Abstract

This paper presents a novel solution to evaluate the real impact of information and information technology (IT) in companies as fundamental tools to assess how valuable the company’s customers are. The focus is on the concept of information and knowledge as an asset with intrinsic economic value and a variable to consider in order to achieve effective customer management. It is dual research. On the one hand, it is an exploratory-conceptual type based on a review of the literature and, on the other hand, it is descriptive-quantitative through the application of an empirical case study. The proposed new customer relationship management (CRM) information value model (VICRM) offers significantly different results from other traditional models. Its main advantages include the possibility of carrying out new segmentations of customers and estimations of the company’s value. On the other hand, the model corrects some of the classic problems in customer evaluation models, such as their high dependence on the retention rate or being very regressive in the first years. The results of this research aim to serve any company whose business model is Business to Consumer (B2C) to calculate, in an effective way, the value of a large amount of information companies have about their customers.

Similar content being viewed by others

Introduction

In today’s environment of a knowledge-based economy, it is not easy for businesses to assess the usefulness of acquiring or developing customer relationship management (CRM) tools to implement the corresponding strategies. Companies find it difficult to quantify this usefulness clearly and simply and to determine the economic value of the information generated and managed from the perspective of managing the customer base (Heidemann et al., 2013). It is increasingly common to require those responsible for the different business areas to know the detailed level of return on investments in commercial tools to enjoy greater credibility inside and outside the organization.

Although the conceptual foundations of a CRM strategy are not currently in question, its implementation faces many challenges (Rodríguez and Boyer, 2020). One of the cornerstones of this research is the concept of CRM as a strategic bridge between IT and marketing strategies aimed at building profitable customer relationships. IT management in customer profitability analysis can be considered a resource that enables companies to collect much more specific data, leading to competitive advantage, which in turn translates into superior performance. These resources facilitate the free flow of information, allowing the company to transform and exploit it, providing potential resources and capabilities to create economic value by implementing successful strategies, mainly through the mediating influence of customer service and understanding customers’ needs better (Harrigan et al., 2020; Krizanova et al., 2018).

There is abundant literature related to the quantification of the economic value of a company’s customer portfolio. However, there is no clear link between the needed IT tools and the management of information as an asset, or with the relationships that have arisen with the different dimensions of CRM. Almost all studies are limited to proposing exclusively theoretical models or models that, due to their technical complexity, can hardly be put into practice in a real work environment (Bauer and Jannach, 2021). Despite its growing importance, little research has focused on developing a valid measurement scale and empirically testing the CRM concept concerning business performance and knowledge management leveraging the use of IT (Krizanova et al., 2018). As an approach to the valuation of customers as assets, we highlight the work of Kumar (2018) and his Customer Valuation Theory, which brings together an extensive compendium of factors that influence customer valuation. However, an integrated deterministic quantitative model has not yet been proposed.

The main problem indicated by some authors is the lack of rigorous studies that demonstrate the value that Business Intelligence (BI) brings to the company because the expected benefits are largely intangible (Xie et al., 2016). In his work, Trieu (2017) reviewed the literature on how business value is obtained from BI systems, underscoring that very few cases focus on customer value management.

Much CRM research addresses the need to develop a comprehensive customer profitability model, as knowing which customers are profitable is a critical starting point (Hwang et al., 2004). Consequently, for effective CRM, it is essential to have information about customers’ potential value. Until now, only a few studies have quantified the connection between soft and hard metrics so managers can use the resulting information (Hanssens and Pauwels, 2016). Thus, there remains a need for holistic and interdisciplinary research to help both managers and researchers assess the performance of integrating marketing, information, and technology systems in organizations (Iacobucci et al., 2019).

Finally, of particular interest for this research, as a previous scenario from a marketing perspective, is the work carried out by Glazer (1991), the precursor of the concept of “Vic” or value of the information associated with the exchanges between a company and its customers. This seminal paper treats information or knowledge as an asset that helps examine the consequences of increasing information intensity for some key strategy components.

The priority objective of this research is the conceptualization and empirical verification of an exploratory model that quantifies the economic value of the information and knowledge generated by the different computer tools that help implement CRM solutions. Specifically, it is intended to be applied in B2C business environments and from a customer value management perspective. More specifically, this study has three goals: (1) to propose and test a new model to measure the value of business information in CRM environments rooted in the information valuation theory. This theory is based on the fact that information, like any asset, has a value according to the benefits obtained through its use (Moody and Walsh, 1999); (2) to compare the performance of the model with traditional methods; and (3) to analyze the influence/sensitivity of each component in the model. From the managerial point of view, small and medium-sized enterprises (SMEs) companies may be the most interested in this research because the use of CRM is particularly beneficial in an organizational context such as SMEs (Li and Mao, 2012).

In this paper, we expand the traditional definition of CLV models to reflect the customer’s actual contribution to the value of the company more accurately. Beyond the due mathematical rigor applied, it has been shown in practice what measures or indicators can be useful to assess customers with the enormous amount of information companies handle. New segmentations compared to other traditional models, a guide to developing IT CRM or awareness of the great potential of customer information, among others, are relevant findings of this research.

Work proposals

Then, the three working propositions that support the materialization of the model are developed.

-

(1)

The use of information creates value for companies. Information is previously conceptualized as an asset generated by CRM tools that can create value. This is based on the theories of the value generated for the company (Value to Firm) (Verhoef et al., 2015) through the theory of general utility, derived from the belief that a commodity’s value is given by its utility (Iyengar, 1997). Customers are the company’s main source of profitability; therefore, if it is possible to estimate the value of current and future customers, it is also possible to estimate a large part of the value of a company (Ferrentino et al., 2016).

-

(2)

Existence of a direct and clear relationship between CRM tools and the information they generate for the company. Thanks to the existence of this relationship, it is feasible to generate a model that estimates the value that the combined use of both terms will have for a company (Krush et al., 2016), in this case, from a customer value management approach as a consequence of the knowledge generated in organizations (Toriani, and Angeloni, 2011).

-

(3)

Analysis of the constructs involved in the model. Below is an explanation of why the following constructs involved in the model named VICRM have been specifically proposed.

