Abstract

The paper aims to investigate the impact of board gender diversity in explaining the relationship between bank disclosure and the predicted probability of banking crises in Africa. The study employs robust panel estimates based on an aggregate dataset of banks in 42 African countries over the 2006–2018 periods. From the study, board gender diversity (more women on boards and the presence of women on boards) has a positive impact on information disclosure of banks. We find that board gender diversity and bank disclosure have the possibility of reducing a banking crisis. We observe that board gender diversity enhances the reductive effect of bank disclosure on a predicted probability of a banking crisis. The implication is that women on boards provide prudent decisions on financial information disclosure that significantly reduce the possibility of a banking crises in order to ensure stable banking systems.

Similar content being viewed by others

Introduction

In recent years, the banking crises has become common occurrence and periods of crises have brought a certain level of disruption in most economies, not only in Africa but the world at large (Hoggarth et al., 2001). The need for greater monitoring of banks has emerged due to the common occurrences of banking crises. One possible way to instil market discipline in the monitoring process is through the inclusion of managers who have distinctive characteristics and in turn, can offer a great opportunity to influence the board’s decisions, and improve banking system stability (Al-Amarneh et al., 2017). Corporate governance literature show that women contribute unique benefits and resources, as they tend to bring diverse backgrounds, human capital and provide the board with unique information needed to address agency problems, foster stakeholder value and aid mitigate possible crisis situations (Qi and Tian, 2012; Carter et al., 2010; Grassa, 2018). However, the threat of disciplining action by market participants (particularly, depositors and investors) puts management under heightened scrutiny which encourages greater prudence and efficiency among board members. Moreover, early detection of banks’ risk exposures, weak governance system and banking can contain the problem in a specific bank from spreading to the entire industry. Thus, the amount of information that banks disclose matter because the absence of information prevents market discipline from taking place. The attention given to banking information disclosure and the role that board gender diversity plays in moderating the amount of information disclosed in the banking sector, particularly in Africa, is yet to gain empirical support in the literature.

This study seeks to examine the impact of board gender diversity in explaining the relationship between banking information disclosure and the banking crisis in Africa. In line with the wake-up call hypothesis, this study first provides the relationship between board gender diversity and disclosure in the African banking system. It shows that board gender diversity increases information disclosure of banks and supports the argument of Lara et al. (2017). Disclosure can be defined as the act of releasing all relevant financial information pertaining to a bank that may influence an investment decision (Baumann and Nier, 2004; Linsley and Shrives, 2005; Lanam, 2007). Corporate governance literature has explained the effect of governance on information disclosure among banks (Bidabad et al., 2017; Bidabad and Sherafati, 2019). For instance, Bidabad and Sherafati (2019) explained that a better governance system results in achieving goals like accountability, transparency and protection of shareholders’ rights. Therefore, a better governance system enhances disclosure. Despite the extant literature on the effect of individual characteristics of corporate governance on corporate disclosure from a different context (Chantachaimongkol and Chen, 2018; Al-Janadi et al., 2016; Akhtaruddin et al., 2009; Aksu and Kosedag, 2005), less attention has been given to the effect of board gender diversity on bank disclosure, particularly in Africa. For instance, Chantachaimongkol and Chen (2018) show that the extent of corporate disclosure in ASEAN is positively linked to the number of board meetings, but it is negatively linked to board size, and board independence. In line with this argument, few studies have analysed board gender diversity on corporate disclosure (Terjesen et al., 2015). The current study fills this gap by examining the effect of board gender diversity on bank disclosure in Africa.

Secondly, it shows the independent effect of board gender diversity and disclosure on the possibility of a banking crisis. While the resource dependency theory is expected to predict a negative relationship between board gender diversity and banking crises, the signalling theory is expected to predict a negative relationship between bank disclosure and banking crisis. The resource dependency theory recognizes the need for women’s participation in top hierarchy roles in corporate governance and that firms can depend on women in corporate boardrooms as resources to enhance firm value. This supports the work by Adeabah et al. (2018), who found that female directors on boards promote bank efficiency. However, studies have not provided empirical evidence on how board gender diversity helps in reducing possible banking crises in order to achieve a stable banking system (see, Oba and Fodio, 2013; Owen and Temesvary, 2018; Pathan and Faff, 2013). The signalling theory posits that firms with good performance tend to make voluntary disclosures more readily, as doing so is regarded as an easy means for the company to distinguish itself from its peers (Bhattacharya and Ritter, 1983), hence leading to a lower possibility of a crisis in the banking system. Existing studies debate that disclosure is good for banks as it offers greater prudence (Hossain, 2008; Eng and Mak, 2003; Chau and Gray, 2002) while others argue that disclosure is bad for banks since banks have a general tendency to under disclose (Clatworthy and Jones, 2006). Banks may have the ability to use greater information disclosure as a signal to attract more deposits (Grassa, 2018), and hence increase bank performance. However, full bank disclosure is not the optimal choice for banks and may affect bank performance differently. Given that, existing literature shows a positive impact of board gender diversity and bank disclosure on performance, the question, however is, whether or not board gender diversity and bank information disclosure lead to a reduction in possible banking crisis?

