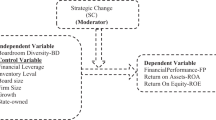

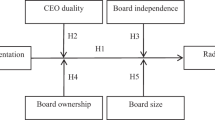

Abstract

A company’s board of directors plays a critical role in making decisions relating to strategy, high-level structure, and the appointment of the CEO. The role of the board and its impact on corporate performance has been well studied; however, the diversity of the board of directors and the corresponding correlation to the level of corporate innovativeness has not been previously investigated. Here, we provide a critical analysis of board members’ diversity as it relates to innovative corporations in what is considered a mature industry in transition to a bioeconomy: the pulp and paper industry. Our findings contribute to the body of knowledge on the role of board member diversity in shaping company culture and how that drives, shapes, and sustains innovation.

Similar content being viewed by others

Introduction

Fundamentally, companies are guided by three generic strategies: product leadership, customer intimacy, and operational excellence (Balas, 2015). Each of these strategic approaches is supported by the components of efficiency, service, and functionality. The quest for differentiation from competitors in a mature industry highlights the importance of innovation. Innovativeness is not only associated with a firm’s products, but also with the organization’s ability to effectively align its strategy, structure, systems and leadership practices to support innovation. Effective alignment ensures that the company’s resources are deployed optimally to support the chosen strategy, including the ability to perform distinctive sets of activities that lead to a unique, i.e., differentiated mix of deliverables. Strategy and structure establish the maximum level of firm performance possible and strategic alignment determines how close actual performance comes to that maximum. Scholars and practitioners in the industry agree with these concepts, with slight differences in emphasis (Chan and Mauborgne, 2009). Innovative corporations excel in these processes and are thus agile and strategic in making decisions (Ehsan et al., 2017). The systemic understanding of market trends, value chain developments, and consumer or customer needs are some of the factors that contribute to an innovative corporation’s success (Xinchun et al., 2016; Chen, 2019; Jari and Sahebi, 2013).

The board of directors’ key function is to ensure that the appropriate interests of shareholders and stakeholders are met by overseeing the firm’s executive management. This broad component of corporate governance is used to separate ownership and control (Kose and Senbet, 1998). An important element in the board’s oversight is to approve and monitor the company’s business strategy to achieve long-term value creation (Eloranta, 2019). The authority and responsibility for operating the company is delegated to the CEO; and through the CEO to the executive and senior management. Relating to innovation, the board of directors monitors the progress of strategy implementation, as well as influences the senior team in establishing a corporate culture that encourages innovation. The board operates through a well-established committee structure that includes executive compensation, finance, and audit; (and more recently) sustainability and ethics. The rise in focus on ethics, corporate social responsibility, and diversity have become critical components of the board of directors’ responsibilities (Fuente et al., 2017; Braverman, 2019). The boundary between oversight and management is not always precise, and some situations (such as a crisis) may require greater than usual board involvement in operational matters. To effectively operate, boards need to be collegial bodies in the traditional sense as their members share the responsibility to have both individual and collective accountability (Keay, 2017; Paine and Srinivasan, 2019).

The importance of innovation to any corporation is clear. It depicts the ability to identify and react to new business opportunities. Zahra and Covin (1994) suggested that innovation is widely considered the life blood of a corporation and a critical component of its survival and growth. Baregheh et al. (2009) defined innovation as “… the multi-stage process whereby organizations transform ideas into new/improved products, service or processes, in order to advance, compete, and differentiate themselves successfully in their marketplace”. Kimberly (1981) defined innovation from a different perspective by stating: “There are three stages of innovation: innovation as a process, innovation as a discrete item including, products, programs or services; and innovation as an attribute of organizations”. Kimberly’s definition of innovation as “an attribute of organizations” serves as the lens through which we examine highly innovative companies.

A firm’s long-term performance requires organic growth and renewal, both born from innovation to create a competitive advantage in the economy (Baregheh et al., 2009). Therefore, research on a firm’s ability to be successfully innovative must include a critical analysis of its highest level—the board of directors.