Figure 1 represents the general structure of the model VICRM as follows:

The Customer Lifetime Value (CLV) has been and is increasingly a fundamental concept to consider in the field of marketing as a discipline (Bauer and Jannach, 2021) and from a professional or managerial point of view (Ferrentino et al., 2016). It has been shown to be a good predictor of future customer profitability. Experts believe that in the next 5 or 10 years, it will be the most important metric for companies. However, despite its success, it has not yet been accepted in all industries (Kumar, 2018).

Among the multitude of definitions in the literature, this concept can be defined synthetically as the present value of future profits generated by a client throughout their life with the company (Kumar, 2018), or also as the discounted value of cash flows generated by a client.

The base formula is proposed for calculating the transactional CLV. In the following expression, for the present moment, t = 0:

where

-

GPc;s ∈ \({\mathbb{R}}\) = gross profit for a customer c or a segment s (including the total costs of serving them)

-

t ∈ \({\mathbb{R}}\)+ = annual period of occurrence of the cash flow

-

n ∈ \({\mathbb{R}}\)+ = total number of projected annual periods

-

d ∈ \({\mathbb{R}}\)+ = annual discount factor or rate.

The traditional CLV is a dependent variable that considers the expected potential economic value of strictly transactional relationships that a customer can bring to the company.

There is no doubt that customers can interact and create value for companies in various ways. Organizations are beginning to realize that different customers bring different economic value and are, therefore, moving away from product-centric or brand-centric marketing toward a customer-centric approach as the primary asset (Heidemann et al., 2013). Assessing the value of customers based solely on their transactions does not seem to be enough, and valuing this engagement correctly is crucial to avoid both undervaluing and overvaluing customers (Tomczyk, 2016). This context has led to the emergence of customer valuation theory, which can be defined as a mechanism for measuring the future value of each customer based on three aspects: (1) The contribution of the customer’s direct economic value, expressed as a margin contribution or net profit. (2) The depth of that direct value, referring to the intensity of the contributions to the company through their purchases, including acquisition and retention of profitable customers based on their future value and purchase potential across multiple categories. (3) The amplitude of the indirect economic value contribution, expressed as the volatility of customer cash flows. The latter refers to customers’ contributions through their referral behavior, their influence on the purchases of potential customers and on existing customers, and their comments on the company’s offers (Kumar, 2018).

Aligning the disciplines of marketing and IT is no longer enough. An extension to a financial management perspective is required to address new situations. Thus emerges the new concept of a triad (marketing, IT, and finance) in the business world. The methods used in finance have become important because of their similarity to CRM systems, as both are based on the construction and management of a portfolio (Gneiser, 2010). For their part, accounting and finance are not as precise disciplines as one might imagine, and they are also becoming increasingly qualitative (Persson and Ryals, 2010). Recent literature has shown that the inclusion of nonfinancial and attitudinal measures in market response models increases their predictive and diagnostic power. They are the so-called customer mindset metrics, that is, self-reported measures of customers’ perceptions, attitudes, and intentions (Matsuoka, 2020; Srinivasan et al., 2010).

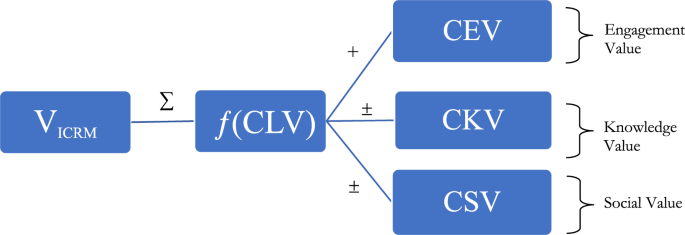

Considering the above, a reformulation of the CLV is proposed as a new function represented by the following expression.

ƒ(CLV) is a function of the CLV that includes the expected economic value, on the one hand, of the customer’s transactional operations together with the mediating effect of the three factors (endogenous variables) or constructs that influence the result. The extended CLV is explained in detail below.

Customer engagement value (CEV)

It is a diffuse concept, contradictory, and difficult to measure (Kumar et al., 2010). Although it has been conceptualized as a multidimensional construct that collects the client’s different activities that affect the company, providing added value, in this research, we will treat it in a more restricted way. The reason is that some of its dimensions (indirect contributions), as defined by Pansari and Kumar (2017), such as the value of references, and the influence and knowledge a company can derive from the client, are included in other constructs used here, such as customer social value (CSV) and customer knowledge value (CKV). Of these authors’ ideas about customer engagement, the part they call direct contribution is maintained. Its antecedent is satisfaction, and its result is an increase in customers’ purchases (Yoon et al., 2018).

Satisfaction becomes the main driver of loyalty, which in turn, is a function of commitment (Plangger, 2012). Loyalty represents the main key to measure customer retention (Mohamed, 2016). Repurchase intention is often known as loyalty, with high levels of repurchase being a characteristic of the most loyal customers (Singh and Saini, 2016). However, these relationships among satisfaction, retention, and profitability are not always necessarily immediate and linear and are usually moderated by the characteristics of the customer and the industry (Sánchez García and Curras-Perez, 2019).

Given the absence, in academic literature, of a clear and fully generalizable quantitative criterion at the time of weighing the intervening variables, the following metric is proposed:

where

-

NPS ∈ [−1;1] = metric based on a customer’s willingness to recommend the company to others. At the individual level, it can also be used to quantify an individual’s propensity to recommend the company.

-

Ton (Tone) ∈ [0;1] = sentiment analysis towards a company measured through text mining techniques on a customer’s messages about the company (Ho et al., 2021). Direct metrics can also be used, such as the CSAT (customer satisfaction). A direct influence of these indicators has been shown with trust in the brand and this, in turn, with customer loyalty.

-

Vo (Volume) ∈ \({\mathbb{R}}\)+ = number of comments made through digital social media.

-

Vi (Virality) ∈ \({\mathbb{R}}\)+ = number of comments shared on social media by the client, both made by the company itself and comments where it is mentioned.

-

Pop (Popularity) ∈ \({\mathbb{R}}\)+ = number of “likes” made by the customer in comments made by the company or in those that mention it.

CEV is a mediating variable of the retention rate that collects the value of the customer’s engagement with the company measured by the level of affinity towards it.