Moreover, there has been an increasing number of women in top management and this has increased research in the area of board gender diversity. Conversely, research explaining the relationship between gender diversity on board and disclosures on the possibility of the banking crisis is still growing in the banking sector. The study argues that increased disclosure and presence of women on boards should reduce the possibility of a crisis. This is because board gender diversity provides managers with unique information that allows for better decision-making and financial reporting (Qi and Tian, 2012) and increases public disclosure (Adams and Ferreira, 2009) and corporate performance (Campbell and Minguez-Vera, 2008). Therefore, reporting or communicating information about a bank’s financial conditions reduces information asymmetry between the bank and market participants while the diverse roles of women on boards provide an incentive in protecting the interest of stakeholders, thereby reducing agency problems and the possibility of a banking crisis. The study fills this gap by providing evidence to support the independent relationship between board gender diversity (women on boards) and bank disclosure and a predicted probability of banking crisis.

Finally, the study investigates the role of board gender diversity in explaining the relationship between bank disclosures and banking crises. For a bank to operate efficiently, improve performance, reduce the future occurrence of crisis and control its risk exposures prudently, it is important to understand board gender diversity and bank information disclosure. This can be argued in relation to prior disclosure studies that combine corporate governance and directors’ financial information experience with disclosures (Erhardt et al., 2003; Matsunaga and Yeung, 2008; Chau and Gray, 2002). For instance, Erhardt et al. (2003) explained that gender diversity leads to improved performance and better financial performance leads to an increase in the amount of information disclosed by firms (Nalikka, 2009) in developed economies. Further, theoretical ambiguity surrounding the role of gender diversity amidst the growing number of women in management in explaining the relationship between information disclosure and banking crisis, emphasizes the need for empirical analysis in ascertaining the effects. Nevertheless, to date, it appears there is a lack of studies that have dwelt on this gap in empirical literature from an African perspective.

Given the discussion above, the paper contributes to bank governance literature by specifically considering the impact of board gender diversity on bank disclosure in Africa. The paper contributes to the board gender diversity and corporate disclosure literature by offering new insight into the influence of women on boards and bank disclosure on the possibility of a banking crisis occurring in Africa. Further, the paper contributes to the literature by providing insight for managers, shareholders, researchers and policymakers to estimate the role of women on boards in empirically explaining the disclosure-banking crisis nexus from an African perspective. Africa presents an interesting case because the banking crisis occurs at unknown intervals throughout history in some African countries (Laeven and Valencia, 2018). Moreover, there have been several changes to governance standards and voluntary disclosure framework among banks in Africa (Egboro, 2016; Adeabah et al., 2018). It is on this premise that the study empirically examines the role of board gender diversity (women on boards) in explaining the relationship between bank disclosures and the banking crisis in Africa.

The rest of the work is organized into four sections. Literature review of related studies is contained in the section “Literature review: theories, empirics and hypothesis development”, and section “Data and methodology” discusses the data and methodology. The empirical results are contained in section “Empirical results and discussion” and section “Conclusion and policy implications” concludes the study.

Literature review: theories, empirics and hypothesis development

This study draws inspiration from theories associated with corporate governance, financial disclosure and banking crisis. These include the resource dependency theory and the signalling theory. In line with board gender diversity–corporate disclosure nexus, the resource dependence theory explains the rationale for the board’s function of linking a firm to the external environment, providing advice and counsel and meeting the information needs of the various stakeholders (Hillman and Dalziel, 2003; Bear et al., 2010). The diversity characteristics of the board members that have been discussed in the current literature are board gender diversity. Board gender diversity is a mechanism to improve and increase corporate governance and disclosure. The diversity of the board brings different views and perspectives and problem-solving skills, leading to better quality decision-making at the board level (Lara et al., 2017). In view of that it is argued that females on boards, with respect to communication channels, are able to better monitor, due to their experiences, networking and socialization skills, thus, resulting in enhanced information environment (Lucas‐Pérez et al. 2015; Liu et al. 2014). Following earlier studies, the study is motivated by the fact that the resource dependency theory induces a positive impact of women on boards in explaining corporate disclosure.

Prior studies apply the resource dependency theory to underpin the importance of board gender diversity for various firm-level outcomes, such as financial performance (Liu et al., 2014; Miller and del Carmen Triana, 2009) and the possibility of a banking crisis. Theories used to explain the importance of board gender diversity and how it influences banking system stability to include stakeholder theory and resource dependency theory. Stakeholder theory advocates that the interest of the firm lies on stakeholders and that the firm must be managed in the interest of these stakeholders. Thus, companies involving more women on their boards reflect protecting the interest of various stakeholders, thus, a positive relationship between women’s presence on boards and bank disclosure (Francoeur et al., 2008). The resource dependency theory advances that female directors provide closer monitoring, participate more in committee meetings, and are more likely to ensure banking system stability.