Assessing and ranking companies’ innovativeness is a challenging task (Blomqvist et al., 2004). Many corporate metrics have been developed and used, including the number of new products launched, new product sales, number of patents, number of R&D personnel, et cetera. (Thamhain, 2014). A major issue with these metrics is that they are lagging indicators, addressing the technical and product-focused side of innovation quite narrowly. In essence, innovation is ultimately a process of creating value that includes not just novel products, but also new business models and partnerships that enhance a firm’s ability to perform. Innovative companies use a wide variety of external data to support the implementation of their innovation processes (Xinchun et al., 2016). These include capturing and scouting promising new ideas, as well as identifying partnerships with start-up companies. Most innovative firms are able to attract investors who see the high potential of new revenue streams and premium talent that enables the company to excel in performance and execution. In this study, we used the Boston Consulting Group’s (BCG’s) annual global survey and ranking of the most innovative companies (Most Innovative Companies, 2018). Using an established ranking methodology as the baseline for this study reduced potential bias. The BCG survey assesses companies’ ability to use competitive intelligence, strategic partnerships, customers’ voice, value chain expertize, and big data or social network data in their innovation process. Furthermore, BCG identifies five ways in which leaders impact innovation—dedicating resources, investing in speed, taking smart risks, investing in data, and building advantaged capabilities (Most Innovative Companies, 2018). We used this existing data on the most innovative companies and compared it to the list of the largest companies in the bioeconomy to investigate the potential differences in the diversity of the composition of their board of directors. These findings were then interrelated to the companies’ innovation performance.

The most innovative companies and the bioeconomy

This article compares the top innovative companies with companies in the bioeconomy industry to determine the way the composition of a company’s board of directors affects its innovativeness. In general terms, the bioeconomy encompasses the use of renewable natural resources and their conversion into bio-based products and bioenergy. According to the Kondratieff Wave for economic cycles, the future role of the bioeconomy represents the next natural major wave in the evolutionary profile of the economy (Dabbert et al., 2017; Hakovirta and Lucia, 2019). As such, bioeconomy sectors have a strong potential for growth and innovation, by using a wide range of novel technologies and science. This includes, for example, biotechnology, nanotechnology, big data, and smart manufacturing. We selected the pulp and paper industry as our specific focus as it is one of the leading industries in this sector as determined by size, influence, and R&D investments. The pulp and paper industry and its associated sectors in the bioeconomy have done considerable work on innovation and sustainability during the past 20–30 years (Gaston et al., 1995; Collins, 1994). Examples of these efforts include the development of the best technologies available for water purifications, energy efficiency, and closed loop systems (Jyothirmayee et al., 2016; Gerstlberger et al., 2014; Genc and De Giovanni, 2020). With respect to bioenergy, pulp and paper companies are one of the major contributors in biomass and biofuel processing for sustainable energy solutions (Malik et al., 2016). The term biorefinery is associated with this industry and encompasses the concept of valorization of waste by products obtained from processing the lignocellulosic feedstock used in the industry (Karlsson et al., 2014). The use of wood fibers to replace the commonly used petrochemical-based textile materials and progress in reducing the use of plastics in packaging are examples of the latest innovations in sustainability (Kim et al., 2015). Unfortunately, while the pulp and paper industry has the potential to be innovative, it is not known for it. This is explained in part due to the perception among mature companies that some of the processes used in the industry are not perceived to require major changes to remain competitive. Moreover, the industry’s positioning as being distant from the consumer in the value chain may play a role in the lack of recognition of the need for innovation. Ten of the largest bioeconomy companies were compared with the ten most innovative companies in the world to further explore this interesting polarity. The working hypothesis is that a higher level of diversity in the composition of the board of directors positively affects a company’s innovativeness, which implies that the most innovative companies should have a higher level of diversity in some or all of the attributes measured than bioeconomy companies’ boards.

Corporate governance and the importance of diversity

In general terms, corporate governance is related to the mechanisms by which stakeholders exercise control over operational management and ensure that their interests are protected. The range of stakeholders includes equity shareholders, creditors, employees, suppliers, customers, and governmental entities. The senior executive team is responsible for making and implementing the corporation’s key operational decisions.

The board of directors is a fundamental component of corporate governance, serving as the voice of shareholders in overseeing executive leadership. The directors’ service on behalf of shareholders is critical due to the wide disbursement of stock in public corporations. Board independence, size, and composition (including diversity among its members) are essential aspects when examining whether or not the Board is effectively meeting its responsibilities. In this regard, a key board function is to help shape and guide the company’s long-term strategic positioning within its industry. It can be argued that the composition of the board of directors is core to its effectiveness as addressing strategic complexities requires diverse talent and perspectives. In this regard, progressive boards realize that they need to have an optimal composition that reflects the strategic priorities of the business and the diversity of its stakeholders (Kiel and Nicholson, 2003; Macaulay et al., 2018). Boards are increasingly recognizing that those with members who represent a good mix of age, experience, and background tend to foster constructive debate and decision-making. For example, the 2012 Credit Suisse Research Institute report, Gender Diversity and Corporate Performance, found that during the six-year period ending in 2011, companies with female representation had better share price performance, higher return on equity, and better average growth than did those with no women on their boards (Gender diversity and corporate performance, 2012).

