years for the lower-income countries. Year of schooling is the third dimension of HDI. It registers a mean value of 8 years for UMI countries, 6 years for LI countries, and only 3 years for lower-income countries.

Concerning FI indicators, we found that the average number of ATMs per 100,000 adults is 39 for UMI countries, 12 for LMI countries, and only 3 for LI countries. In addition, statistics show that the mean value of the number of bank branches per 100,000 adults is 17 for UMI countries, 20 for LMI countries, and only 2 for LI countries. From these statistics, we note that through the access dimension, the level of FI is very weak in LI countries compared to those in upper and LMI countries.

The utilization dimension, like the access dimension, underlines the supremacy of upper- and LMI nations. According to statistics, the average GDP percentage deposit for UMI nations is 44%, for LMI countries it is 32%, and for LI countries it is 29%. Additionally, we found that the mean value of DCPS in UMI nations is 42%, but it is only 16% in LMI nations. The poor level of FI in LI nations is once again confirmed by descriptive data employing the usage dimension.

In reference to the FI index constructed by Principal Components Analysis (PCA), statistical data suggests that the average value of this index is 0.38 for nations in the UMI range, 0.16 for countries in the LMI range, and −0.62 for countries in the LI range.

We check for the multicollinearity issue in Table 3a after providing some descriptive data on the variables employed in this study. A relatively low correlation exists between the independent variables, as this table demonstrates. At greater than 60%, BORR, ATM, and ACC have the greatest values. These variables, however, represent important FI metrics that have been independently examined in the robustness check or in models (1), (2), and (3). Consequently, we verify that multicollinearity is not a major issue.

Utilizing the variance inflation factors (VIFs), we do a second assessment of the multicollinearity issue. In a model where the variables are uncorrelated, a value of 1 denotes this. A moderate correlation is shown by a number between 1 and 5, while a potentially severe connection is shown by a value larger than 5. In Table 3b, the results are shown. We may infer from this Table that there is no possibly severe correlation between the variables in the model and that there is a moderate correlation between all values, which ranges from 1 to 5.

Slope homogeneity test

The slope homogeneity test was developed by Swamy in 1970 and further enhanced by Pesaran and Yamagata (2008). The findings are shown in Table 4. In contrast to the heterogeneous alternative hypothesis, the null hypothesis claims that slope coefficients are homogenous. With the exception of the third model for the LI nations, the results show that mean-variance bias corrected and simple delta tilde are both significant for models 1 and 2. Concerning the middle-low countries, results prove that the null hypothesis of homogeneity is accepted for the second and the third model and rejected for the first one. However, findings indicate that the null hypothesis of homogeneity is accepted for all the models of the up-middle countries. Thus, the study adopts the dynamic panel data estimation technique for all models and the simple fixed /random effect estimation for the third and the first model in the Low and LMI countries respectively.

Linearity test

Based on the homogeneity results, the dynamic panel data method is the most appropriate for studying the effect of FI on HD. However, several authors who have studied the relationship between FI and HD emphasize the non-linear nature of this relationship. We therefore applied the Wald and Fisher linearity tests against the dynamic threshold panel model.

Where SSR0 and SSR1 represent the panel sum of square residuals under H0 (linear dynamic panel model) and the panel sum of square residual H1 (dynamic threshold panel model) respectively.

Where k is the number of explanatory variables. \(L{M}_{F}\) follows the Fisher distribution with k and TN-N-k degrees of freedom. Besides, all these linearity tests are dischi-squared \({\chi }^{2}(k)\) under the null hypothesis.

Table 5 provides the Wald and Fisher linearity tests. This table demonstrates that the null hypothesis of linearity is rejected at the 1% significance level for the third model (M3 with the FI index) for low-income, lower-middle-income and upper-middle-income countries. Therefore, the relationship between FI (index) and HD is not linear.

