Abstract

In 2021, governments of 51 countries spent US$697 billion on subsidizing fossil fuels. Removing fossil fuel subsidies is crucial not only for reducing CO2 emissions and making carbon pricing more effective, but also for making more valuable use of government funds. Currently, however, scientific evidence on the scale and scope of public attitudes towards fossil fuel subsidy-removal policies is lacking, yet it is instrumental for gauging political feasibility. Furthermore, previous studies tend to focus on carbon pricing in the developed world only. Here we present a comparative analysis of attitudes towards both carbon taxation and fossil fuel subsidy removal, focusing on five developing countries across four continents. It is found that (1) removing fossil fuel subsidies is not more undesirable than introducing carbon taxation and (2) the public has more-positive attitudes towards subsidy removal if optimal use of the saved fiscal revenues is specified.

Similar content being viewed by others

Main

To reach the CO2-emission reduction targets of the Paris Agreement’s Nationally Determined Contributions, a growing number of countries are considering implementing domestic carbon taxes. These would increase the price on fossil fuels (coal, natural gas, end-use electricity and petroleum) to decrease fossil fuel consumption (for example, Coalition of Finance Ministers). However, and repeatedly recognized during both the 26th UNFCCC Conference of the Parties (COP26) meeting in Glasgow and the recently finalized COP27 in Sharm el-Sheikh, many countries currently have policies that keep end-user prices artificially low through subsidies. This encourages increases in both production and consumption of fossil fuels and thus effectively counteracts the intended objective of carbon pricing. In addition, subsidies represent a burden on the governments’ fiscal budgets through deficits and revenue losses. The Organisation for Economic Co-operation and Development (OECD) found that tax breaks and spending programmes (fossil fuel support) in the G20 countries, linked to both the production and use of coal, oil, gas and other petroleum products, had risen to US$190 billion in 2021, a level that is higher than in previous years (30% higher than in 2020)1. The OECD and International Energy Agency (IEA) have also estimated that governments in 51 countries provided US$697.2 billion in fossil fuel subsidies in 2021, doubling the amount from 20202, an amount that is three times the annual amount needed to eradicate global extreme poverty3.

All these mentioned costs are, however, only the direct costs of the subsidies themselves. According to the International Monetary Fund (IMF), including also indirect costs (the contribution of fossil fuels to global warming, local air pollution and other externalities, and foregone consumption tax) would increase the figure for annual fossil fuel subsidies by around US$6 trillion, or 6.5% of global GDP3,4. They also find that 45% of the benefits from direct fossil fuel subsidies goes to the richest quintile, while only 7% goes to the poorest 20% of the population5.

Removing subsidies on all fossil fuels simultaneously should be the natural first step to reduce CO2 emissions6 since removing subsidies only on some fossil fuels will risk increasing the consumption of another, still subsidized, fossil fuel (compare ref. 7). Particularly in developing countries, increasing fiscal revenues originated from savings from removed fossil fuel subsidies can be used for welfare-enhancing projects (for example, investments in health care and education) and spurring economic growth8 and eradicate the regressivity of the existing subsidies.

These issues have started to be acknowledged also by world leaders, for example, in the Glasgow Climate Pact at the 2021 COP26, which calls for “accelerating efforts toward the phase-out of […] inefficient fossil fuel subsidies, recognizing the need for support toward a just transition”.9 The concept of just transitions implies recognizing and attempting to counteract the profound societal impacts that a shift towards a low-carbon future implies, not the least in the form of job losses due to fossil fuel industry decline and uneven distribution of costs and benefits both within and between countries (for example, ref. 10). Given that such a shift may have immediate negative consequences for individuals and groups, the political feasibility of removing fossil fuel subsidies in any country highly depends on the degree of public acceptability of such a policy11,12.

