Abstract

Corrosion is a ubiquitous and costly problem for a variety of industries. Understanding and reducing the cost of corrosion remain primary interests for corrosion professionals and relevant asset owners. The present study summarises the findings that arose from the landmark “Study of Corrosion Status and Control Strategies in China”, a key consulting project of the Chinese Academy of Engineering in 2015, which sought to determine the national cost of corrosion and costs associated with representative industries in China. The study estimated that the cost of corrosion in China was approximately 2127.8 billion RMB (~ 310 billion USD), representing about 3.34% of the gross domestic product. The transportation and electronics industries were the two that generated the highest costs among all those surveyed. Based on the survey results, corrosion is a major and significant issue, with several key general strategies to reduce the cost of corrosion also outlined.

Similar content being viewed by others

Introduction

Corrosion is a naturally occurring phenomenon with costly and detrimental impact on most critical industry sectors. Understanding the exact costs of corrosion has been of great interest to corrosion scientists and engineers for many decades. In-depth comparison of corrosion costs among different industries or company sectors provides the prospect of identifying the common issues/problems, and also any best practice in corrosion control. Quantifying the staggering size of corrosion costs is also an important step in raising awareness of the seriousness and magnitude of corrosion issues, particularly relevant to decision makers in the industry and government—such that better policies can be established to improve our capacity for mitigating corrosion risks. It is noted that herein, ‘‘cost’’ will most often refer only to the economic cost of addressing corrosion and its consequences, although the societal cost and associated externalities are even more far-reaching and beyond measure. The economic cost of corrosion may be estimated directly from the application, operation and maintenance of anti-corrosion technologies (e.g., corrosion-resistant materials, protective coatings, corrosion inhibitors, anodic/cathodic protection and corrosion inspection and monitoring tools); or indirectly from the loss of productivity, compensation for casualties and environmental pollution, and any other cost that is not directly incurred within that industry. While it is difficult to quantify the indirect cost of corrosion, the direct cost is deemed calculable by combining appropriate methodologies (such as questionnaires, statistics and extrapolation), and by applying expertise in both corrosion and economics.

Historical overview of key cost of corrosion studies in other countries

The first systematic study on the cost of corrosion was performed in 1949 by H. H. Uhlig.1 Uhlig estimated the annual direct cost of corrosion in the United States to be 5.427 billion US dollars (2.1% of GNP, gross national product, at the time), by summing the costs related to anti-corrosion materials and corrosion-induced maintenance and replacement. This original report also highlighted the significance of the indirect cost of corrosion and the cost incurred through over-design. The approach described in Uhlig’s report, known as the Uhlig method, was adopted by Japan in 19772 and 1999,3 and again in the United States in 1998.4 Another pioneering corrosion cost study was published by T.P. Hoar in the United Kingdom in 1971.4 The Hoar method investigated the corrosion costs in 10 individual industrial sectors in the UK, the total associated cost of which was determined to be 1365 million pounds (3.5% of the UK GNP at the time). Hoar also estimated that among this cost, 310 million pounds could be saved by appropriate corrosion mitigation. In 1978, the National Bureau of Standards (NBS) collaborated with the Battelle Memorial Institute to review the cost of corrosion in the United States.5 An economic input/output model was applied to three different scenarios, namely, an actual world with corrosion, an imaginary world with no corrosion and an ideal world with inhibited corrosion. By comparison among the different so-called ‘‘worlds’’, the corrosion cost and the avoidable corrosion cost were derived. The Battelle-NBS study revealed that the total cost of corrosion per year was 70 billion US dollars (4.5% of GNP at the time) and that 14% of corrosion costs could be directly avoided using existing anti-corrosion technologies. According to the NBS, the uncertainty of this method was estimated to be 30%. This input/output method was also later adopted by Australia in 1983,6 Kuwait in 19957 and Japan in 1999.3 Funded by the Federal Highway Administration of the United States, CC Technologies Laboratories (now DNV GL) partnered with NACE International and conducted another nationwide cost of corrosion survey in the United States in 1998.8 The study combined the Uhlig and Hoar methods with significant input of expert knowledge and determined the corrosion costs associated with five major categories (infrastructure, utilities, transportation, production and manufacturing, and, government), including 27 industrial sectors. The results showed that the total direct cost of corrosion was ~ 276 billion US dollars per year (3.1% gross domestic product (GDP) at the time), which means that the cost per each person per year was approximately 970 US dollars. The cost from the lost time and productivity of the general public due to corrosion-related delays and outages represented the primary indirect cost, which was estimated to be approximately equal to the direct cost. Table 1 provides a historical overview of the cost of corrosion studies undertaken by large-economy countries.1, 2, 4, 5, 7,8,9,10,11

As revealed (Table 1), the national costs of corrosion generally represent approximately 1–5% of the GNP. This large variation in the corrosion cost relative to GNP was attributed to the specifics of each country and to the methodology used by each study. To the best of our knowledge, the first estimation of the global cost of corrosion, i.e., a value of 2.5 trillion US dollars (3.4% of global product), was reported by NACE International as part of its International Measures of Prevention, Application, and Economics of Corrosion Technologies (IMPACT) study in 2016.12 This estimation was obtained by analysing the data from available representative studies from different regions of the world.