Discussion of the empirical results

We employ an empirical technique based on three phases, as outlined in the empirical approach. The first phase is talking about how FI affects HD levels through the access dimension (Table 5). The second phase examines how the usage dimension affects HD (Table 6). The third step is a robustness check in which we explore the link between FI and HD on the basis of an index of FI (Table 7) and other important FI measures, including account ownership at a financial institution or with a mobile money service provider, the proportion of depositors and borrowers from commercial banks, and Table 8 (mortor accounts with commercial banks).

Results of the impact of “access” dimension

Results of access dimension on HD are displayed in Table 4. Arellano and Bond’s (1991) AR (2) test has a p-value greater than 5%, as does the Sargan test, which confirm the right specification of the model.

Findings in Table 5 show that the current year’s HD level has a significant and positive correlation with the prior year’s level.

Using the SGMM or the fixed effect methods, we note from Table 5 that there is a positive relationship between “access to financial services” and HD regardless of whether we use macro or micro-level measures of FI. We found that the access dimension through the number of ATMs significantly enhances HD for the three sub-samples. Unlike the effect of the ATMs, empirical results show that the number of bank branches (BRAN) is without any significant effect for the three sub-samples. The ATM exerts positive and significant. This suggests that increasing the number of ATMs improves HD in low- and middle-income countries. Financial services must be made more accessible to the general public by providing deposit collection, payment processing, microfinance, mortgage loans, and insurance products. All of these services improve HD. Furthermore, access to financial services offers several advantages. It allows people to smooth their consumption and invest in their well-being through education and health. This result is in line with Arora and Kumar (2021), Kamalu and Wan Ibrahim (2021), Emara and El Said (2021), and Matekenya et al. (2021).

Domestic or foreign investments exert a negative and significant effect on HD only for UMI countries. Although foreign investment has been treated as one of the primary sources of technology transfer that enhances skills, we found that the coefficient of FDI is negative and significant. Concerning local investment, it was considered a driver for more job opportunities and employment. It also narrows the gap between education and employability. Empirical results confirm the negative effect of investments on HD. The negative impact of investments and FDI on HD can be explained through the environment and the health effects. In low and middle-income countries, most investments use non-clean energies that affect environmental quality and threaten health. In addition, in some cases, multinational firms operate in host countries just to benefit from the abundance of natural resources and low wages. The benefits of their firms are not fully exploited locally but are transferred to the countries of origin. These results are divergent from Hakimi and Hamdi (2016) and Abdelaziz and Hamdi (2019) which supported the positive relationship between investment and HD in Middle and East North African countries. These findings are also divergent from Sharma and Gani (2004) who reported that FDI and HD can be traced from welfare and EG literature.

Only in LI nations does trade openness have a positive and significant relationship with HD levels. Theoretically, it was reported that trade indirectly affects HD through three main channels: EG (gross national income), environmental quality, and health conditions. Although several prior works have reported the harmful effect on environmental qualities through dirty energies and CO2 emission (Hua and Boateng 2015), this study supports a positive association between trade and HD. This result can be explained as follows. In an open economy, poverty will be reduced through EG and income distribution. It was argued that open economies grow relatively faster than closed economies (Tsai and Huang 2007). Furthermore, higher EG induced by higher openness results in an improvement in government earnings that enhance investments in education, infrastructure, and job creation; and, consequently, improve HD. This result is in line with Dollar and Kraay (2004) and Todaro and Smith (2009).

Findings also indicate that gross saving and gross national expenditure significantly enhance HD only for UMI countries. However, there is no significant effect for both lower-middle and LI countries.

Results of the “usage” dimension

This second step discusses the impact of the usage dimension, just as it does with the access dimension. The use of financial goods and services as a substitute for FI could have an impact on human development. Bank deposits to GDP (DEPO) and domestic credit to the private sector expressed as a percentage of GDP (DCPS) are used as measures of the utilization dimension. Table 6 shows empirical outcomes.

Table 6 shows that the p-values for Arellano and Bond’s AR (2) test and Sargan test are more than 5% each. This means that the models fit the data and are well-specified, which validates the estimation outcomes.