It is argued in the literature that, a country’s financial and banking industry experiences a significant number of defaults (large increase in nonperforming loans), causing a reduction in the large part of bank capital and runs on banks, leading to a systemic banking crisis. This problem is transmitted to involve a large number of institutions of the banking system. A significant number of financial institutions were affected, especially during the meltdown (Laeven and Valencia, 2010). The financial market turmoil, which started in 2007/2008 and turned into a global financial crisis affected the banking sector. The results caused significant losses, massive write-downs, increased impairments which altered banks’ capital ratios and liquidity; and the functioning of many credit markets was influenced, when almost all banks recorded losses. However, all these circumstances made the publication of banks’ assets and financial reporting, frequently under scrutiny, reflecting one of the causes of the crisis. The annual reports of the banks during the crises were expected to provide useful information for the prevention of other crises in the future and also to explain to users what went wrong in the credit markets (Bogolsaw, 2008). Thus, non-disclosure of financial reports affects investors’ confidence in the financial system and could further lead to systemic crises in the banking sector. On one hand, Gul et al. (2011) argue that societies enjoying a feminine attitude tend to be more secretive, affecting information disclosure practices (Chau and Gray, 2002). Women, according to Fondas (2000) are more independent as they are not part of the “old boys” network, thus can increase the firm’s value. On the other hand, women might provide more insights about companies, supporting the work by Bernardi et al. (2002) that the presence of women on boards will improve board monitoring (Carter et al., 2010), enhance the quality of public disclosure through better monitoring (Gul et al., 2011) and ensure a stable banking system that reduces the possibility of a banking crisis. Women on boards contribute unique benefits and resources because they tend to bring diverse expertise and leadership competencies, soft-skill resources, human capital, and backgrounds needed to improve company performance and protect the interest of shareholders (Folkman and Zenger, 2012). Thus, the presence of women on boards leads to increasing firms’ value (Fondas, 2000).

In economic literature, the disclosure relates to the signalling theory that states that informational asymmetry is reduced through the disclosure of risk-related information by the management of the informed party to investors (Anifowose et al., 2017). The role of information disclosure in the banking sector is to disclose financial information to users in making a better investment decisions (Watts and Zimmerman, 1986). It is possible for depositors’ behaviour of making investment decisions to be altered any time information is available. According to Berger and Davies (1998), disclosure is beneficial as it allows investors to punish bad financial intermediaries for higher risk-taking and reward good financial institutions for greater prudence. Despite, the benefits of financial disclosure or transparency to users, information disclosure by banks can cause investors to misinterpret particular information revealed by a single bank to reflect the weaknesses of the entire banking system, and this could be costly, as it can trigger investor or creditors’ panic—leading to bank failure and crisis (Goldstein and Pauzner, 2005). A number of corporate attributes have been used in previous studies to explain the determinants of the financial disclosures of banks. Financial disclosure is made in annual reports to provide traditional users with information useful to them when making investment and regulatory decisions.

Empirically, Kang et al. (2010) examined the effect of corporate disclosure on banking stability in Kong Chian. They found that not only does corporate disclosure enhance stability in the banking system, but the diversity of board members has been one of the most important governance regulatory mechanisms (Kang et al., 2010) that helps to reduce the possibility of crises in the banking sector. Watts and Zimmerman (1986) empirically show that financial information disclosure increases the value of a firm because it helps financial statement users in making better investment decisions. They expanded that financial information disclosure is beneficial to firms as it allows depositors to reward good banks for greater prudence. Further, increasing participation of women on boards enrich board information and strengthen financial disclosure, as women on boards play an important role during the communication and decision-making process as to which (relevant) information to disclose in the reports (Erhardt et al., 2003). Thus, Erhardt et al. (2003) found that women on boards strengthen financial disclosure and by so doing, improve banking performance. However, during crisis situations, banks are less relevant to disclose financial information. Thus, the magnitude and significance of the impact of disclosure on bank performance are weaker in countries with banking crises compared to those who have never experienced a banking crisis.

More so, gender diversity increases the level of information voluntarily disclosed by companies—thus, a positive relationship between the extent of disclosure and firm profitability (Erhardt et al., 2003). Nalikka (2009) finds that firms with female chief financial officers are associated with higher voluntary disclosures in annual reports, using data from companies listed on the Helsinki Stock Exchange. Mitton (2002) indicates the benefits of greater information disclosure in East Asia and presents in his findings that greater performance during periods of crisis is linked to greater disclosure quality while countries affected by the crises had lower disclosure. It is shown that greater disclosure requirements can enhance market discipline, reduce the cost of the banking crises (Rosengren, 1999); and reduce the possibility of a crisis in the banking sector (Tadesse, 2016). Grassa (2018) studied whether banks should disclose more information based on depositor discipline in East Asia, and found that healthy banks can raise deposits by disclosing more information, while weak banks cannot.