Numerous scholars and policy experts have advocated putting a price on carbon as a highly cost-effective way to reduce GHG emissions13,14. Introducing such policies has, however, become a vexing problem for decision makers worldwide. The examples of Australia in 2015, France in 2018 and Ecuador in 2019 demonstrate how widespread the public’s negative attitudes towards carbon taxes and removal of fossil fuel subsidies seem to be, and thus how difficult they are to implement. Several factors are known to determine policy attitudes, including perceptions of fairness, effectiveness, political trust and climate concern15 (compare refs. 16,17,18,19,20,21.) Political feasibility of carbon-pricing implementation and subsidy removal requires that one measures and analyzes how public opposition can be minimized. Such analyses are indeed crucial for stakeholders, policymakers and academics involved in climate change and policymaking. The empirical analysis of political feasibility, balancing effectiveness and cost efficiency with public acceptability, is imperative, especially as policymakers tend to be reluctant to introduce policies if levels of public acceptability are low22. From a theoretical perspective, understanding why certain policies generate negative perceptions, and the extent to which a design of a policy measure affects mass policy attitudes, is of great interest since it speaks to theories of policy feedback and how policy design can create its own constituency of support (for example, refs. 23,24)

In light of this, a number of recent experimental survey studies have suggested policies that could make carbon pricing more readily acceptable to the public, for example, fee-and-dividend approaches25 (feebates), earmarking of tax revenues for necessary investments26 and even rhetorical shifts from ‘tax’ to ‘fee’27. These studies have focused mostly on (1) carbon taxation and (2) the developed world. Far fewer studies are concerned with public attitudes towards climate policy in developing countries, and even fewer, if at all, with attitudes towards the removal of fossil fuel subsidies as a climate change mitigation strategy15. However, considering the literature focusing on both contextual drivers of climate policy attitudes (for example, ref. 21) and cross-national patterns in carbon pricing (for example, ref. 28), we do not expect that attitudes and attitude formation differ systematically between the Global North and Global South. We rather assume that both attitudes and policy are sensitive to a range of complex and country-specific factors.

By using a 1 × 7, pre-registered, factorial-design survey experiment (N = 6,636), we make the following contributions to the related literature. (1) We consider five developing countries (Ecuador, Egypt, India, Indonesia and Mexico) that currently subsidize both consumption and production of fossil fuels. We select these countries because they have some of the highest levels of subsidies on consumption of fossil fuels29. (2) We analyse public attitudes in these countries towards (a) the introduction of a carbon tax and (b) the removal of subsidies on both industrial and private consumption of fossil fuels. (3) We examine whether and how attitudes towards subsidy removal and carbon taxation may differ from each other. (4) We compare attitudes towards removal of subsidies on private consumption of fossil fuels with those towards removal of subsidies on fossil fuels for industrial use. (5) We study whether policies that reallocate money spent on fossil fuel subsidies to investments that increase social and economic welfare systems lead to more-positive attitudes towards subsidy removal (refs. 26,30,31). At the outset, we report that optimal use of savings from subsidy removal has positive effects on public attitudes.

In our survey, the respondents were also asked about their social and economic characteristics, whether they own a fossil fuelled vehicle and their views regarding various climate change scenarios (Supplementary Information). In addition, we empirically analyse the effects of these variables on their policy attitudes.

We proceed from the well-established hypothesis that an important driver of policy attitudes is the balance of perceived personal costs and benefits of a proposed policy32,33,34,35. First, we hypothesize that acceptance of removing fossil fuel subsidies will be lower than the corresponding attitude to introducing a carbon tax, as the former indicates a more visible and direct loss of money for the consumer compared with the indirect workings of a tax.

H1: The public acceptance of removing subsidies on fossil fuels is lower than the public acceptance of introducing a CO2 tax on fossil fuels.

Second, a range of studies (for example, refs. 36,37) have demonstrated how individuals display more-positive attitudes towards policies directed towards industry rather than towards themselves, in much the same way as people in general tend to prefer less-stringent policies over more-coercive ones (for example, ref. 38). This might be due to both general beliefs concerning how the proposed policy will have direct implications for personal welfare (personal outcome expectancies)33 and distributional preferences driven by the attitude that industry rather than individuals should bear the main costs of climate change39. As such, we hypothesize that people dislike policies that imply direct personal costs more than policies aimed towards industry, even if these might indirectly affect consumer prices, and that public acceptance of removing fossil fuel subsidies for private consumption therefore is lower than for those for industrial use.

H2: The public acceptance of removing fossil fuel subsidies for private consumption is lower than the public acceptance of removing fossil fuel subsidies for industrial use.