Cost of corrosion studies in China

Since the 1980s, China has conducted a number of differently scaled studies on the cost of corrosion. Table 2 summarises the results obtained from a pilot survey conducted by the National Science and Technology Committee of China in 1980 in the chemical, refinery, metallurgy and fibre industries.13 The first nationwide cost of corrosion study in China was led by Prof. Wei Ke from the Institute of Metal Research, Chinese Academy of Sciences, during the period of 1999–2002. In this study, the Uhlig method was applied considering the costs of anti-corrosion technologies, whereas the Hoar method was applied to several key sectors, including the chemical, energy, transportation, construction and mechanical industries. The results from both approaches are summarised in Table 3 and Table 4.14

In recent decades, China has undergone one of the most rapid economic growths worldwide, largely supported by developments in so-called heavy industries. The rapid deployment of new materials and the widespread ageing of existing engineering structures are exacerbating corrosion issues in such industries. Therefore, increased corrosion awareness and adequate corrosion control will play a fundamental role in achieving a more sustainable and energy-efficient economy in the future. With such a background, in 2015, the Chinese Academy of Engineering initiated “Study of the Corrosion Status and Control Strategies in China”, a key consulting project led by the Institute of Oceanology, Chinese Academy of Sciences and engaging experts from the Chinese Society for Corrosion and Protection and hundreds of other related organisations. This present paper summarises the results of this study, including the economic costs of corrosion determined using the Uhlig and Hoar methods.

Results and discussion

Results obtained from the Uhlig method

The Uhlig method was applied herein by taking into account the annual gross production of the major, and different, anti-corrosion technologies in China. According to Uhlig, the costs determined by this method include expenditures for the measures applied for the protection of materials, which increase the cost of materials over that of plain carbon steels.1 Therefore, the cost associated with the replacement of carbon steels due to corrosion is not considered in the present study.

Coatings

This section includes only the costs associated with organic paints and their application. According to the statistics from the National Bureau of Statistics of China, the gross production of paints within the period of January to December 2014 was 16,481,900 tonnes.15 Regardless of the huge variety of different types and brands of coatings, the calculation in this study was based on the average price of the coatings, which was 24,400 RMB per tonne. In general, painting costs (operation and application) are 2–3times of the paint itself. Thus, in this study, a value of 2.5 was selected.14 Notably, in addition to their anti-corrosion purpose, paints are also applied for decorative and functional effects. Anti-corrosion paints account for only approximately 50% of the total paints. Therefore, the annual gross production of anti-corrosion paints was estimate as:

Surface treatments

This section principally addresses the costs associated with surface treatments on steels and aluminium-based materials (which are the key commodity engineering metals).

i. Galvanised steels

In 2014, the national gross production of galvanised steels was 47.2 million tonnes, and the imported volume of galvanised steels was 2.882 million tonnes. The exported volume was 7.565 million tonnes. The consumption of galvanised steels was 42.517 million tonnes. The average unit prices of galvanised steels and cold-rolled steels are 5200 and 3500 RMB per tonne, respectively. The price difference is 1700 RMB per tonne. The application of galvanised steels instead of cold-rolled steels is for the purpose of an anti-corrosion effect. Therefore, the anti-corrosion investment associated with galvanised steels was calculated by multiplying this price difference with the total consumption volume as follows:

ii. Tinplating

In 2014, China’s consumption of tinplated steels was approximately 4.4 million tonnes. The average unit price of tinplated steels is estimated to be 7000 RMB per tonne. Similar to the case of galvanised steels, the difference between the unit prices of tinplated steels and cold-rolled steels was calculated to be 3500 RMB per tonne. As a result, the anti-corrosion investment from tinplating was determined to be:

iii. Electroplating

This cost represents the total production from small to medium-sized electroplating factories in China. In 2014, the gross production volume of these factories was 28.9 billion RMB, where approximately 60% was related to surface treatment. Therefore, the total cost of electroplating was determined to be 17.34 billion RMB.

iv. Surface treatments for aluminium alloys

In 2014, China’s aluminium alloy production was 6.4 million tonnes. The imported and exported volumes were 80,000 and 521,000 tonnes, respectively. The consumption volume was 5.966 million tonnes. The average price of surface-treated aluminium and its alloys is estimated to be 18,000 RMB per tonne, whereas non-surface-treated aluminium ingot is 12,000 RMB. The surface treatment cost of aluminium alloys was thus determined to be:

The summation of these costs shows that the cost of corrosion related to surface treatments was 140.82 billion RMB.