From the theoretical and empirical reviews, it is evident that the relationship between disclosure and the possibility of a banking crisis may be influenced by board gender diversity. However, empirical evidence of this effect is non-existent in the African context. It is worthwhile noting that studies that investigate the direct or individual effects of board gender diversity and bank disclosure on banking stability exist. The literature is however silent on how board gender diversity affects disclosure–crisis nexus. Moreover, the existing literature on board gender diversity, bank disclosure and banking crises have focused largely on single countries, developed countries and developing countries (see Nalikka, 2009; Anifowose et al., 2017; Chantachaimongkol and Chen, 2018; by Adeabah et al., 2018).

Based on the above literature review, the following hypothesis is made:

H1: Board gender diversity (women on boards) increases bank disclosure;

H2: Board gender diversity and bank disclosure reduce a predicted probability of banking crisis;

H3: Board gender diversity enhances the negative impact of bank disclosure on a predicted probability of banking crisis.

Data and methodology

The study finds out the impact of board gender diversity in explaining the impact of bank disclosure on the banking crisis in Africa. The study employs an unbalanced panel dataset of 42 African countries over the 2006–2018 period. We use the pooled ordinary least square (OLS) panel, random effect model, fixed effect model, two staged the least square (2SLS), and dynamic system generalized methods of moment (GMM) and the logistic regression model, but were applicable based on the specification of the models.

Country data on macroeconomic indicators were obtained from the World Development Indicator (WDI) while data for bank-specific variables were obtained from Bank scope and the Global Financial Development Databases.

Model specification

Following the baseline model specification, the study examines three (3) key hypotheses as expressed below:

The effect of board gender diversity on bank information disclosure

Equation (1) shows the effect of board gender diversity on bank information disclosure. Board gender diversity is decomposed into the number of women on boards and the presence of women on a board. We expect women on boards to have a positive impact on the information disclosure of banks. This supports the resource dependency theory that female directors on boards provide closer monitoring, participate more in committee meetings, and are more likely to improve information disclosure (Terjesen et al., 2016). However, we expect a negative relationship between the number of women on boards and information disclosure of banks. This is because banks that provide a smaller number of female directors on their boards are more likely to reduce information disclosure. We introduce the square term of the number of women on boards into the model and expect a positive relationship between the square term and information disclosure of banks. This implies that an additional increase of women on boards brings more diverse views and skills on the board, and hence promotes information disclosure of banks based on the resource dependency theory.

In what follows, the study looks at the effect of board gender diversity on the relationship between bank disclosure and a predicted probability of a banking crisis. The study shares the approach where the dependent variable is a dummy variable that distinguishes between years of banking crisis and years without banking crisis in Africa. We use a qualitative response logit model to estimate the probability of the occurrence of a banking crisis.

Effect of board gender diversity and bank information disclosure on the banking crisis

The panel logistic regression method is used to analyse the predictive ability of the banking crisis in Africa since the dependent variable takes the value of zero 0 and one (1). The model is expressed as follows:

The study uses panel logistic regression to analyse the effect of board gender diversity and bank disclosure on the predicted probability of a banking crisis. To deal with possible endogeneity between the variables, the study employs the dynamic panel estimation. Following Ozili (2018), we use the dynamic panel estimation techniques including the system-GMM estimation and the model is specified as.

In Eqs. (1)–(3), subscript \(i\) denotes the cross-sectional dimension (bank), \(i = 1,...,N\); j denotes cross-sectional dimension (country specifics), j = 1, …, M; and \(t\) denotes the time-series dimension (time), \(t\) = 1, …, T; βi; \(i = 1,...,11\), are regression parameters to be estimated; λi is the bank fixed effect i; δj is the country fixed effect; and μt is the time fixed effect \(t\); and \(\varepsilon _{ijt}\) is idiosyncratic error term which controls for unit-specific residual in the model for the ith bank in the jth country at period t.

The error term of the model was tested for their assumptions of normality, autocorrelation and homoscedasticity. The coefficients of variables were tested to address the presence of multicollinearity among the predictors.

Prior to estimating the interaction effect of board gender diversity and bank disclosure on a predicted probability of banking crisis, the study looks at the independent effect of board gender diversity and bank disclosure on a predicted probability of banking crisis.

From Eq. (2) the study expects a negative impact of board gender diversity and bank disclosure on a predicted probability of banking crisis. This supports the resource dependency theory and the signalling theory. The resource dependency theory argues that women are more independent as they promote network experience, thus can increase the firm’s value and reducing the possibility of a banking crisis. The signalling theory shows the benefits of financial disclosure or transparency to users, and that information disclosure by banks increases the firm value and reduces the possibility of the banking crisis.

Next, the study interacts with board gender diversity and bank disclosure and regresses it on the predicted probability of a banking crisis. The study computes the net effect and interprets the results based on marginal effects. Our interpretations are close to the work of Bramber et al. (2006) and we expect that board gender diversity enhances the negative impact of bank disclosure on a predicted probability of banking crisis.

Description of all variables, measurements and expectations of the results are presented in Table 1.