Subject to:

CKV

Global knowledge of customers helps create value for companies (Wu et al., 2013) if it is processed correctly because in some cases, it can become a value destroyer (Tomczyk, 2016). This contribution to value creation can be defined as CKV and must be captured and included in any model that aims to measure the customers’ value (Kumar et al., 2010). This customer value is captured, among other ways, through their comments and the information available in the CRM (Kumar and Reinartz, 2016).

It has been shown that the quality of information positively affects the relationship with the customer, which consequently improves business performance (Soltani and Navimipour, 2016), as well as being a significant antecedent of both perceived usefulness and user satisfaction (Kim and Lee, 2014). When measuring its usefulness, the level of recency, immediacy, or renewal of the information is also important because old knowledge has limited usefulness due to its obsolescence (Crié and Micheaux, 2007).

Following the ideas collected above, the following indicators are suggested in a reasoned way to measure the CKV variable:

where

-

Qi (Quality) ∈ [−1;1] = metric based on the level of usefulness found by a user in the information about a client when achieving their business objectives. As with research on credibility, quality can be directly assessed by asking respondents to indicate whether the information is credible or, in this case, of quality (Wathen and Burkell, 2002).

-

Act (Recency) ∈ [0;1] = renewal or update level of the information that the company has about the customer.

-

Ki (Quantity) ∈ [0;1] = amount of information about a client that the company has for its analysis and exploitation.

CKV ∈ [−1;1]: is an endogenous variable, a mediator of the CLV, which considers the value that customer knowledge brings to a company measured by the amount and recency of the available data based on the quality perceived by the user who manages the data. Due to the fact that it has been impossible to find a satisfactory explanation of the degree of impact of each variable of the equation on the dependent variable, it has been proposed that the quantity and the level of recency have the same weight, using “quality” as a moderating variable that indicates the sign (direction) of the metric.

CSV

Most research has implicitly assumed that a customer’s value is independent of others. However, in an increasingly interconnected society, in many cases, the effects of the network can be strong and ignoring them can lead to underestimating the CLV, as occurs in traditional models (Gupta et al., 2006). We begin to find this explicitly in the recent literature that tries to analyze the social value a client brings (CSV as analyzed in this paper). That is, the potential value that a customer contributes or detracts thanks to the influence they exert on the environment in which customers operate. Weinberg and Berger (2011) deal with an analogous concept; the customer social media value (CSMV), which refers to the value of the customer in social media but is limited to the influence exerted on digital social media. This indicator ignores the part of the influence that a person exercises outside the digital environment through traditional channels, which we think must also be considered within the social component of value. We found other concepts and metrics in the literature related to this construct, such as the customer’s referral value (Kumar and Reinartz, 2016) or the effect of the customer’s influence on people (Kumar, 2018). Both the customer reference value and the customer’s influence value are generally combined in the CSV concept (Tomczyk, 2018), in the same line as followed in this work. The explanation is that it seems more reasonable to group into a single concept everything related to an individual’s interactions with their social environment.

There is no doubt that as a network adds members to its structure, its value increases because the potential links increase with each new user (Van Hove, 2016). Previous research shows that this form of interconnection positively affects cooperation, knowledge transfers, and the final performance of companies (Palmatier, 2008). In this context, a very popular heuristic is Metcalfe’s law, which emerged in the early 1980s, stating that the value of a network is proportional to the square of the number of users. That is, the added value of the network grows quadratically: n*(n−1) ≈ n2 when n → ∞ (Van Hove, 2016). This is true for any business process (Alavi et al., 2012), where the quantity and quality of participation in a network are considered the main indicators of success, as well as the individual’s level of credibility and reputation, which act as precursors to their level of influence.

In this way, based on the well-proven Metcalfe’s law, we can estimate a customer’s CSV as the potential value that their network of contacts can bring to the company due to the effect of their influence:

where

-

Qm ∈ [−1;1] = variable that measures the quality of contacts; as a coupling force between the size of the network and the value generated thanks to the client’s authority in their network, measured by the level of influence exerted for the company and the volume of participation in the network, Qm = 0: no authority and/or no social activity, Qm = 1; maximum social activity and authority with a level of positive influence for the company and Qm = −1: maximum social activity and authority with a level of negative influence.

-

N ∈ \({\mathbb{R}}\)+ = number of contacts who have a close relationship with the customer and whom the customer can influence sensitively

CSV is an endogenous variable, a mediator of the CLV, which considers the potential value that a client’s social relationships can contribute or remove from the company, both through the acquisition/loss of potential customers and through the improvement or worsening of unit revenues and the retention of those who already were customers.

Finally, Table 1, which synthesizes the metrics that establish each of the constructs of f(CLV), is presented for a better understanding.

Model construction

The structure of the model can be explained mathematically as follows:

From the above equation, it follows that the value of information in CRM environments (VICRM) is the result of the sum of the CLV functions of all the customers or segments that make up the company’s portfolio. Continuing with the development of the previous formula, it is extended with each of the components that the CLV function contains: ƒ(CLV):

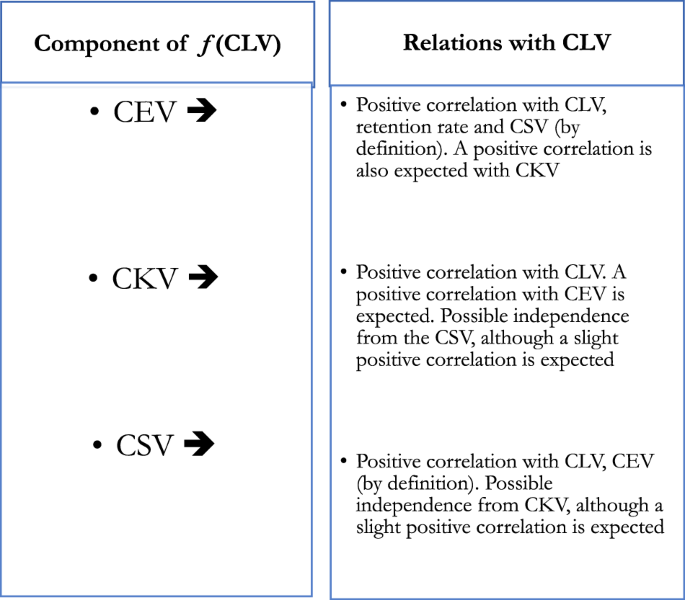

Each of the components contained in the ƒ(CLV) will be developed and explained, analyzing the different constructs and how they are predictably related to the CLV, which ultimately allows us to provide each component with units of economic measurement (see Fig. 2).