Corrosion-resistant materials

For the present cost study, corrosion-resistant materials refer to stainless steels, weathering steels, titanium and titanium alloys, engineering plastics and rubbers.

i. Stainless steels

In 2014, China’s consumption of stainless steel was 15.72 million tonnes. As there are many different types of stainless steels (austenitic, ferritic, duplex, etc.), an average unit price of 14,000 RMB per tonne was employed. By comparing with the average price of cold-rolled steels, the anti-corrosion investment associated with stainless steel was

ii. Weathering steels

China’s consumption of weathering steels in 2014 was 7.95 million tonnes. The average price of weathering steels is estimated to be 4000 RMB per tonne. Therefore, the total cost of corrosion based on weathering steels was

iii. Titanium and titanium alloys

The annual consumption of titanium and its alloys in China was 44,500 tonnes. The difference between the unit prices of titanium alloys and cold-rolled steels is approximately 90,000 RMB per tonne. The total cost associated with the use of titanium and its alloys was, therefore, 4 billion RMB.

iv. Engineering plastics and rubber

The annual gross production of rubber and plastics industry in 2014 was 2991.9 billion RMB.16 Engineering plastics and rubbers used for corrosion protection accounted for approximately 0.7% of the total value. Thus, the anti-corrosion investment associated with these materials was 20.94 billion RMB.

In total, the cost of corrosion-resistant materials in 2014 was determined to be 205.81 billion RMB.

Corrosion inhibitors

In general, corrosion inhibitors can be defined as substances added at low concentrations to effectively reduce metal corrosion rates. The cost related to corrosion inhibitors in China in 2014 is summarised in Table 5.

Rust-preventing oils and greases

The variety of rust-preventing oils and greases is large. Therefore, the unit price ranges from 8000 to 20,000 RMB per tonne. In 2014, China’s demand for rust-preventing oils and greases was 0.2 million tonnes. Taking the unit price as 11,000 RMB per tonne, the cost related to rust-preventing oils and greases was approximately 2.2 billion RMB in 2014.

Electrochemical protection

The costs associated with electrochemical protection include the production of anodes and the engineering cost of cathodic protection projects, the latter of which is difficult (actually, not possible) to quantify in terms of production volume. Thus, to determine the cost of electrochemical protection, we surveyed a major company in the CP market whose annual sales in 2014 totalled 113 million RMB. The market share of this company is 1.8%. Thus, the total sales of the entire industry were approximately 6.3 billion RMB.

Summary of the results by the Uhlig method

The estimated total cost of each major anti-corrosion measure in China in 2014 has been summarised in Table 6.

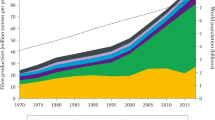

The results herein have revealed that the direct cost of corrosion totalled approximately 1063.91 billion RMB. Among these costs, protective coatings remained the leading expenditure, followed by corrosion-resistant materials and surface treatments (Fig. 1). These summarised are in close agreement with the proportions reported in the Chinese cost of corrosion survey in 2002, and with studies by other nations.3, 14 This is indicative, perhaps alarmingly, that lessons learned are not rapidly translated to cost savings. It should be noted that the cost associated with the emerging market of corrosion inspection and monitoring was not included in this study, which was partly due to the difficulty in obtaining definitive original data. According to previous studies, the indirect corrosion cost, incurred from compensation for the corrosion-induced loss of productivity and product quality and compensation for environmental pollution, casualties, and other damages, may be one to several times of the direct corrosion cost.8, 15 Here, we conservatively estimated that the indirect corrosion cost is equal to the direct cost. Thus, the total cost of corrosion, determined by Uhlig’s approach, was at least 2127.8 billion RMB, representing 3.34% of the GDP in China.

Results obtained from the Hoar method

The Hoar method was applied in the present study by taking into consideration the five major economic sectors: infrastructure; energy; transportation; water; and manufacturing and public services. Questionnaires that were used are shown below as Table 7 in the 'Methods' section, and were distributed among typical industries of these sectors. In most of the collected questionnaires, only direct corrosion costs were given since the indirect costs such as compensation for environmental pollution and casualties and injuries were, in most cases, challenging to quantify. It is also possible that industries may have been reluctant to provide such information. The following section summarises the estimated direct corrosion costs associated with each industry in the different sectors.

Infrastructure

Roads and bridges

In 2014, 107,700 km of new roads (104,900 km) and bridges (2800 km) were constructed in China. The investments totalled 1546.09 billion RMB for roads and bridges.17 The cost associated with their construction includes the cost of concrete, drainage and pavement, design and measurement, management, consultation fees and labour costs. Based on the collected questionnaires, the total anti-corrosion investment for new road and bridge construction in China in 2014 was 51.49 billion RMB. In 2014, 4,353,800 km of roads were under maintenance in China.17 The total corrosion cost from their maintenance in China in 2014 was estimated to be 10.89 billion RMB. Therefore, the total corrosion cost for the roads and bridges in China in 2014 was 62.37 billion RMB, which is equivalent to 4.03% of the total investment in this industry.