Gender diversity at the board of directors’ level can be explored through multiple levels of analysis including individual, firm, industry, as well the board itself. For example, on an individual level, a female member of a board of directors can serve as a role model. At the firm level, gender diversity can have an effect on organizational legitimacy and corporate monitoring (Terjesen et al., 2009; Adams et al., 2009).

Somewhat surprisingly, there are only a few peer-reviewed empirical studies on the topic of increasing the numbers of women on corporate boards. It is noteworthy, however, that results from some of the available research indicate a strong correlation between boards that have female directors and innovation effectiveness measured through R&D expenditures and citations, especially in industries in which innovation and creativity are critical (Chen et al., 2018).

Discussions about the diversity in boards of directors often focus on gender and ethnicity, as well as independence from the firm’s internal pressures. The thrust of the argument in favor of a diverse board is to go beyond selection based upon a prospective members’ fit into one of these categories. Productive board discussions require a breadth of perspective that by definition are supported by diverse composition. Leszczyńska (2018) argued that selection of directors based on filling a category to meet the composition desired without considering whether the director can fill the need for varied perspectives reduces the opportunity for robust discussions and well-rounded decision-making. It can be stated that a board’s composition should reflect diversity in thinking, background, skills, experiences, expertize and a range of tenures that are appropriate given the company’s current and anticipated circumstances. It is reasonable to conclude that diverse backgrounds and experiences on corporate boards, including those of directors who represent the broad range of society, strengthen board performance and promote the creation of long-term shareholder value.

Research methodology

The most innovative companies list was selected using BCG’s 2018 annual ranking list (Most Innovative Companies, 2018). We used this list as much of the data on board of directors and company performance was from the same period. The BCG methodology for the Most Innovative Companies ranking is widely used in corporate planning and consulting. However, as with any global rankings, careful understanding of the methodology is needed. In principal, the way their data was collected was by surveying senior-level executives representing a wide spectrum of global industries to identify three companies they regard as top innovators across all industries. They were also asked to rank three of the most innovative companies in their own industry. Several financial metrics were also used to measure innovation in addition to the more subjective survey instrument. For the 2018 ranking, they focused on three financial metrics measured over the span of three years: total shareholder return (TSR), revenue and margin growth. To achieve a balance between the subjective opinions and financial metrics, the executives’ votes for companies within their industry accounted for 30% of the ranking, votes for companies outside their industry accounted for 30%, and (to simplify the financial inputs) three-year TSR accounted for 40%.

The methodology to measure aspects of innovation included whether or not a company fully utilizes external sources to identify new ideas for growth or new value creation projects. This provides a way of screening how well a company uses competitive intelligence, strategic partnerships in academia or industry, social networks or big data mining, for example. The study also focused on new innovation models and mechanisms, including accelerators, incubators, and innovation labs. A 3-year TSR analysis for the top-50 was used to avoid putting at a disadvantage new companies with high valuations that promised strong returns, but had not yet had a public offering. Start-up companies founded after 2001 that had a market capitalization of more than $1 billion and had an initial public offering from 2010–2012 were also included in the answers the executives provided. Ranking firms by their innovativeness has to balance hard data and subjective information that may derive from biased perceptions. However, a company that is perceived to be an innovator attracts new partnerships and talent, capital holders, and customers differently than does a company that is perceived to be more traditional. The BCG study did not offer any information on the diversity of the executives who responded. Thus, it provides no diversity elements that might introduce more insight into the opinions. While the study may have its limitations, it is important to note that there are few rankings available for global companies’ innovativeness, especially that have as consistent and structured a methodology as BCG’s. It is not only difficult to measure innovativeness accurately, but it is challenging to obtain access to senior-level executives to solicit their opinions. The BCG rankings had sufficient methodological rigor to fit with the research thrust of this paper. The limitations of the BCG rankings are noted, discussed, and addressed through the use of more objective and diverse metrics. The list of selected pulp and paper or bioeconomy companies was determined by reviewing their corporate annual reports and identifying those with the most revenue. Annual reports were analyzed from company websites. Once identified, the research focus was to best understand the firms’ innovation culture and operations, as well as to collect data on their board of directors’ composition and attributes. Each board member was analyzed using a variety of diversity and inclusion-related data. These data comprised 315 datapoints, including gender, age, education level and type, career background, and diversity of the discipline and experience. In instances where the company’s website provided insufficient information, additional web search tools were used to find other databases and reports to collect the desired information. For the purposes of this study the authors acknowledge the cross-cultural dynamics of different governance models and board composition across Anglo-Saxon, German, and Nordics models. The distinct difference between the Nordic model and the others is that the shareholders are more in control of the company, whereas the board and executive management are seen as the shareholders’ representatives in charge of running the company. The ensuing strict accountability to the shareholders, including hierarchical governance and strict division of directing executive management distinguishes the Nordic model. The other models are referred to as one- and two-tier-systems that are typical in countries with Anglo-Saxon and German traditions. In the two-tier system (German) there is a clear separation between the supervisory board and executive management. In this model, the shareholders play a very limited role in managing the company. In one-tier system companies (Anglo-Saxon), the board, together with executive and non-executive directors, serve both supervisory and executive functions. In US companies, this model also offers concentration of power, as the chairman of the board may also be the company CEO. Interestingly, in the one-tier system, the shareholders have more power over the board, at least theoretically. However, these companies’ highly dispersed ownership causes the shareholders to act as investors and not as engaged players in the running of the company.