o Engagement value component measures the potential that a customer’s engagement will have for the company, measured by the probability that they will continue generating all the CLV possible, or, on the contrary, will leave the company or not continue consuming in the next periods, with the consequent loss of profit. It is estimated by multiplying the CLV of the client or segment by the CEV, adjusted by the retention rate of the company or of a particular segment or, failing that, based on the data of the industry or of a comparable company. That is:

o Knowledge value component aims to measure the potential that a customer’s knowledge will have for the company. It is understood as the probability that the customer will continue generating all the theoretical CLV if the information is perfect or, on the contrary, due to the bad information available, no additional value is provided. It is estimated by multiplying the absolute value of the CLV of a customer (i) or of a “typical” customer who is representative at the company/segment level (m). It is estimated by multiplying the absolute value of the CLV by its corresponding CKV together with the retention rate of a “typical” customer who is representative at the company/segment level. Unlike the rest of the constructs that make up the ƒ(CLV), we will use the absolute value of the CLV because in those cases in which the CLV could turn negative by its own definition, as it would not be logical for a customer with a negative CLV who also had a negative CKV, which would result in a positive knowledge value. The generic expression would be the following:

o Social value component of a customer for a company is understood as the potential value that their network of contacts can bring to the company. Measurement of this value is a result of multiplying the theoretical CLV by the CSV variable, considering the corresponding retention rate, adjusted by the CEV of the company. The estimation of this construct can be approached using the CLV, the CEV, and the “r” of an average customer of a cohort or of a “typical” client considered representative. Mathematically expressed as follows:

Finally, simplifying the VICRM equation, which includes the extended formula with each of the components and their respective metrics, the following equation is obtained for its individual calculation:

Main characteristics of the model

Deterministic models may be suitable for many different systems and situations. The inclusion of greater complexity involving a larger number of variables allows us to develop a stochastic approach model (Ríos, 1995). These models accurately explain the results of the different parameters, relationship states, and initial conditions. Normally, they are used to study different business processes, such as customer acquisition, retention, and profitability, among others (Kumar and Reinartz, 2016). For analyses that aim to study differences between customers, such as segmentation research, data collection at a single point in time is appropriate (Blozis, 2022).

This model is based on the multiplicative effect of each construct as a function of a potential transactional CLV that supports the economic value of a client’s information. This formulation is proposed in recognition of the fact that there is a potential interaction effect between the different constructs in the model. This is what we refer to in marketing as an “interaction effect” (Weinberg and Berger, 2011).

Methodology

Given the complexity of the processes involved in the analysis and the objectives sought, the methodology is structured in two clearly differentiated stages. Firstly, a bibliographic review has been carried out that aims to lay the foundations for the construction of the model. Second is the preparation of an empirical framework. Considering the casuistry and the complex context of the business phenomena that arise, as well as the possible ambiguities of the different concepts treated, an empirical case is approached that provides a holistic vision of the investigated phenomenon based on a deductive philosophy (Saarijärvi et al., 2014). The successful implementation of conceptual models and heuristics in real companies is an additional advantage for these investigations (Fischer et al., 2011).

Applied research data

To apply this mathematical model, we have selected a company that is part of the financial services industry, specifically the insurance sector. At present, this industry is an important part of the financial sector, not only because insurers are significant investors in the financial markets but also because they provide various important services to consumers and companies (Gaganis et al., 2019). The insurance industry is mature and highly competitive. Success in this industry depends, in addition to the traditional control of financial metrics, on the insurer’s ability to monitor other intangible assets. However, there are only a few papers that address this problem in this field that specifically consider its uniqueness (Marcos et al., 2018).

To choose a paradigmatic company, we look for these characteristics: a high degree of organizational maturity, medium size, high availability of data, high willingness to commit the necessary resources for the investigation, and the lack of useful prior information about the value of its customers, which has led managers to receive new information with interest. A Spanish insurance company (hereinafter, “the company”) met all these requirements.

The research phase was collaborative and involved a series of individual interviews and group workshops with the different areas related to customer information management. Client-specific costs and revenues were considered using a longitudinal approach to estimate product margins and other financial metrics necessary to capitalize and discount cash flows. We also apply the conventional assumption that after customers are lost, they do not return, which is reasonable given the contractual relationships being considered (Ryals, 2005).

From the entire client portfolio, it was finally decided to choose 60 randomly, 10 for each previously defined archetype by the company together with a consulting company. The criterion chosen for the segmentation followed consumption patterns and socio-demographic characteristics. In this way, the different segments forming the customer portfolio are represented through the sample. This decision seeks a balance between the operability of the calculations and the goals pursued. All these customers met the requirement of having answered one of the surveys that the company sends regularly. We emphasize that although it is true that in terms of representativeness, no substantial differences were detected between those who answered and those who did not, there are significant differences in terms of other characteristics, as those who responded seem to have greater engagement with the company according to several metrics, including roughly double savings on average.

Table 2 summarizes the metrics used in the model where a brief definition of them and how they have been operationalized in this context have been included.

Results

The results shown in Table 3 were obtained by substituting the corresponding values in Eq. (8). In each case, the corresponding trend measure has been highlighted depending on whether the sample distribution is normal (mean) or not (median) after using the corresponding Shapiro–Wilk and d’Agostino–Pearson tests.

About V ICRM model

There is substantial heterogeneity among different segments when observing any of the measures of central tendency and dispersion analyzed. On the other hand, the great differences in value between the different constructs that make up the model are also observed. Similar results are obtained in the heterogeneity between the different segments and components of the model if we analyze the rest of the measures described.

To confirm the differences indicated in the previous section, beyond the direct observation of the results, a statistical analysis is carried out that helps to confirm the heterogeneity both at the component level of the model and at the segment level to check whether significant differences are found. More than the differences between each factor, what is interesting to verify with this analysis is that the factors are different from each other and that all of them provide differentiated value to the dependent variable.