Ports and piers

The total investment for ports and piers on the rivers and coasts in China was 145.99 billion RMB17 in 2014, of which 1.67%, according to the survey results, was associated with anti-corrosion. The anti-corrosion investment for newly constructed ports and piers in 2014 was 2.44 billion RMB. In addition, approximately 0.19 billion RMB was spent on corrosion-related maintenance of ports and piers. Thus, the total direct cost of corrosion for ports and piers was 2.63 billion RMB, which accounted for 1.80% of the annual investment in the survey period.

Water conservancy

A survey of major reservoirs in China showed that the corrosion costs were mainly incurred from the application of anti-corrosion technologies in the construction and the ultilisation of metallic equipment and structures. At present China has established >97,700 reservoirs of different types and sizes, and in 2014 alone, the total investment for water conservation was 488.1 billion RMB,18 of which 2.03% was used to cover corrosion costs. Therefore, the total direct corrosion cost for water conservancy in China was 9.91 billion RMB.

Energy

Coal mining

Corrosion costs in the coal mining industry were mainly incurred from underground construction, repairs, inspections, maintenance and asset depreciation. In the present study, 30 coal mines of different scales were surveyed. Their annual production accounts for ~ 4% of the total coal production in China. It was estimated that the direct corrosion costs in coal mining industries in China was 84.70 billion RMB, representing 4.67% of the total annual production value of coal.

Fossil fuel power

Corrosion-resistant materials, such as plastic coatings and linings, are widely used in fossil fuel power plants. In 2014, the total installed capacity of fossil fuel power plants in China was 911.33 gigawatts.16 Based on the survey results, the total direct corrosion cost in the fossil fuel plants was 30.53 billion RMB, representing 1.91% of the annual production value. In all, 4.37 billion RMB of this cost was from the anti-corrosion investment of new constructions, while the other 26.16 was for maintenance and repair of existing structures.

Oil and gas

The oil and gas industry referred to in this study covers all of exploration, production and transmission. Corrosion is considered a primary factor affecting the reliability of engineering structures in this industry. Relative to other industries, a higher expenditure on anti-corrosion investment can be expected in the oil and gas industry to cover corrosion allowance, coatings, cathodic protection, corrosion inhibitors, inspection and repairs, corrosion-related personnel and other ancillary items. In 2014, the annual crude oil production in China was 210 million tonnes, and the gas production was 128 billion cubic metres.19 The total direct corrosion cost in this industry was estimated to be 34.70 billion RMB, representing 2.82% of the total production value.

Electric power transmission

The costs in this section refer to those generated from corrosion and its control during power transmission and at electric substations. According to the survey results, the annual direct corrosion costs (including anti-corrosion investment and asset depreciation) for electric power transmission and substations were 76.1 billion and 3.30 billion RMB, respectively. The total of the two costs was 79.4 billion RMB, representing 3.58% of the annual production value.

Transportation

Automobiles

The auto industry has been one of the fastest growing industries in China in the past decade. China is currently the second largest market for new automobiles and the third largest automobile manufacturer. In 2014, the quantity of privately owned automobiles was 145.98 million,16 which represented a growth of ~ 15% relative to the value in 2013. The total volume of automobile transactions in China in 2014 was 648.1 billion RMB and the market value of automobile repairs was approximately 500 billion RMB per year. Corrosion heavily impacts the auto industry. Based on the survey results, the annual direct corrosion costs totalled 187.25 billion RMB, representing 2.82% of the total asset value of the auto industry.

Shipbuilding

In 2014, the completed shipbuilding in China was 39.05 million DWT (i.e., dead weight tonnage).20 There are a total number of 1491 shipbuilders of varying size, which generated a main business income of 633.4 billion RMB in 2014. Due to the application environment of ships, heavy costs are incurred in anti-corrosion investments, repairs and asset depreciation of the shipbuilding industry. The total values of these costs were estimated to be 58.00 billion RMB, representing 9.16% of the total main income in the industry.

Railways

In this category, only corrosion of railways was considered, while the corrosion costs of railcars was not included. The total mileage of railway in China is one of the longest in the world. In 2014, the mileage of railways in use was 0.11 million km,17 and the annual construction investment was 808.8 billion RMB. Based on the survey results, the direct corrosion cost was 18.88 billion RMB.

Airplanes

Typical corrosion costs in the aviation industry are generated from the application of comparatively expensive corrosion-resistant materials and coatings, and from asset depreciation. Our survey showed that direct corrosion cost in the aviation industry in 2014 was 4.59 billion RMB.