Results

Both of these groups of companies had similarly sized boards, averaging eleven members. We analyzed the educational disciplines (degree major) represented by board members and placed them into one of four categories: Engineering; business; social sciences, and science and natural resources. These categories were uniformly applied to both company groups.

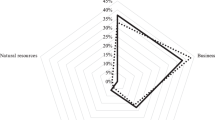

Table 1 and Fig. 1 show the types of education that the board of directors in bioeconomy companies have compared to the world’s top ten innovative companies. The total number of board members in bioeconomy companies was 118 compared with 120 for the most innovative companies. The engineering discipline category includes all engineering fields, as well as computer science. The business discipline category encompasses fields, such as business administration (bachelor’s/master’s level), accounting and economics, while the social science discipline encompasses such majors as history, sociology, law, and others. The sciences category includes mathematics, physics, medicine, and other related fields. Lastly, the natural resources discipline includes only forestry. Bioeconomy companies alone have natural resource discipline members because these companies have forestry or natural resource-related operations and products. One observation is that the five disciplines used are only a small section of all of the existing educational disciplines. For example, agriculture, life sciences, design, music, and others exist in the academic world, but none of those disciplines were listed as a major field of study for any of the directors that were involved in the study.

Our results showed that bioeconomy companies have more business majors than engineering majors on their boards. Although bioeconomy companies are highly engineering oriented, a surprising 18 percentage point difference was observed between the two disciplines. Looking at the most innovative companies, the same comparison showed only a nine-percentage point difference. A one distinct difference was that on average the bioeconomy boards had 11% more business majors compared to the most innovative companies. It is important to note that the pulp and paper industry’s boards are actively working on strategies related to major capital investments in global manufacturing capacity. These strategic investments can be in excess of $1 billion at any given time. Such critical undertakings obviously require board members who have experience and education in large capital investment, investment banking, corporate treasury, and macroeconomics.

The differences between both company groups observed in the social science majors and science majors were very small. However, the total number of board of directors in both disciplines was much lower than in the business and engineering fields. This may be due to business and engineering being perceived as more associated with governing than are the social sciences and sciences.

Table 2 lists the education level between the two company groups.

The mode approach was used to identify which type of degree was held the most when making the calculations reported in Fig. 2. The number “1” was assigned to all Bachelor’s degrees. “2” was assigned to Master’s or MBA degrees, and “3” was assigned to doctoral degrees. The modal average was compared between the two company groups. The average number of degrees held was slightly higher in the most innovative companies (1.8) compared to the companies in bioeconomy (1.5). A median of the mode was also calculated, which showed that the most innovative companies had a median of 2.0 and bioeconomy companies 1.5. From this analysis, we can conclude that the most innovative companies’ board of directors’ educational level was a Master’s degree, while the most common bioeconomy company degree was equally Master’s and Bachelor’s.