Moreover, a growing body of research concludes that negative attitudes towards price-based climate policy tools can be alleviated through policy design, in particular revenue recycling, where a price increase is combined with a specified use of the available public funds26,31 (but see ref. 30). Although research is somewhat inconclusive concerning the attitudinal effects of different forms of revenue recycling (for example, fee-and-dividend solutions, increased investments in welfare systems (for example, education and health care) and using revenues for specific climate-related projects), we nevertheless expect that transparency in the use of generated public funds will trigger more-positive attitudes compared with non-specified use of public funds19,40. Such additional information aims to prevent people’s perception that the subsidy removal is only an increased cost for the household.

H3: Compared with non-specified revenue use, the public acceptance of removing fossil fuel subsidies for private consumption is higher when revenue use is specified.

Public attitudes towards fossil fuel subsidy removal

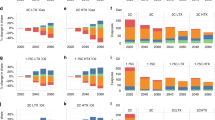

To determine how different policy designs affect public policy support, as well as test our three hypotheses (H1, H2 and H3), we randomly assigned the respondents to one of a total of seven groups (Methods). On a 0–10 scale, the average support is 6.22 for removing industrial-use subsidies, 6.31 for removing subsidies on private consumption of fossil fuels and 6.33 for introducing a carbon tax. Apparently, the differences between these numbers are small. The statistical testing of the means (M) confirms this as well. When t testing the differences between the proposal of removing subsidies on private consumption (M = 6.31, s.d. = 2.67) and the introduction of a carbon tax (M = 6.33, s.d. = 2.77), we find no statistically significant differences (t(1,893.16) = –0.1604, P = 0.4363). The first hypothesis is thus rejected. Nor do we find any differences between attitudes toward removing subsidies on industrial-use fossil fuels (M = 6.22, s.d. = 2.57) and subsidies on private consumption of fossil fuels (M = 6.31, s.d. = 2.67) (t(1,896.18) = 0.6985, P = 0.7575). Hence, we reject H2.

Revenue recycling and fossil fuel subsidy removal

As a next step, we investigate whether people’s attitudes towards the removal of subsidies on private consumption of fossil fuels are impacted when four alternative uses of fiscal revenues saved from such removals are part of the proposed policy. In addition to the proposal to remove subsidies on private consumption of fossil fuels, the respondents were randomly assigned five different alternatives for revenue use: investments to enhance welfare in society (for example, education and health care), income tax reductions, investments in climate adaptation measures, cash transfers to the poor and most-affected households and no information about revenue use.

When aggregating the groups where revenue use is specified (M = 6.49, s.d. = 2.59) and comparing them with the group with unspecified revenue use (M = 6.31, s.d. = 2.67), we find a significant difference (t(1,428.25) = 1.88, P = 0.03). In line with H3, public acceptance of removing subsidies for private consumption of fuels is higher when revenue use is specified, as compared with non-specified revenue use. Considering the treatment groups separately, we find that private-consumption subsidy removal reaches a higher level of acceptance if revenues are directed towards investments in welfare systems (M = 6.59, s.d. = 2.55) compared with a non-specified use (t(1,893.68) = 2.36, P = 0.01) or towards investments in climate adaptation (M = 6.62, a.d. = 2.65) compared with non-specified revenue use (t(1,887.99) = 2.57, P = 0.01). However, we do not find any statistically significant differences between a proposal to use fiscal revenues to reduce income taxes (M = 6.25, s.d. = 2.48) or to provide cash transfers to the poor and most-affected households (M = 6.49, s.d. = 2.66) and non-specified revenue use (M = 6.31, s.d. = 2.67): (t(1,884.34) = –0.50, P = 0.69) and (t(1,894) = 1.53, P = 0.06), respectively. Taken together, we cannot reject our third hypothesis. Attitudes towards removing subsidies can turn more positive when revenue use is specified. However, these results are also dependent on the type of revenue recycling proposed. Whereas investments overall drive more-positive attitudes, monetary compensation (either to all or to the most affected) does not.

Cross-national comparison of public attitudes

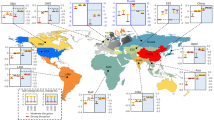

When we, more exploratorily, consider each of our countries (Ecuador, Egypt, India, Indonesia and Mexico) individually, we find that the attitudes towards fossil fuel subsidy removal are on the same level as attitudes towards the introduction of a carbon tax. In the comparison, Egypt constitutes an exception, with the least positive attitudes towards removal of fossil fuel subsidies for industrial use (M = 5.4) and private consumption (M = 5.3) compared with averages in the other countries of 6.2 for industrial use and 6.3 for private consumption (Fig. 1). Overall, from our results, we can conclude that the resistance towards (or acceptance of) the removal of fossil fuel subsidies is on par with the public opinion on introducing taxes on CO2.