As we found that the relationships between the samples are basically independent and given the non-normal nature of the data, the Scheirer–Ray–Hare test was justified. This test is a non-parametric equivalent of the two-way analysis of variance (Šimkovic and Träuble, 2019). Assumptions for the test to be used satisfactorily: the samples should have the same size and at least five observations each.

The results obtained reveal (see Table 4) that both factors show significant differences because, for both values of the H statistic, very small p-values are associated (0.0170 and 3.74E−19, respectively), which are lower than the significance levels (α) of 5% and even of 1% if we examine the components of the model. Therefore, in both cases, with a confidence level of 95%, we can reject the null hypothesis that the mean ranks of all groups are equal. This implies that there are significant differences in the results depending on which segment the customers belong to and that the value of the different components of the model differs according to the construct analyzed. On the other hand, regarding the analysis of the interaction between the two factors, it cannot be concluded that there are differences (intra-subject analysis).

It can be concluded that the segments are not homogeneous concerning the value of the information captured by the model, which confirms what has already been pointed out by some researchers (Mccarthy et al., 2017). This implies that it may be interesting for the company to carry out new segmentations based on the economic value of CRM information beyond the use of already established archetypes.

Two correlation matrices among the different items that make up the model are shown to examine the relationships that may arise:

The first thing that emerges is the differences in significance according to the two correlation coefficients. Of the 20 association relations found in the two regular matrices (M5 × 5), only one of the relations is significant. Additionally, two other relationships migrate to different levels of significance.

Given the definition of the dependent variable as a sum (VICRM), all the intervening constructs have very significant levels of association and vary in the same direction. This is especially remarkable if we observe the value of engagement. It is also found that, as anticipated by Pansari and Kumar (2017), there is a positive relationship between the level of commitment and the amount of information provided to the company, measured by the Spearman correlation (rho = 0.468). This commitment is manifested in more information, of better quality, and more updated, which is how it has been measured in this research. Finally, we highlight the negative, almost null, relationship found between the social and knowledge part. The relationship is not significant in either case. Thus, all the relationships anticipated in Fig. 2 that were based on the literature and the propositions that support the model have been confirmed.

Focusing the analysis of the VICRM and its relationship with the different components on which it depends, it is observed (see Table 3) that the one with the greatest weight is the value of engagement, although if we examine the medians of the sample, the results are significantly different, and now, the highest weight is the value of knowledge. This difference is explained by the existence of extreme values within the compromise value throughout the sample. In all cases, the contribution of social value is very residual. This can be explained by the fact that very few relationships were reported in the system. It is expected, and even desirable that the social value can collect all the potential for the business shown in other research.

It is observed that the results do not conform to the well-known Pareto principle and follow another somewhat different distribution, which some authors, such as Brynjolfsson et al. (2011), call the long tail, where they find that, thanks to the use of IT, the participation of niche customers increases. This topic may be interesting for the company, as it will concentrate less risk by having better-distributed profitability per customer.

Once the analysis has been completed both at the level of individuals and segments, the following Table 5 summarizes the different final values of the constructs according to the previously configured segments. The theoretical value that implementing the model would have had on the total customer base is established.

Given that other studies have found a relationship between models based on customer value and company value in the markets and their link with business results (Kumar and Reinartz, 2016), it would be interesting to compare the data obtained with the available company results. Due to the lack of representativeness of the sample, such a comparison is not reliable because the result of the aggregate model will surely be inflated.

Finally, given the results shown in Table 6, the usual maxim in traditional customer lifetime value models, where the projected business accumulates significantly in the first few years, does not seem to hold in this case. According to Berger and Nasr (1998), this happens in the first 4 or 5 years. For Kumar et al. (2007), approximately half of a customer’s total lifetime value is generated in the first year, although it depends on the industry. With the implementation of this model, it would take approximately 7 years to reach 50 percent of the expected value, which shows that it is clearly less regressive than other traditional valuation models.

In relation to the lower prospective value of the first years, the fundamental reason lies in the effect of the engagement value, which increases over time due to how it is calculated, including the restriction that must be fulfilled: CEV*r∈[0;1]. Apart from the justification by the mathematical logic, the rationale for the long-term effect of customer engagement is that retention and relationships produce several important benefits. It is also consistent with existing literature highlighting that the gains generated tend to accelerate over time. The underlying evidence is that customers increase a company’s profitability because they are willing to pay higher prices, buy more, and recommend the company to others (Chang et al., 2012).

Comparison of the V ICRM model with a traditional alternative model

The calculations are available for what has been called an exclusively transactional CLV model throughout the paper, very similar to the one used in many studies. It only considers information on income and expenses together with the annual retention rate. A comparative analysis has been carried out to understand the present model better.

To confirm the differences indicated in the previous section, a statistical analysis is carried out to assess the heterogeneity both at the level of the models and of the segments. As the assumptions and conditions are the same, the Scheirer–Ray–Hare test is used again. The results obtained also confirm that both factors show significant differences. It follows that there are differences in the results depending on whether customers belong to one segment or another and that the value of the models differs.

Due to the importance of confirming the significant difference between the two models, the results of Mood’s median test have been added to verify that the two samples are significantly different (see Table 7). Therefore, it would be justified to use the new proposed model for the entire customer base, at least in terms of systematically obtaining results that are different and that promote different decision-making.

At this point, we continue reviewing the correlations, including the relationships between all the components of the complete model of VICRM and the traditional model.

Directly comparing the two models (see Table 8), it is verified that there is a significant correlation with a confidence level of 99%, both through linear and Spearman correlations. In both cases, it is a large and positive intense correlation (r & rho > 0.5). On the other hand, both correlations are significant and positive between all VICRM model components and the traditional CLV model, except for the linear correlation for the knowledge value part.

If the results of the two models are directly compared (see Table 9), it is verified that the traditional model calculates a value more than twice the new one (∆142%). This may mean that, in general, the new model undervalues customers or that customers are overvalued by the traditional model. In any case, in the new model, we found that there is not such a high relationship between income and final value due to the mediating effect of the ƒ(CLV) compared to traditional models, which are much more dependent on operating margins. The overvaluation of the customers in traditional models is an issue that has been extensively studied in the literature. In particular, the segments with the higher and recurring income are the ones that suffer the greatest overestimation. Gupta and Lehmann (2003) and Jasek et al. (2018) show that the use of these traditional static models generally overestimates CLV, sometimes very substantially, because they ignore other important dynamics in customer relationships that impact their value.