The ethnic diversity between the two company groups was examined. The level of ethnic diversity in each company group’s boards of directors was defined by creating a category of minority ethnic origin. This category shows the number of individuals that are not of the same ethnic background as the locale of the corporate head office personnel suggests. The percentage of board members in that category was used to determine the level of diversity. For example, International Paper, based in Tennessee, USA, has nine people with a Caucasian background, one with an African American background, and one with an Asian background. Therefore, African Americans and Asians were considered the “minority ethnicity group” at International Paper. Using the same logic for Alibaba, the two people of Caucasian descent were considered “other minority ethnicity” because Alibaba is based in China. Table 3 shows the average percentage of minority ethnicities in the bioeconomy companies that have 20% fewer board members in this category than the most innovative companies. This indicates clearly that the top 10 most innovative companies are seemingly more ethnically diverse than the pulp and paper companies. In addition, there are bioeconomy companies that have no ethnic diversity compared to the most innovative companies. Not only does this reduce the average for the bioeconomy companies, the outliers also skew the data negatively. The normal distribution depicts that bioeconomy companies’ ethnic diversity is dispersed more from their average of 15% than the most innovative companies with an average of 19% (Fig. 3).

Interestingly, the gender diversity between the two groups is identical (Table 4 and Fig. 4). Both bioeconomy companies and the most innovative companies have 25% females on the board. The normal distribution of the data also illustrates that not only is the average the same, but the diversity of the genders in the other companies is similar as well. While the numbers show equal diversity, it can be stated that true gender diversity exists only after the board of each company has 50% of both genders represented. The only company that approaches that number is Amazon. Further, there was no director on a board who did not fall into the categories male or female (gender neutral), and thus the categories included in the table are only male and female.

The average age of board of directors’ members in bioeconomy companies is 61 years. In comparison, the average age of those in the most innovative companies is 4% lower, 59 years (Table 5). Figure 5 illustrates the dispersion of their ages in the normal distribution. This clearly indicates that the age spread of the most innovative companies’ members is much greater than that of bioeconomy companies. Bioeconomy companies’ board members’ age is more concentrated around the average age of 61 and the most innovative companies have more diverse ages represented on their boards. This also illustrates that the ages of board of directors’ members in bioeconomy companies are more similar than for the most innovative companies.

Discussion and conclusions

Our research gives insight into the existing discussion on the impact of board diversity by using innovation as the dependent variable to compare two different company groups. Existing research has analyzed the effect of board composition by focusing either on gender or age diversity. In this article, multiple independent variables were addressed to determine which ones correlated most with innovativeness. Furthermore, we examined diversity in an industry that is not well known for its innovativeness and compared it to the underlying differences in the most innovative companies from the perspective of board diversity.

The composition of the board is an important variable in determining firm performance related to innovativeness. It was reported earlier (Pfeffer, 1972) that when the board size is large, individual directors may be less concerned about monitoring management and thus reduce the board’s oversight, which leads to lower financial performance. Interestingly, the same study also stated that boards with a large number of directors may not make effective strategic plans and decisions because of the many differences in ideas. However, in our study, diversity of thought was demonstrated from several perspectives (age, ethnicity, education) that create a distinct character for each group of companies to promote innovativeness. It should be noted that in our study the average number of board members (eleven) represented a relatively small board size.

We assessed global corporations with a variety of different governance models and structures. The most innovative companies are dominantly US-based and therefore, use the one-tier-system. However, bioeconomy companies are a mix of one-tier, two-tier, and Nordic systems. This difference in their governance structures creates some limitations in the study, including differences in the board’s ability to influence executive management. In addition, the differences in the shareholders’ role and the related board accountability affects the board’s agenda and its support of innovation. However, the board of directors can determine some of the key issues that drive innovation, including the ability to identify new business and value creation opportunities and react to them, regardless of the governance structure. In addition, some differences in the governance structures were diluted because of the large number of companies compared and the diversity metrics that were used.

Compared to other articles on board of directors’ effectiveness, many independent and dependent variables were used to answer the question of the way diversity affects innovativeness in highly ranked companies compared to bioeconomy companies. We argue that because diversity attributes combined with education are considered some of the fundamental aspects that influence the assortment of human ideas, opinions and team dynamics, the greater the diversity in these observed characteristics, the higher the likelihood for diversity of thought (Ely et al., 2012; Rabl and Triana, 2013; Harjoto et al., 2019).