Estimation technique

The study conducts some diagnostics tests. Table 2 shows the summary statistics of the variables employed in the models to screen for outliers that have the potential to affect the efficiency, consistency and biasness of the estimated coefficients. The summary statistics do not show any evidence of outliers and the Shapiro–Wilk (SWILK) normality test indicates that the variables are normality distributed around their mean. The variance inflation factor (VIF) shows the acceptability of each explanatory variable in the dataset. Following the rule of thumb with a threshold of 10 for VIF, VIF values were below the threshold of 10, indicating that the variables are all acceptable in the model. Some tests were conducted and these include Breusch and Pagan LM test results. Moreover, the 2SLS was conducted to deal with possible endogeneity that might be present in the model. However, the nature of the dependent variable, which is a dummy variable (probability distribution), calls for the use of a logistic regression model. This is presented in Table 6.

Empirical results and discussion

The study presents descriptive statistics of the explanatory variables. Summary statistics and Pearson’s correlation are used to screen and test the reliability of the dataset. These are presented in order to ensure consistency, efficiency, reliability and robustness of findings (see Table 2). Return on asset (ROA) is averagely about 9.1%. The average number of women on Boards was 1 while there was an average of 10% for a woman to be present on a board. Bank disclosure recorded an average of 5.19, ranging between 0 and 10. The average Lerner index of banks is 0.52, ranging between –1.1979 and 2.22. The average percentage of board members owning shares in the company is 51.97%. The log of GDP per capita recorded a mean of 2.76. Exchange rates recorded an average of 6.645 rates to the dollar and inflation recorded an average of 8.86. Table 3 reports the Pearson correlation coefficient matrix to check for possible multicollinearity between the explanatory variables. For multicollinearity to occur, the correlation coefficient between any two variables should be 0.7 or more (Kennedy, 2008). We find no multicollinearity problem and we proceed to run the regression.

Regression results

The study finds out whether board diversity is important in explaining the effect of bank disclosure on the banking crisis in Africa. First, we find out the effect of gender diversity on bank disclosure. Second, we conduct an independent effect of gender diversity and bank disclosure on the probability of a banking crisis. Finally, it examines the role of board diversity, specifically women on boards in explaining the relationship between bank disclosures and the banking crisis in Africa.

Board gender diversity and bank disclosure

We present a robustness check by employing pooled OLS panel, fixed effect model, random effect model, two-staged least square (2SLS) and the logistic regression model to analyse the effect of women on boards (diversity) on disclosure of banks. We test for the appropriate estimation model that best explains our results by using the Hausman test and Breusch and Pagan Lagrangian Multiplier Test. Board gender diversity was measured using the number of women on board and the presence of women on board.

From Table 4 (Models 1–4), the number of women on boards was negatively linked to bank disclosure. This suggests that a decrease in the number of women directors limits the amount of information disclosed. Thus, smaller number of women on board decreases bank disclosure. The study found a positive impact of the square of the number of women on boards and bank disclosure. This implies that banks that increase the number of women onboard above-average levels promote banking disclosure. The resource dependency theory predicts a positive relationship between board gender diversity and corporate disclosure as board gender diversity is expected to increase board independence, decrease information asymmetry, and hence increase information disclosure. Again, the presence of women on board has a positive impact on bank disclosure (see Models 1–4). This supports the resource dependency theory that induces a positive impact of gender-board diversity on corporate disclosure. It agrees with the work of Lara et al. (2017), who found a positive relationship between gender–board diversity and corporate disclosure.

From our results, although the number of women on boards has a negative and significant relationship on disclosure across the models, we observe that the square of women on boards has a positive and significant relationship on disclosure (see Models 1–4). This suggests that an increasing degree of women on boards confirms a positive relationship between board gender diversity and disclosure through resource dependency theory and stakeholder theory where women play an important role in protecting the interest and information of investors and stakeholders. Our results show non-linear or an indirect U-shaped relationship between the number of women on board and bank disclosure. Thus, protection of shareholder’s interest or banks’ financial information (disclosure) reduces but reaches a limit as the number of women on board grow. Thus, disclosure may decrease as the number of women on boards increases to a point where the relation hits the optimal or maximum point from which disclosure will increase. The implication is that banks should keep an optimal number of women on boards in order to enhance disclosure.

Independent effect of board gender diversity and bank disclosure on banking crisis

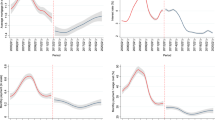

Next, we find out the independent effect of board gender diversity and disclosure on the predicted probability of banking crisis, using the logistic model. We conduct a robustness check (pooled OLS panel, fixed effect model, random effect model and two-staged least square (2SLS)) to identify the consistency and efficiency of the estimates, as shown in Table 5. However, we interpret our results using the logistic regression model (Model 5) due to the nature of the dependent variable (i.e., a dummy variable (probability distribution).

In Table 5, our results present a negative and significant relationship between the number of women on boards and predicted probability of banking crisis (model 5). This shows that increasing the number of women on a board is likely to decrease the likelihood of a banking crisis. This is in line with the work by Lucas‐Pérez et al. (2015) and Liu et al. (2014); as this implies that more women on boards may reduce the problem of cohesiveness, control and flexibility of decision making, decrease communication costs, as well as reducing gender conflict and imbalances which may interfere with the goal of achieving banking stability. Moreover, women on boards may bring independent views that align the interest of shareholders with board directors and protect the interest of owners to achieve the objective of attaining banking system stability.