Water

Water supply and drainage

In this category, it is noted that only urban areas were included for calculations. In 2014, the total water supply in the urban areas of China was 546.7 billion cubic metres, based on an annual gross production value of 218.7 billion RMB. The total urban drainage in 2014 was 40.22 billion tonnes, at a cost of 54.70 billion RMB.21

In 2014, 31,000 kilometres of different water pipes were constructed in China. The anti-corrosion investment associated with these new constructions varied from 30 to 70% of the total construction cost. Other direct corrosion costs were generated from pipeline replacements, depreciation and corrosion loss, and mitigation in water-supplying companies themselves. According to our survey, the total direct corrosion cost was 9.69 billion RMB. Notably, the cost from water leakage, considered as an indirect cost, may be much higher than the direct corrosion cost. Our study showed that leaked water resulted in a loss of 13.12 billion RMB in China in 2014.

Manufacturing and public services

Metallurgy

In the iron and steel-making industry, corrosion costs were most often incurred from material loss during high temperature oxidation and acid cleaning, representing roughly 60 and 20% of the total corrosion cost. Based on the questionnaires collected from the major steel companies in China, the direct corrosion cost is estimated to represent 1.40% of the gross production value of the industry, which resulted in a value of 104.02 billion RMB in 2014.

Relative to ferrous materials, the production processes of non-ferrous materials generated less corrosion issues. Based on the survey results from typical aluminium and copper producers, direct corrosion costs represented 0.60% of the gross production value. Thus, the direct corrosion cost was 30.78 billion RMB.

Chemical industry

The direct corrosion cost in the chemical production and processing industries was estimated based on questionnaires distributed to chemical plants producing acids, chlorines, bases, fertilisers and manufacturers of protective coatings and linings. The result showed that the expenditures on corrosion-resistant alloys and coatings were the leading direct corrosion costs in the chemical industry. According to the survey, the total direct corrosion cost of this industry in 2014 was 147.10 billion RMB, representing 1.67% of the gross market size. Relative to the direct cost, indirect costs in the chemical industry, such as those generated by production downtime, hazardous incidents and environmental pollution, could be several times higher.

Pulp and paper

China is one of the largest producers and consumers of pulps and papers. In 2014, there were ~ 3000 companies in this industry. Corrosion in pulp and paper manufacturing facilities can cause production downtime and the loss of product quality. In 2014, the gross market size of the pulp and paper industry was 787.9 billion RMB in China, and the direct corrosion cost was estimated to be 9.78 billion RMB.

Electronics

Corrosion issues with materials used in electronics have been rapidly growing in the past decade. For example, corrosion on printed circuit boards may lead to malfunctions or even failures of entire electronic devices. The consequences and the indirect cost of these incidents can be enormous. In the present study, questionnaires were distributed among several major companies in consumer electronics and home appliances. The results revealed that in 2014, the direct corrosion cost of this industry in China was as high as 224.80 billion RMB. However, it should be acknowledged that a large percentage of this cost can be saved with proper recycling of electronic waste materials.

Agriculture production

Corrosion issues on agricultural machinery were considered in this category. The tools used for agriculture production are often exposed to outdoor environments with high levels of sunlight radiation and high humidity. They are also in contact with corrosive media such as soils and fertilisers and are subjected to heavy material loss due to mechanical impact and abrasion. However, only commodity materials and minimal mitigation measures are applied on most agricultural machinery. Our survey estimated that the direct cost of corrosion in the agriculture production industry in China was 9.89 billion RMB in 2014, representing 2.50% of the gross production value of the industry.

Cultural heritage

The conservation of historic relics and artefacts remains an outstanding issue in China considering its relatively long history. The environmental deterioration problems are ubiquitous, occurring not only on metallic objects but also on rocks, wood, leather and paper. Factors that contribute to the deterioration of historic artefacts include humidity, sunlight, temperature, wind and biological activity. In 2014, the gross final expenditure on historic preservation was 36.40 billion RMB,13 and the direct corrosion cost was estimated to be 12.20 billion RMB.

Summary of the results by the Hoar method

By summarising the costs from the aforementioned representative industries, the Hoar method revealed that the total direct corrosion cost associated with the five major economic sectors was 1109.02 billion RMB (excluding the cost related to cultural heritage due to the difficulty in defining a gross production value). Extrapolation from the GDP of these sectors to the overall GDP in China showed that the total direct corrosion cost determined by the Hoar method was 1348.98 billion RMB. Notably, this value is higher than that determined by the Uhlig method. As explained in previous studies,3 this difference can be attributed to (1) the fact that the Hoar method takes into consideration both anti-corrosion investments and maintenance, whereas the Uhlig method focuses principally on the former; and (2) some unavoidable increase in calculated values if there is an overlap from different industries.

