Abstract

With the development of society, the number of female-headed households is on the rise. Based on the data from the China Household Finance Survey (CHFS) in 2019, this paper establishes a Tobit model to study the influence of female-headed households on household debt risk. Results indicate that female-headed households can substantially reduce household debt risk, and this conclusion still holds after overcoming endogeneity issues. Further tests on the mediating effect reveal that risk aversion and housing property holding have partial mediating effects and masking effects, respectively, in the path of female-headed households affecting household debt risk. In addition, the heterogeneity analysis indicates that the influence of female-headed households on household debt risk is more significant in third-tier cities, as well as in families without children, families without elderly members, and families with more than two elderly members. The conclusions of this paper provide a reference for the relevant policy measures to reduce household debt risk and promote gender equality.

Similar content being viewed by others

Introduction

As society progresses, improving women’s social status has become a global trend, and countries have made significant efforts to promote gender equality, resulting in a narrowing of the gender gap (Charles, 2011). Women’s social status includes political status, economic status, educational status, legal status, household status, and other aspects, among which women’s household status is an important manifestation of social status. When considering gender role characteristics of households, although it is still predominantly male-dominated worldwide, the status of females in the household is increasing, and it is undeniable that there are more and more households headed by females. The so-called “female-headed households” refers to households where females have the dominant right to make decisions on family affairs. Take Chinese families as an example. According to the Fourth Chinese Survey on the Social Status of Women in 2020, 89.5% and 90.0% of wives participated in major family decisions such as “investment or loan” and “purchase or construction of a house,” respectively. These figures are 14.8 and 15.6 percentage points higher than in 2010.

The improvement of female household status has spurred academic research on topics related to female-headed households. For instance, studies have explored the correlation between female household heads and household poverty (Katapa, 2006; Ayodeji et al., 2013; Fuwa, 2000), the influence of female household heads on household food security (Mallick and Rafi, 2010; Sewnet and Wang, 2023; Daniel and Augustina, 2022), the influence of female household heads on household assets (Kpoor, 2019; Debela, 2017), the influence of female household heads on housing purchase (Gandelman, 2009; Kupke et al., 2014), the influence of female household heads on children’s health (Wendt et al., 2021; Kennedy and Haddad, 1994), etc. However, there has been limited research on the relationship between a female-headed household and household debt. Only a few studies have investigated the influence of female household heads on household debt levels (Ozawa and Lee, 2006), debt growth (Long, 2018), and debt repayment rates (Wong et al., 2023). On the one hand, household debt is an important factor affecting financial stability, and many central banks are highly concerned about the risk of household debt. The Bank of Canada, the Bank of Korea, and the People’s Bank of China have all issued warnings that financial stability will face risks with the aggravation of household debt. According to The research group of the Institute for Advanced Research of Shanghai University of Finance and Economics (2018), household debt in China is very close to the limit that households can tolerate, and its adverse effects have been transmitted to both the real economy and the financial system, aggravating the likelihood of systemic financial risks. On the other hand, women are characterized by sensitive minds and cautious personalities (Chang, 2015), and they are more risk-averse than men (Brooks et al., 2019; Fehr-Duda et al., 2006), preferring to allocate less risky household assets (Sundén and Surette, 1998). Therefore, female-headed households will inevitably have an effect on household debt risk. The objective of this paper is to answer questions such as whether female-headed households can reduce household debt risk and how females’ risk attitudes and asset allocation preferences affect household debt risk. Answers to these questions can help to establish the importance of female participation in family decision-making, provide effective solutions to address household debt risk, and raise awareness about gender equality.

This paper examines the influence of female-headed households on household debt risk. The household debt risk is measured by the ratio of total household debt to total income. Due to the truncation feature observed at zero in the debt-to-income ratio, the Tobit model is selected for testing the impact of female-headed households on household debt risk. To address possible omitted variable bias and endogeneity issues, this paper employs an instrumental variables approach. To correct for potential estimation bias due to self-selection, this paper uses the propensity score matching method and the treatment effect model. Furthermore, in order to account for potential differences in the urban development level and family population structure that may affect the financial decisions of female-headed households, this paper conducts the heterogeneity analysis on them separately. Finally, to further validate the reliability of the empirical results, this paper uses robustness analysis methods such as examining the asset–liability ratio as the indicator of debt risk and changing the regression model.

The contributions of this paper are as follows: (1) Define the connotation of female-headed households and find appropriate variables for female-headed households. In this paper, we consider households with a female household head in the CHFS2019 database as female-headed households. It is because the household head in the CHFS database is not necessarily the household head in the household registration book but rather the person who plays a decisive role in family affairs, which is consistent with this paper’s definition of female-headed households as “households where the female has the dominant right to make decisions on family affairs.” In previous studies, the household heads were usually referred to as the head of household on the household registration booklet (Yang et al., 2019), or considered as the oldest family member with the highest income (Posel, 2001), or regarded as the female who does not live with their spouse (Sakamoto, 2011). Obviously, the household heads defined by previous studies do not necessarily have the dominant decision-making right regarding family affairs. (2) The female-headed households were found to be able to significantly influence household debt. The results of the study found that female-headed households can significantly reduce the risk of household debt, which provides a basis for improving the status of women and the role of women in family decision-making. (3) The influence mechanism of female-headed households on household debt risk is clarified. The results of the study suggest that risk aversion and housing property holding have partial mediating and masking effects, respectively, in the path of female-headed households reducing household debt risk.

The subsequent content of this paper is arranged as follows. Next section is the “Literature review”. Section next to that presents the “Theoretical analysis and research hypothesis”. After this section is the “Research design”. Next section provides the “Empirical results”. Penultimate section is the “Discussion and limitations”. Last section is the “Research conclusions and policy implications”.

Literature review

Literature related to the research topic of this paper mainly includes two aspects: the influence of gender characteristics on debt and the influencing factors of household debt.

Research on the influence of gender characteristics on debt

Existing academic research on the influence of gender characteristics on debt has primarily focused on the influence of female executives on corporate debt. One type of research suggests that female executives have the potential to lower the level of corporate debt. Compared to their female counterparts, male executives tend to exhibit overconfidence in significant corporate decisions and issue more debt (Huang and Kisgen, 2013). Conversely, female executives have rational and cautious financing preferences that may help reduce managements’ overconfidence and lead to more rational financing decisions (Zhang et al., 2019). Furthermore, female-owned firms face more severe financing constraints due to gender discrimination against women on the supply side of financing (Asiedu et al., 2013; Hu, 2015). As a result, female CEOs can have a significant negative impact on firms’ debt levels (Setiawan and Navianti, 2020). However, firms run by female CEOs that generate less financial leverage may also imply less volatile returns (Faccio et al., 2016). Another type of research takes the opposite view, arguing that female executives will raise corporate debt levels. In terms of debt maturity structure, female executives are more likely to hold a greater proportion of short-term debt than male executives (Datta et al., 2021), and the presence of female executives will improve the company’s short-term debt financing level (Rocca et al., 2020). Regarding differences in corporate ownership, companies with female CEOs and non-state-owned holding companies possess higher debt financing levels, more bank borrowings, and more long-term debt (Xu et al., 2018).

Some scholars have also examined the influence of gender characteristics on household debt and found that gender characteristics will have an impact on household debt willingness, debt level, and channels. Male household heads significantly increase the likelihood of household indebtedness (Chai and Zhou, 2020), while females are more hesitant to add more unnecessary debt (Almenberg et al., 2021). The influence of gender on household debt levels is, to some extent, related to different measurement standards of debt, thus leading to inconsistent conclusions. Some scholars suggest that male household heads incur lower household debt compared to females (Brown and Taylor, 2008), while others have found that male-headed households are significantly more indebted than female-headed households (Daniels, 2001). Female household heads are more conservative and risk-averse, which has a negative effect on the demand for debt. However, there is a positive effect on the demand for debt from informal financial institutions (Jin and Li, 2009). Related to gender discrimination in credit and gender inequality in financial services (Wang et al., 2008; Fletschner, 2009; Ghosh and Vinod, 2017), females have more difficulty in accessing financing through formal financial channels, whereas male household heads are more likely to obtain loans from formal financial institutions (Cai et al., 2022; Aterido et al., 2013). Gender also influences household debt through factors such as risk attitudes, subjective debt burden, and financial self-efficacy. Females are less risk-tolerant and more cautious compared to men (Huh and Park, 2013), and they experience a higher subjective burden of debt and exhibit greater prudence and responsibility when handling household finances and debt (Keese, 2012). According to Farrell et al. (2016), females with high financial self-efficacy are more inclined to hold financial products of investment and savings and avoid debt-related financial products.