Gender diversity was the only diversity-related attribute examined that did not differ between the bioeconomy and top ten most innovative companies. However, the board of directors of both groups are only 25% female, which is a low number compared to the 50% of females in the general population. Interestingly, the Stuart Board Index (SBI) found that the average percentage of women in all S&P 500 companies (comprises 5254 directors) is 26% (Stuart, 2019). This number is very similar to the 25% average we found for both innovative companies and pulp and paper companies in our study. While it is noteworthy that bioeconomy companies match the innovative companies’ gender diversity, more could be done to increase this diversity in both company groups. Prior research on this subject has shown that boards with a higher percentage of women have higher stock liquidity through better monitoring and oversight abilities and more stock price informativeness of their respective companies (Ahmed and Ali, 2017; Gul et al., 2011). Another variable in boards’ gender diversity is that there is a higher likelihood that women will be on a corporate board in countries with a narrow gender gap and less masculine cultures (Griffin et al., 2019). It must be stated that 90% of the most innovative companies analyzed in this paper are based in North America, compared to only 40% of the bioeconomy companies. Because of this high homogeneity in the most innovative companies’ home locations, it is difficult to evaluate the effect of countries with masculine cultures and those with a narrower gender gap. It should be stated also that all companies analyzed were largely global, which should offset some of the differences in their home locations.

While gender diversity is related positively to company performance, it has been shown that there must be at least three female directors on a board to have any positive influence (Liu et al., 2014). In this event, the bioeconomy companies were positioned better than the most innovative companies because 50% of the most innovative companies studied have fewer than 3 female directors, while 20% of the bioeconomy companies have fewer than 3. Gender diversity is limited not only to the influence on innovativeness performance. It can also contribute positively to the quality of the decisions high-level executives make to stimulate the development of organizational capabilities (Ruiz-Jiménez et al., 2016). It can be also stated that continuous development of organizational capabilities increases its innovation capabilities.

SBI also found that the mean age for board of directors’ members is 63 (Stuart, 2019), which is very similar to the average age of board members found in the bioeconomy companies. However, this figure is slightly, but clearly higher than the average age for the top ten innovative companies. This may imply that the number of younger board members affects a company’s innovativeness. Furthermore, the average age of new S&P 500 independent directors is 58 years, which indicates that more and more companies are recruiting younger directors. As bioeconomy companies have been established for longer than the top ten most innovative companies, this could mean that there is less board turnover in bioeconomy companies, which makes it more difficult to recruit from a more diverse group of leaders. Most directors (60%) retire at the age of 70, which leaves quite some time for bioeconomy company boards to wait to recruit new talent and more diverse leaders (Stuart, 2019). The most significant difference between the company groups was their ethnic diversity. The most innovative companies are 27% more ethnically diverse than are bioeconomy companies. Racial diversity contributes significantly to diversity in thought and decision-making (Galinsky et al., 2015; Bradbury and Kellough, 2008; Bottia et al., 2018). The large difference observed may be attributable to the market area in which they operate and their extent of global business operations. In addition, newer companies were founded in a time when the importance of ethnic diversity had been established, while the boards of bioeconomy companies were founded in an era that respected local cultural homogeneity over diversity as a success factor.

With respect to education, it was found specifically that the board members of the most innovative companies have higher levels of education than do those in bioeconomy companies. While the difference between a Bachelor’s and a Master’s degree is not great, it can make a difference when the average educational level of an entire board tends toward a higher level of education. A higher level of education can sometimes increase innovation activities, particularly in high tech sectors (Wincent et al., 2010; Soutaris, 2002). The most innovative companies had more engineering majors than did bioeconomy companies, although both industries’ products have a large engineering component. This is an interesting finding, as over a decade ago, bioeconomy companies focused more on technology-driven innovation. This has changed, and today these companies are recognized increasingly for developing new business models including services, in addition to brand owner, and consumer understanding (Berg and Lingqvist, 2019; Wessel, 2014). In contrast, the top ten most innovative companies are interested in developing uniquely differentiated products and services, not just their business models (Kerr, 2015). The correlation between a larger number of engineering majors and innovativeness is a testament to how important it is to continue to focus on core competencies and internal innovation and not just external business expansion. Lastly, it must be stated that the board members are not chosen solely because of broad diversity arguments. Each member must understand the earning logic, market dynamics, and the corporate governance model.

Data availability

All data generated or analyzed during this study are included in this published article. Raw data in Excel format are available from the corresponding author upon reasonable request.