A commitment to use the tax money saved from removing existing subsidies in a way that benefits stakeholders will increase the level of public acceptance. At the country level, we find that the use of revenues for ‘investment in climate adaptation’ is the most popular alternative in both Mexico and Ecuador, while it is the least popular alternative in Egypt (Fig. 2). These results indicate that there are potentially important country-specific characteristics that should be considered by policymakers aiming to remove fossil fuel subsidies. In this explorative part of our study, we do not have any causal claims or hypotheses regarding mechanisms. However, factors such as cultural differences, tax levels and differences in welfare programmes could potentially explain country variation in support for various uses of revenues.

Discussion

Contrary to our expectations, when investigating public opinion on the removal of existing fossil fuel subsidies in five developing countries, we do not find the attitude towards removal of existing subsidies to be more negative than that towards the introduction of a carbon tax. Our study is unique in its focus on fossil fuel subsidies, and there are, currently, not many studies with which we can compare our findings. Therefore, there are reasons to be cautious and not draw any conclusions regarding the level of support for fossil fuel subsidy removal in these countries. Survey research is always sensitive to certain formulations and sampling strategies, and we know, from both previous studies and a range of real-world examples, that carbon pricing is indeed politically challenging and that rising fuel prices have spurred resistance in many countries across the world. However, one way of interpreting our results is that the public in fact considers a subsidy-removal policy as being equally acceptable (or not acceptable) as the introduction of a carbon tax. If this is the case, we should expect real-life suggestions for subsidy removal to be met with similar public opposition or acceptability as we have seen for other carbon-pricing measures. Furthermore, another finding from our study is that attitudes can be affected (in this case, increasing public acceptance) by combining a possible subsidy removal with a revenue-recycling policy. Yet again, we call for more studies to be able to more thoroughly evaluate and calibrate the size and strength of this effect. However, the results so far correspond with previous research on carbon pricing, consistently showing that revenue recycling increases support for such policies25,26,27. We also find that the respondents’ concern for climate change appears to be a strong driver of policy attitudes, which has also been previously shown to be a strong predictor of climate policy support in the Global North15, and finally that the impact of revenue recycling varies across the five countries (compare ref. 31).

These findings may have important policy implications. First, our overall results concerning policy attitudes imply that removing subsidies on fossil fuels may not present much more of a political challenge than introducing carbon taxation. More important, by specifying alternatives for revenue recycling where public funds currently used for subsidies are instead directed towards other public investments, the level of acceptability may increase. However, the answer to the question of which specific investments are the most popular seems to be determined by national context. This further highlights the need for careful country-specific empirical investigations to determine preferred options for revenue recycling among the public, before making political decisions to remove or roll back existing fossil fuel subsidies.

The study has other limitations. Although conducted over several continents, the total number of countries is small, and there are probably important nuances to be grasped by extending the sample to other countries using representative samples. Furthermore, neither different levels of subsidy cuts nor any variation in how quickly the subsidies should be removed is specified by the study. From previous research, however, we can expect that such elements of policy design do affect policy attitudes. In addition, fuel prices are always fluctuating, and the survey was conducted before the notable rise in energy prices caused partly by the conflict in Ukraine. Furthermore, the current experimental design has no control group to benchmark the treatment groups against.

A venue for future research is to study the degree to which public acceptance of various policy instruments is affected by such price fluctuations. Furthermore, future research should test similar hypotheses where respondents are provided with more information on how certain policy instruments work. Misunderstanding, or lack of information, might be part of the explanation to the similar support for removing subsidies on fossil fuels and introducing a carbon tax. Developing a more innovative design, including a control group, may also be a future avenue to consider.