The impact of the usage dimension is comparable to that of the access dimension in that it greatly enhances HD in both upper- and LMI nations. HD is greatly increased by higher private sector loan and deposit ratios. Greater FI through the usage dimension allows access to financial instruments and credit, enabling businesses to grow, creating jobs, and reducing inequalities. More job opportunities improve the standard of living of individuals. In this case, it improves education quality and more investment in health conditions. This finding is convergent with Kamalu and Wan Ibrahim (2021), Matekenya et al. (2021), and Nanda and Kaur (2016). Once again, no significant effect of the usage dimension on HD was detected for LI countries.

However, actual findings show that HD in LI nations is not significantly impacted by FI. Aggregate measures of FI as proxies of the use of financial services (e.g., private credit as a % of GDP), are not positively associated with HD in LI countries. These measures are often used to measure financial development rather than FI.

As with Table 5’s results, Table 9’s data support the favorable relationship between trade, gross national income, and gross saving. For both the lower and higher middle income groups, the coefficients of these factors are significant and positive. For LI nations, however, no noticeable effect was discovered.

Robustness check

In the first phase, we constructed an index of FI3, following Hakimi et al. (2022), Ahamed and Mallick (2019), and Sarma (2008) to assess the robustness of the results. In this part, we use a FI index (IFI) to investigate the influence of FI on HD. Table 7 contains the empirical findings.

Based on the homogeneity and the linearity tests, we applied the dynamic threshold panel (DTP) method for the UMI countries and the LMI countries. However, the fixed effect model will be performed for LI countries.

A threshold effect is present in the FI-HD connection, according to the DTP method’s results. For higher-income nations, this cutoff is set at 0.189, whereas for lower-income countries, it is set at 0.183. We see from the first observation that the two defined criteria do not differ significantly. The second observation is that either below or above the defined thresholds, FI significantly increases HD in the two groups of countries. Nevertheless, we note that the coefficient of \({\beta }_{2}\) (index of FI above the threshold) is lower tthan the coefficient of \({\beta }_{2}\) (index of FI below the threshold). Thus, to enhance HD in the MENA area, a more inclusive financial system should be bolstered by a robust infrastructure and a high degree of financial literacy.

The result of the fixed effect and the influence of the access and usage dimension are both supported by the FI index’s positive and statistically significant connection with HD. For LI nations, this beneficial impact is also demonstrated. Higher FI considerably improves HD in these nations, as was previously mentioned for the results in Tables 5 and 6. According to empirical findings, LI nations get a 2.1% rise in HD with every 1% increase in FI.

The second step involves using key measures of FI, such as account ownership at a financial institution or with a mobile money service provider (percentage of population, ages 15+) (ACC), depositors with commercial banks (per 1000 adults) (DEPOS), and borrowers from commercial banks (per 1000 adults) (BORR), to assess the robustness of the results. One of the advantages of using these measures is that they allow for a sharper distinction between “financial development” (often measured as the ratio of private credit over GDP) and “FI.” We checked the results for the same sample of 79 divided into the three sub-samples but observed from 2011 to 2021. The statistics pertaining to account ownership at a financial institution or with a mobile money service provider (% of the population, aged 15+) only goes back to 2011. Table 8 provides the empirical results.

Only in LMI and LI countries are additional FI measures—such as the proportion of the adult population aged 15 and over with an account at a financial institution or with a mobile money service provider, the number of adults who deposit money at commercial banks, and the number of adults who borrow from these banks—used to substantiate the positive impact of FI on HD. Contrary to aggregate measures of FI, the Micro-level measures of FI as proxies of the use of financial services use of financial services (e.g., % people with an account at a financial institution or no. of depositors/borrowers per 1000 people) tend to be positively related to HD in these same countries. For example, an increase of 1% in the ownership of the accounts at a financial institution or with a mobile money service provider increases HD by 7.16%. However, no significant effect was found for the upper-middle –income. We found that an increase in the ownership of the accounts at a financial institution and in the borrowers from commercial banks significantly improves HD in LI countries. Additionally, more depositors with commercial banks increase HD in LMI countries. The improvement of HD is attributed to increased accessibility to banking and financial services. Thus, for practically all of the important metrics included in this study, the positive effect of FI on HD remains stable.