The direct corrosion costs in the five major economic sectors and their percentages are shown in Table 8 and pictorially in Fig. 2. The highest corrosion cost, with a value of 538.57 billion RMB, was generated by the sector of manufacturing and public services, which is rationalised on the basis that China has the largest manufacturing output (~ 20%) in the world. The large population of China also contributes to the high corrosion cost in this sector due to the large, and rapid, asset depreciation.

The direct corrosion costs of the surveyed industries are listed in Table 9 and plotted in Fig. 3. Among the industries surveyed, the top two industries in terms of corrosion costs are transportation and electronics, which is different in comparison to the corrosion cost study in 2002; which listed construction and machinery as they top corrosion cost industries. Such differences are attributed to the shift of economic conditions in China. The past decade has seen boosts in both transportation (e.g., automobiles and railways) and electronics industries, which now have relatively high gross market values. For the transportation industry, the large corrosion cost may also be attributed to substantial maintenance costs in corrosive service environments (e.g., for ships). Coal mining and roads and bridges were the top two industries in terms of the percentages of corrosion costs as normalised by their respective gross product values. This is rationalised by the wide use of comparatively inexpensive (also less corrosion-resistant) materials, which leads to more rapid asset depreciation and high replacement costs. Such findings highlight the relevance of life cycle considerations and longer-term durability management planning.

Comparison of cost of corrosion studies between China and other countries

Based on the Uhlig method, the total (direct + indirect) corrosion cost was estimated to be 3.34% of the GDP of China. This value is slightly lower than the global percentage cost of corrosion (3.4%),12 which was estimated by NACE primarily based on the US cost of corrosion in the 1998 study.8 However, it is difficult to directly and quantitatively compare the costs of corrosion from different countries. The reasons are at least twofold. First, the methodologies adopted by different countries are different.22, 23 While the Uhlig method is relatively straightforward, it requires trustworthy and detailed national economic data, which are not easy to obtain in some countries. For the Hoar method, the difference in the classifications of direct/indirect costs can be a significant source that adds to the difficulty of comparing the corrosion costs. For example, the direct corrosion cost in the 2012 India study was 2.4% of the GDP, which excluded the loss of product and efficiency due to corrosion.12, 24 If these costs are included, the direct cost of corrosion in India was 4.5%. The second reason for the difficulty in a quantitative cost comparison arises from the fact that the different countries have varied economic structures. For example, countries that rely highly on importation may not generate a high corrosion cost in the manufacturing sectors.

Conclusions

The Cost of Corrosion study reported herein is a summary of results from a national survey on the general costs arising from corrosion in the major representative industrial sectors in China. Utilising the Uhlig method of cost calculation, the total annual cost of corrosion in China was estimated to be 2127.8 billion RMB, representing 3.34% of the GDP. This result implies that corrosion could cost ~ 1555 RMB each year for each individual. It is generally agreed that 15–35% of corrosion costs can be avoided via appropriate corrosion mitigation approaches,12 which implies that up to 774.7 billion RMB of corrosion associated costs could be avoided annually, in China alone. Therefore, with the aim of reducing corrosion associated costs, it is possible to propose the following general strategies:

-

a.

A national strategy should be developed with the principal aim of reducing corrosion costs, and minimising the risks and hazards from corrosion. This action requires coordination from multiple governmental agencies (including national, regional and provincial), the participation by relevant corrosion professionals, and increased awareness of corrosion in the entirety of society. To be impactful, it would require a the establishment of a cross-agency national committee. Potential functions of such a committee, may include, but not be limited to, establishing policies on corrosion research and education.

-

b.

Continuous efforts and funding to support basic and applied research remain a critical requirement to further identify causes and fundamentals of corrosion, in addition to the development of improved anti-corrosion technologies. Furthermore, the rapid insertion of new materials and the extreme application of existing materials in new environments, will also require continued research regarding durability. Models that comprehensively consider key material and environmental factors are also presently lacking a mechanistic understanding and also then lacking accurate prediction of what are often complex corrosion processes. Protective coatings with high-corrosion resistance performance, with low repair costs and a low concentration of volatile organic compounds—will be increasingly required for corrosion protection. Many of the contemporary materials durability issues are multidisciplinary, which highlights the necessity of developing an open dialogue and an effective means for sharing and collaborations within the (comparatively large) Chinese corrosion community.25

-

c.

Despite the high technological / scientific output of the Chinese corrosion community overall, standardised technologies are yet to be outlined that broadly benefit the industrial sector. Moreover, corrosion standards (in numerous areas, be it prediction, monitoring, repair, etc.) should be developed under an international setting so that best practices in China and other countries, may be shared. Furthermore, stricter regulations or even law enforcement may be needed for the inspection, monitoring and protection of infrastructure and equipment whose corrosion failures may cause severe damage and casualties.

-

d.