Our study is one of rather few investigating attitudes towards climate policy instruments in the Global South. As these countries are parties of the Paris Agreement and thereby struggle to find ways to limit their emissions, there is an increasing need for knowledge on attitudes and attitude formation in contexts outside the Global North. Simultaneously, there is a need for studies targeting actors’ (citizens, consumers, business and other stakeholders) acceptance of subsidy removals in specific contexts. This need is palpable in both the developing and developed countries as subsidies on fossil fuel consumption and production do exist also within the OECD member states and since the formation of policy attitudes is probably driven by a range of complex country- and situation-specific factors.

Finally, since climate change concern is a factor that significantly affects policy attitudes, further public and media attention assigned to climate change may make subsidy removals more conceivable and open up promising avenues for developing countries to contribute to the global mitigation of climate change. At the same time, fossil fuel subsidy removal frees public funds for investing in social and economic development, which would be of great value and use in many developing countries.

Methods

We conducted an online survey experiment (carried out through YouGov) in five countries. Our sample is based on pooled groups from Ecuador, Egypt, Mexico, Indonesia and India, which all have substantial consumption- and production-based fossil fuel subsidies. We had slightly more than 1,000 respondents in Ecuador and slightly more than 1,400 in each of the other countries, all of whom were asked about their support/acceptance of climate policy introduction. We use a 1 × 7 factorial survey experiment where respondents participating in the study were randomly exposed to different kinds of policy measures (treatments), which they were asked to evaluate (hypotheses pre-registered at OSF Registries41). (1) One group gave their opinion about the proposal of introducing a carbon tax in their country (as a point of reference for us to compare with the other proposals). (2) One group gave their opinion about the proposal of removing the current industrial subsides to fossil fuels in their country. (3) One group gave their opinion about the proposal of removing the current private-consumption subsides to fossil fuels in their country. Four different groups gave their opinion about the proposal of removing the current consumption subsides on fossil fuels in their country plus any of the following additional policies: (4) use the surplus funding for general welfare purposes (for example, improved health or education), (5) use the surplus funding to compensate for a general reduction of the income tax, (6) use the surplus funding for climate change adaptation projects (for example, flooding prevention) and (7) use the surplus funding for cash transfer to the poor most-affected households to keep their welfare levels unchanged.

Following previous research demonstrating how factors at the individual level affect policy attitudes, the study includes both beliefs (climate concern) and standard socioeconomic items (age, sex, income, education and urban/rural place of residence).

Sample and respondents

The samples are based on quota criteria. That is, the probability for each individual who could theoretically be included is not determined in advance but is based on their demographic background information, such as gender, age and region, from population statistics/census from each country.

Respondents participating in the study were randomly exposed to different kinds of policy measures (treatments). They did not know the treatment group to which they had been assigned. Subsequent to the question on policy support, they were asked to state their evaluative response to the specific policy. The respondents also answered survey questions regarding their gender, age, educational background, household income level, area of residence and climate concern.

Data collection

Data were collected by YouGov. YouGov uses their proprietary panels and proprietary sampling technology. YouGov begins by framing quotas on the basis of the census of the named populations. This frame is the basis on which the sampling software controls the flow of members into each survey. The sampling system will randomly select from each panel and allocate to surveys according to the quotas set. Panellists receive an invitation email containing a survey link. When they access the link, the router checks against quotas on all live surveys and allocates them to a survey they qualify for.

Statistical analysis

All the samples from the different countries were pooled when testing H1, H2 and H3. With 1,400 respondents in four countries and 1,000 respondents in one country, the total sample contained 6,600 respondents. These were then divided into seven groups (1,000 respondents in each group). To test H1, H2 and H3, we used independent-sample one-sided t tests and ordinary least-squares regression models with robust standard errors (results reported in Supplementary Information). We used the standard P < .05 criterion for determining whether there are differences between the groups. Hypotheses H1, H2 and H3 were supported if the null was rejected, and the estimates are statistically significant and have the expected signs and directions for both these tests. To test H3, group 3 was compared with an aggregated group based on group 4, group 5, group 6 and group 7. For the exploratory part where we investigated the role of individual factors for policy support, we used ordinary least-squares models.