We observe that the presence of women on a board, is negatively and significantly linked to the possibility of the banking crisis in the regression (Model 5). This shows that the presence of women on boards has a direct negative effect on the possibility of the banking crisis. This can be explained that the presence of women on the boards provide an incentive to reduce the banking crisis while controlling for a prudent information disclosure environment.

The study found that disclosure has a negative and significant relationship with the predicted probability of a banking crisis (Model 5). This can be explained that disclosure reduces information asymmetry and confirms the signalling theory that disclosure is beneficial as it allows investors to take higher risks and reward good financial institutions for greater prudence. This shows that increasing disclosure is likely to reduce the possibility of a banking crisis. This is because banks in countries with strong information-sharing mechanisms are able to decrease the banking crises.

The negative impact of board gender diversity and bank disclosure on the banking crisis is consistent and robust across all the models (Models 5–9). The findings can be explained that a large proportion of women on boards and the presence of women on boards increase the amount of information disclosed, especially for banks who are prone to taking more risk and whose market had yet to perceive serious problems. Moreover, women on boards bring diverse opinions in the boardroom, bring strategic inputs to the board, influence decision making and ensuring leadership and boardroom behaviour, and hence increase banking system stability and reduce the likelihood of a banking crisis.

In what follows, we investigate the joint effect of board gender diversity and disclosure on the predicted probability of a banking crisis.

Interaction effect of board gender diversity on the relationship between bank disclosure and banking crisis

We use the logistic model to examine the role that board gender diversity plays in explaining the relationship between bank disclosures and banking crises. The dynamic system GMM model is employed as a robustness check.

In Table 6, we find that the unconditional effect of bank disclosure was negatively and significantly linked to the banking crisis. The coefficient of the presence of women on boards is positive. However, the coefficient of the interaction term between the presence of women on boards and bank disclosure was negative and significant. Thus, the conditional effect of bank disclosure is negative and significant (see model 10). For instance, using model 10, the net effect of bank disclosure on the presence of women on boards based on the coefficients is as follows: Banking crisis = −0.109+ (−0.0299)(presence of women on board) = −0.1389, when a woman is present on a board. The net effect is negative and this suggests that the negative impact of bank disclosure on the predicted probability of banking crisis is enhanced when a woman is present on board. Thus, the presence of women on boards increase the reductive effect of bank disclosure on the likelihood of a banking crisis.

In Model 11, the conditional effect of bank disclosure is negatively and significantly linked to the predicted probability of banking crisis (see Model 11). The net effect is estimated to be −0.1336. This suggests that the reductive effect of bank disclosure on the predicted probability of banking crisis is enhanced when the number of women on boards increases. In Models 12 and 13, the study analyses the interaction effect of board gender diversity (presence of women on a board and number of women on a board) and banks’ information disclosure on the banking crisis. This was done by using the system-GMM analysis that controls for possible endogeneity between board gender diversity, disclosure and banking crisis.

In Table 6, the previous year’s crisis in the banking sector had a positive impact on the current banking crisis (see Models 12 and 13). This shows that the banking crisis in the past is persistent over time. Bank disclosure has a negative and significant relationship with the banking crises (Models 12 and 13). This indicates that increasing the level of bank information disclosure, reduces information asymmetry and builds investor confidence and thereby attracting more investment opportunities for higher returns to the banks. Hence, bank disclosure has a reductive effect on the banking crisis.

The estimated net effect of bank disclosure on banking crisis conditioned on board gender diversity shows that the negative impact of bank disclosure on banking crisis is magnified in the presence of board gender diversity (see Models 12 and 13). The implication is that women on boards should provide a prudent decision on financial information disclosure that would significantly enhance banking profitability in periods with the banking crisis.

Conclusion and policy implications

The study extends the existing literature on gender board diversity and disclosure in the African banking system. The aim of the study is to investigate the role of board gender diversity (presence of women on boards and the number of women on boards) in explaining the effect of bank disclosure on the banking crisis. The study employs different panel estimates based on a dataset of 42 African countries over the 2006–2018 periods. First, the study examines the effect of board gender diversity on the disclosure of banks. It further explains the independent effect of board gender diversity and disclosure on the banking crisis. Lastly, it analyses the interaction effect of gender diversity and disclosure in explaining the possibility of the banking crisis. From the study, the presence of women on boards impact information disclosure of banks positively while the number of women on boards has a non-linear relationship with band disclosure. The non-linear relationship can be explained that a smaller number of women on boards reduces bank disclosure but above the average number of women on boards triggers a positive impact on bank disclosure. This indicates that women on boards play a significant role in enhancing the level of information disclosure in the banking system in Africa.