Research on the influencing factors of household debt

Household characteristics that affect household debt include household income, demographic structure, financial literacy, and expectations about financial conditions. Some studies have found a consistent negative correlation between income and the debt-to-income ratio. Low-income households face greater debt burdens (Garber et al., 2019; Muthitacharoen et al., 2015), and debt default problems are more severe in these households (Alfaro and Gallardo, 2012). However, it has been argued that higher-income households may also increase their demand for debt and debt burden. This may be related to the purpose for which debt is taken on by households with different incomes (Christelis et al., 2021, 2015), and because of credit constraints, higher-income households are more likely to have access to credit and incur more debt than lower-income households (Heintz-Martin et al., 2022; Coletta et al., 2019; Borowski et al., 2019). Households with females as the highest earners are more likely to be over-indebted, while households with asset income are negatively correlated with over-indebtedness (Angel and Heitzmann, 2015). Regarding household demographic structure, Guo et al. (2015) found that an increasing elderly dependency ratio and a decreasing youth dependency ratio significantly increase household debt. In terms of financial literacy, financially illiterate families with lower net assets and higher credit costs are more likely to fall into excessive debt (Gathergood and Disney, 2011). Household debt is also influenced by their expectations about future financial conditions. According to Hyytinen and Putkuri (2018), households with biased, optimistic expectations experience faster growth in debt and higher debt-to-income ratios. Additionally, excessive optimism about future financial situations can significantly increase debt servicing distress in future periods (Dawson and Henley, 2012).

Household debt is also influenced by the personal characteristics of the decision maker, such as age, health status, education level, and financial literacy. In Chinese households, the person responsible for making household decisions is typically the household head. Research has shown that older and healthier household heads are less likely to incur household debt (Chen and Li, 2011), and higher education levels are associated with lower household debt (Zhu and Xia, 2018). However, socially excluded groups, such as single parents, people with long-term illnesses or disabilities, and the uneducated, often face more severe debt problems (Patel et al., 2012). Individuals with lower debt literacy tend to engage in high-cost trading (Bucks and Pence, 2008), resulting in higher fees and the use of high-cost borrowing (Lusardi and Tufano, 2015). Household financial literacy also affects the channels through which households acquire debt, with those who have higher levels of financial literacy being more likely to obtain loans from formal sources (Huang et al., 2022; Klapper et al., 2013). Furthermore, household heads who follow patterns of conformity, as well as exhibit neurotic personality traits, significantly increase the probability and scale of household debt (Zhou and Feng, 2020).

Macro factors that affect household debt primarily include the housing market and the economic environment. Studies have shown that rising house prices (Kim et al., 2014; Meng et al., 2013), as well as price increases in the economy (Lerskullawat, 2020), a booming consumer credit market, and increased investment, are contributing factors (Dumitrescu et al., 2022). The widening income gap is also a factor in the growth of household debt, with low-income households experiencing a faster growth rate of their debt (Carr and Jayadev, 2015). The development of payment instruments and digital financial inclusion can also impact household debt. The use of mobile payments has also been linked to an increase in household debt (Chai, 2020). Additionally, the development of digital inclusive finance has been found to significantly contribute to the rise in household debt (Chen et al., 2022; Zhang et al., 2023).

In summary, the literature on the influence of gender characteristics on debt and debt influencing factors is rich and provides theoretical support for this paper’s research. However, there are two aspects that still requiring an in-depth study. First, previous research on female-headed households and household debt has mainly focused on the relationship between gender characteristics and debt behavior, while there is a scarcity of literature that examines the influence of female-led financial decision-making on household debt risk from the perspective of female-headed households. Second, the mechanisms through which female-headed households influence household debt have not been thoroughly explored.

Theoretical analysis and research hypothesis

The influence of female-headed household on household debt risk

Unlike the traditional Chinese concept of “supporting the husband and teaching the children,” females are increasingly taking on senior management positions (Dreher, 2003), performing well in both corporate leadership and household maintenance (Anyanwu et al., 2023; Iyiola and Azuh, 2014; Nwosu et al., 2019). A report by the Chinese Academy of Financial Inclusion (CAFI, 2021) states that Chinese women perform better overall in financial health than men, especially in terms of balancing income and expenses and rationally planning debts, indicating that women are breaking through gender barriers and are capable of managing family finances rationally. Furthermore, there is a growing focus on promoting female financial empowerment (Ali et al., 2021). Efforts have been made to tackle gender inequality in the financial industry (Park et al., 2021; Cabeza-García et al., 2019), and women’s involvement in managing household finances has been further protected. In terms of debt-related decisions, females tend to be more cautious (Keese, 2012; Anon, 2012), and evidence suggests that they generally have a better debt repayment performance (Wong et al., 2023; Kevane and Wydick, 2001; Sharma and Zeller, 1997). Financial decisions within households can be influenced by gender and the division of roles among household members, and as the financial managers of the family, female household heads will influence household debt performance. Based on this analysis, this paper proposes the following hypothesis:

H1: Female-headed households significantly reduce household debt risk.

The influence mechanism of female-headed household on household debt risk

If female-headed households have a significant influence on household debt risk, then deeper issues will inevitably arise: how does the female-headed household influence household debt risk, and what is its transmission path? Based on Hypothesis H1 and combining research from sociology, psychology, and economics on the influence of gender characteristics regarding debt issues, this paper proposes that female-headed households affect household debt risk through the following two important mechanisms: risk aversion and housing property holding.

Female attitudes towards debt risk

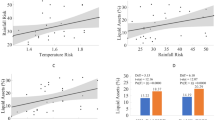

Numerous studies have demonstrated gender differences in risk preferences (Yuan, 2017). Research has shown that females have a lower risk tolerance than males (Grable, 2000), and they are generally more risk-averse than males (Nelson, 2015; Croson and Gneezy, 2009). They are more cautious and conservative and more inclined to risk aversion when taking risks (Saltık et al., 2023; Jianakoplos and Bernasek, 1998). According to behavioral finance theory, individual economic decisions are often influenced by cognitive biases such as risk preference and overconfidence, leading to irrational decisions. In the financial field, men show higher overconfidence, engaging in more debt acquisition and issuance (Hu, 2021; Huang and Kisgen, 2013), trading more than rational investors. However, overconfidence may lead to underestimation of risk and overestimation of expected utility (Heaton, 2019; Zeng et al., 2023), while women’s investment style, influenced by personal characteristics, is more cautious and financially stable (Chang, 2015). When faced with uncertainty and risk, women’s risk aversion may lead them to be more cautious about debt-incurring behaviors such as borrowing and more willing to take avoidance measures against increasing household debt risk. Studies have shown that females exhibit greater relative risk aversion when allocating wealth to defined contribution pension assets (Bajtelsmit, 1999), and for married households with joint investment decisions, gender differences are an important factor in explaining individual retirement asset allocation, with women’s asset allocation being more risk-averse than men’s (Arano et al., 2010). Based on this analysis, this paper argues that the debt risk attitude of the household head is a crucial factor that influences household debt. If the household head tends to take lower risks, they may be more willing to make low-risk debt decisions, thus affecting household debt. Therefore, the following hypothesis is proposed:

H2: Females are more risk-averse, and risk aversion mediates the effect between female-headed households and household debt risk; that is, the more obvious risk aversion presented by female-headed households, the lower the household debt risk.