References

Adams RB, Ferreira D (2009) Women in the boardroom and their impact on governance and performance J Financ Econ 94(2):291–309

Ahmed A, Ali S (2017) Boardroom gender diversity and stock liquidity: evidence from Australia. J Contemp Account Econ 13(2):148–165

Balas RM (2015) Competing via creation of distinctive organizational competences: “how to do it”. Ekonomski Vjesnik/Econviews: review of contemporary business. Entrepreneurship Econ Issues 28(1):143–159

Baregheh A, Rowley J, Sambrook S (2009) Towards a multidisciplinary definition of innovation. Manag Decision 47(8):1323–1339

Berg P, Lingqvist O (2019) Pulp, paper, and packaging in the next decade: transformational change. In: McKinsey & Company. www.mckinsey.com/industries/paper-forest-products-and-packaging/our-insights/pulp-paper-and-packaging-in-the-next-decade-transformational-change. Accessed Jul 1 2020

Blomqvist K, Harknink E, Kerssens-fan Drogenlon I et al. (2004) Measuring innovativeness-challenges and possibilities for knowledge-based firms. Paper presented at the 2004 IEEE International Engineering Management Conference, Singapore, pp. 530–535

Bottia MC, Mickenson RA, Giersch J et al. (2018) The role of high school racial composition and opportunities to learn in students’ STEM college participation. J Res Sci Teach 55(3):446–476

Bradbury MD, Kellough JE (2008) Representative bureaucracy: exploring the potential for active representation in local government. J Public Admin Res Theory 18:697–714

Braverman B (2019) A culture of inclusion: the board’s role in fostering companywide diversity. Director Board 43(5):44

Chan K, Mauborgne R (2009) How strategy shapes structure. Harvard Business Review. hbr.org/2009/09/how-strategy-shapes-structure. Accessed July 31 2020

Chen C (2019) Developing a model for supply chain agility and innovativeness to enhance firms’ competitive advantage. Manag Decision 57(7):1511–1534

Chen J, Leung WS, Evans KP (2018) Female board representation, corporate innovation and firm performance. J Empir Finan 48:236–254

Collins L (1994) Environmental performance and technological innovation: the pulp and paper industry as a case in point. Technol Soc 16(4):427–446

Dabbert S, Lewandowski I, Pyka et al. (2017) Transformation of economic systems: the bio-economy case. In: Dabbert S, Lewandowski I, Weiss J, Pyka A (eds), Knowledge-Driven Developments in the Bioeconomy - Technological and Economic Perspectives. Springer, pp. 3–16

Ehsan S, Yazdani N, De Leeuw S (2017) Supply chain integration strategies in fast evolving industries. Int J Logist Manag 28(1):29–46

Eloranta J (2019) Board of directors–focus on value creation. Keuruu, Finland

Ely RJ, Padavic I, Thomas DA (2012) Racial diversity, racial asymmetries, and team learning environment: effects on performance. Organ Stud 33(3):341–362

Fuente JA, García-Sánchez IM, Lozano MB (2017) The role of the board of directors in the adoption of GRI guidelines for the disclosure of CSR information. J Clean Prod 141:737–750

Galinsky A, Todd A, Homan A et al. (2015) Maximizing the gains and minimizing the pains of diversity: a policy perspective. Perspect Psychol Sci 10(6):742–748

Gaston C, Steven G, Ilan V (1995) Biotechnology in forestry: technological and economic perspectives. Technol Forecast Soc Chang 50(1):79–92

Genc TS, De Giovanni P (2020) Closed-loop supply chain games with innovation-led lean programs and sustainability. Int J Prod Econ 219:440–456

Gender diversity and corporate performance (2012) Credit Suisse: Research Institute. Accessed 31 Jul 2020

Gerstlberger W, Knudsen MP, Stampe I (2014) Sustainable development strategies for product innovation and energy efficiency. Bus Strategy Environ 23(2):131–144

Griffin DW, Li K, Xu T (2019) Board Gender Diversity and Corporate Innovation: International Evidence. J Financial Quant Anal 1–32. https://doi.org/10.1017/S002210901900098X

Gul FA, Srinidhi B, Ng AC (2011) Does board gender diversity improve the informativeness of stock prices? J Account Econ 51(3):314–338

Hakovirta M, Lucia L (2019) Informal STEM education will accelerate the bioeconomy. Nat Biotechnol 37(1):103

Harjoto MA, Laksmana I, Yang YW (2019) Board nationality and educational background diversity and corporate social performance. Corp Gov 19(2):217–239

Jari K, Sahebi D (2013) Customer needs linked to production strategy and firm’s dynamic capabilities. Manag Prod Eng Rev 4(2):63

Jyothirmayee CA, Sreelatha K, Rao YH (2016) Innovations in nanotechnology in water purification. Indian J Res Pharm Biotechnol 4(6):282–282