We observe that women on boards negatively lead to the possible occurrence of a banking crisis. We find that banks with more women on their boards have the possibility of reducing a banking crisis. We find that a greater level of information disclosure by banks reduce the possibility of a banking crisis. Thus, disclosure was negatively linked to the banking crisis. Again, we observe that bank disclosure reduces the predicted probability of a banking crisis when women are present on a board.

The implication is that women on boards should bring their unique roles and soft skills when making decisions on the board, especially protecting the firm around a certain level of disclosure environment, so as to reduce banking crisis. The study provides evidence to support that bank disclosure reduces the predicted probability of banking crisis while the negative impact is amplified in the presence of board gender diversity.

The implication is that banks should keep an optimal choice of information disclosure and optimal size of women on boards, so as to reduce possible banking crises and maintain a stable banking system. Further, women on boards are expected to encourage managers to use greater information disclosure as a signal to attract more market participants.

Future research can look at how board gender diversity and information disclosure are associated with banking stability in the different regulatory frameworks for other regions.

Data availability

All data analysed are contained in the paper.

References

Adams RB, Ferreira D (2009) Women in the boardroom and their impact on governance and performance. J Financ Econ 94(2):291–309

Adeabah D, Gyeke-Dako A, Andoh C (2018) Board gender diversity, corporate governance and bank efficiency in Ghana: a two stage data envelope analysis (DEA) approach. Corporate Governance: The International Journal of Business in Society 19(2):299–320

Akhtaruddin M, Hossain MA, Hossain M, Yao L (2009) Corporate governance and voluntary disclosure in corporate annual reports of Malaysian listed firms. Journal of Applied Management Accounting Research 7(1):1–23

Aksu M, Kosedag A (2005) The relationship between transparency and disclosure and firm performance in the Istanbul Stock Exchange. J Soc Sci 3(10):11–34

Al-Amarneh A, Yaseen H, Iskandrani M (2017) Board gender diversity and dividend policy: case of Jordanian Commercial Banks. Corp Board: Duties Compos 13:3

Al-Janadi Y, Rahman RA, Alazzani A (2016) Does government ownership affect corporate governance and corporate disclosure? Evidence from Saudi Arabia. Manag Audit J 25-35 https://doi.org/10.1108/MAJ-12-2015-1287

Anifowose M, Rashid HMA, Annuar HA (2017) Intellectual capital disclosure and corporate market value: does board diversity matter? J Account Emerg Econ 22:33–54

Baumann U, Nier E (2004) Disclosure, volatility, and transparency: an empirical investigation into the value of bank disclosure. FRBNY Econ Policy Rev 10(2):31–45

Bear S, Rahman N, Post C (2010) The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J Bus Ethics 97(2):207–221. https://doi.org/10.1007/s10551-010-0505-2

Berger AN, Davies SM (1998) The information content of bank examinations. J Financ Serv Res 14(2):117–144

Bernardi RA, Bean DF, Weippert KM (2002) Signaling gender diversity through annual report pictures: a research note on image management. Account Audit Account J 15(4):609–616

Bhattacharya S, Ritter JR (1983) Innovation and communication: signalling with partial disclosure. Rev Econ Stud 50(2):331–346

Bidabad B, Sherafati M (2019) Bank information disclosure, financial transparency and corporate governance in rastin banking. International J Shari’ah Corp Gov Res 2(1): 2019 Technical Paper ISSN 2578-0387

Bidabad B, Amirostovar A, Sherafati M (2017) Financial transparency, corporate governance and information disclosure of the Entrepreneur’s Corporation in Rastin Banking. Int J Law Manag 59(5):636–651

Bogolsaw D (2008) How to fix financial reporting. http://www.businessweek.com

Bramber T, Clark WR, Golder M (2006) Understanding interaction models: improving empirical analysis. Political Analysis 14(3):63–82

Campbell K, Minguez-Vera A (2008) Gender diversity in the boardroom and firm financial performance. J Bus Eth 83(3):435–451. https://doi.org/10.1007/s10551-007-9630-y

Carter DA, D’Souza F, Simkins BJ, Simpson WG (2010) The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp Gov 18(5):396–414

Chantachaimongkol N, Chen S (2018) The influence of corporate governance attributes and national characteristics on information disclosures: a case of ASEAN. European. J Account Financ Res 6(5):47–72

Chau GK, Gray SJ (2002) Ownership structure and corporate voluntary disclosure in Hong Kong and Singapore. Int J Account 37:247–265

Clatworthy MA, Jones MJ (2006) Differential patterns of textual characteristics and company performance in the chairmana’s statement. Accounting, Auditing & Accountability Journal 19(4):493–511

Egboro, Edwin M (2016) The 2008/2009 banking crisis in Nigeria: The hidden trigger of the financial crash. Journal of Economics, Management and Trade. 1–16

Eng LL, Mak YT (2003) Corporate governance and voluntary disclosure. Journal of accounting and public policy 22(4):325–345

Erhardt N, Werbel J, Shrader C (2003) Board of director diversity and firm financial performance. Corp Gov 11:102–110