Female asset allocation preferences

In terms of family asset allocation, females prefer low-risk assets and are more willing to hold low-risk assets such as real estate and bank deposits than higher-risk assets such as stocks, bonds, and other types of financial funds for the purpose of risk aversion and financial stability. In terms of the actual situation of Chinese households, housing assets account for more than 64.9% of the total assets in Chinese households, while housing liabilities account for more than 40% of the total liabilities in Chinese householdsFootnote 1. Therefore, on the one hand, due to their own robust characteristics, females may hold more housing property (Liu et al., 2021), and household liabilities are mainly housing liabilities (Li, 2022). On the other hand, owning more properties also means that housing liabilities may be higher, which increases the risk of household debt. It has been found that the higher the house ownership rate of households in the Nordic countries and the UK, the greater the size of debt (Debelle, 2004). A study by He et al. (2012) based on data from Chinese households also concluded that the higher the proportion of property holding, the higher the probability of household indebtedness. Based on the analysis presented above, the paper proposes the following hypotheses:

H3: Females tend to hold more housing property, and housing property holding preference acts as a masking effect between female-headed households and household debt risk; that is, the higher the proportion of housing property holding presented by female-headed households, the higher the household debt risk.

Based on the analysis presented above, this paper proposes a theoretical model consisting of female-headed households as the independent variable, household debt risk as the dependent variable, and risk aversion and housing property holding as the mediating variables. The model’s mechanism is illustrated in Fig. 1.

In the figure, “Female-headed household” represents the independent variable, “Household debt risk” represents the dependent variable, and “Risk aversion” and “Housing property” represent the two mediating variables. The symbols “+” and “–” represent the positive and negative interaction relationships between variables, respectively.

Research design

Data source and sample selection

The data comes from the CHFS2019 database, and the survey sample covers 29 provinces (autonomous regions, municipalities directly under the Central Government), 343 districts and counties, and 1360 village (neighborhood) committees, including 34,643 families and 107,008 family members. The samples in this paper are processed as follows to ensure reliable research results: (1) excluding the samples with missing key variables; (2) excluding the samples with negative income or zero consumption expenditure; (3) Considering the interference of extreme values on model results, this paper applies winsorization to the data of income and liabilities. Furthermore, households with total assets exceeding 100 million yuan have been excluded. After data processing, a total of 20,919 valid sample data was finally obtained.

Variables declaration and descriptive statistics

Variables declaration

Explanatory variables

The core explanatory variable is female-headed households, measured by the female household head variable, and this variable is assigned a value of 1 if the household head is female and 0 otherwise. It should be noted that the household head in the CHFS2019 database refers to those who play a decisive role in family affairs, not necessarily the household head on the registration booklet. This aligns with the paper’s definition of female-headed households as “households where females have the dominant right to make decisions on family affairs.

Explained variables

The paper’s explained variable is household debt risk, which is measured by the debt-to-income ratio, that is, the ratio of total household debt to total income. In the CHFS2019 database, the total household debt encompasses 11 items, namely agricultural liabilities, industrial and commercial liabilities, housing liabilities, store liabilities, vehicle liabilities, other non-financial assets liabilities, financial assets liabilities, education liabilities, credit card liabilities, medical liabilities, and other liabilities. Furthermore, there are five types of income comprising total household income. These include wage income, agricultural income, industrial and commercial income, property income, and transfer income. The higher the debt-to-income ratio, the greater the pressure on the household to use its income to repay its debts and the higher the potential household debt risk, which could lead to a default on the household debt.

Mediating variables

The mediating variables in this paper are risk aversion and housing property holding, which are measured by risk aversion and the proportion of housing assets in total assets, respectively. Among them, risk aversion is a 0–1 variable. For the question in the CHFS questionnaire about “If you have a fund for investment, which investment project would you be most willing to choose?” The answers to “slightly lower risk, slightly lower return” and “unwilling to take any risk” are defined as risk aversion and assigned a value of 1, otherwise 0.

Control variables

This paper examines control variables through three levels: individual characteristics of the household head, family characteristics, and regional characteristics. Individual characteristic variables include the age, education level, and health level of household heads. Family characteristics include family size, the number of participants in social security, the number of participants in medical insurance, whether they have their housing owner-occupied, household consumption expenditure, household savings assets, and whether they use the Internet (the value is assigned to 1 if using smartphones, otherwise it is 0); the variables at the regional level consist of urban and rural background (with a score of 1 for rural households and 0 for urban households), as well as the geographical region (encompassing four regions in eastern, central, western, and northeastern China).

Descriptive statistics

The descriptive statistics of the main variables are presented in Table 1, where the mean value of the household debt-to-income ratio is 0.853, the mean value of the asset–liability ratio is 0.115, and the percentage of female-headed households is 14%. The mean value of risk aversion of household heads is 0.644, which means that the majority of household heads in the country are risk-averse. The mean value of housing property holdings is 0.649, which means that the average household assets have 64.9% of its total assets in the form of house equity. The mean health level of household heads is 3.247, indicating that the majority of household heads are in between “fairly healthy” and “very healthy.” The mean value of years of education of household heads is 8.786, which means that household heads have an average education level of middle school, reflecting that the education level of household heads is generally not high. The average family size is 3–4 people, and the vast majority of families have owner-occupied housing. The mean value of Internet use is 0.697, which means that more than 2/3 of the households use the Internet, indicating a high Internet penetration rate.

Univariate analysis

Table 2 presents a univariate analysis that compares the mean differences in debt-to-income ratio, asset–liability ratio, risk aversion, and housing property holding between female-headed households and other households. According to Table 2, it can be seen that: (1) For female-headed households, the mean value of debt-to-income ratio and asset–liability ratio is 0.1165 and 0.1154 smaller than other households, with significance levels of 10% and 5%, respectively; (2) The risk aversion level of female-headed households is higher than that of other households, and the mean difference is significant at the 5% level; (3) The mean proportion of housing assets to total assets in female-headed households is 0.0664 higher than other households, significantly at the 1% level.

Model setting

Since the explanatory variable (debt-to-income ratio) has a clear truncation at 0, the Tobit model is adopted:

In model (1), \(i\) represents the household, \({\rm {{{DIR}}}}_{i}\) is the debt-to-income ratio variable,\(\,{{{\rm {Fhead}}}}_{i}\) is the female-headed households variable, \({{{\rm {Convar}}}}_{i}\) represents the control variable, includes individual, family, and urban–rural background and other characteristic variables, \({{{\rm {Region}}}}_{i}\) represents the regional fixed effect, \({\varepsilon }_{{i}}\) is a random disturbance term. To further investigate the mediating effect of female-headed households on household debt, the following model is constructed:

In model (1), \({\beta }_{1}\) represents the total effect of female-headed households on household debt risk; In models (2) and (3), \({M}_{i}\) is the two mediating variables (risk aversion and housing property holding) in this paper; \({c}_{1}\) is the effect of female-headed households on the mediating variables; \({\gamma }_{1}\) is the direct effect of female-headed households on household debt risk after adding the mediating variables and \({c}_{1}\times {\gamma }_{2}\) is the indirect effect of female-headed households on household debt risk.

According to the mediating effect test process provided by Wen and Ye (2014), the first step is to test whether the total effect \({\beta }_{1}\) is significant, then determine whether \({c}_{1}\) is indeed significant. Finally, based on the significance of the direct effect \({\gamma }_{1}\), we can assess the presence of a mediating effect of the two mediating variables between the explanatory and explained variables. To better understand the mediating effect, this paper also refers to the distinction between the mediating effect and masking effect in the mediating analysis method of MacKinnon et al. (2000), which means that the mediating effect reduces the total effect between the explanatory variable and the explained variable, while masking effect increases the total effect between the explanatory variable and the explained variable. Based on the actual situation in this paper, several possible situations are summarized in Table 3.

Empirical results

Results of the benchmark regression model

Table 4 reports the corresponding results of the Tobit model by sequentially adding individual, family, and region characteristic variables, corresponding to columns (1)–(3), and column (4) is the marginal effect of column (3). From columns (1)–(3), female-headed households suppress household debt risk and are significant at 1%; from column (4), household debt risk will decrease by 14.29 percentage points when the household is headed by a female. Therefore, it can be concluded that without considering the influence of risk aversion and housing property holding, female-headed households will significantly reduce the risk of household debt, and H1 is confirmed.