Fixing the analysis unit in the client, the following results can be observed in Table 9.

Despite the fact that the total economic value of the CLV model is much higher than that estimated through the VICRM, it is verified that, of the 60 individuals, 14 would have a higher value when analyzed under the prism of the VICRM, shown in bold in Table 9 (23.3%). Therefore, the company could risk undervaluing almost a quarter of the portfolio with a traditional model. However, it is also true that the difference in these clients’ values is not very substantial compared to the total value.

Subsequently, we verified whether the sample data are equally homogeneous. The goal is to check whether a model better captures the heterogeneity of the customers, given the high observed variability. Several statistics frequently used in previous studies have been used to calculate the degree of dispersion (see Table 10).

Except for the coefficient of variation, which is lower for the traditional CLV, for the rest of the metrics, the results are higher in all cases for the traditional CLV. Therefore, it can be concluded that the new model is more homogeneous and robust and that, consequently, it will be less exposed to outliers’ effects.

To verify that the new model is less regressive than the traditional ones, the following Table 6 shows how the two models behave over time. Although the behavior of the traditional CLV is more like the base models, it still does not concentrate as much value in the first years as other examples. This situation is due to the nature of the well-established contractual business of this insurance company.

Finally, the analysis of the effect of the retention rate is interesting. A 5% drop implies an economic value drop in the traditional model of 32.7%, whereas, in the new model, this same descent would only imply a decrease of 9.2%, caused exclusively by the effect on the part of the value of knowledge, because the part of the engagement and the part of the social value is subject to the constraint CEV*r∈[0,1]. A drop of 10% in the same rate represents a drop in the base model of 41.2%, whereas, in the new model, this same drop would mean a decrease of 14.1%. Therefore, the new model partially dissipates the effect that the retention rate variation has on traditional models, which are highly exposed to its effects. Several authors have begun to question whether the dependence between retention and CLV is as high as traditionally considered (Badri and Tran, 2022).

In the proposed model, the effect of retention is managed individually for everyone, which seems to mitigate the cumulative effect that the retention rate has on customer value in traditional models. The introduction of a concept such as the value of the normalized engagement for each client helps companies not only look at the retention rate to consider the probability of whether a customer will continue to generate economic flows in the coming years.

Contributions

From an academic perspective, we delve into a field of knowledge where there are few studies that propose novel quantitative models. To our knowledge, this is the first research with a theoretical-practical approach that seeks to unify in a single deterministic model the different components that reflect the value of customer information in the financial industry. Future research requires interdisciplinary collaboration between academics in accounting, marketing, management, and finance. This paper sheds more light on essential topics in customer valuation, such as the effect of retention and the relationships between different components of customer value that, despite having been mentioned in the literature, had not been clearly grounded in the form of soft and hard metrics. We contribute to marketing literature by proposing and testing a set of assumptions through real practice, using a new model that allows comparisons with traditional models in real-time. Thanks to this comparison, we could validate some theories about the overvaluation of some clients, the problems with retention rates, the distribution of value among customers, and how traditional models are too regressive.

From a professional perspective, starting from the traditional knowledge of the financial sector on asset valuation, this model can be used in multiple B2C industries without many adaptations. It serves to assign a specific value to CRM solutions that, until now, were difficult to quantify, providing a tool that allows objectifying the decision-making processes at the managerial level (for example, improving regular segmentation processes, including the partial values of each component separately, offering a guide to know what and how to measure the information available from your customers and to enhance the accountability of IT investments in CRM). Customer misclassification can cause companies to provide high service to current high-return customers who become less profitable in the future and/or low service to current low-return customers who are likely to become more profitable later. This model is simple and intuitive to apply and cheap to implement compared to other alternatives, as many executives and managers demand (Hanssens and Pauwels, 2016). These requirements represent a particularly critical barrier for SMEs. It has been shown that more sophisticated models are not always better or more beneficial for the user (Holm et al., 2012). Measuring the value of information as a new strategic metric can be helpful for the following purposes: (1) becoming aware of the value of information as an organizational asset to be managed, (2) improving the accountability of business areas, and (3) assessing the effectiveness of IT (Moody and Walsh, 1999).

Conclusions

Metrics are essential for advancing research and practice in an area, providing a basis for empirical validation of theories and relationships among concepts. On the other hand, for professionals, metrics are a way to learn what does and does not work when used in real environments. Companies should improve flexibility in the use and distribution of information in order to make the appropriate decisions more safely and quickly, helping to provide a higher level of customer service by personalizing business–customer relationships, which results in greater satisfaction and loyalty over time (Chen and Tsou, 2012).

The use of a longitudinal case study has allowed an empirical application of the proposed model. Analyzing customers’ values from other perspectives with real data is not an easy task. It can help to establish new successful strategies for companies in the future, where traditional financial and accounting tools coexist harmoniously with the use of new ones managed by marketing.

It has been proven that the exclusive use of traditional assessment models may be insufficient to show a complete image of customers. No approach to measuring customer profitability is universally superior. Instead, companies must balance the degree of sophistication of CPA and CLV with the complexity of customer service and customer behavior in their work environment (Holm et al., 2012). The use of the VICRM model serves as a new, more holistic, and comprehensive approach that helps to capture the particularities of the information value of their customers that the companies possess in their databases and that many are still incapable of making profits.

Limitations and directions for future research

More field research should be done in other contexts that can help to fit the different metrics better or even investigate new mediating or moderating variables. Due to the difficulty of establishing generalizable and contrasted metrics, researchers, together with the companies, should establish their metrics according to their preferences because different companies or industries may have different concerns about the importance of each variable (Safari et al., 2016). An attempt has been made to use the minimum number of variables and items to measure the necessary constructs, always seeking a reasonable balance between operability and rigor. However, this is a frequent discussion in the literature (Petrescu, 2013). Extending the customer value model to include new data-intensive and actionable metrics is a critical requirement for future research. For this reason, the model’s versatility allows certain adjustments to capture the essence of a particular business.