Folkman J, Zenger J (2012) Are women better leaders than men? Harv Bus Rev http://hbr.org

Fondas N (2000) Women on boards of directors: gender bias or power threat?. In Women on corporate boards of directors (pp. 171–177). Springer, Dordrecht

Francoeur C, Labelle R, Sinclair-Desgagnè B (2008) Gender diversity in corporate governance and top management. J Bus Eth 81:83–95

Goldstein I, Pauzner A (2005) Demand-deposit contracts and the probability of bank runs. J Financ 60(3):1293–1327

Gul F, Srinidhi B, Ng AC (2011) Does board gender diversity improve the informativeness of stock prices? J Account Econ 51(3):314–338

Grassa R (2018) Deposits structure, ownership concentration and corporate governance disclosure in GCC Islamic banks: Empirical evidence. J of Islam Account and Bus Res 9(4):587–606

Hillman AJ, Dalziel T (2003) Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad Manag Rev 28(3):383–396. https://doi.org/10.2307/30040728

Hoggarth G, Reis R, Saporta V (2001) Costs of banking system instability: some empirical evidence. Bank of England Working Paper No. 144

Hossain M (2008) The extent of disclosures in annual reports of banking companies: the case of India. Eur J Sci Res 23(4):659–680

Kang E, Ding DK, Charoenwong C (2010) Investor reaction to women directors. Kong Chian: Research Collection Lee Kong Chian School of Business

Kennedy P (2008). A guide to econometrics. John Wiley & Sons

Laeven L, Valencia F (2010) Resolution of banking crises: the good, the bad, and the ugly. International Monetary Fund (IMF) Working Paper 10/146, June 2010

Laeven L, Valencia F (2018) Systemic banking crisis revisited, IMF Working Paper, 18/206

Lanam L (2007) Consumer disclosure as consumer protection. J Insur Regul 26:2

Lara JM, Osma G, Mora BGA, Scapin M (2017) The monitoring role of female directors over accounting quality. J Corp Finance 45:651–668

Linsley PM, Shrives PJ (2005) Transparency and the disclosure of risk information in the banking sector. J Financ Regul Compliance 13(3):205–214

Liu Y, Wei Z, Xie F (2014) Do women directors improve firm performance in China? J Corp Financ 28:169–184

Lucas‐Pérez ME, Mínguez‐Vera A, Baixauli‐Soler JS, Martín‐Ugedo JF, Sánchez‐Marín G (2015) Women on the board and managers’ pay: Evidence from Spain. J Bus Eth129(2):265–280

Matsunaga, SR, Yeung PE (2018) Evidence on the Impact of a CEO’s Financial Experience on the Quality of the Firm’s Financial Reports and Disclosures. AAA 2008 Financial Accounting and Reporting Section (FARS) Paper, Available at SSRN: https://ssrn.com/abstract=1014097

Miller T, del Carmen Triana M (2009) Demographic diversity in the boardroom: mediators of the board diversity–firm performance relationship. J Manag Stud 46(5):755–786

Mitton T (2002) A cross-firm analysis of the impact of corporate governance on the East Asian financial crisis. J Financ Econ 64(2):215–241

Nalikka A (2009) Impact of gender diversity on voluntary disclosure in annual reports. Account Tax 1:1

Oba VC, Fodio MI (2013) Boards’ gender mix as a predictor of financial performance in Nigeria: an Empirical Study. Int J Econ Financ 5(2):170–178

Owen AL, Temesvary J (2018) The performance effects of gender diversity on bank boards. J Bank Financ 90:50–63

Ozili PK (2018) Banking stability determinants in Africa. International Journal of Managerial Finance 14(4):462–483

Pathan S, Faff R (2013) Does board structure in banks really affect their performance? J Bank Financ 37(5):1573–1589

Qi B, Tian G (2012) The impact of audit committees' personal characteristics on earnings management: evidence from China. J Appl Bus Res 28(6):1331–1343. https://doi.org/10.19030/jabr.v28i6.7347

Rosengren E (1999) Will greater disclosure and transparency prevent the next banking crisis?. In The Asianfinancial crisis: Origins, implications, and solutions (pp. 369–376). Springer, Boston, MA

Tadesse S (2016) Stigma against tuberculosis patients in Addis Ababa, Ethiopia. PLoS ONE 11(4):e0152900

Terjesen S, Aguilera RV, Lorenz R (2015) Legislating a woman’s seat on the board: institutional factors driving gender quotas for boards of directors. J Bus Eth 128(2):233–251

Terjesen S, Couto EB, Francisco PM (2016) Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management & Governance 20(3):447–483

Watts RL, Zimmerman JL (1986) Positive accounting theory. Prentice-Hall, Englewood Cliffs, New Jersey

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval to conduct this study was not applicable.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ofori-Sasu, D., Sarpong, M.O., Tetteh, V. et al. Banking disclosure and banking crises in Africa: does board gender diversity play a role?. Humanit Soc Sci Commun 9, 12 (2022). https://doi.org/10.1057/s41599-021-01019-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-021-01019-x