Ethics

This study has been reviewed and approved by the legal division of Luleå University. In addition, the survey company (YouGov) has all the required permits and obtained informed consent from all participants.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

Data for replication are available via the Harvard Dataverse 41: https://doi.org/10.7910/DVN/0SU8CJ

Code availability

The code for the statistical analysis is available via the Harvard Dataverse41: https://doi.org/10.7910/DVN/0SU8CJ

References

Update on Recent Progress in Reform of Inefficient Fossil-Fuel Subsidies that Encourage Wasteful Consumption (OECD and IEA, 2021); http://www.oecd.org/fossil-fuels/publicationsandfurtherreading/OECD-IEA-G20-Fossil-Fuel-Subsidies-Reform-Update-2021.pdf

Support for Fossil Fuels Almost Doubled in 2021, Slowing Progress Toward International Climate Goals, According to New Analysis from OECD and IEA (OECD, 2022); https://www.oecd.org/newsroom/support-for-fossil-fuels-almost-doubled-in-2021-slowing-progress-toward-international-climate-goals-according-to-new-analysis-from-oecd-and-iea.htm

Alternative Uses of Pre-tax Fossil-Fuel Subsidies per Year (UNDP, 2021).

Parry, I., Black S. & Vernon, N. Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies (IMF, 2021).

Coady, D., Flamini, V. & Sears, L. The Unequal Benefits of Fuel Subsidies Revisited: Evidence for Developing Countries (IMF, 2015).

Mundaca, G. How much can CO2 emissions be reduced if fossil fuel subsidies are removed? Energy Econ. 64, 91–104 (2017).

Freire-González, J. & Ho, M. S. Policy strategies to tackle rebound effects: a comparative analysis. Ecol. Econ. 193, 107332 (2022).

Mundaca, G. Energy subsidies, public investment and endogenous growth. Energy Policy 110, 693–709 (2017).

Glasgow Climate Pact FCCC/PA/CMA/2021/L.16 (UNFCCC, 2021).

Wang, X. & Lo, K. Just transition: a conceptual review. Energy Res. Soc. Sci. 82, 102291 (2021).

Zheng, Z., Liu, Z., Liu, C. & Shiwakoti, N. Understanding public response to a congestion charge: a random-effects ordered logit approach. Transp. Res. A 70, 117–134 (2014).

Jagers, S. C., Matti, S. & Nordblom, K. The evolution of public policy attitudes: comparing the mechanisms of policy support across the stages of a policy cycle. J. Public Policy 40, 428–448 (2020).

Sterner, T. et al. Policy design for the Anthropocene. Nat. Sustain. 2, 14–21 (2019).

Effective Carbon Prices (OECD, 2013); https://doi.org/10.1787/9789264196964-en

Bergquist, M., Nilsson, A., Harring, N. & Jagers, S. C. Meta-analyses of fifteen determinants of public opinion about climate change taxes and laws. Nat. Clim. Change 12, 235–240 (2022).

Baranzini, A. et al. Carbon pricing in climate policy: seven reasons, complementary instruments, and political economy considerations. WIREs Clim Change 8, e462 (2017).

Baranzini, A. & Carattini, S. Effectiveness, earmarking and labeling: testing the acceptability of carbon taxes with survey data. Environ. Econ. Policy Stud. 19, 197–227 (2017).

Kallbekken, S. & Aasen, M. The demand for earmarking: results from a focus group study. Ecol. Econ. 69, 2183–2190 (2010).

Hammar, H. & Jagers, S. C. Can trust in politicians explain individuals’ support for climate policy? The case of CO2 tax. Clim. Policy 5, 613–625 (2006).

Thalmann, P. The public acceptance of green taxes: 2 million voters express their opinion. Public Choice 119, 179–217 (2004).

Drews, S. & van den Bergh, J. C. J. M. What explains public support for climate policies? A review of empirical and experimental studies. Clim. Policy 16, 855–876 (2016).

Burstein, P. The impact of public opinion on public policy: a review and an agenda. Polit. Res. Q. 56, 29 (2003).

Stimson, J. A. Public Opinion in America: Moods, Cycles, and Swings (Westview Press, 1999).

Wlezien, C. & Soroka, S. N. Political institutions and the opinion–policy link. West Eur. Polit. 35, 1407–1432 (2012).

Jagers, S. C., Lachapelle, E., Martinsson, J. & Matti, S. Bridging the ideological gap? How fairness perceptions mediate the effect of revenue recycling on public support for carbon taxes in the United States, Canada and Germany. Rev. Policy Res. 38, 529–554 (2021).

Carattini, S., Kallbekken, S. & Orlov, A. How to win public support for a global carbon tax. Nature 565, 289–291 (2019).