From the parameter estimates of the main control variables: having their owner-occupied housing, larger family size, using the internet, higher household consumption expenditure and rural households are positively associated with household debt risk, while the household head who is older and healthier, the more members participating in social security and larger household deposit assets significantly reduce household debt risk, and the number of participants in medical insurance has no significant effect on household debt risk.

Endogeneity issues

Instrumental variables approach

Regression models may suffer from endogeneity issues due to omitted variables and reverse causality. When the household debt risk is low, the household may also choose a female as the household head; that is, there may be a mutually causal relationship between the household debt risk and female-headed households. In addition, whether a female is the household head may also be influenced by unobservable factors such as personal personality and social relations. Given the possible estimation bias due to endogeneity issues, this paper adopts the instrumental variable method to estimate the model (1) in two stages. After multiple attempts, the instrumental variable chosen in this paper is the rate of female household heads in the same community, that is, the proportion of the number of households headed by females to the total number of households in the community. On the one hand, the greater the number of households headed by females in the same community, the greater the likelihood that a female is the household head due to the potential influence of the community environment. This satisfies the correlation condition of the instrumental variable. On the other hand, the rate of female-headed households in the same community is not directly related to the household debt risk of other households, so it satisfies the exogeneity condition of the instrumental variable. Therefore, it is theoretically feasible to choose the rate of female household heads in the same community as the tool variable of female-headed households.

Table 5 reports the results of the instrumental variable regression. The t value of the first stage regression of the instrumental variable test is 41.15, which means the rate of female household heads in the same community had a positive effect on female household heads and was significant at 1%, and the F value was 143.02, greater than the critical value of 10, so the problem of weak instrumental variables does not exist. The second stage estimation of the instrumental variable test shows that the Wald test value of the Tobit model passed the 5% significance test, which indicates that the instrumental variables selected in this paper could better overcome the endogeneity issues of the regression model, and after overcoming the endogeneity issues, the female-headed households will still significantly reduce the household debt risk.

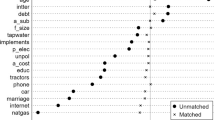

Propensity score matching method

The propensity score matching method (PSM) can alleviate the estimation bias caused by the self-selection problem to some extent. The steps of calculating the average treatment effect on the treated (ATT) of female-headed households are as follows: Firstly, variables such as age, years of education, health level, family size, and whether the family has an owner-occupied housing are selected for Logit regression to estimate the propensity score; then, one-to-four propensity score proximity matching, radius matching, and kernel matching are performed; to further validate the robustness of the treatment effects obtained using the propensity score matching method, the bootstrap method was conducted using 500 bootstrap samples, and the bootstrap standard errors and p-values were obtained. Table 6 reports the PSM test results, in which the results of the one-to-four matching reveal that the average treatment effect on treated female-headed households was −24.5%, significant at the 1% level, and the estimates of radius matching and kernel matching are generally consistent with those of the one-to-four nearest neighbor matching. Moreover, all variables demonstrate a standardized deviation of <10% after matching, satisfying the balance requirement.

Boundary sensitivity analysis

The PSM method is prone to hidden bias problems attributed to unobservable variables. To further test the robustness of the results, this paper uses the boundary method to assess the sensitivity of PSM estimation results to hidden biases. The parameter Gamma represents the impact of unobserved confounding factors on household debt risk. If the conclusion is not significant when Gamma is close to 1, it can be inferred that the PSM results are not robust. This paper estimates hidden biases for three matching methods, and Table 7 reports the results of the sensitivity analysis, showing that there is no sensitivity when the Gamma coefficient is between 1 and 2, indicating that the hidden bias problem in PSM estimation can be ignored and that the estimation results based on the PSM model are robust.

Treatment effect model

The treatment effect model is also able to alleviate the estimation bias resulting from the self-selection problem to some extent. The endogenous variable “female-headed households” is a binary dummy variable, allowing for the adoption of a treatment effects model. Table 8 reports the estimation results of the two-step approach of the treatment effect model. The results of the first-stage Probit regression show that the rate of female household heads in the same community has a positive impact on female household heads, and it is significant at 1%. Furthermore, endogeneity tests using likelihood estimation indicate that it passes the significance level test of 5%. The final results of the treatment effect model show that female-headed households still have a significant inhibitory effect on household debt risk, and it is significant at the 1% level.

Analysis of mediating effects

Table 9 shows the results of the mediating effect test: (1) Risk aversion channel. Firstly, this paper tests whether female-headed households have a significant impact on the risk aversion variable, that is, the significance of \({c}_{1}\). The results show a positive correlation between female-headed households and risk aversion, with a regression coefficient of 0.0234 and a significance level of 5%, indicating that female-headed households will significantly increase the probability of risk aversion. Secondly, this paper determines the significance of \({\gamma }_{2}\) and \({\gamma }_{1}\). The regression results indicate that risk aversion significantly reduces household debt risk, and even after controlling for the risk aversion variable, female-headed households still significantly reduce household debt risk, i.e., both \({\gamma }_{2}\) and \({\gamma }_{1}\) are significant. Up to now, both direct effect \({\gamma }_{1}\) and indirect effects \({c}_{1}\times {\gamma }_{2}\) are significant. Finally, based on the regression results, it is known that \({c}_{1}\times {\gamma }_{2}\) and \({\gamma }_{1}\) are of the same sign, and the absolute value of the total effect \({\beta }_{1}\)(−0.143) is greater than that of the direct effect \({\gamma }_{1}\)(−0.138), indicating that there is a partial mediating effect of risk aversion in the path of female-headed households on household debt risk.

(2) Housing property holding channel. Firstly, this paper tests whether female-headed households have a significant impact on the housing property holding variable, that is, the significance of \({c}_{1}\). The results show that the regression coefficient of housing property holding on female-headed households is 0.049, which is significantly positive at the 1% level, indicating that female-headed households will significantly increase the housing property holding. Secondly, the regression results show that housing property holding significantly increases the household debt risk. After controlling the housing property holding variable, female-headed households still significantly reduce the household debt risk as both \({\gamma }_{2}\) and \({\gamma }_{1}\) are significant. Up to this point, both direct effect \({\gamma }_{1}\) and indirect effect \({c}_{1}\times {\gamma }_{2}\) are significant. Finally, based on the regression results, it is known that \({c}_{1}\times {\gamma }_{2}\) and \({\gamma }_{1}\) have different signs, and the absolute value of the total effect \({\beta }_{1}\)(−0.143) is smaller than that of the direct effect \({\gamma }_{1}\)(−0.169). According to MacKinnon et al. (2000), it can be seen that housing property holding has a masking effect in the path of female-headed household’s influence on household debt risk. Based on the above analysis, H2 and H3 are validated.

Heterogeneity analysis

The influence of female-headed households on household debt risk may vary according to the availability of financial services, the source of household labor and income, and the characteristics of household consumption and expenditure, which tend to be related to the level of urban development and family population structure (Bai, 2021; Afjal, 2023; Zheng et al., 2023), which this paper analyses for heterogeneity. In terms of the differences in the impact of urban development levels, this paper follows the division of urban development levels as noted in the questionnaire to analyze the differences in their impact. The study divides the sample into households in the first-tier, new first-tier, second-tier, and third-tier cities, as well as cities below the third-tier. In terms of differences in the impact of family population structure, the population aged 14 and below is defined as the child population, and the population aged 65 and above is defined as the elderly population. Based on this, the sample is further divided into households with 0, 1, 2, and more children according to the number of children in the family, and households with 0, 1, 2, and more elderly population according to the number of elderly people in the family.

Differences in urban development level

Table 10 presents the impact of female-headed households on household debt risk under different urban development levels. The results show that the inhibitory effect of female-headed households on household debt risk was only significant in households in third-tier cities and below, while no significant effect was observed in households in first-tier and new first-tier cities and second-tier cities.

Differences in family population structure

Table 11 reports the impact of female-headed households on household debt risk when there are differences in family population structure. The findings demonstrate that the inhibitory effect of female-headed households on household debt risk is significant in households without children, without an elderly population, and with two or more elderly persons. However, it is not significant in households with one child, two or more children, or one elderly person.