Conclusion and policy recommendations

This study looks at how FI affects HD in low-, lower-, and UMI nations. The sample of 79 nations included in this article spans the years 1990–2017. To facilitate comparison analysis, the whole sample was split into three smaller samples. The first one includes 27 nations with upper middle incomes. 26 LMI nations serve as the basis for the second, while 26 LI nations are the focus of the third.

The hypothesis that FI improves HD in both lower- and upper-income countries is supported by the empirical results of the SGMM. Moreover, the DTP method results indicate that there is a threshold effect between FI and HD. In both lower- and UMI nations, FI considerably raises the level of HD, whether it is above or below the established criterion. Furthermore, the robustness check’s findings support F.I.’s positive impact on HD. It was also observed that in upper- and LMI nations, trade openness, gross saving, and gross national expenditure all positively enhance HD. Additionally, research shows that only in UMI nations does HD go worse due to local or foreign investments.

Government representatives in low- and middle-income countries may find the study’s conclusions to be quite significant. In order to raise the degree of HD, it is first important to raise the FI. Therefore, it is imperative to give considerable thought to augmenting the availability and utilization of diverse financial services via the integration of FinTech, escalating digitization, and allocating resources towards innovation that guarantees effortless access to financial instruments and services. The establishment of favorable conditions for increased access to financial services should be a major responsibility of central banks. Besides the role of central banks, governments are invited to implement laws and regulations that promote both financial sector development and FI. Second, to get full benefits from the positive effect of FI, a certain level of income should be achieved since it mediates the inclusion-HD relationship. Third, these countries are invited to encourage trade and gross saving since they positively contribute to improving HD.

This study has a few drawbacks. First, the FI metrics included in this study only account for the “quantitative dimension” of FI, which is access and consumption, leaving out the “qualitative” dimension, which is the question of whether financial services, like credit, are provided in an ethical and sustainable manner. There is no comparison between high-income and LI nations in this study; instead, it solely focuses on those with low and intermediate incomes. Thus, improving the paper’s outcomes would include taking the qualitative aspect into account and conducting a comparative study between high- and LI nations.

Data availability

The datasets analyzed during the current study are available in the Dataverse repository: https://doi.org/10.7910/DVN/GJITCL.

Notes

The World Bank classification covers 137 low-middle-income countries divided into 27 low-income countries, 55 lower-middle-income countries, and 55 upper-middle-income countries.

The index of financial inclusion is built using the Principal Component Analysis (PCA).

This index of financial inclusion is made from the four indicators namely, ATM, BRAN, DEPO, and DCPS. We built this index using the Principal Component Analysis (PCA). All diagnostic tests related to the PCA such as component values and related weights of selected factors, variance explained, KMOs, and sample adequacy results are reported in appendix 3.

References

Abdelaziz H, Helmi H (2019) Financial development and human development: A non-linear analysis for Oil-exportingand Oil-importing countries in MENA region”. Econ Bull 39(4):2484–2498

Abdelghaffar RA, Emam HA, Samak NA (2023) Financial inclusion and human development: is there a nexus? J Humanit Appl Soc Sci 5(3):163–177

Adeola O, Evans O (2017) Financial inclusion, financial development, and economic diversification in Nigeria. J Dev Areas 51(3):1–15

Ahamed MM, Mallick SK (2019) Is financial inclusion good for bank stability? International evidence. J Economic Behav Organ 157:403–427

Ali M, Hashmi SH, Nazir MR, Bilal A, Nazir MI (2021) Does financial inclusion enhance economic growth? Empirical evidence from the IsDB member countries. Int J Financ Econ 26:4

Allen F, Demirguc-Kunt A, Klapper L, Peria MSM (2016) The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financial Intermediation 27:1–30

Anurag G, Varun Rao C, Muralidha NV (2014) Financial inclusion and human development: A state-wise analysis for India. Int J Econ Commer Manag 2(5):1–23

Arellano M, Bond S (1991) Some tests of specification for panel data: monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51

Arora N, Kumar N (2021) Does Financial Inclusion Promote Human Development? Evidence from India. Jindal J Bus Res 10(2):163–184