Karlsson H, Borjesson P, Hanssen P-A (2014) Ethanol production in biorefineries using lignocellulosic feedstock–GHG performance, energy balance and implications of life cycle calculation methodology. J Clean Prod 83:420–427

Keay A (2017) Stewardship theory: is board accountability necessary? Int J Law Manag 59(6):1292–1314

Kerr WR (2015) Innovation and Business Growth. In: Designing the Future: Economic, Societal and Political Dimensions of Innovation, edited by Austrian Council for Research and Training Development, Vienna, Austria, Echomedia Buchverlag, pp. 137–156

Kiel GC, Nicholson GJ (2003) Board composition and corporate performance: how the Australian experience informs contrasting theories of corporate governance. Corp Gov 11(3):189–205

Kim MS, Lee DH, Kim CH et al. (2015) Shell–core structured carbon fibers via melt spinning of petroleum- and wood-processing waste blends. Carbon 85:194–200

Kimberly JR (1981) Managerial innovation. Handbook of Organization Design. Oxford, England

Kose J, Senbet L (1998) Corporate governance and board effectiveness. J Bank Finan 22(4):371–403

Leszczyńska M (2018) Mandatory quotas for women on boards of directors in the European Union: harmful to or good for company performance? Eur Bus Organ Law Rev 19(1):35–61

Liu Y, Wei Z, Xie F (2014) Do women directors improve firm performance in China? J Corp Finance 28:169–184

Macaulay C, Richard O, Peng M et al. (2018) Alliance network centrality, board composition, and corporate social performance. J Bus Ethics 151(4):997–1008

Malik A, Lenzen M, Geschke A (2016) Triple bottom line study of a lignocellulosic biofuel industry. GCB Bioenergy 8(1):96–110

Most Innovative Companies (2018) Innovation and digital. Boston Consulting Group, www.bcg.com/publications/collections/most-innovative-companies-2018.aspx

Paine L, Srinivasan S (2019) A guide to the big ideas and debates in corporate governance. hbr.org/2019/10/a-guide-to-the-big-ideas-and-debates-in-corporate-governance. Accessed 31 Jul 31 2020

Pfeffer J (1972) Size and composition of corporate boards of directors: the organization and its environment. Admin Sci Quart 17:218–228

Rabl T, Triana MC (2013) How German employees of different ages conserve resources: perceived age discrimination and affective organizational commitment. Int J Hum Resour Manag 24(19):3599–3612

Ruiz-Jiménez JM, Fuentes-Fuentes M et al. (2016) Knowledge combination capability and innovation: the effects of gender diversity on top management teams in technology-based firms. J Bus Ethics 135(3):503–515

Soutaris V (2002) Firm-specific competencies determining technological innovation: a survey in Greece. R & D Manag 32:61–77

Stuart S (2019) 2019 Spencer Stuart Board Index. www.spencerstuart.com/-/media/2019/ssbi-2019/us_board_index_2019.pdf. Accessed 31 Jul 31 2020

Terjesen S, Sealy R, Singh V (2009) Women directors on corporate boards: a review and research agenda. Corp Gov 17(3):320–337

Thamhain HJ (2014) Assessing the effectiveness of quantitative and qualitative methods for R&D project proposal evaluations. Eng Manag J 26(3):3–12

Wessel M (2014) Why big companies can’t innovate. Harvard Business Review. hbr.org/2012/09/why-big-companies-cant-innovate. Accessed 31 Jul 2020

Wincent J, Anokhin S, Ortqvist D (2010) Does network board capital matter? a study of innovative performance in strategic SME networks. J Bus Res 63(3):265–275

Xinchun W, Arnett D, Hou L (2016) Using external knowledge to improve organizational innovativeness: understanding the knowledge leveraging process. J Bus Ind Market 31(2):164–173

Zahra SA, Covin JG (1994) The financial implications of fit between competitive strategy and innovation types and sources. J High Technol Manag Res 5:183–211

Author information

Authors and Affiliations

Contributions

All authors contributed meaningfully to this study.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hakovirta, M., Denuwara, N., Bharathi, S. et al. The importance of diversity on boards of directors’ effectiveness and its impact on innovativeness in the bioeconomy. Humanit Soc Sci Commun 7, 116 (2020). https://doi.org/10.1057/s41599-020-00605-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-020-00605-9

This article is cited by

-

The limitations of bioeconomy LCA studies for understanding the transition to sustainable bioeconomy

The International Journal of Life Cycle Assessment (2022)