Robustness test

Replace the measurement indicators of debt risk

To further demonstrate the robustness of the research results, this paper uses asset–liability ratio instead of debt-to-income ratio to measure household debt risk. Table 12 reports the estimation results of the model with the sequential inclusion of individual, family, and regional characteristic variables and the results show that similar to the debt-to-income ratio, female-headed households also have a negative effect on household debt risk and are significant at the 1% level.

Replace the model

The Tobit model is used to predict the probability of target occurrence. Female-headed households are found to significantly reduce the household debt risk, whereas other household heads also reduce the debt-to-income ratio, while female-headed households may also increase the debt-to-income ratio. Therefore, to eliminate the doubts of the probability model, this paper also employs an OLS regression model to examine the effect of female-headed households on household debt risk. The results show that the regression coefficient of female-headed households on household debt risk is −0.1656, significant at the 1% level.

Provincial fixed effects

The basic model sets regional dummy variables to control for regional fixed effects. To further avoid the estimation error, the paper also controls the provincial fixed effect by setting the provincial dummy variables. The results show that the regression coefficient of female-headed households on household debt risk is −0.373, which is significant at the 5% level, proving that the basic conclusion is robust.

Discussion and limitations

Discussion

This paper examines the influence of female-headed households on household debt risk using a Tobit model and finds that female-headed household significantly reduces household debt risk, adding to the arguments in favor of female participation in the family economies. This conclusion also supports, to some extent, previous studies that suggest females are less likely to incur debt (Flores and Vieira, 2014; Davies and Lea, 1995). The discussion of control variables can also be reasonably explained and supported by evidence. As the household head gets older, they may have more assets and financial experience, thereby reducing household debt holdings and household debt risk (Tseng and Hsiao, 2022; Abd Samad et al., 2023), which is consistent with the life-cycle hypothesis (Modigliani, 1986), according to which rational individuals accumulate assets during their working life to cover expenses in old age. The healthier household head borrows less due to illness, thus reducing household debt risk; for example, there are research studies showing that health problems are often the main reason for falling into financial collapse (McCloud and Dwyer, 2011). Larger family size implies a greater need for expenditure and, therefore, a greater need for debt, while household financial assets buffer against negative shocks to debt burdens (Stavins, 2021), and larger household deposit assets can better cover household expenditures (Bandelj and Grigoryeva, 2021), thus reducing household debt risk. The Internet enriches people’s channels for consumption, investment, and borrowing, and some studies have shown a positive correlation between Internet use and household debt leverage ratio (Zhou et al., 2021). Social security provides broad and long-term stable risk protection, such as pension, medical care, unemployment, work injury, and maternity insurance. The more members participating in social security, the better the household’s ability to protect itself against uncertain risks such as income shocks, and therefore the lower the demand for debt and the household debt risk. While the number of participants in medical insurance has no significant effect on household debt risk, which may be because the reimbursement ratio of basic medical insurance is generally low and its scope of coverage is limited (Hua, 2023), and households still have to bear large medical costs when facing serious illnesses. Additionally, the cumbersome reimbursement process may also cause families to face significant financial pressure in the short term. Rural households significantly increase household debt risk, possibly because they have lower incomes and need to take on more debt compared to their income to meet household expenses (He and Li, 2022; Meniago et al., 2013). Increasing household consumption expenditure will significantly increase the household debt risk (Kasoga and Tegambwage, 2021; Abd Samad et al., 2023). This may be due to the presence of a “ratchet effect” (Duesenberry, 1949), which means that consumption habits are easy to adjust upward but difficult to adjust downward, thus increasing the risk of household debt. Additionally, having their owner-occupied housing significantly increases the household debt risk, possibly because higher debt is required to purchase a house (Pastrapa and Apostolopoulos, 2015).

Regarding the mechanism of influence, risk aversion, and housing property holding have partial mediating and masking effects, respectively, in the path through which female-headed households influence household debt risk. The results are in line with expectations and consistent with some existing research conclusions. Almenberg et al. (2021) found that risk aversion is inversely related to household debt levels. Attitude towards risk is a key factor in debt or other financial decisions in the presence of risk and uncertainty in the future income distribution (Vargas-Sierra and Orts, 2023; Brown et al., 2013), and risk aversion tends to lead households to manage their debt more prudently and rationally, reducing the household debt risk by increasing savings, moderating borrowing and choosing low-risk debt (Zhou and Chen, 2020; Wang and Tian, 2012). While home ownership and higher house values tend to be associated with higher debt levels (Jarmuzek and Rozenov, 2019; Abd Samad et al., 2020), this may result firstly because borrowing to buy a house increases household debt and then increases the household debt to asset ratio when house prices fall (Gerlach-Kristen and Merola, 2019; Meng et al., 2013). Secondly, housing for investment may put households under greater financial pressure due to falling markets or longer-than-expected repayment periods (Worthington, 2006). Additionally, owning housing property allows households to use increased house values and home equity lines of credit for further loans and financing and further increasing household debt (Coletta et al., 2019). The discussion on the influence mechanisms provides insights into women’s influence on household debt risk. While recognizing that risk aversion can increase the prudence of women’s financial decision-making, and females tend to increase housing property holdings in pursuit of conservatism, it should also be recognized that a lack of investment confidence and excessive risk aversion may lead to excessive investment in low-risk assets such as housing, lacking investment in assets that can yield higher returns (Black et al., 2018; Ozawa and Lee, 2006), which could cause distortion in resource allocation (Keese, 2012). Therefore, correctly assessing personal risk attitudes, receiving more financial education and improving financial literacy and fund management skills (Tseng and Hsiao, 2022; Philippas and Avdoulas, 2020; French and McKillop, 2016; Sundén and Surette, 1998), and diversifying investments within an acceptable range of risk are also important for the economic health of the household.

Heterogeneity analyses show that, in terms of urban development level, the influence of female-headed households on reducing household debt risk is significant only for households in third-tier and below, which may be related to the financial development of different cities. The lower the level of urban development, the more scarce financial resources tend to be (Liu et al., 2021; Pateman, 2011), especially in rural areas where economic development is relatively lagging behind, household economic situations are relatively fragile and rural financial infrastructure is underdeveloped with limited loan channels and low credit convenience. These factors make rural households more inclined to borrow from informal sources (Kumar et al., 2017; Wong et al., 2023) and depend more on their own financial management and risk control, and in this case, the influence of female-headed households on household financial management is more significant. They borrow more cautiously and pay more attention to reducing the household debt risk and maintaining household financial stability. Conversely, the higher the level of urban development, the better the financial infrastructure. Coupled with higher income levels and stronger debt repayment capabilities, it ultimately results in the influence of female-headed households on household debt risk not being significant.

The influence of female-headed households on household debt risk is also varied based on differences in family population structure. This may be linked to expenditure patterns and borrowing purposes. The expenditure responsibilities of male and female household heads are not consistent (Reboul et al., 2021). When considering household financial decisions, females tend to prioritize collective spending and exhibit altruistic tendencies. They often take on a significant amount of household responsibilities and are more likely to spend on children and collective goods (Kasoga and Tegambwage, 2021; Pahl, 2008). Additionally, there is a positive correlation between female-controlled household assets and household spending on children’s clothing and education (Quisumbing and Maluccio, 2000). Thus, different family population structures lead to different consumption needs, affecting debt demands and borrowing decisions (Van Winkle and Monden, 2022; Kowalski et al., 2023). For example, Maroto (2018) found that children are associated with a decline in wealth for low-and middle-income families. Married couples with children are more likely to incur debts than other types of families (Xiao and Yao, 2020), and the number of children and other dependents in the family is positively correlated with household debt (Deng and Yu, 2021; Kasoga and Tegambwage, 2021). In this study, households without young children or elderly dependents have less financial pressure, allowing more income to be allocated for savings and reducing the relative need for household debt; and therefore, a female household head significantly reduces household debt risk. For households with two or more elderly members, although the financial pressure of supporting multiple elderly members is greater, the continuous improvement in the pension service policy system and the quality of pension services will help effectively reduce the family’s financial burden (Du and Wu, 2023; Han et al., 2023; Ke and Shi, 2023). Additionally, the consideration of preventing medical expenses from elderly illnesses also prompts female household heads to be more cautious in debt decisions, thus significantly reducing household debt risk. For households with one child, two or more children, and one elderly person, providing care for them can lead to economic pressure and an increase in debt demand. However, female household heads do not significantly worsen household debt after risk control due to their prudent considerations. Therefore, the influence of female-headed households on household debt risk is not significant.