Löfgren, Å. & Nordblom, K. Puzzling tax attitudes and labels. Appl. Econ. Lett. 16, 1809–1812 (2009).

Mahdavi, P., Martinez-Alvarez, C. B. & Ross, M. L. Why Do Governments Tax or Subsidize Fossil Fuels? CGD Working Paper 541 (CGD, 2020).

Energy Subsidies, Tracking the Impact of Fossil-Fuel Subsidies (IEA, 2021); https://www.iea.org/topics/energy-subsidies

Mildenberger, M., Lachapelle, E., Harrison, K. & Stadelmann-Steffen, I. Limited impacts of carbon tax rebate programmes on public support for carbon pricing. Nat. Clim. Change https://doi.org/10.1038/s41558-021-01268-3 (2022).

Beiser-McGrath, L. F. & Bernauer, T. Could revenue recycling make effective carbon taxation politically feasible? Sci. Adv. 5, eaax3323 (2019).

Bernauer, T. & McGrath, L. F. Simple reframing unlikely to boost public support for climate policy. Nat. Clim. Change 6, 680–683 (2016).

Kallbekken, S., Garcia, J. H. & Korneliussen, K. Determinants of public support for transport taxes. Transp. Res. A 58, 67–78 (2013).

Schuitema, G., Steg, L. & Forward, S. Explaining differences in acceptability before and acceptance after the implementation of a congestion charge in Stockholm. Transp. Res. A 44, 99–109 (2010).

Lubell, M., Zahran, S. & Vedlitz, A. Collective action and citizen responses to global warming. Polit. Behav. 29, 391–413 (2007).

Rinscheid, A., Pianta, S. & Weber, E. U. Fast track or slo-mo? Public support and temporal preferences for phasing out fossil fuel cars in the United States. Clim. Policy 20, 30–45 (2020).

Harring, N., Jagers, S. C. & Matti, S. The significance of political culture, economic context and instrument type for climate policy support: a cross-national study. Clim. Policy 19, 636–650 (2019).

Attari, S. Z. et al. Preferences for change: do individuals prefer voluntary actions, soft regulations, or hard regulations to decrease fossil fuel consumption? Ecol. Econ. 68, 1701–1710 (2009).

Cai, B., Cameron, T. A. & Gerdes, G. R. Distributional preferences and the incidence of costs and benefits in climate change policy. Environ. Resour. Econ. 46, 429–458 (2010).

Kallbekken, S. & Sælen, H. Public acceptance for environmental taxes: self-interest, environmental and distributional concerns. Energy Policy 39, 2966–2973 (2011).

Harring, N., Jönsson, E. Matti, S., Mundaca, G. & Jagers, S. C. Replication data for: cross-national analysis of attitudes towards fossil fuel subsidy removal (OSF Registries, 2022, and Harvard Dataverse, 2023); https://doi.org/10.17605/OSF.IO/89CWY; https://doi.org/10.7910/DVN/0SU8CJ

Acknowledgements

We are grateful for financial support from FORMAS—the Swedish research council for Sustainable Development, 2019-00916, 2019-02005; the Swedish Research Council, 2016-03058; the Swedish Energy Agency, 2019-006655.

Funding

Open access funding provided by University of Gothenburg.

Author information

Authors and Affiliations

Contributions

S.C.J. initiated the study. N.H., E.J., S.M., G.M. and S.C.J. conceptualized the paper and designed the survey experiments and contributed to the interpretation of the results. E.J. performed the analyses and implemented the data presentation and visualization with contribution from N.H., S.M., G.M. and S.C.J. G.M. provided statistics on fossil fuel consumption, production and subsidies. Finally, N.H., E.J., S.M., G.M. and S.C.J. wrote the main manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Climate Change thanks Ayşe Uyduranoğlu and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Sections 1–6.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Harring, N., Jönsson, E., Matti, S. et al. Cross-national analysis of attitudes towards fossil fuel subsidy removal. Nat. Clim. Chang. 13, 244–249 (2023). https://doi.org/10.1038/s41558-023-01597-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41558-023-01597-5

This article is cited by

-

Least developed countries versus fossil fuel incumbents: strategies, divisions, and barriers at the United Nations climate negotiations

International Environmental Agreements: Politics, Law and Economics (2024)