The choice of the multiplicative design of the model and some of the metrics may seem somewhat arbitrary until enough real-world evidence is available to choose a clearly superior choice, including the possible variation of the weight or range of each construct within the f(CLV). In any case, the weights may be adapted depending on the context. That said, we consider our proposal well-grounded in the literature, reasonably sophisticated, and especially practical to cover the research objective. Similar models have been used for other issues. We have responded to the call of the authors who demanded innovative and practical research on the subject (Matsuoka, 2020), as companies are reluctant to adopt complex models (Óskarsdóttir et al., 2018).

One of the main limitations found in this research has been the composition and, to a lesser extent, the size of the sample, which implies that the extrapolation of the results to calculate the entire portfolio must be done with caution. However, the rest of the conclusions should continue to remain valid. Other similar investigations have used much smaller sample sizes and more limited compositions (Ryals, 2005).

These and other possible limitations detected become useful lines of research for the future. This paper proposes a comprehensive model. Although exhaustive in the analysis, it is more than a conclusive model and can be adapted, for example, in B2B environments or in clearly non-contractual industries. Thus, we can extend the model to almost any industry or sector of economic and business activity.

Data availability

Some or all the data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Alavi S, Ahuja V, Medury Y (2012) Metcalfe’s law and operational, analytical and collaborative CRM-using online business communities’ co-creation. J Target Meas Anal Mark 20(1):35–45

Badri H, Tran A (2022) Beyond customer lifetime valuation: measuring the value of acquisition and retention for subscription services. In Proceedings of the ACM Web Conference 2022 (WWW ’22), ACM, New York, NY, USA, pp 132–140. https://doi.org/10.1145/3485447.3512058

Bauer J, Jannach D (2021) Improved customer lifetime value prediction with sequence-to-sequence learning and feature-based models. ACM Trans Knowl Discov Data 15(5):1–37

Berger PD, Nasr NI (1998) Customer lifetime value: marketing models and applications. J Interact Mark 12(1):17–30

Blozis SA (2022) Bayesian two-part multilevel model for longitudinal media use data. J Mark Anal 10:311–328

Brynjolfsson E, Hu Y, Simester D (2011) Goodbye Pareto Principle, Hello Long Tail: the effect of search costs on the concentration of product sales. Manag Sci 57(8):1373–1386

Chae H, Ko E (2016) Customer social participation in the social networking services and its impact upon the customer equity of global fashion brands. J Bus Res 69(9):3804–3812

Chang W, Chang C, Li Q (2012) Customer lifetime value: a review. Soc Behav Personal 40(7):1057–1064

Chen J, Tsou H (2012) Performance effects of IT capability, service process innovation, and the mediating role of customer service. J Eng Technol Manag 29(1):71–94

Crié D, Micheaux A (2007) From customer data to value: what is lacking in the information chain? J Database Mark Customer Strategy Manag 13(4):282–299

Ferrentino R, Cuomo MT, Boniello C (2016) On the customer lifetime value: a mathematical perspective. Comput Manag Sci 13(4):521–539

Fischer M, Sönke A, Wagner N, Frie M (2011) Dynamic marketing budget allocation across countries, products, and marketing activities. Mark Sci 30(4):568–585

Fisher NI, Kordupleski RE (2019) Good and bad market research: a critical review of net promoter score. Appl Stoch Models Bus Ind 35(1):138–151

Gaganis C, Hasan I, Pasiouras F (2019) Cross-country evidence on the relationship between regulations and the development of the Life Insurance Sector. Econ Model 89:256–272

Glazer R (1991) Marketing in an information-intensive environment: strategic implications of knowledge as an asset. J Mark 55(4):1–19

Gneiser MS (2010) Value-based CRM: the interaction of the triad of marketing, financial management, and IT. Bus Inf Syst Eng 2(2):95–103

Gupta S, Lehmann DR (2003) Customers as assets. J Interact Mark 17(1):9–24

Gupta S, Hanssens D, Hardie B, Kahn W, Kumar V, Lin N, Ravishanker N, Sriram S (2006) Modeling customer lifetime value. J Serv Res 9(2):139–155

Hanssens D, Pauwels K (2016) Demonstrating the value of marketing. J Mark 80(6):173–190

Harrigan P, Miles MP, Fang Y, Roy SK (2020) The role of social media in the engagement and information processes of social CRM. Int J Inf Manag 54:102–151

Heidemann J, Klier M, Landherr A, Zimmermann S (2013) The optimal level of CRM it investments: an economic model and its application at a financial services provider. Electron Mark 23(1):73–84

Ho MT, Mantello P, Nguyen HKT, Vuong QH (2021) Affective computing scholarship and the rise of China: a view from 25 years of bibliometric data. Humanit Soc Sci Commun 8(1):1–14

Holm M, Kumar V, Rohde C (2012) Measuring customer profitability in complex environments: an interdisciplinary contingency framework. J Acad Mark Sci 40(3):387–401

Hwang H, Jung T, Suh E (2004) An LTV model and customer segmentation based on customer value: a case study on the wireless telecommunication industry. Expert Syst Appl 26(2):181–188

Iacobucci D, Petrescu M, Krishen A, Bendixen M (2019) The state of marketing analytics in research and practice. J Mark Anal 7(3):152–181

Iyengar JV (1997) Information value—an utility approach. J Comput Inf Syst 37(2):37–40

Jasek P, Vrana L, Sperkova L, Smutny Z, Kobulsky M (2018) Modeling and application of Customer Lifetime Value in online retail. Informatics 5(1):2

Kim Y, Lee HS (2014) Quality, perceived usefulness, user satisfaction, and intention to use: An empirical study of ubiquitous personal robot service. Asian Soc Sci 10(11):1–16

Krizanova A, Gajanova L, Nadanyiova M (2018) Design of a CRM level and performance measurement model. Sustainability 10(7):2567

Krush MT, Agnihotri R, Trainor K (2016) A contingency model of marketing dashboards and their influence on marketing strategy implementation speed and market information management capability. Eur J Mark 50(12):2077–2102

Kumar V, Petersen JA, Leone RP (2007) How valuable is word of mouth? Harv Bus Rev 85(10):139–146

Kumar V, Aksoy L, Donkers B, Venkatesan R, Wiesel T, Tillmanns S (2010) Undervalued or overvalued customers: capturing total customer engagement value. J Serv Res 13(3):297–310