A paradigm shift is required for companies whose operations are corrosion-affected; standing to benefit from integration of corrosion management into their regular management system. The risks and costs of corrosion should be tracked throughout asset life cycles. The returns (both short-term and long-term) on anti-corrosion investments should be calculated prior to materials selection and corrosion control. The study herein reveals that the top performing companies that invested in superior corrosion-resistant materials (combined with regular inspection) incurred much lower long-term corrosion costs than those using lower-quality and inexpensive materials.

-

e.

A lack of corrosion awareness in the general society and the general population, remains a key concern of the Chinese corrosion community. In the present study, only a few percent of responders indicated that their facilities employ professional corrosion engineers or employees with sufficient (or any) corrosion background. This finding applies to industries that are well known for their corrosion losses, such as the oil and gas and chemical industries. A solution to this issue relies on the growth and focus of investment in corrosion education at different levels. Presently, no university in China offers an undergraduate corrosion degree, and corrosion education, if any, is nominally restricted to no more than 1–2 courses at the graduate level, and 1–2 class hours at the undergraduate level—even for the top Chinese universities with degrees in Materials Science and Engineering. In addition, professional societies, universities and the private sector are also urged to work together to develop professional training and certification programmes to meet the practical requirements of industry.

Methods

The Uhlig method

According to the Uhlig method, the direct cost of corrosion in China was estimated based on the total values of major anti-corrosion technologies in the year 2014, including the following:

-

a.

Paints and coatings (costs associated with their application were also included);

-

b.

Surface treatments (galvanising, tinplating and electroplating; and surface treatments for aluminium and its alloys);

-

c.

Corrosion-resistant materials (stainless steels, weathering steels, titanium and its alloys, engineering plastics and rubbers);

-

d.

Corrosion inhibitors;

-

e.

Rust-preventing oils and greases; and

-

f.

Electrochemical protection (cathodic and anodic protection).

The annual gross production values of anti-corrosion technologies were obtained from governmental statistics departments, whereas the average unit prices were determined based on data and expert opinions from various sources including, industry, governmental agencies, trade organisations and individual manufacturers. Alternatively, the total market value can also be estimated by surveying a limited number of manufacturers and weighting their contributions by market share.

Notably, the cost calculated by the Uhlig method does not include certain direct or indirect losses, including but not limited to the following:

-

a.

Production loss due to corrosion-induced outage;

-

b.

Loss of products caused by corrosion leakages and accident;

-

c.

Reduction in the production efficiency from corrosion activities;

-

d.

Quality loss of the product due to the contamination of corrosion products;

-

e.

Over-design for corrosion; and

-

f.

Compensation for hazardous incidents caused by corrosion.

The total cost of these important factors varies across industries and may be several times larger than the direct cost of corrosion.

The Hoar method

For the Hoar method, the total cost of corrosion is the summation of the costs of individual industries, which are typically obtained by investigating a limited number of companies in the particular industry, and weighting their contributions by market share. In this method, the representativeness of the companies selected is critical, as any calculation based on companies’ subject to different degrees of corrosion can produce significantly different total costs for the industry. In the present study, a general questionnaire, as shown in Table 7, was distributed to five categorised economic sectors (i.e., infrastructure, transportation, energy, water, and manufacturing and public services) covering the industries of: roads and bridges; ports and piers; water conservation; oil and gas (i.e., exploration and production, storage and distribution, and refining); coal mining; electric power transmission;ships; motor vehicles; aircrafts; railroads, water and sewer systems; pulp and paper; metallurgy; chemical production and processing; electronics; agriculture; and historical artefacts.

It should be noted that the questionnaire utilised was intended to be comprehensive, and, therefore, some items included may not apply to all industries. Within each industry, companies of different scales were included to ensure representativeness of the results. During the investigation, typical issues that were encountered included the unavailability of the cost of corrosion data (which is a significant point to emphasise) or the lack of necessary corrosion awareness and expertise. In such cases, expert opinions were largely required to help separate the corrosion cost from general costs such as maintenance and replacements.

Data availability

The data presented and discussed in this study is available from the authors upon reasonable request.

References

Uhlig, H. H. The cost of corrosion to The United States. Corrosion 6, 29–33 (1950).

Committee on Corrosion Loss in Japan. Report on corrosion loss in Japan. Boshoku-Gijutsu (Corros.Eng) 26, 401–512 (1977).

Committee on Corrosion Loss in Japan. Survey of corrosion cost in Japan. Zairyo-to-Kankyo (Corros.Eng) 50, 490–512 (2001).

Hoar, T. P. Corrosion of metals: Its cost and control. Proc. R. Soc. 348, 1–18 (1976).

Bennett, L. H. Economic Effects of Metallic Corrosion in the United States: A Report to the Congress (1978).

Cherry, B. W. & B. S. Skerry, Corrosion in Australia: The Report of the Australian National Centre for Corrosion Prevention and Control Feasibility Study. (1983).

Al-Kharafi, F., Al-Hashem, A. & Martrouk, F. Economic Effects of Metallic Corrosion in the State of Kuwait (KISR Publications, 1995).