Limitations

Firstly, the asset–liability ratio and debt-to-income ratio can reflect the level of household financial leverage and repayment capacity, providing a reasonable measure of household debt risk. However, these indicators do not consider the specific types and structures of household assets and liabilities, nor the source and stability of household income, while different types of assets and liabilities have varying impacts on household debt risk and the source and stability of income also affect a household’s ability to service its debt in the future. Therefore, future studies could consider factors such as debt type, interest rates, employment type, income source, future income and repayment plans, and family credit records to develop a more comprehensive indicator of household debt risk. Secondly, this paper has used cross-sectional data, and in the future, the use of panel data could be considered to study the impact of female-headed households on household debt risk from a dynamic perspective, in order to gain more insights on this topic.

Research conclusions and policy implications

This paper examines the influence and mechanisms of female-headed households on household debt risk from the perspectives of gender and household status. Using CHFS2019 data, we employ the debt-to-income ratio and asset–liability ratio as indicators of household debt risk, and the study demonstrates that female-headed households can significantly decrease household debt risk. Further analysis reveals that female-headed households affect household debt risk through two important mechanisms: risk aversion and housing property holding, and there are partial mediating and masking effects in the path of female-headed households influencing household debt risk. Female-headed households reduce household debt risk through risk aversion and increase household debt risk through increased housing property holding. Differences in the impact of female-headed households on household debt risk vary across different levels of urban development and family population structure, and these differences may be related to financial infrastructure, female consumption, and expenditure characteristics.

The fact that female-headed households significantly reduce the household debt risk and their increasing ability to participate in economic decision-making is an important reference for promoting gender equality and supporting the advancement of females in both the family and society. Encouraging women’s participation in household economic decision-making and management also has a positive effect on the stable management of households and the resolution of household debt risks. The risk attitudes and asset allocation preferences of females have a significant influence on household debt management. This highlights the importance of emphasizing financial education for females and improving their financial skills, which is crucial in reducing household financial decision-making errors. Females should have a clear and correct understanding of their risk attitude and risk tolerance and avoid falling into financial difficulties due to the holding of single assets such as housing property. The different urban development levels and family population structure can affect the role of females in household debt management. This highlights the need for the government to adopt multiple approaches to increase household income and improve the level of financial infrastructure construction in underdeveloped areas while continuing to improve pension insurance policies and laws and regulations on family fertility and parenting.

Data availability

The data that support the findings of this study are available from China Household Finance Survey (CHFS) but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are however available from the authors upon reasonable request and with permission of China Household Finance Survey (CHFS).

Notes

The author’s calculations based on data from CHFS2019.

References

Abd Samad K, Idris NH, Abd Rahman NH, Abdullah Sani A, Mohd Soffian Lee UH (2023) Systematic Literature Review on the Macroeconomic Factors of Household Debt. In: Jaaffar AH, Buniamin S, Rahman NRA, Othman NS, Mohammad N, Kasavan S, Mohamad NEAB, Saad ZM, Ghani FA, Redzuan NIN (eds) Accelerating Transformation towards Sustainable and Resilient Business: Lessons Learned from the COVID-19 Crisis, Vol 1. European Proceedings of Finance and Economics. European Publisher, p 207–223. https://doi.org/10.15405/epfe.23081.18

Abd Samad K, Mohd Daud SN, Mohd Dali NRS (2020) Determinants of household debt in emerging economies: a macro panel analysis. Cogent Bus Manag 7(1):1831765. https://doi.org/10.1080/23311975.2020.1831765

Afjal M (2023) Bridging the financial divide: a bibliometric analysis on the role of digital financial services within FinTech in enhancing financial inclusion and economic development. Humanit Soc Sci Commun 10(1), Article 1. https://doi.org/10.1057/s41599-023-02086-y

Alfaro R, Gallardo N (2012) The determinants of household debt default. Econ Anal Rev 27(1):27–54

Ali M, Ali I, Badghish S, Soomro YA (2021) Determinants of financial empowerment among women in Saudi Arabia. Front Psychol 12:4049. https://doi.org/10.3389/fpsyg.2021.747255

Almenberg J, Lusardi A, Säve‐Söderbergh J (2021) Attitudes toward debt and debt behavior. Scand J Econ 123(3):780–809

Angel S, Heitzmann K (2015) Over-indebtedness in Europe: the relevance of country-level variables for the over-indebtedness of private households. J Eur Soc Policy 25(3):331–351. https://doi.org/10.1177/0958928715588711

Anon (2012) Who feels constrained by high debt burdens? Subjective vs. objective measures of household debt. J Econ Psychol 33(1):125–141

Anyanwu OC, Oloto SE, Nwokocha VC (2023) Impact of strategic alliance on the innovation of women-owned enterprises in Nigeria. Humanit Soc Sci Commun 10(1), Article 1. https://doi.org/10.1057/s41599-023-02463-7

Arano K, Parker C, Terry R (2010) Gender-based risk aversion and retirement asset allocation. Econ Inq 48(1):147–155. https://doi.org/10.1111/j.1465-7295.2008.00201.x

Asiedu E, Kalonda-Kanyama I, Ndikumana L, Nti-Addae A (2013) Access to credit by firms in sub-Saharan Africa: how relevant is gender? Am Econ Rev 103(3):293–297. https://doi.org/10.1257/aer.103.3.293

Aterido R, Beck T, Iacovone L (2013) Access to finance in sub-Saharan Africa: is there a gender gap? World Dev 47:102–120. https://doi.org/10.1016/j.worlddev.2013.02.013

Ayodeji O, Babatunde A, Francis U (2013) Are female-headed households typically poorer than male-headed households in Nigeria? J Socio-Econ 45:132–137. https://doi.org/10.1016/j.socec.2013.04.010

Bai M (2021) The impact of financial service availability on household consumption volatility and its mechanism. J Commerc Econ 21:49–52. (in Chinese)

Bajtelsmit V (1999) Gender differences in defined contribution pension decisions. Financ Serv Rev 8(1):1–10. https://doi.org/10.1016/S1057-0810(99)00030-X

Bandelj N, Grigoryeva A (2021) Investment, saving, and borrowing for children: trends by wealth, race, and ethnicity, 1998–2016. RSF 7(3):50–77. https://doi.org/10.7758/RSF.2021.7.3.03

Black SE, Devereux PJ, Lundborg P, Majlesi K (2018) Learning to take risks? The effect of education on risk-taking in financial markets. Rev Finance 22(3):951–975. https://doi.org/10.1093/rof/rfy005

Borowski J, Jaworski K, Olipra J (2019) Economic, institutional, and socio-cultural determinants of consumer credit in the context of monetary integration. Int Finance 22(1):86–102. https://doi.org/10.1111/infi.12144

Brooks C, Sangiorgi I, Hillenbrand C et al. (2019) Experience wears the trousers: exploring gender and attitude to financial risk J Econ Behav Organ 163(C):483–515. https://doi.org/10.1016/j.jebo.2019.04.026

Brown S, Garino G, Taylor K (2013) Household debt and attitudes toward risk. Rev Income Wealth 59(2):283–304. https://doi.org/10.1111/j.1475-4991.2012.00506.x

Brown S, Taylor K (2008) Household debt and financial assets: evidence from Germany, Great Britain and the USA. J R Stat Soc Ser A: Stat Soc 171(3):615–643. https://doi.org/10.1111/j.1467-985X.2007.00531.x

Bucks B, Pence K (2008) Do borrowers know their mortgage terms? J Urban Econ 64(2):218–233. https://doi.org/10.1016/j.jue.2008.07.005

Cabeza-García L, Del Brio EB, Oscanoa-Victorio ML (2019) Female financial inclusion and its impacts on inclusive economic development. Women’s Stud Int Forum 77:102300. https://doi.org/10.1016/j.wsif.2019.102300