Barik R, Lenka S-K, Parida J-K (2022) Financial Inclusion and Human Development in Indian States: Evidence from the Post-Liberalisation Periods. Indian J Hum Dev 16:3

Beck T, Demirgüç-Kunt A, Martinez-Peria M (2007) Reaching out: Access to and use of banking services across countries. J Financial Econ 85(1):234–266

Carbó S, Gardener EPM, Molyneux P (2005) Financial exclusion. Palgrave Macmillan, Basingstoke

Chakrabarty M, Mukherjee S (2022) Financial inclusion and household welfare: An entropy-based consumption diversification approach. Eur J Dev Res 34(3):1486–1521

Chowdhury K-E, Chowdhury R (2023) Role of Financial Inclusion in Human Development: Evidence from Bangladesh, India and Pakistan. J Knowl Econ. https://doi.org/10.1007/s13132-023-01366-x

Danisman GO, Tarazi A (2020) Financial inclusion and bank stability: Evidence from Europe. Eur J Financ 26(18):1842–1855

Demir A, Pesqué-Cela V, Altunbas Y, Murinde V (2022) Fintech, financial inclusion and income inequality: a quantile regression approach. Eur J Financ 28(1):86–107

Demirgüç-Kunt A, Klapper L, Singer D (2017) Financial inclusion and inclusive growth: A review of recent empirical evidence. World Bank Policy Research Working Paper, No. 8040, Washington, DC

Demirguc-Kunt A, Klapper L, Singer D, Ansar S, Hess JR (2018) The Global Findex Database 2017 : Measuring Financial Inclusion and the Fintech Revolution. World Bank Group, Washington, D.C

Djekonbe D, Ahmat Tidjani MI, Oumarou B (2022) Reexamining the effects of Financial Inclusion on Human Development in Sub-Saharan. Afr Econ Res Guardian 12(1):55–71

Dogan E, Madaleno M, Taskin D (2022) Financial inclusion and poverty: evidence from Turkish household survey data. Appl Econ 54(19):2135–2147

Dollar D, Kraay A (2004) Trade, growth, and poverty. The Econ J 114(493):F22–49

Duvendack M, Mader P (2019) Impact of financial inclusion in low-and middle-income countries: A systematic review of reviews. Campbell Syst Rev 15:1–2

Emara N, El Said A (2021) Financial inclusion and economic growth: The role of governance in selected MENA countries. Int Rev Econ Financ 75:34–54

Evans O (2015) The Effects of Economic and Financial Development on Financial Inclusion in Africa. Rev Econ Dev Stud 1(I):17–25

Hakimi A, Boussaada R, Karmani M (2022) Are financial inclusion and bank stability friends or enemies? Evidence from MENA banks. Appl Econ 54(21):2473–2489

Hakimi A, Hamdi H (2016) Trade liberalization, FDI inflows, environmental quality and economic growth: a comparative analysis between Tunisia and Morocco. Renew Sustain Energy Rev 58:1445–1456

Hua X, Boateng A (2015) Trade openness, financial liberalization, economic growth, and environment effects in the North-South: new static and dynamic panel data evidence. In Beyond the UN global compact: institutions and regulations. (Vol. 17, pp. 253-289)

Hund J, Bartram SM, Brown GW (2007) Estimating Systemic Risk in The International Financial System. J Financial Econ 86(3):835–869

Kamalu K, Wan Ibrahim WHB (2021) Financial Inclusion and Human Development in OIC Member Countries: Evidence from Panel Quantile Regression Method. Iranian Econ Rev 27:377–404

Khan I, Khan I, Sayal AU, Khan MZ (2022) Does financial inclusion induce poverty, income inequality, and financial stability: empirical evidence from the 54 African countries. J Econ Stud 49(2):303–314

Kim D-H, Lin S-C (2011) Nonlinearity in the Financial Development–Income Inequality Nexus. J Comp Econ 39(3):310–25

Kremer S, Bick A, Nautz D (2013) Inflation and Growth: New Evidence from a Dynamic Panel Threshold Analysis. Empir Econ 44:861–78