Koch, G. H., Brongers, M. P. H., Thompson, N. G., Virmani, Y. P. & Payer, J. H. Chapter 1 - Cost of corrosion in the United States, In Handbook of Environmental Degradation of Materials (William Andrew Publishing, 2005).

Behrens, D. Research and development programme on ‘corrosion and corrosion protection’in the German federal republic. Br. Corros. J. 10, 122–127 (1975).

Potter, E. C. & Potter, E. G. The corrosion scene in Australia. Aust. Corros. Eng. 16, 21–29 (1972).

Revie, R. W. & Uhlig K., H. H. Cost of corrosion to Australia. J. Inst. Eng. Aust. 46, 3–15 (1974).

Koch, G., J. Varney, N., Thompson, O., Moghissi, et al. International Measures of Prevention, Application, and Economics of Corrosion Technologies Study. NACE International (2016).

State Scientific and Technological Commission Corrosion Science Department Report on Corrosion Loss in China. (1982).

Ke, W. China Corrosion Investigation Report (Chemical Industry Press, 2013).

Zhou, F. The main characteristics of the coatings enterprises in our country. China Coating 2, 10–11 (2001).

National Bureau of Statistics of the People’s Republic of China. China Statistical Yearbook (2014).

Ministry of Transport of the People’s Republic of China. Statistical bulletin of transportation industry development in 2014 (2015).

The Ministry of Water Resources of the People’s Republic of China. Bulletin of water resources development in 2014 (2015).

Ministry of Land and Resources of the People’s Republic of China. Bulletin of land and resources in 2014 (2015).

Ministry of Industry and Information Technology of the People’s Republic of China. Report on the development of shipbuilding industry in 2014 (2015).

The Ministry of Housing and Urban-Rural Development of the People’s Republic of China Bulletin of Urban-Rural Development in (2014).

Biezma, M. & Cristobal, J. S. Methodology to study cost of corrosion. Corros. Eng. Sci.Techn. 40, 344–352 (2005).

Biezma, M. & Cristóbal, J. S. Is the cost of corrosion really quantifiable? Corrosion 62, 1051–1055 (2006).

Bhaskaran, R., Bhalla, L., Rahman, A. & Juneja, S. et al. An analysis of the updated cost of corrosion in India. Mater. Perform. 53, 56–65 (2014).

Li, X., Zhang, D., Liu, Z. & Li, Z. et al. Share corrosion data. Nature 527, 441–442 (2015).

Acknowledgements

This work was supported by the Key Consulting Project of Chinese Academy of Engineering—“Study of the Corrosion Status and Control Strategies in China” (2015-ZD-08). We would like to express our deepest gratitude to Academician Kuangdi Xu (Honorary President of the Presidium of the Chinese Academy of Engineering), Academician Zhongli Ding (President of University of Chinese Academy of Sciences), Academician Binshi Xu (Academy of Armored Forces Engineering), Academician Huibin Xu (President of Beihang University), Academician Jianyun Zhang (President of Nanjing Hydraulic Research Institute), Professor Shicheng Wei (Academy of Armored Forces Engineering), Professor Jianhua Liu (Beihang University), Professor Xichang Zhu (Nanjing Hydraulic Research Institute) and all participating organisations and individuals of this project. We would also like to acknowledge the support from Ministry of Science and Technology of China (2012FY113000).

Author information

Authors and Affiliations

Contributions

B.H. designed the research and led the study. All authors conducted the research and analysed the results. B.H., X.L., X.M. and D.Z. wrote the manuscript and all authors read and edited the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare that they have no competing financial interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hou, B., Li, X., Ma, X. et al. The cost of corrosion in China. npj Mater Degrad 1, 4 (2017). https://doi.org/10.1038/s41529-017-0005-2

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41529-017-0005-2

This article is cited by

-

A Comparative Study on Anti-corrosion and Antifouling Performance of Marine High Density Polyethylene-Capsaicin Composite Coatings with Different Biocide Content

Journal of Thermal Spray Technology (2024)

-

Electrochemical Behavior of Laser Powder Bed Fusion (L-PBF) Ti–6Al–4V Alloy: Influence of Phase and Grain Boundaries on Surface Passive Film Formation

Metals and Materials International (2024)

-

An Analytical Solution of Chloride Transfer into RC Pipe Pile by Convection–Diffusion Effect Considering Time-Dependent Surface Chloride Concentration

Iranian Journal of Science and Technology, Transactions of Civil Engineering (2024)

-

Synthesis and Characterization of Electrodeposited Ni-Co Self-Healing Coating with Hybrid Shell Microcapsules

Journal of Materials Engineering and Performance (2024)

-

Corrosion of Duplex Stainless Steel Manufactured by Laser Powder Bed Fusion: A Critical Review

Acta Metallurgica Sinica (English Letters) (2024)