Cai Z, Ding C, Cai X (2022) How the gender structure of children affects household debt. Finance Trade Econ 43(04):113–128. https://doi.org/10.19795/j.cnki.cn11-1166/f.20220408.009. (in Chinese)

Carr MD, Jayadev A (2015) Relative income and indebtedness: evidence from panel data. Rev Income Wealth 61(4):759–772. https://doi.org/10.1111/roiw.12134

Chai S (2020) Does mobile payment amplify household debt risk? Micro evidence based on the perspective of family financial leverage. J Southwest Minzu University (Humanit Soc Sci) 41(10):122–133. (in Chinese)

Chai S, Zhou L (2020) An empirical study on household debt, debt level, and influencing factors. Stat Decision 36(22):140–142. https://doi.org/10.13546/j.cnki.tjyjc.2020.22.031. (in Chinese)

Chang M (2015) Analysis of the relationship between CFO gender, financial robustness, and corporate financing decisions. J Commer Econ 8:93–95. (in Chinese)

Charles M (2011) A world of difference: international trends in women’s economic status. Annu Rev Sociol 37(1):355–371. https://doi.org/10.1146/annurev.soc.012809.102548

Chen B, Li T (2011) A study on the current situation and causes of asset liability of urban household in China. Econ Res J 46(S1):55–66+79. (in Chinese)

Chen C, Fang F, Zhang L (2022) Digital inclusive finance, income levels, and household debt. Econ Survey 39(01):127–137. (in Chinese)

Chinese Academy of Financial Inclusion (CAFI) (2021) Renmin University of China. Women’s financial health is accelerating in China. Int Financ 5:76–80. (in Chinese)

Christelis D, Ehrmann M, Georgarakos D (2015) Exploring differences in household debt across euro area countries and the United States (2015–16). Bank of Canada. https://doi.org/10.34989/swp-2015-16

Christelis D, Ehrmann M, Georgarakos D (2021) Exploring differences in household debt across the United States and Euro Area countries. J Money Credit Bank 53(2–3):477–501. https://doi.org/10.1111/jmcb.12769

Coletta M, De Bonis R, Piermattei S (2019) Household debt in OECD countries: the role of supply-side and demand-side factors. Soc Indic Res 143(3):1185–1217. https://doi.org/10.1007/s11205-018-2024-y

Croson R, Gneezy U (2009) Gender differences in preferences. J Econ Lit 47(2):448–474. https://doi.org/10.1257/jel.47.2.448

Daniel DI, Augustina C (2022) Female-Led agrarian households and the question of sustainable land and food security in an emerging economy: evidence from Tula Baule. Habitat Int 120:102512. https://doi.org/10.1016/j.habitatint.2022.102512

Daniels R (2001) Consumer indebtedness among urban South African households: a descriptive overview. Development Policy Research Unit Working Paper 01/055. University of Cape Town

Datta S, Doan T, Toscano F (2021) Top executive gender, board gender diversity, and financing decisions: evidence from debt structure choice. J Bank Finance 125(1):106070. https://doi.org/10.1016/j.jbankfin.2021.106070

Davies E, Lea SEG (1995) Student attitudes to student debt. J Econ Psychol 16(4):663–679. https://doi.org/10.1016/0167-4870(96)80014-6

Dawson C, Henley A (2012) Something will turn up? Financial over-optimism and mortgage arrears. Econ Lett 117(1):49–52. https://doi.org/10.1016/j.econlet.2012.04.063

Debela LB (2017) Factors affecting differences in livestock asset ownership between male- and female-headed households in Northern Ethiopia. Eur J Dev Res 29(2):328–347. https://doi.org/10.1057/ejdr.2016.9

Debelle G (2004) Macroeconomic implications of rising household debt. SSRN Electron J. https://doi.org/10.2139/ssrn.786385

Deng X, Yu M (2021) Does the marginal child increase household debt?—Evidence from the new fertility policy in China. Int Rev Financ Anal 77:101870. https://doi.org/10.1016/j.irfa.2021.101870

Dreher GF (2003) Breaking the glass ceiling: the effects of sex ratios and work-life programs on female leadership at the top. Hum Relat 56(5):541–562. https://doi.org/10.1177/0018726703056005002

Du P, Wu Y (2023) The changing path, motivational mechanism, and future transformation of China’s rlderly care service policy. Acad J Zhongzhou 3:82–90+2. (in Chinese)

Duesenberry JS (1949) Income, saving, and the theory of consumer behavior. Harvard University Press, Cambridge, MA

Dumitrescu BA, Enciu A, Hândoreanu CA et al. (2022) Macroeconomic determinants of household debt in OECD countries. Sustainability 14(7):3977. https://doi.org/10.3390/su14073977

Faccio M, Marchica MT, Mura R (2016) CEO gender, corporate risk-taking, and the efficiency of capital allocation. J Corp Finance 39:193–209. https://doi.org/10.1016/j.jcorpfin.2016.02.008

Farrell L, Fry TRL, Risse L (2016) The significance of financial self-efficacy in explaining women’s personal finance behavior. J Econ Psychol 54:85–99. https://doi.org/10.1016/j.joep.2015.07.001

Fehr-Duda H, Gennaro M, Schubert R (2006) Gender, financial risk, and probability weights. Theory Decision 60(2-3):283–313. https://doi.org/10.1007/s11238-005-4590-0

Fletschner D (2009) Rural women’s access to credit: market imperfections and intrahousehold dynamics. World Dev 37(3):618–631. https://doi.org/10.1016/j.worlddev.2008.08.005

Flores SAM, Vieira KM (2014) Propensity toward indebtedness: an analysis using behavioral factors. J Behav Exp Finance 3:1–10. https://doi.org/10.1016/j.jbef.2014.05.001

French D, McKillop D (2016) Financial literacy and over-indebtedness in low-income households. Int Rev Financ Anal 48:1–11. https://doi.org/10.1016/j.irfa.2016.08.004

Fuwa N (2000) The poverty and heterogeneity among female-headed households revisited: the case of Panama. World Dev 28(8):1515–1542. https://doi.org/10.1016/S0305-750X(00)00036-X

Gandelman N (2009) Female headed households and homeownership in Latin America. Hous Stud 24(4):525–549. https://doi.org/10.1080/02673030902938397

Garber G, Mian A, Ponticelli J, Sufi A (2019) Household debt and recession in Brazil. In: Haughwout A, Mandel B (eds) Handbook of US Consumer Economics. Academic Press, p 97–119. https://doi.org/10.1016/B978-0-12-813524-2.00004-4

Disney RF, Gathergood J (2011) Financial Literacy ad Indebtedness: New Evidence for UK Consumers, Discussion Papers, University of Nottingham, Centre for Finance, Credit and Macroeconomics (CFCM). SSRN Electronic Journal. Available at SSRN 1851343

Gerlach-Kristen P, Merola R (2019) Consumption and credit constraints: a model and evidence from Ireland. Empir Econ 57(2):475–503. https://doi.org/10.1007/s00181-018-1461-4

Ghosh S, Vinod D (2017) What constrains financial inclusion for women? Evidence from Indian micro data. World Dev 92:60–81. https://doi.org/10.1016/j.worlddev.2016.11.011

Grable JE (2000) Financial risk tolerance and additional factors that affect risk taking in everyday money matters. J Bus Psychol 14(4):625–630. https://doi.org/10.1023/A:1022994314982

Guo X, Chen B, Wu Z (2015) An empirical study on the relationship between population structure changes and household debt growth in China. Stat Decision (4), 96–99. https://doi.org/10.13546/j.cnki.tjyjc.2015.04.027 (in Chinese)

Han Z, Liu T, Liu W (2023) Improving the quality of China’s elderly care services: policy evolution logic and trend foresight—an analysis based on national policy texts from 1989–2020. Soc Secur Stud 3:29–41. (in Chinese)

He L, Li M (2022) Does rising household debt lead to consumption upgrading? Evidence from the Chinese Household Tracking Survey. Jiang-huai Trib 2:26–35. https://doi.org/10.16064/j.cnki.cn34-1003/g0.2022.02.003. (in Chinese)