Matekenya W, Moyo C, Jeke L (2021) Financial inclusion and human development: Evidence from Sub-Saharan Africa. Dev South Afr 38(5):683–700

Mialou A, Amidzic G, Massara A (2017) Assessing countries’ financial inclusion standing—A new composite index. J Bank Financ Econ 2(8):105–126

Morgan PJ, Long TQ (2020) Financial literacy, financial inclusion, and savings behavior in Laos. J Asian Econ 68:101197

Nanda K, Kaur M (2016) Financial inclusion and human development: A cross-country evidence. Manag Labour Stud 41(2):127–153

Ofosu‐Mensah Ababio J, Attah‐Botchwey E, Osei‐Assibey E, Barnor C (2021) Financial inclusion and human development in frontier countries. Int J Financ Econ 26(1):42–59

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Pesqué-Cela V, Tian L, Luo D, Tobin D, Kling G (2021) Defining and measuring financial inclusion: A systematic review and confirmatory factor analysis. J Int Dev 33(2):316–341

Rangarajan C (2008) Report of the Committee on Financial Inclusion. Ministry of Finance, Government of India

Rasheed B, Law SH, Chin L, Habibullah MS (2016) The role of financial inclusion in financial development: International evidence. Abasyn Univ J Soc Sci 9(2):330–348

Sarma M (2008) Index of financial inclusion (No. 215). Working paper. Indian Council for Research on International Economic Relations, Delhi

Sarma M (2012) Index of Financial Inclusion–A measure of financial sector inclusiveness. Centre for International Trade and Development, School of International Studies Working Paper Jawaharlal Nehru University, Delhi, India

Sarma M (2016) Measuring financial inclusion for Asian economies. In Financial inclusion in Asia. Palgrave Macmillan, London, pp. 3–34

Sarma M, Pais J (2011) Financial inclusion and development. J Int Dev 33(2):279–285

Schultz TW (1961a) Investment in human capital. Amer Econ Rev 51:1–17

Schultz TW (1961b) Investment in human capital: Reply. Amer Econ Rev 51:1035–1039

Sen A (1993) Capability and well-being73. The quality of life. 11;30:270–293

Sharma B, Gani A (2004) The effects of foreign direct investment on human development. Glob Econ J 4(2):1850025

Teixeira AA, Queirós AS (2016) Economic growth, human capital and structural change: A dynamic panel data analysis. Res Policy 45(8):1636–1648

Todaro MP, Smith SC (2009) Economic development. Pearson education

Tram TXH, Lai TD, Nguyen TTH (2023) Constructing a composite financial inclusion index for developing economies. Q Rev Econ Finance 87: 257–265

Tsai PL, Huang CH (2007) Openness, growth and poverty: The case of Taiwan. World Dev 35(11):1858–1871

United Nations (2022) About Human development. Human development reports. Available at https://hdr.undp.org/

Van LTH, Vo AT, Nguyen NT, Vo DH (2021) Financial inclusion and economic growth: An international evidence. Emerg Mark Financ Trade 57(1):239–263

World Bank (2016). Financial Inclusion and Financial Capability in Morobe and Madang Provinces Papua New Guinea, ISBN 9980-77-182-8. National Library Service, Papua New Guinea

World Bank (2022a) Financial inclusion is a key enabler to reducing poverty and boosting prosperity. Available at https://www.worldbank.org/en/topic/financialinclusion/overview

World Bank (2022b) Human development. Available at https://www.worldbank.org/en/research/brief/human-development

Author information

Authors and Affiliations

Contributions

KT and AH conceptualized the study, obtained the data, conducted the data analysis and drafted the paper. AH and TZ contributed to the model development and results interpretation. KT and TZ contributed to the literature review, the formation and compilation of conclusion. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Tissaoui, K., Hakimi, A. & Zaghdoudi, T. Can financial inclusion enhance human development? Evidence from low- and middle-income countries. Humanit Soc Sci Commun 11, 573 (2024). https://doi.org/10.1057/s41599-024-03048-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03048-8