Kumar V, Reinartz W (2016) Creating enduring customer value. J Mark 80(6):36–68

Kumar V (2018) A theory of customer valuation: concepts, metrics, strategy, and implementation. J Mark 82(1):1–19

Li L, Mao J (2012) The effect of CRM uses on internal sales management control: an alternative mechanism to realize CRM benefits. Inf Manag 49(6):269–277

Marcos AMB, De F, Coelho AF, De M (2018) Communication relational outcomes in the insurance industry. Asia Pac J Mark Logist 30(5):1294–1318

Matsuoka K (2020) Exploring the interface between management accounting and marketing: a literature review of customer accounting. J Manag Control 31(3):157–208

Mccarthy D, Fader P, Hardie B (2017) Valuing subscription-based businesses using publicly disclosed customer data. J Mark 81(1):17–35

Metcalfe B (2013) Metcalfe’s law after 40 years of ethernet. Computer 46(12):26–31

Mohamed A (2016) The relationship between revenue management and profitability—a proposed model. J Bus Stud Q 7(4):44–63

Moody DL, Walsh P (1999) Measuring the value of information. An asset valuation approach. In: European conference on information systems (ECIS’99), Copenhagen Business School, Frederiksberg, Denmark, pp. 496–512

Óskarsdóttir M, Baesens B, Vanthienen J (2018) Profit-based model selection for customer retention using individual customer lifetime values. Big Data 6(1):53–65

Palmatier RW (2008) Interfirm relational drivers of customer value. J Mark 72(4):76–89

Pansari A, Kumar V (2017) Customer engagement: the construct, antecedents, and consequences. J Acad Mark Sci 45(3):294–311

Petrescu M (2013) Marketing research using single-item indicators in structural equation models. J Mark Anal 1(2):99–117

Plangger K (2012) The power of popularity: how the size of a virtual community adds to firm value. J Public Aff 12(2):145–153

Peng S, Zhou Y, Cao L, Yu S, Niu J, Jia W (2018) Influence analysis in social networks: a survey. J Netw Comput Appl 106:17–32

Persson A, Ryals L (2010) Customer assets and customer equity: management and measurement issues. Mark Theory 10(4):417–436

Rapp A, Trainor KJ, Agnihotri R (2010) Performance implications of customer-linking capabilities: examining the complementary role of customer orientation and CRM technology. J Bus Res 63(11):1229–1236

Ríos S (1995) Modelización. Alianza (Alianza Universidad, 822), Madrid

Rodríguez M, Boyer S (2020) The impact of mobile customer relationship management (mCRM) on sales collaboration and sales performance. J Mark Anal 8(3):137–148

Ryals L (2005) Making Customer Relationship Management work: the measurement and profitable management of customer relationships. J Mark 69(4):252–261

Saarijärvi H, Kuusela H, Neilimo K, Närvänen E (2014) Disentangling customer orientation—executive perspective. Bus Process Manag J 20(5):663–677

Safari F, Safari N, Montazer GA (2016) Customer lifetime value determination based on RFM model. Mark Intell Plan 34(4):446–461

Sánchez García I, Curras-Perez R (2019) Is satisfaction a necessary and sufficient condition to avoid switching? The moderating role of service type. Eur J Manag Bus Econ 29(1):54–83

Shi R, Guo C, Gu X (2021) Authority updating: an expert authority evaluation algorithm considering post‐evaluation and power indices in social networks. Expert Syst 38(1):e12605

Šimkovic M, Träuble B (2019) Robustness of statistical methods when measure is affected by ceiling and/or floor effect. PLoS ONE 14(8):1–47

Singh J, Saini S (2016) Importance of CEM in CRM-CL framework. J Model Manag 11(1):91–115

Soltani Z, Navimipour NJ (2016) Customer relationship management mechanisms: a systematic review of the state-of-the-art literature and recommendations for future research. Comput Hum Behav 61:667–688

Srinivasan S, Yanhuele M, Pauwels K (2010) Mind-set metrics in market response models: an integrative approach. J Mark Res 47(4):672–684

Tomczyk P (2016) Customer knowledge valuation model based on customer lifecycle. Mark Zarz 5(46):87–94

Tomczyk P (2018) Knowledge from customers Definition and research areas. Handel Wewn 4(375tom I):377–389

Toriani S, Angeloni MT (2011) CRM as a support for knowledge management and customer relationship. J Inf Syst Technol Manag 8(1):87–108

Trieu V (2017) Getting value from business intelligence systems: a review and research agenda. Decision Support Syst 93:111–124

Van Hove L (2016) Testing Metcalfe’s law: pitfalls and possibilities. Inf Econ Policy 37:67–76

Verhoef P, Kooge E, Walk N (2015) Creating value with big data analytics: making smarter marketing decisions. Routledge

Wathen CN, Burkell J (2002) Believe it or not: factors influencing credibility on the Web. J Am Soc Inf Sci Technol 53(2):134–144

Weinberg BD, Berger PD (2011) Connected customer lifetime value: the impact of social media. J Direct Data Digit Mark Pract 12(4):328–344

Wu J, Guo B, Shi Y (2013) Customer knowledge management and IT-enabled business model innovation: a conceptual framework and a case study from China. Eur Manag J 31(4):359–372

Xie K, Wu Y, Xiao J, Hu Q (2016) Value co-creation between firms and customers: the role of big data-based cooperative assets. Inf Manag 53(8):1034–1048

Yoon G, Li C, Ji Y, Hong C, Liu J, North M (2018) Attracting comments: digital engagement metrics on Facebook and financial performance. J Advert47(1):24–37

Yusheng K, Ibrahim M (2019) Service innovation, service delivery and customer satisfaction and loyalty in the Banking Sector of Ghana. Int J Bank Mark 37(5):1215–1233

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This paper is a study using only existing data with non-linkable anonymization and does not require ethical review.

Informed consent

Oral informed consent was obtained from all participants prior to enrollment in this study and additionally written permission from general management of the company.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lamela-Orcasitas, C., García-Madariaga, J. How to really quantify the economic value of customer information in corporate databases. Humanit Soc Sci Commun 10, 166 (2023). https://doi.org/10.1057/s41599-023-01654-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-01654-6