He L, Wu W, Xu Q (2012) Analysis of the debt situation, structure, and influencing factors of Chinese families. J Central China Normal Univ: Humanit Soc Sci 51(01):59–68. (in Chinese)

Heaton JB (2019) Managerial optimism: new observations on the unifying theory. Eur Financ Manag 25(5):1150–1167. https://doi.org/10.1111/eufm.12218

Heintz-Martin V, Recksiedler C, Langmeyer AN (2022) Household debt, maternal well-being, and child adjustment in Germany: examining the family stress model by family structure. J Fam Econ Issues 43(2):338–353. https://doi.org/10.1007/s10834-021-09777-1

Hu Y (2021) Impact of investors’ loss aversion and overconfidence on market performance evidence from China stock markets. 2022–2025. https://doi.org/10.2991/assehr.k.211209.330

Hu Z (2015) Female CEOs, social trust, and corporate financing constraints. Bus Manag J 37(08):88–98. https://doi.org/10.19616/j.cnki.bmj.2015.08.011. (in Chinese)

Hua Y (2023) The Chinese resident medical insurance system: realistic problems and reform prospects. Acad Res 9:87–95. (in Chinese)

Huang J, Kisgen JD (2013) Gender and corporate finance: are male executives overconfident relative to female executives? J Financ Econ 108(3):822–839. https://doi.org/10.1016/j.jfineco.2012.12.005

Huang X, Wang S, Lin L (2022) Does financial literacy affect the debt leverage of rural households?—Empirical evidence from the 2019 CHFS. J Northeast Agric Univ: Soc Sci Ed 20(6):36–49. (in Chinese)

Huh K, Park KY (2013) A study on the effect of risk tolerance and status quo bias on search behavior of financial information, financial management behavior and satisfaction for economic life of households. Financ Plan Rev 6(1):1–26

Hyytinen A, Putkuri H (2018) Household optimism and overborrowing. J Money Credit Bank 50(1):55–76. https://doi.org/10.1111/jmcb.12453

Iyiola O, Azuh D (2014) Women entrepreneurs as small medium enterprises (SME) operators and their roles in socio-economic development in Ota, Nigeria. Int J Econ Bus Finance 2(1):1–10. ISSN: 2327-8188

Jarmuzek M, Rozenov R (2019) Excessive private sector leverage and its drivers: Evidence from advanced economies. Appl Econ 51(34):3787–3803. https://doi.org/10.1080/00036846.2019.1584383

Jianakoplos AN, Bernasek A (1998) Are women more risk averse? Econ Inq 36(4):620–630. https://doi.org/10.1111/j.1465-7295.1998.tb01740.x

Jin Y, Li H (2009) Informal finance and farmers’ borrowing behavior. J Financ Res 346 (4), 63–79 (in Chinese)

Kasoga PS, Tegambwage AG (2021) An assessment of over-indebtedness among microfinance institutions’ borrowers: the Tanzanian perspective. Cogent Bus Manag 8(1):1930499. https://doi.org/10.1080/23311975.2021.1930499

Katapa RS (2006) A comparison of female- and male-headed households in Tanzania and poverty implications. J Biosoc Sci 38(3):327–339. https://doi.org/10.1017/S0021932005007169

Ke W, Shi W (2023) A study on the financial development of China’s elderly care industry. New Finance 9:51–56. (in Chinese)

Keese M (2012) Who feels constrained by high debt burdens? Subjective vs. objective measures of household debt. J Econ Psychol 33(1):125–141. https://doi.org/10.1016/j.joep.2011.08.002

Kennedy E, Haddad L (1994) Are pre‐schoolers from female‐headed households less malnourished? A comparative analysis of results from Ghana and Kenya. J Dev Stud 30(3):680–695. https://doi.org/10.1080/00220389408422332

Kevane M, Wydick B (2001) Microenterprise lending to female entrepreneurs: sacrificing economic growth for poverty alleviation? World Dev 29(7):1225–1236. https://doi.org/10.1016/S0305-750X(01)00032-8

Kim HJ, Lee D, Son JC et al. (2014) Household indebtedness in Korea: its causes and sustainability. Jpn World Econ 29:59–76. https://doi.org/10.1016/j.japwor.2013.12.001

Klapper L, Lusardi A, Panos GA (2013) Financial literacy and its consequences: evidence from Russia during the financial crisis. J Bank Finance 37(10):3904–3923. https://doi.org/10.1016/j.jbankfin.2013.07.014

Kowalski R, Strzelecka A, Wałęga A, Wałęga G (2023) Do children matter to the household debt burden? J Fam Econ Issues 44(4):1007–1022. https://doi.org/10.1007/s10834-023-09887-y

Kpoor A (2019) Assets and livelihoods of male- and female-headed households in Ghana. J Fam Issues 40(18):2974–2996. https://doi.org/10.1177/0192513X19868839

Kumar A, Mishra AK, Saroj S, Joshi PK (2017) Institutional versus non-institutional credit to agricultural households in India: evidence on impact from a national farmers’ survey. Econ Syst 41(3):420–432. https://doi.org/10.1016/j.ecosys.2016.10.005

Kupke V, Rossini P, McGreal S et al. (2014) Female-headed households and achieving home ownership in Australia. Hous Stud 29(7):871–892. https://doi.org/10.1080/02673037.2014.903902

Lerskullawat A (2020) Factors affecting household debt in Thailand. Int J Econ Policy Emerg Econ 13(4):327–336. https://doi.org/10.1504/IJEPEE.2020.109584

Li J (2022) Research on the debt level, structural changes, and causes of Chinese households. Doctoral dissertation, Southwest University of Finance and Economics (in Chinese)

Liu G, Huang Y, Huang Z (2021) Determinants and mechanisms of digital financial inclusion development: based on urban–rural differences. Agronomy, 11(9), Article 9. https://doi.org/10.3390/agronomy11091833

Liu H, Hu S, Chen L (2021) Gender of children and household housing assets. J Zhongnan Univ Econ Law 3:69–78+159. https://doi.org/10.19639/j.cnki.issn1003-5230.2021.0031. (in Chinese)

Long MG (2018) Pushed into the red? Female-headed households and the pre-crisis credit expansion. Forum Soc Econ 47(2):224–236. https://doi.org/10.1080/07360932.2018.1451762

Lusardi A, Tufano P (2015) Debt literacy, financial experiences, and overindebtedness. J Pension Econ Finance 14(4):332–368. https://doi.org/10.1017/S1474747215000232

MacKinnon DP, Krull JL, Lockwood CM (2000) Equivalence of the mediation, confounding and suppression effect. Prev Sci 1(4):173–181. https://doi.org/10.1023/A:1026595011371

Mallick D, Rafi M (2010) Are female-headed households more food insecure? Evidence from Bangladesh. World Dev 38(4):593–605. https://doi.org/10.1016/j.worlddev.2009.11.004

Maroto M (2018) Saving, sharing, or spending? The wealth consequences of raising children. Demography 55(6):2257–2282. https://doi.org/10.1007/s13524-018-0716-1

McCloud L, Dwyer RE (2011) The fragile American: hardship and financial troubles in the 21st century. Sociol Q 52(1):13–35. https://doi.org/10.1111/j.1533-8525.2010.01197.x

Meng X, Hoang TN, Siriwardana M (2013) The determinants of Australian household debt: a macro level study. J Asian Econ 29:80–90. https://doi.org/10.1016/j.asieco.2013.08.008

Meniago C, Mukuddem-Petersen J, Petersen MA, Mongale IP (2013) What causes household debt to increase in South Africa? Econ Model 33:482–492. https://doi.org/10.1016/j.econmod.2013.04.028

Modigliani F (1986) Life cycle, individual thrift, and the wealth of nations. Science 234(4777):704–712. https://doi.org/10.1126/science.234.4777.704

Muthitacharoen A, Nuntramas P, Chotewattanakul P (2015) Rising household debt: implications for economic stability. Thail World Econ 33(3):3. Article

Nelson JA (2015) Are women really more risk-averse than men? A re-analysis of the literature using expanded methods. J Econ Surv 29(3):566–585. https://doi.org/10.1111/joes.12069